We believe that no one glide path meets the needs of all plan sponsors and all participants. Even when a suitability assessment suggests higher equity allocations may be appropriate, glide path selection should be done with care, an increasing number of target-date providers have moved to a more aggressive equity positioning, justified by trends extrapolated from an unprecedented bull market.1

One Choice Blend+ Portfolios offer a growth-oriented approach to our distinct risk-balanced framework. This philosophy was established with our initial target-date launch in 2004, making us one of the longest-tenured target-date managers in the industry.2

The target date in a fund’s name is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date. Each target-date fund seeks the highest total return consistent with its proprietary asset mix. Over time, the asset mix and weightings are adjusted to be more conservative. In general, as the target year approaches, the portfolio's allocation becomes more conservative by decreasing the allocation to stocks and increasing the allocation to bonds.

¹Source: S&P Dow Jones Indices LLC, Morningstar. Data as of May 31, 2015, and as of Dec. 29, 2023.

²This refers to One Choice Target Date Portfolios. As of August 31, 2024, out of 51 total mutual fund target-date strategies listed in Morningstar, there were only five other strategies with a 20-year track record.

One Choice® Blend+ Portfolios Stand Out with a Prudent Approach to Growth

Pursues a smoother investor journey while emphasizing growth for a more risk-tolerant demographic.

Focuses on providing better outcomes for tomorrow by managing across the entire market cycle.

Aligns with plans seeking an active, cost-effective approach to target-date investing.

A Growth-Focused Glide Path that Pursues a Smoother Journey

Our Balance of Risks Framework

Tail risk is the risk of a tail event. Abandonment refers to the risk that a participant will divest from the strategy. Please see our glossary for definitions of tail event, sequence-of-returns risk, and longevity risk. For more information on longevity risk, view our article.

