Why Municipal Bonds

Tax advantages and income, plus comparatively lower risk

Tax-free income potential. Less sensitivity to market swings than many equity and fixed-income investments. Fewer defaults than other types of bonds. Municipal bonds (munis) offer many advantages that make them worthy building blocks for portfolios.

Menu

Muni Bond Basics

Understand What Makes Municipal Bonds Unique

Government Issued

Munis are bonds issued by local governments and entities.

Powering Infrastructure

Munis help finance bridges, roads, schools, hospitals, libraries and parks – among other quality-of-life enhancing functions.

Tax-Free Interest

Investors don’t owe federal taxes on interest. Interest may also be exempt from state and local taxes.

Less Prone to Market Volatility

Munis’ ties to specific infrastructure projects mean they aren’t usually affected by market events as other investments can be, helping manage risk.

Fewer Defaults

Munis help manage risk through their historically lower default rates compared to other types of bond investments.

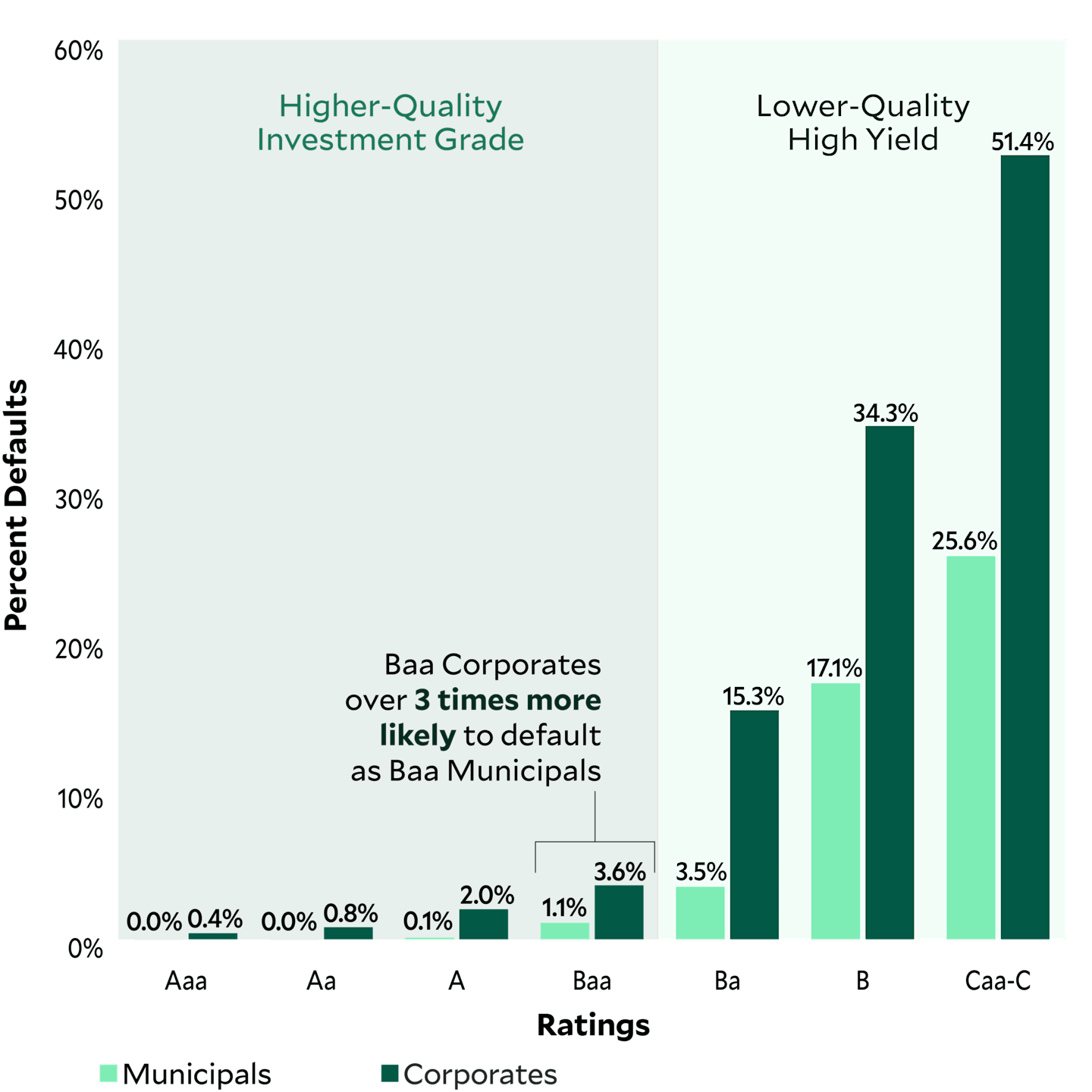

Reviewing the History: Munis’ Lower Default Rate

Municipal bonds have a history of significantly lower default rates than taxable corporate bonds with the same credit quality rating. A comparison of muni bond default rates versus similarly rated taxable bonds shows this result holding up historically since the 1970s through 2023, the last year for which average data is available.

While all investing involves risk, understanding these differences may help investors decide which investments best suit their needs.

10-Year Average Cumulative Default Rates, 1970 to 2023

Source: Moody’s Investors Services. Data as of 12/31/2023.

The letter ratings indicate the credit worthiness of the individual bonds and generally range from Aaa (highest) to D (lowest). Investment grade ratings range from Aaa to Baa; high yield ratings range from Ba to D.

Why Municipal Bond Investments?

Municipal bond strategies can help address challenges many investors face today.

Taxes and Income

Munis can provide investors with income in a tax-advantaged way.

