American Century Investments® recognizes that one target-date solution cannot meet the needs of all plan sponsors, and therefore offer multiple options to choose from. All of our options are built on our time-tested philosophy and process.

Pursues a smoother investor journey through a flatter glide path.

Focuses on providing better outcomes for tomorrow by managing across the entire market cycle.

Options that allow clients to find the right fit for plan needs.

As one of the longest-running target-date providers in the industry, American Century Investments has proudly offered retirement solutions for over 20 years.

As of August 31, 2024, out of 51 total mutual fund target-date strategies listed in Morningstar, there were only 5 other strategies with a 20-year track record.

Investment Options

One Choice® Target Date Portfolios

An Intentionally Moderate Approach

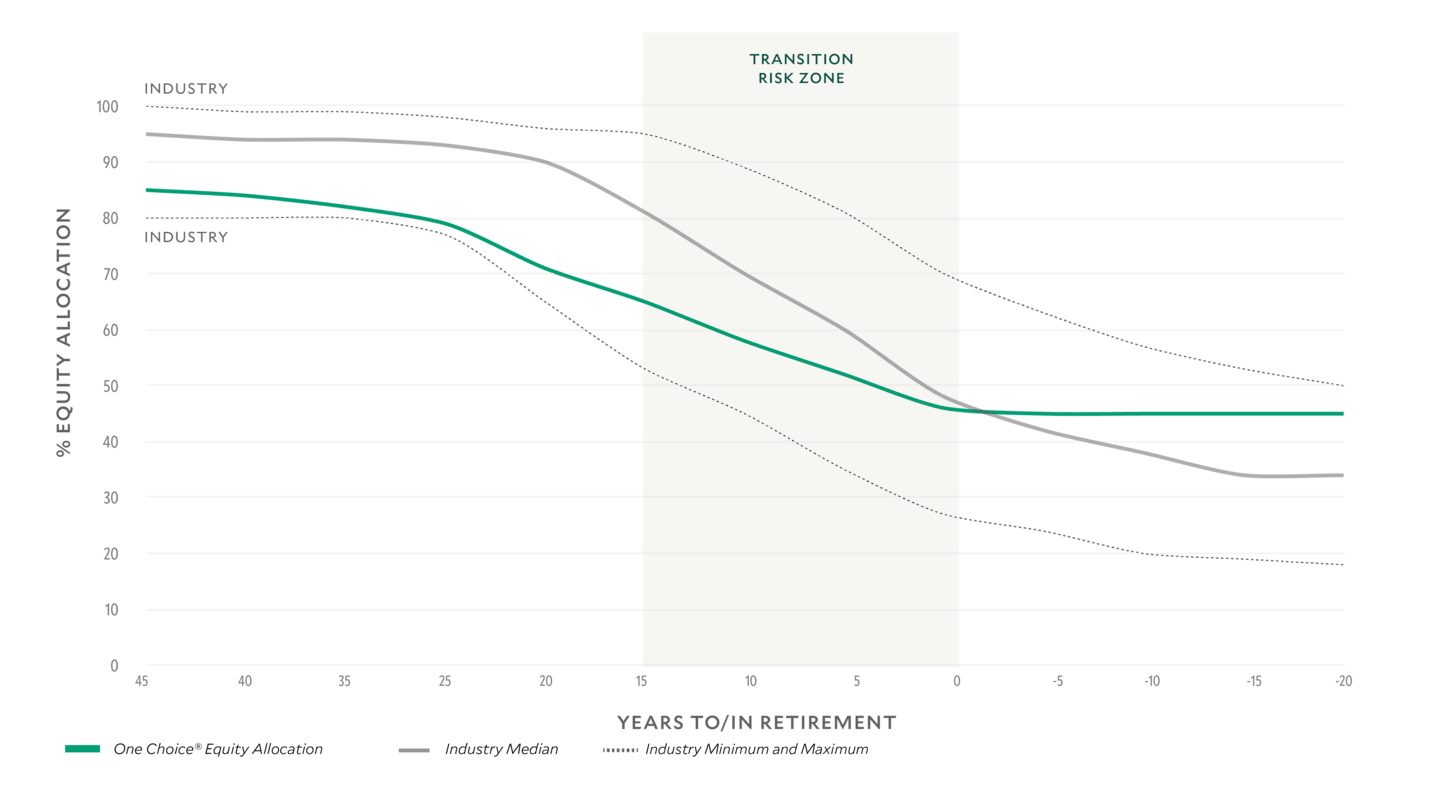

Our more moderate, risk-balanced approach seeks to mitigate losses. This can generate a smoother path of investment returns that may lead to better outcomes over time for more investors.

Data as of 10/31/2024. The industry median glide path represents the 50th percentile equity allocation among funds in the Morningstar Target-Date universe. The industry max and min represent the equity allocation among funds in the Morningstar Target-Date universe.

Source: American Century Investments®, Morningstar.

Moderate equity allocations in the accumulation years.

Flatter glide path during the "transition risk zone."

A 45% equity allocation at retirement to balance growth risk versus market risk.

Learn more about One Choice® Target Date Portfolios.

Learn more about One Choice® Target Date Trust.1

The target date in a fund's name is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date.

Each target-date fund seeks the highest total return consistent with American Century Investments' proprietary asset mix. Over time, the asset mix and weightings are adjusted to be more conservative. In general, as the target year approaches, the portfolio's allocation becomes more conservative by decreasing the allocation to stocks and increasing the allocation to bonds and cash equivalents.