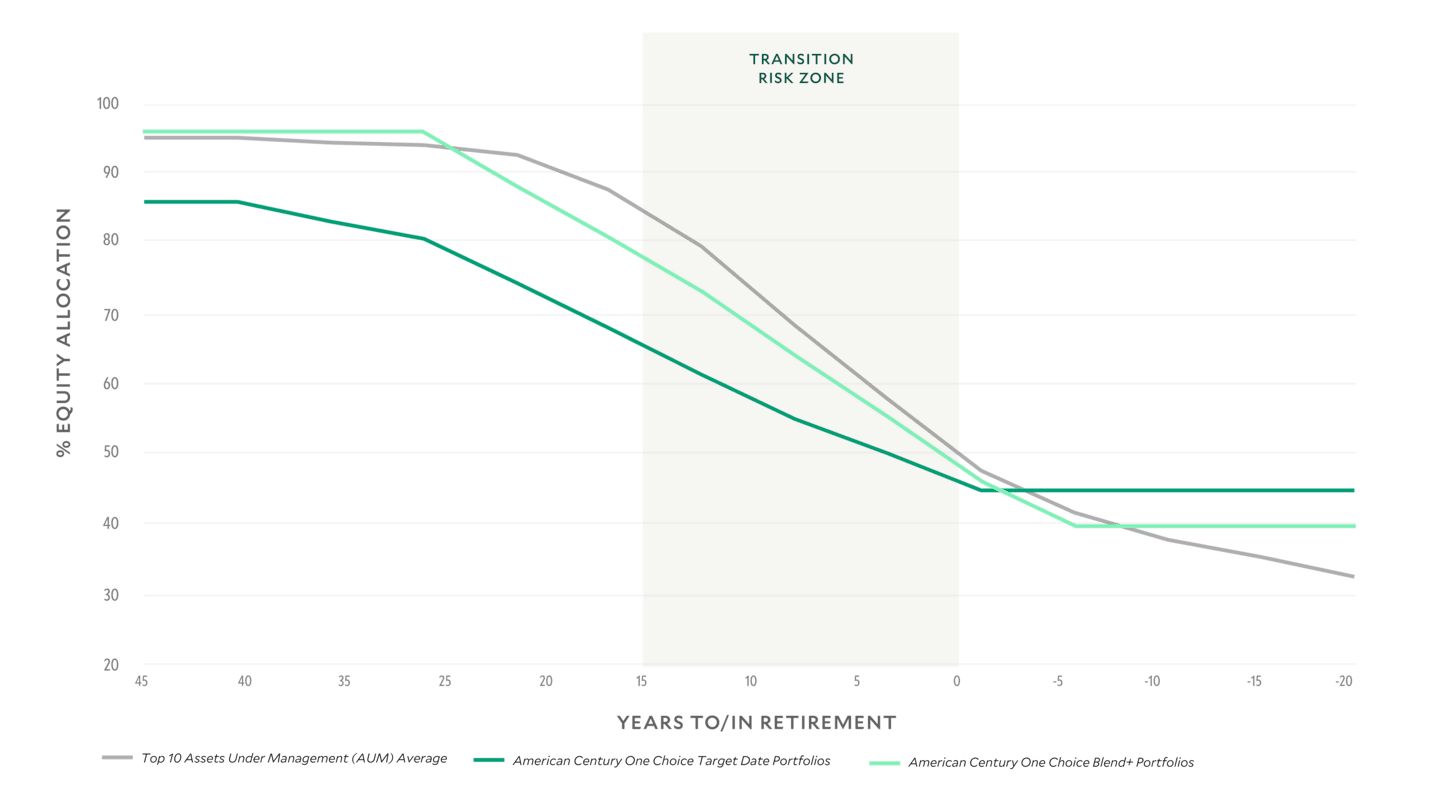

A Flatter Glide Path with a Growth Tilt

Pursuing a growth objective doesn’t mean maintaining extremely high equity allocations throughout a participant’s lifetime. One Choice Blend+ Portfolios glide path seeks growth while aiming to balance the multiple risks participants face. These risks must be managed as they change in relative importance during the target-date life cycle and through various market environments.

The result is growth potential with a flatter glide path than aggressive peers, which aims to keep more participants on course throughout the journey to and through retirement.

Data as of 10/31/2024. Top 10 AUM Average shows average allocations across the “Top 10” peers in terms of target-date assets.

Source: Fund prospectuses and websites, Morningstar. One Choice Blend+ glide path allocations as of December 1, 2024.

The One Choice Blend+ glide path maintains the philosophy of our One Choice Target Date series but is calibrated for populations more suited to higher levels of market risk.

With a long time horizon to retirement, the early-to-mid section of the glide path tilts toward growth for a risk-tolerant demographic while seeking a flatter path.

A smoother rolldown to the glide path during the "transition risk zone," when account balances are at their highest, aims to make a market downturn less painful.

Landing point at 40% equity at age 70 recognizes a phased transition to full retirement.