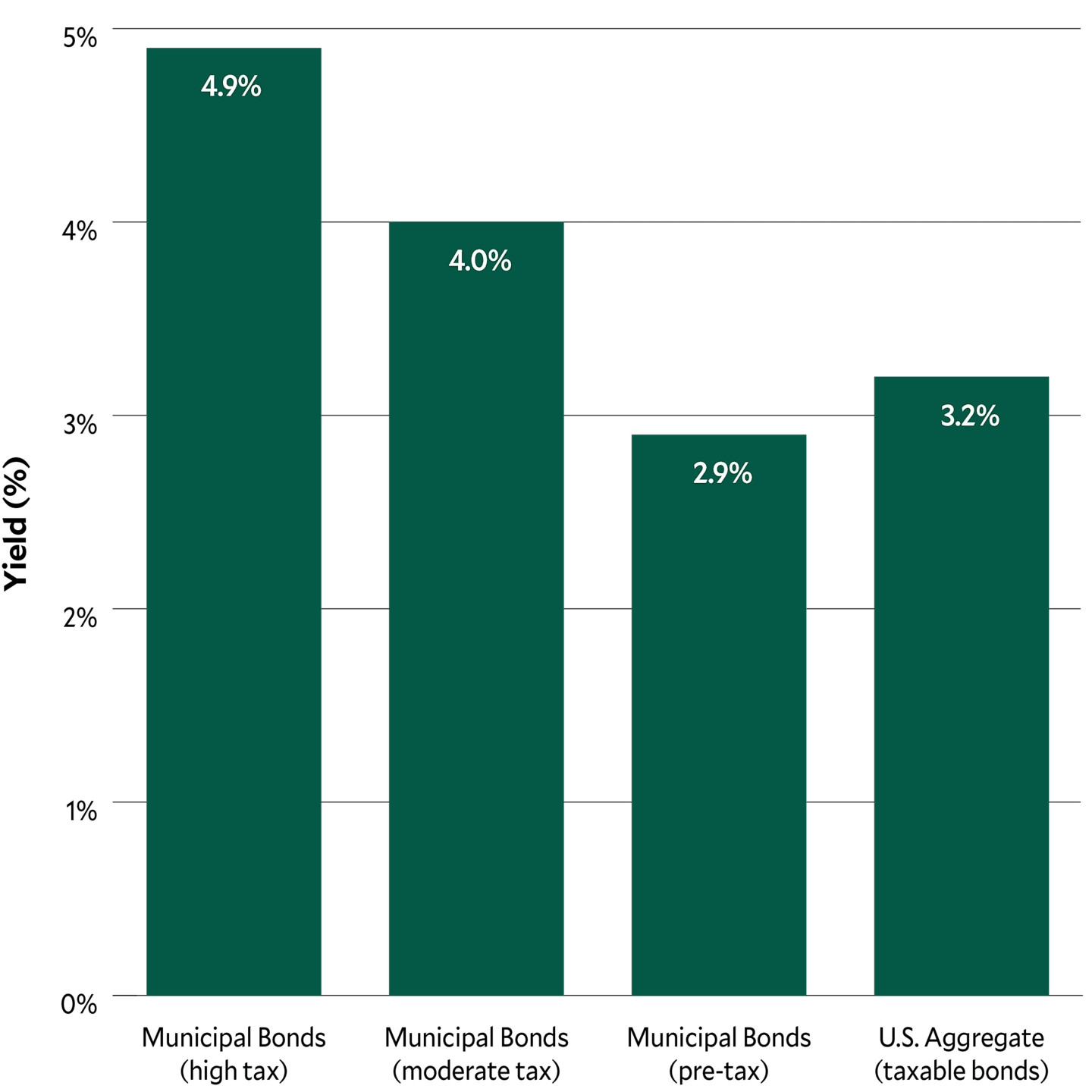

Tax Savings Help Investors Keep More of Any Returns

Munis generate income that’s free from federal taxes and, in some cases, state and local taxes, too.

They also offer potential yield advantages for those in both moderate and higher tax brackets.

Average Yields Over 20 Years

Data as of 12/31/2024. Source: FactSet.

Yield data is based on Yield to Worst calculated over the past 20 years.

Municipal bonds are represented by the Bloomberg Municipal Bond Index. Taxable bonds are represented by the Bloomberg US Aggregate Index.

Past performance is no guarantee of future results.

Federal tax rates used to calculate tax-equivalent yields: Moderate Tax Bracket – 28%; High Tax Bracket: 40.8%.

