Sustainable Investing at American Century

We seek to deliver value to our clients by applying an investment-led approach to sustainability when consistent with our fiduciary duty. Given the significant proportion of an investment’s market value that is now comprised of intangibles, the long-term sustainability of a company’s business model and durability of a borrower’s cash flow can be increasingly influenced by material sustainability factors.

We use the term “ESG” to refer to the data that we incorporate into our processes, rather than an approach to investing. Sustainable investing encompasses both process-oriented (integration) and outcome-oriented solutions that aim to provide traditional financial alpha as well as environmental and social impact.

We believe sustainable investing can produce positive real-world outcomes while generating financial benefits, and that incorporating sustainability factors using ESG data into our investment processes can lead to more informed decision-making for our portfolios.

Our approach to sustainable investing is grounded in three principles:

Investment-led

Investment performance is always our primary focus. Incorporating material sustainability factors is driven by the belief that the consideration of these issues can lead to more informed investment decisions and better outcomes for clients.

Independent Insights

Our investment decisions are driven by proprietary research and tools. Our Sustainable Research analysts collaborate with investment teams in developing tools that help drive deeper insights and better results.

Innovation

To stay ahead of the rapidly evolving, sustainable investing landscape, we partner with clients to develop new capabilities designed to achieve their specific investment goals.

“We partner with clients to provide solutions that help achieve their risk, return and sustainability objectives.”

A History of Sustainability

Our commitment to sustainability begins with American Century’s purpose-driven business model, which sets us apart in the asset management industry. Our unique ownership structure supports advances in global health through the Stowers Institute for Medical Research while we strive to help our clients achieve financial success. This business model helps to shape our culture and makes incorporating sustainability principles into our investment practices a natural fit.

Within our investments, we have been considering sustainability factors to some degree for many years. We first began socially responsible investing, using an exclusions approach, in 2006. In 2014, we began formally incorporating material sustainability factors into several global and non-U.S. flagship strategies with the objective of making more informed investment decisions.

Since that time, we have made significant progress in our efforts, including:

Establishing a dedicated sustainable research team

Developing proprietary sustainability research and assessment tools

Advancing stewardship practices

Expanding integration across many of our investment strategies

Launching outcome-oriented solutions for clients

1994

Stowers Institute for Medical Research founded by Jim and Virginia Stowers, who dedicated the vast majority of their net worth to benefiting humankind.

2006

Initiated socially responsible investing with tobacco-free portfolios.

2014

Formally integrated sustainability considerations into several flagship strategies.

2016

Introduced first sustainability-focused strategy.

2017

Established a dedicated Sustainable Research Team and integration framework.

2018

Signed United Nations-supported Principles for Responsible Investment (PRI).

Developed first impact strategy.

2020

Launched industry’s first sustainable semi-transparent active ETFs.

2021

Established Sustainable Investment Council.

2022

Launched Avantis Investors® responsible portfolios.

Won Environmental Finance's Sustainable Investment Awards 2022: Social Fund of the Year (Health Care Impact Equity strategy).

2023

Extended capabilities with private equity team focused on healthcare and climate solutions.

Launched Sustainability 360 (S360) our proprietary sustainability research platform.