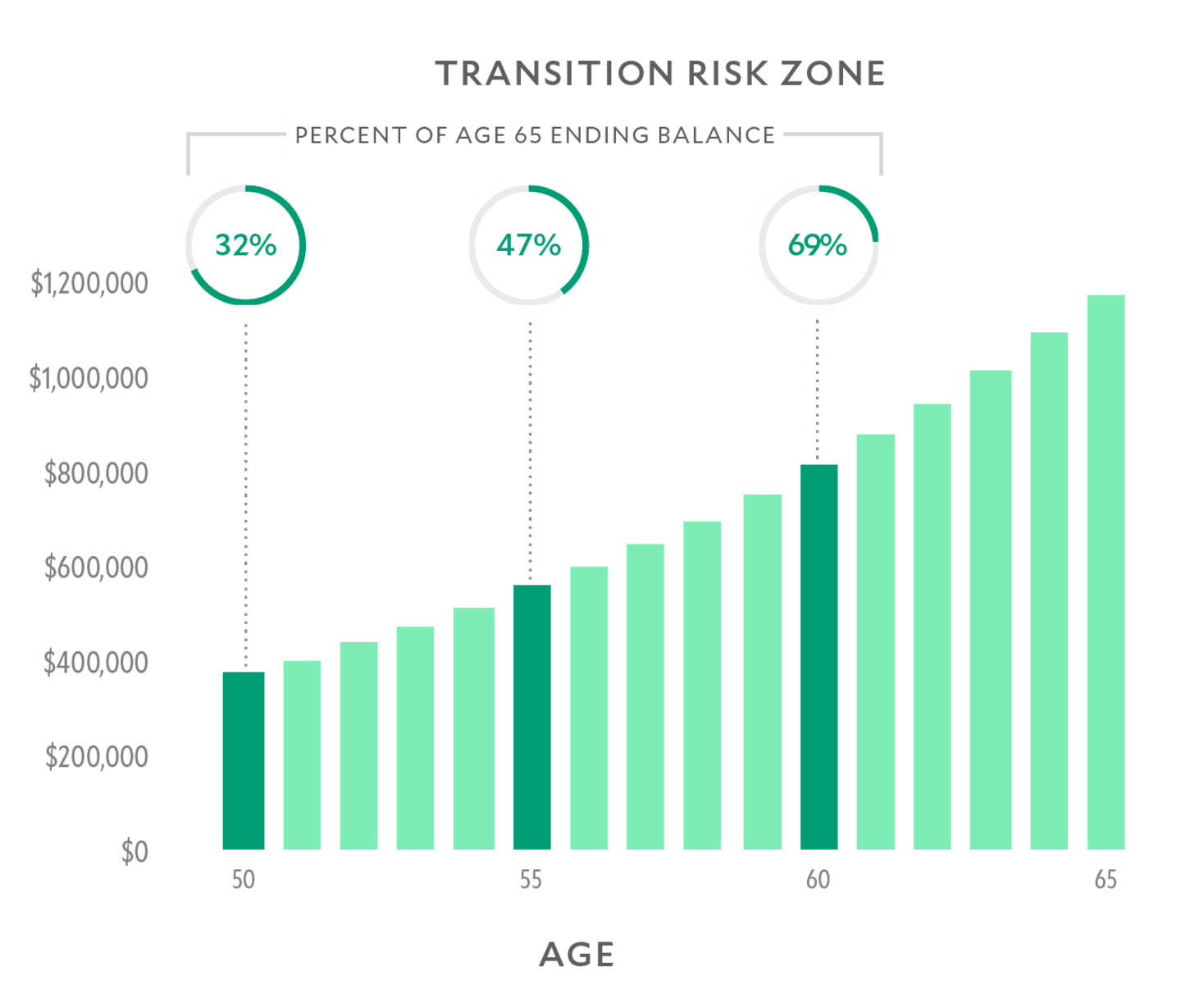

As participants reach the transition phase toward retirement, glide path design involves more than just the level of equity allocation -- seeking to manage against large losses is important too. We know that a shock --an unexpected job loss or significant market event --could jeopardize savings plans just when participants have the most to lose and the least amount of time to recover.

In contrast to our approach to growth, steep glide path descents in the transition risk zone have a higher probability of locking in losses for participants near retirement.

Participants Ages 50+ Typically Have the Most to Lose

Growth of a hypothetical participant's retirement savings from age 25 to 65. Assumptions: starting salary $45,000, growing at 2% per annum. Contribution rate fixed at 10% of salary each year. Annual portfolio return of 6.5% per year. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

³Source: American Century Investments.

⁴Source: FactSet, S&P 500 Index Returns. Average returns 1/1/1929 – 12/31/2023.

⁵Source: 2023 Transamerica Center for Retirement Studies "Life in Retirement: Pre-Retiree Expectations and Retiree Realities."