Returns Consistency

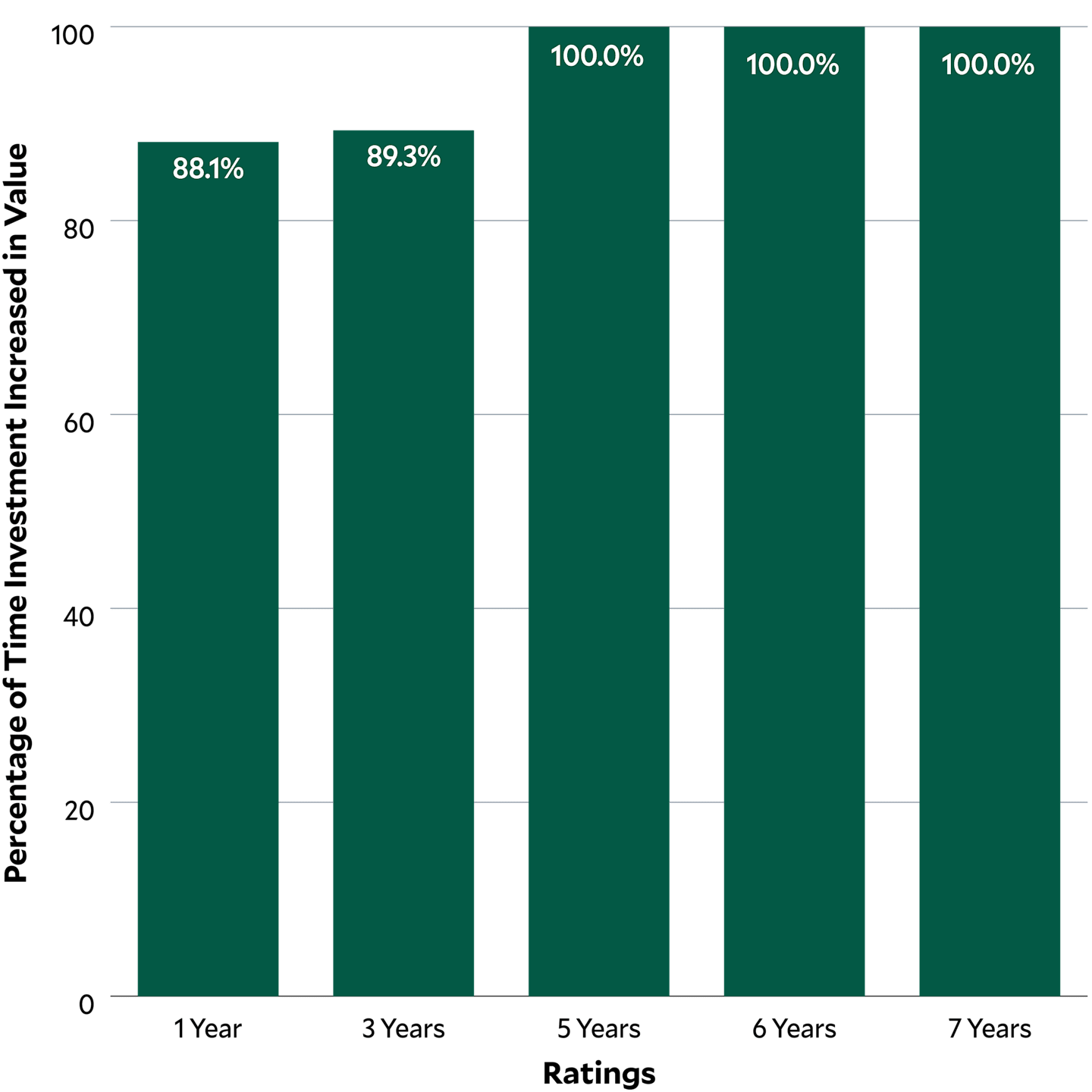

Munis have generated consistently positive returns for decades.

A History of Growth

Since 1998, munis have delivered positive returns over most rolling time periods.

Percentage of Time Municipal Bonds Increased in Value per Holding Period

Bloomberg Municipal Bond Index, Monthly Rolling Investment Periods Since 2024

Data as of 12/31/2024. Source: Barclays.

Municipal bonds are represented by the Bloomberg Municipal Bond Index.

Past performance is no guarantee of future results.