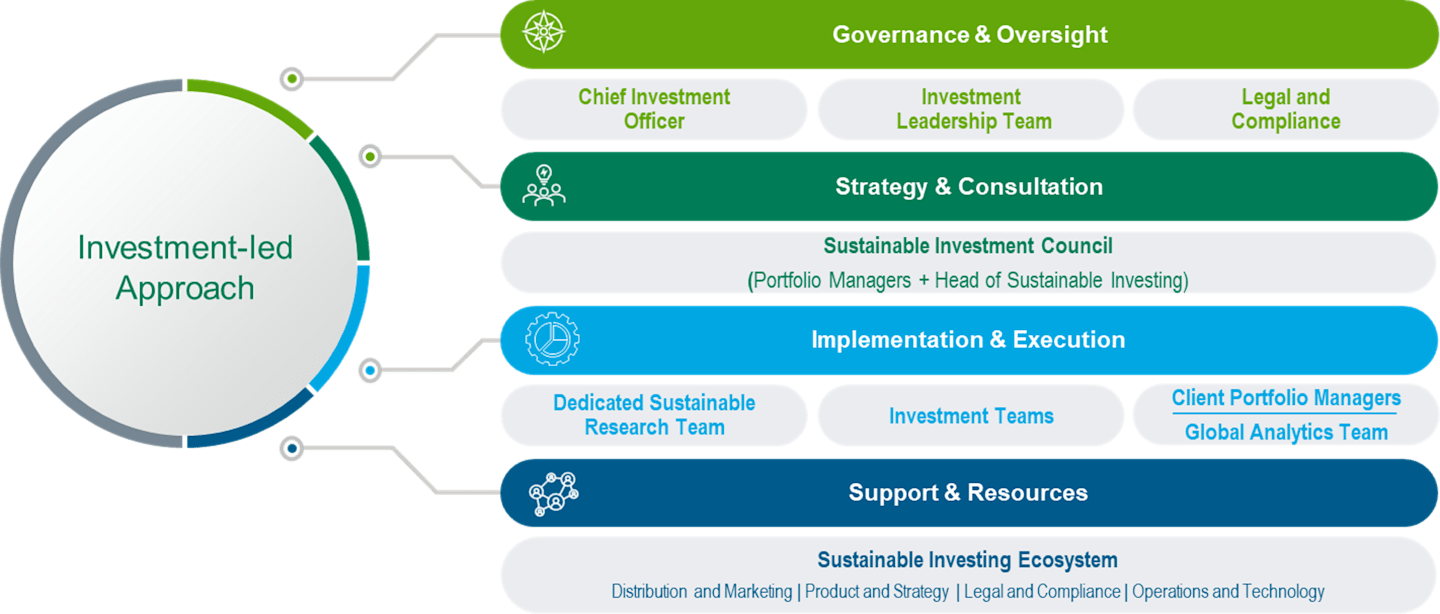

Investment-led Approach, Firmwide Commitment

Our sustainable investing approach is investment-led, but the success of our program requires a commitment beyond our investment teams. That's why we have built an ecosystem of support and resources with colleagues across the firm whom all play an integral role in advancing our sustainable investing initiatives.

The Sustainable Investment Council

The Sustainable Investment Council (SIC), comprised of our head of sustainable investing and tenured investment professionals across many of our investment disciplines, underscores our investment-led approach to sustainability.

The SIC is responsible for:

Consulting on and reviewing our sustainable investing approach

Supporting the consistent implementation of our sustainable investing approach

Evaluating, developing, and innovating our proprietary sustainable investing platform, S360

Center of Expertise -

The Sustainable Research Team

The team serves as the center of expertise supporting those investment teams that seek to incorporate sustainability-related considerations into fundamental analysis and portfolio decision-making.

Primary Responsibilities

Expanding issuer and thematic research and training

Developing proprietary sustainability assessment tools and models

Advancing stewardship practices

Producing thought leadership

Innovating client solutions

Collaborating with industry partners

Sustainability Themes Drive our Research and Stewardship Priorities

Our Approach

Large global challenges and opportunities cannot be assessed independent of other drivers of economic sustainability and growth.

We focus on five mega themes and related sub-themes that we believe are key to achieving a more sustainable future economy for all.

Themes are incorporated into our proprietary tools and drive our top-down research and stewardship priorities.

Healthcare

- Access to Medicine & Healthcare Services

- Innovative Treatment

- Lowering Costs

- More Productive Medical Equipment & Services

Empowerment

- Human/Labor Rights

- Upward Mobility

- Wage Structures

Sustainable Living

- Food Systems

- Product End of Life Production

- Product Life Extension

- Sustainable Infrastructure

Climate

- Alternative Energy

- Biodiversity

- Climate Mitigation

- Climate Technology

- Waste Water Management

Technological Advancement

- Automation

- Connectivity

- Digitalization

- E-Commerce

- FinTech

“Our top-down, thematic approach is driven by five sustainability themes that we believe will define a sustainable economy for the next 20–30 years.”