Focuses on Providing Better Outcomes for Tomorrow

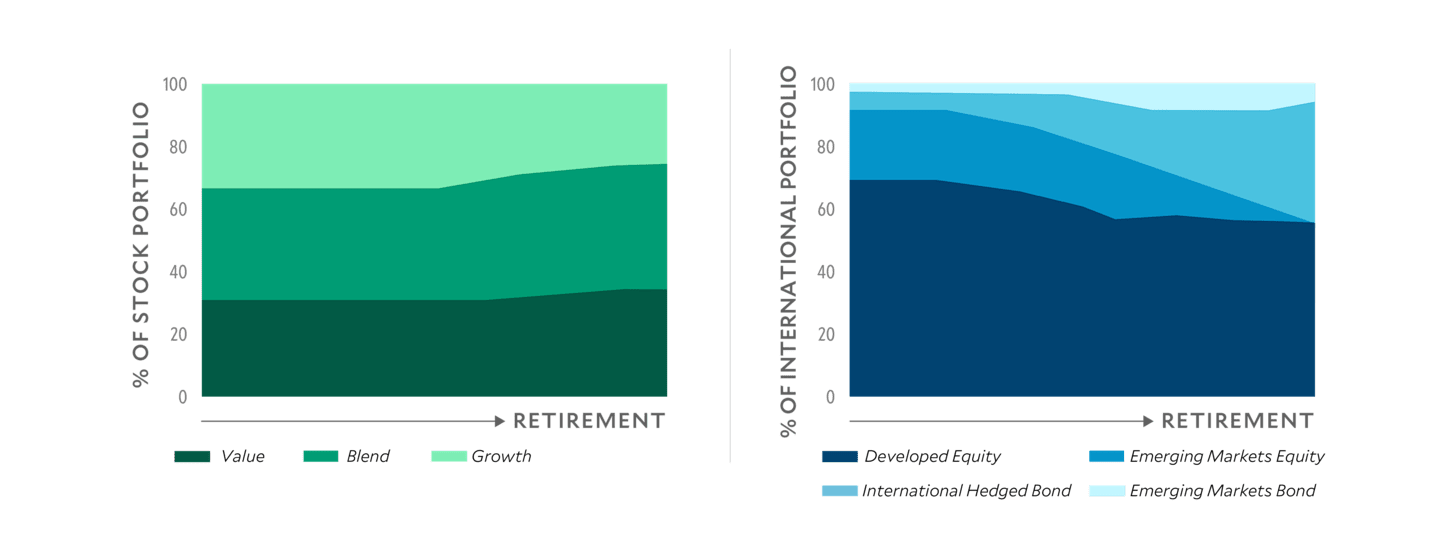

Sub-Asset Class Allocations Adjust Throughout the Life Cycle to Manage Risk

Risk management goes beyond equity allocation. As retirement nears, our underlying asset class mix shifts in multiple ways to calibrate the portfolio for each phase of the life cycle.

As retirement nears, vintages:

Move away from growth to more core and value equity.

Reduce emerging markets equity; removed completely by age 70.

Increase lower-volatility equities near and in retirement.

Introduce short-duration bonds 15 years before retirement.

We believe a thoughtfully diversified portfolio is more likely to provide positive investor outcomes.

Increase in Blend and Value Equity, Non-U.S. Exposure Shifts to Bonds

Sub Asset Class refers to the investment styles within the equity and fixed income asset classes, such as Growth or Value. Value refers to value stock. Growth refers to stocks that may trade at a higher price relative to their fundamentals because they are expected to grow faster than the rest of the market. Blend refers to strategies that blend growth and value. Developed Equity refers to securities of companies from countries with economies that are developed. International Hedged Bond refers to bonds issued by a foreign entity, primarily in developed markets excluding the United States, and denominated in U.S. dollars. Emerging Markets Equities include securities of companies from countries with economies that are undergoing economic transition generally from less to more developed. Emerging Markets Bond refers to bonds that are issued by countries with developing economies as well as corporations within those nations.