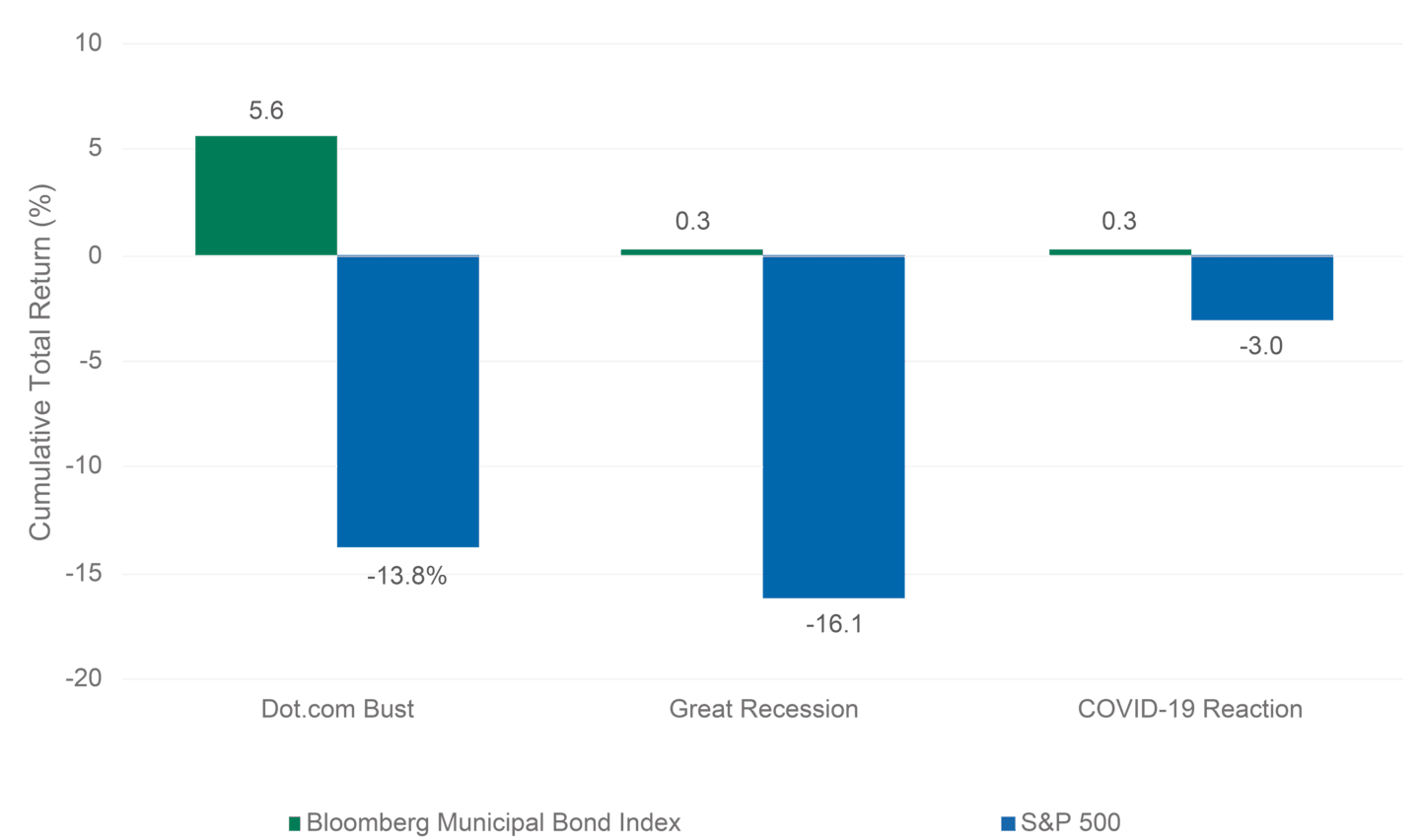

Wealth Preservation

Many investors want to preserve the capital they invest, as well as gain some growth. Munis have historically answered the call.

Resilience Under Market Pressure

During periods of extreme stock market stress, municipal bonds balanced broad market declines.

Total Returns During Periods of Market Stress

Source: FactSet.

Dot.com bust: 3/31/2001 - 10/31/2001; Great Recession: 2/28/2007 - 9/30/2008; COVID-19 Reaction: 2/28/2020-6/30/2020.

Municipal bonds are represented by the Bloomberg Municipal Index; stocks are represented by the S&P 500 Index.

Past performance is no guarantee of future results.

Portfolio Diversification

Munis react differently than other investments, helping manage market risk in a portfolio.