Independent Insights Derived From Proprietary Research and Tools

S360® is an innovative platform designed to enhance insights for clients

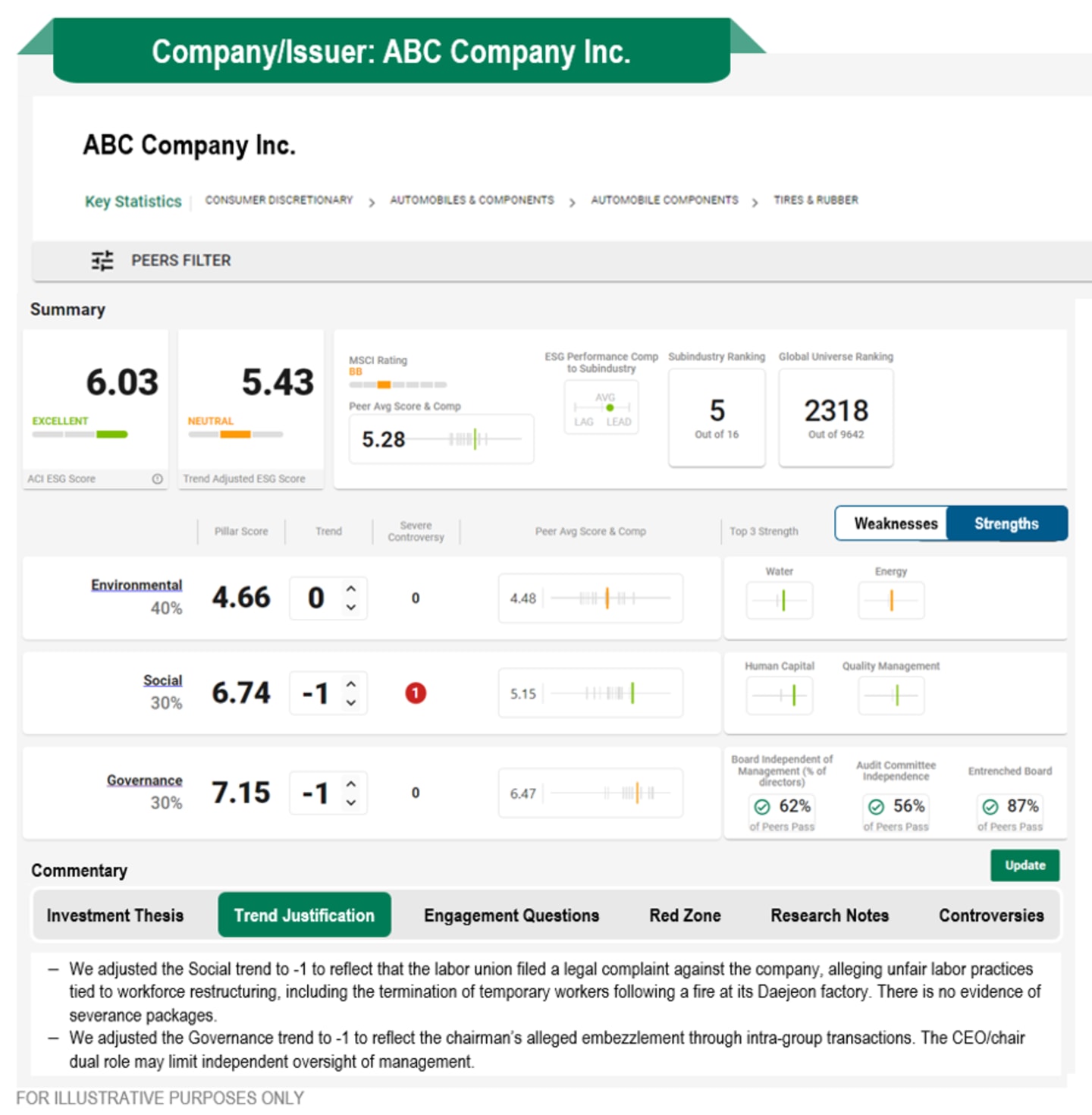

Our proprietary sustainability research platform, S360, brings together a wide range of datasets, a quantitative scoring model and other tools, information related to engagement activities, and qualitative research. The platform provides a holistic view of sustainability-related risks and opportunities at both the individual issuer and portfolio level.

The S360 framework is built for bottom-up issuer-level analyses that can be combined at the portfolio level. Driven by rigorous peer-group comparisons, the quantitative scoring model, along with other analyses, help our investment teams to make informed decisions.

Engagement

Engagement Approach

Direct engagement with equity and corporate bond issuers is an important element of our sustainable investing approach.

Engagement is a partnership between our investment teams and Sustainable Research team. Engagement activities may include in-person meetings, written communications, phone or video calls, and industry forums.