An Active, Cost-Effective Approach Suited for a More Risk-Tolerant Demographic

A Broad Range of Investment Strategies From American Century Investments and Avantis Investors®

Selecting the right target-date strategy is a critical decision for plan sponsors and their consultants. Cost is but one factor among many to consider when choosing a target-date strategy for a plan's qualified default investment alternative (QDIA). We believe a full fiduciary review should also consider participant demographics, age and wealth profiles, savings levels and appetite for various risks. We also believe lower cost should not come at the expense of suitability or alpha potential.

One Choice Blend+ Portfolios pair actively managed investments from American Century Investments and broadly diversified, low-cost active strategies from Avantis Investors®. Through a systematic, valuation-based approach, Avantis delivers daily managed strategies with active upside potential at near-passive fees. This combination results in a highly competitive fee to both actively managed and hybrid target-date products.

Are Your Demographics Suited to Your Chosen Investment Approach?

We remain steadfast in the belief that the most important factor in target-date selection is suitability. Aligning a plan's objectives and demographics with the risk/reward ambitions of the glide path is critical. While One Choice Blend+ Portfolios offer a growth tilt, we still prioritize risk management, seeking balance rather than extremes.

plan sponsors and almost half of participants prefer a target date approach that prioritizes protection from losses over growth potential.

American Century Greenwald Retirement Survey 2024.

Hear Straight Talk from the Investment Team

Weekly Updates from Rich Weiss, CIO

Every Monday, American Century Investments hosts a call with CIO Rich Weiss, where he addresses the latest news—offering his insights and color commentary on the economy, markets and portfolio positioning.

For Professional Use Only.

Need Help Finding the Right Target-Date Strategy?

Find out if a moderate or more aggressive target-date strategy is better suited for your plan.

Target-Date Blueprint is an online tool designed to help you apply a prudent process to identify the right QDIA solution for each plan. Narrow the target-date universe to focus on only those with appropriate investment profiles aligned.

Speak with a DCIO Specialist

Contact us to schedule a meeting.

Effective April 11, 2025, One Choice Blend Plus 2020 Portfolio was renamed One Choice Blend Plus In Retirement Portfolio.

A One Choice Blend+ Target Date Portfolio's target date is the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date.

Each target-date One Choice Blend+ Target Date Portfolio seeks the highest total return consistent with American Century Investments' proprietary asset mix. Over time, the asset mix and weightings are adjusted to be more conservative by decreasing the allocation to stocks and increasing the allocation to bonds and short-term investments. The portfolios reach their most conservative allocation approximately five years after the target date, at which point its neutral mix is expected to become fixed.

Diversification does not assure a profit nor does it protect against loss of principal.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

The performance of the portfolios is dependent on the performance of their underlying American Century Investments' funds and will assume the risks associated with these funds. The risks will vary according to each portfolio's asset allocation, and a fund with a later target date is expected to be more volatile than one with an earlier target date.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

American Century Investments does not guarantee the quality, accuracy or completeness of data entered by advisors. In addition, American Century isn’t responsible for any errors or omissions, or for the results obtained from the use of such data or information entered by the advisor.

This information is for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. There are different options available for your retirement plan investments. You should consider all options before making a decision.

©2025 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

©2025 Standard & Poor's Financial Services LLC. All rights reserved. For intended recipient only. No further distribution and/or reproduction permitted. Standard & Poor's Financial Services LLC ("S&P") does not guarantee the accuracy, adequacy, completeness or availability of any data or information contained herein and is not responsible for any errors or omissions or for the results obtained from the use of such data or information. S&P GIVES NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE IN CONNECTION TO THE DATA OR INFORMATION INCLUDED HEREIN. In no event shall S&P be liable for any direct, indirect, special or consequential damages in connection with recipient's use of such data or information.