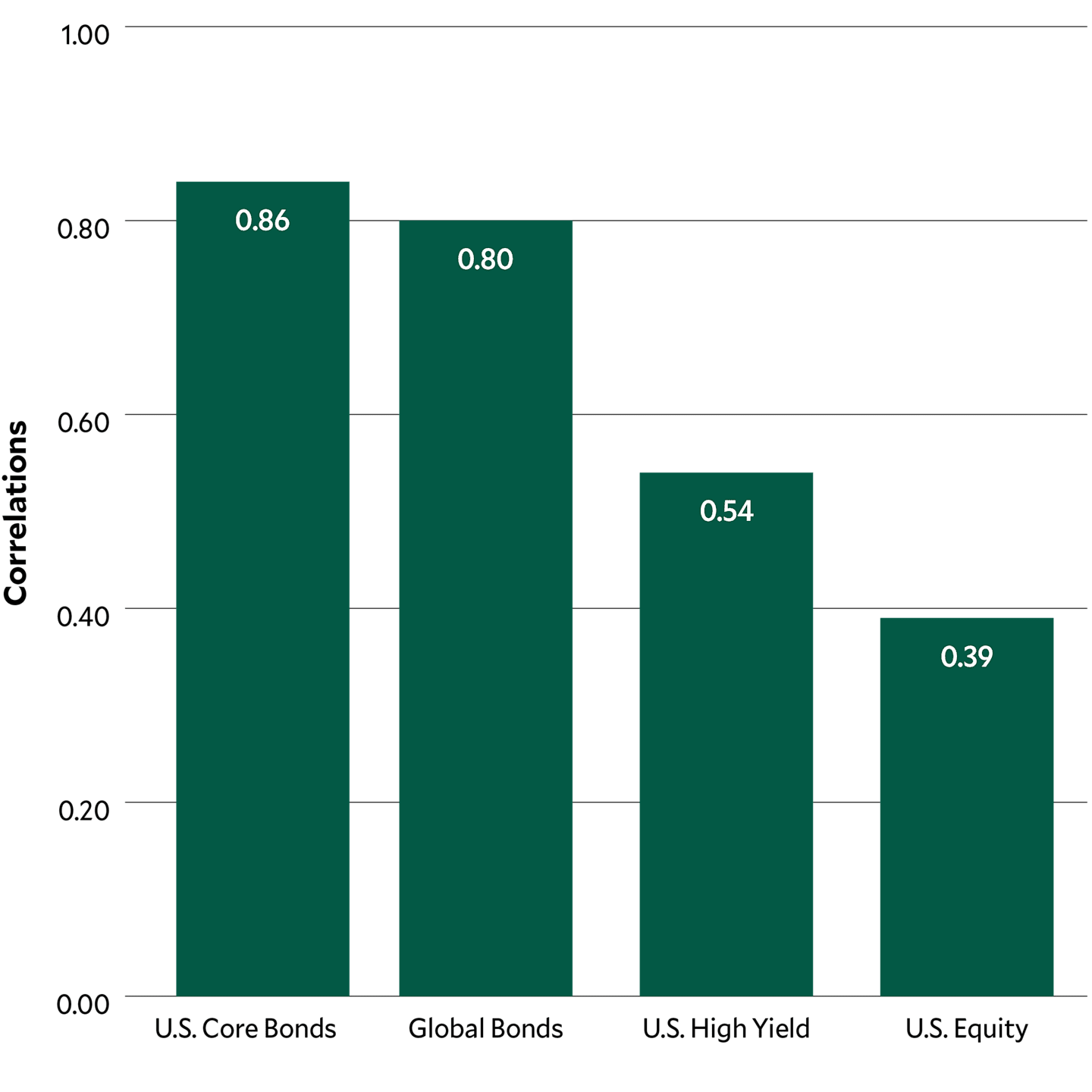

A Difference in Reactions Enhance Diversification

Lower correlations have helped municipal bonds diversify portfolios.

Correlations of Other Types of Investments to Investment Grade Municipal Bonds – Trailing 10 Year

12/31/2014 - 12/31/2024. Source FactSet.

Investment categories are represented by the following indexes: Municipal Bonds: S&P Municipal Bond Investment Grade Index; U.S. Core Bonds: Bloomberg US Aggregate Index; Global Bonds: Bloomberg Global Aggregate Index; U.S. High Yield: Bloomberg US High Yield Index; U.S. Equity: S&P 500 Index.

A diversified portfolio includes a variety of investments that react differently to the same market or economic event. Diversification is measured by correlation, the extent to which the performance of two investments move in relation to each other. Correlations range from -1.0 (always moving in opposite directions) to +1.0 (always moving in the same direction). Although diversification cannot guarantee a profit or protect against loss of principal, it has helped smooth the ups and downs of a single type of investment.

Why American Century?

Our municipal bond strategies pursue consistency, an attractive risk/return tradeoff, and are competitively priced*. Find them here.

Municipal Bonds Are Not Created Equal

Credit ratings don’t always signify the best investment opportunities. We seek out the bonds we believe offer attractive risk/return potential.

Index Limitations