One Choice® Blend+ Portfolios

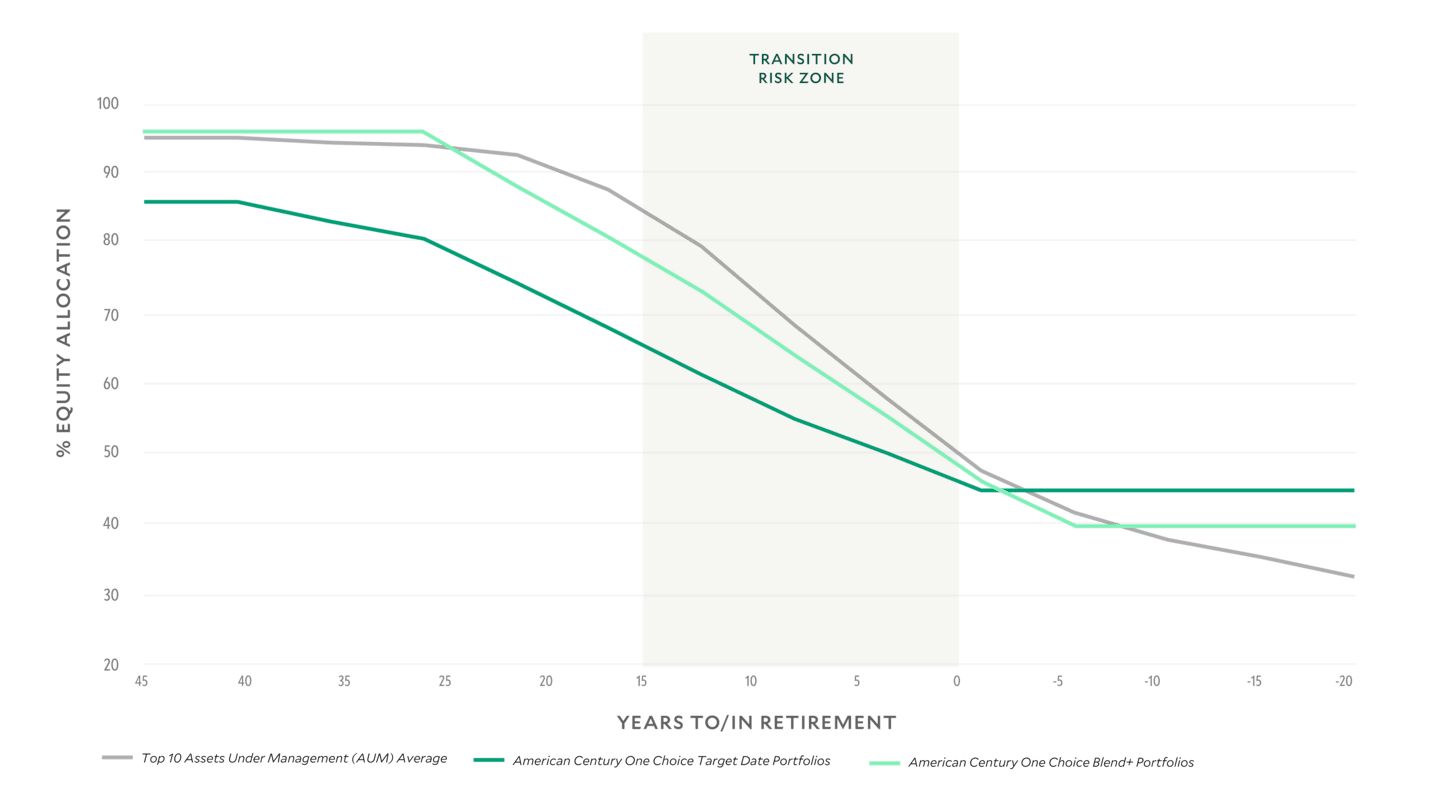

An Intentional Approach to Growth

Data as of 10/31/2024. Top 10 AUM Average shows average allocations across the “Top 10” peers in terms of target-date assets.

Source: Fund prospectuses and websites, Morningstar. One Choice Blend+ glide path allocations as of December 1, 2024.

Early-to-mid section of the glide path tilts towards growth for a risk-tolerant demographic while retaining a flatter shape.

Smooth rolldown to the glide path during the “transition risk zone.”

Landing point at 40% equity at age 70 recognizes a phased transition to full retirement.

Learn more about One Choice® Blend+ Portfolios.

A One Choice Blend+ Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date.

Each target-date One Choice Blend+ Target Date Portfolio seeks the highest total return consistent with American Century Investments' proprietary asset mix. Over time, the asset mix and weightings are adjusted to be more conservative by decreasing the allocation to stocks and increasing the allocation to bonds and short-term investments. The portfolios reach their most conservative allocation approximately five years after the target date, at which point its neutral mix is expected to become fixed.

Co-Manufactured Solutions

Collective investment trusts are available only to certain institutional accounts. For additional information, please contact your American Century Investments retirement specialist at 1-800-345-6488.

Choose the Right Target-Date Solution for Each Plan

Focus on the options that align with a plan’s profile and preferences.

Effective September 30, 2024, the funds that serve as the underlying investment funds of the American Century Retirement Date Trust were renamed One Choice Target Date Trusts.

This information is for educational purposes only and is not intended as investment or tax advice.

Diversification does not assure a profit nor does it protect against loss of principal.

Fees are subject to change.

©2025 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.