Engagement activities focus on material sustainability-related factors. The Sustainable Research team may also engage with companies on our sustainability themes that we believe are essential to achieving a sustainable economy.

Reasons for Engaging

Gain a more thorough understanding of a company’s approach to managing sustainability-related opportunities and risks.

Communicate views on sustainability-related best practices and industry standards.

Discuss views regarding a company’s sustainability practices.

Review shareholder proposals.

Proposals Involving Sustainability Matters

We vote proxies in the manner that we believe will do the most to maximize shareholder value.

American Century has adopted written proxy voting policies to help inform our voting decisions.

We believe certain sustainability issues can potentially impact a company’s long-term financial performance.

On a case-by-case basis, the financial materiality and potential risks or economic impact of the sustainability issues underpinning proxy proposals are considered.

It is ultimately each team’s portfolio managers that are responsible for making the election decision.

Innovation Drives our Sustainable Investment Solutions

For many of our investment teams, integrating sustainability-related factors is part of a comprehensive assessment of an issuer’s long-term sustainability, which may help to maximize an investment strategy’s performance. In certain cases, clients have specific objectives related to a portfolio’s sustainability-related characteristics that we address by offering sustainability-focused investment solutions designed to reflect these bespoke requirements.

Sustainable Investing Approaches

Explicitly incorporate material sustainability factors into investment analysis with the objective of making more informed investment decisions.

- Norms based

- Values based

Screen and exclude companies whose business activities do not meet client-specific values or guidelines or that violate "universal norms."

Invest in companies selected for positive sustainability profiles or factors (e.g., human capital, carbon emissions) relative to industry peers.

Invest in companies that have improving sustainability profiles or factors (e.g., human capital carbon emissions) relative to industry peers and encourage companies to transition to more sustainable practices.

Invest in companies whose business activities are aligned with a specific theme or series of themes (e.g., clean tech, energy transition, health care) with an intention to contribute to a specific environmental and/or social outcome.

Generate a measurable social and/or environmental impact alongside a financial return. The impact could also be associated with a specific theme or framework (e.g., U.N. Sustainable Development Goals (SDGs)).

Sustainability: It’s in our Genes®…

Sustainability isn't just something we practice; it's part of who we are as a company and as global citizens.

The portfolio managers use a variety of analytical research tools and techniques to help them make decisions about buying or holding issuers that meet their investment criteria and selling issuers that do not. In addition to fundamental financial metrics, the portfolio managers may also consider environmental, social, and/or governance (ESG) data to evaluate an issuer's sustainability characteristics. However, the portfolio managers may not consider ESG data with respect to every investment decision and, even when such data is considered, they may conclude that other attributes of an investment outweigh sustainability-related considerations when making decisions. Sustainability-related characteristics may or may not impact the performance of an issuer or the strategy, and the strategy may perform differently if it did not consider ESG data. Issuers with strong sustainability-related characteristics may or may not outperform issuers with weak sustainability-related characteristics. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and may not be available, complete, or accurate. Not all American Century investment strategies incorporate ESG data into the process.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

S360's proprietary scoring model uses third-party data to generate a quantitative score that summarizes an issuer's performance on financially material sustainability factors relative to its peers. The S360® Quantitative Score is driven by issues and metrics that are most relevant and financially material at the sub-industry level and supported by academic and/or industry research. S360 quantitative scores are generated for individual sustainability factors, which are then weighted appropriately and combined to generate separate scores for the three pillars of Environment, Social, and Governance (ESG). These pillar scores are then combined into an overall S360 Quantitative Score. All scores range from 0-10 and are peer relative within the subindustry. Fundamental investment analysts may apply a trend adjustment of negative or positive 0.5, 1 or 2 to the pillar scores to reflect their qualitative view of an issuer's sustainability practices and/or to account for additional sustainability-related information not captured by the model. The S360 Quantitative Score is tied to a fiscal year and does not consider historical data at this time. A relatively low quantitative score, negative trend, or red zone flag does not mean that the security cannot be purchased, as sustainability is one of many factors the investment team takes into account when deciding to purchase a security. References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and along with other portfolio data, are subject to change without notice. Third-party ESG data used by S360's scoring model may lack uniform regulation and reporting standards across sustainability factors. In addition, some of the data may be inconsistent across sources and, in certain cases, incorrect. In addition, data may not currently be available for many issuers and, when available, frequently only includes some but not all of the sustainability factors considered by an investment team.