Unlike index-constrained funds, we have the flexibility to anticipate and adjust to changing markets.

Managed with Consistency in Mind

Our portfolios focus on consistent income by emphasizing individual bonds and seeking to avoid the potential pitfalls of leverage.

Research-Driven Bond Selection

We analyze factors driving credit quality, so we can include non-rated and off-benchmark issues and steer clear of bonds we believe are excessively risky.

Cost-Conscious

We strive to keep our fund expenses competitive, which we believe helps improve returns.

*Source: Morningstar. As of 12/31/2024.

Based on a peer group comparison of expense ratios for each fund. The expense ratio for Investor Class shares are below median for each fund within their Morningstar category: Intermediate-Term Tax-Free – US Muni National Intermediate; High Yield Municipal – US Fund High Yield Muni; California Intermediate-Term Tax-Free – US Fund Muni California Intermediate; California High-Yield-Municipal – US Fund California Long. The expense ratio for Diversified Municipal Bond ETF is below the peer group median within the Morningstar US Muni National Intermediate category.

Investment Options

Intermediate-Term Tax-Free

Core holding featuring the potential for monthly income free of federal taxes.

High-Yield Municipal

Satellite holding offering higher tax-free income potential for more risk-tolerant investors.

California Intermediate-Term Tax-Free

Core holding for California residents featuring the potential for income free of state and federal taxes.

California High-Yield Municipal

Satellite holding designed for more risk-tolerant California residents seeking higher income potential free of state and federal taxes.

California Municipal Bond ETF

Core holding designed for more risk-tolerant California residents seeking higher income potential and is free of federal and California taxes.

Diversified Municipal Bond ETF

Core, federal tax-free ETF that offers a single fund solution blending investment grade and high-yield bonds.

Current Views & Insights

We believe municipal bond market dynamics favor active managers who have the flexibility to explore all opportunities.

Use this calculator to help your clients understand the impact of taxes when they compare yields of municipal bonds and taxable bonds.

Tap our resources to help your clients understand how tax-efficient investing strategies and tax rules may affect their portfolios.

Have Questions?

Contact us to discuss our muni bond strategies.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The letter ratings indicate the credit worthiness of the underlying bonds in the portfolio and generally range from AAA (highest) to D (lowest).

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

High-Yield Municipal, Intermediate-Term Tax-Free, California High-Yield Municipal, California Intermediate-Term Tax-Free, Diversified Municipal Bond ETF:

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Interest rate changes are among the most significant factors affecting bond return. When rates decline, bond prices rise and the fund may generate less income. When rates rise, bond prices fall. Depending on your tax situation, investment income may be subject to state and local taxes and the federal alternative minimum tax.

Even though the fund is designed to purchase assets exempt from federal taxes and currently has no exposure to the federal alternative minimum tax (AMT), there is no guarantee that all of the fund's income will be exempt from federal income tax or the federal AMT. Specifically, the portfolio managers are permitted at any time to invest up to 20% of the fund's assets in debt securities with interest payments that are subject to federal income tax and/or federal AMT.

Investment income may be subject to certain state and local taxes and, depending on your tax status, the federal alternative minimum tax (AMT). Capital gains are not exempt from state and federal income tax.

There is no guarantee that the investment objectives will be met.

Dividends and yields represent past performance and there is no guarantee that they will continue to be paid.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

The gross expense ratio is the fund's total annual operating costs, expressed as a percentage of the fund's average net assets for a given time period. It is gross of any fee waivers or expense reimbursement. The net expense ratio is the expense ratio after the application of any waivers or reimbursement. This is the actual ratio that investors paid during the fund's most recent fiscal year. Please see the prospectus for more information.

High-Yield Municipal, California High-Yield Municipal, California Intermediate-Term Tax-Free, California Municipal Bond ETF, Diversified Municipal Bond ETF:

The lower-rated securities in which the fund invests are subject to greater default and liquidity risk, because the issuers of high-yield securities are more sensitive to real or perceived economic changes.

California Intermediate-Term Tax-Free Bond and California High-Yield Municipal:

Because the fund invests primarily in California municipal securities and securities issued by U.S. territories, its yield and share price will be affected by political and economic developments within the state and territories.

The fund currently has no exposure to the federal alternative minimum tax (AMT). The portfolio managers, however, are permitted to invest in assets that may be subject to the federal AMT.

There is no guarantee that all of the fund's income will be exempt from federal or state or local income taxes. The portfolio managers are permitted to invest up to 20% of the fund's assets in debt securities with interest payments that are subject to federal income tax, California state or local income tax and/or the federal alternative minimum tax.

California Municipal Bond ETF, Diversified Municipal Bond ETF:

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

This fund is an actively managed ETF that does not seek to replicate the performance of a specified index. To determine whether to buy or sell a security, the portfolio managers consider, among other things, various fund requirements and standards, along with economic conditions, alternative investments, interest rates and various credit metrics. If the portfolio manager considerations are inaccurate or misapplied, the fund's performance may suffer.

California Municipal Bond ETF:

Because the fund invests primarily in California municipal securities and securities issued by U.S. territories, its yield and share price will be affected by political and economic developments within the state and territories.

There is no guarantee that all of the fund’s income will be exempt from federal, California state or local income taxes. The portfolio managers are permitted to invest the fund’s assets in debt securities with interest payments that are subject to federal income tax, California state tax, local income tax and/or the federal alternative minimum tax. Capital gains are not exempt from state and federal income tax.

Exchange Traded Funds (ETFs): Foreside Fund Services, LLC - Distributor, not affiliated with American Century Investment Services, Inc.