Investment Basics

A Beginners’ Guide to Investing

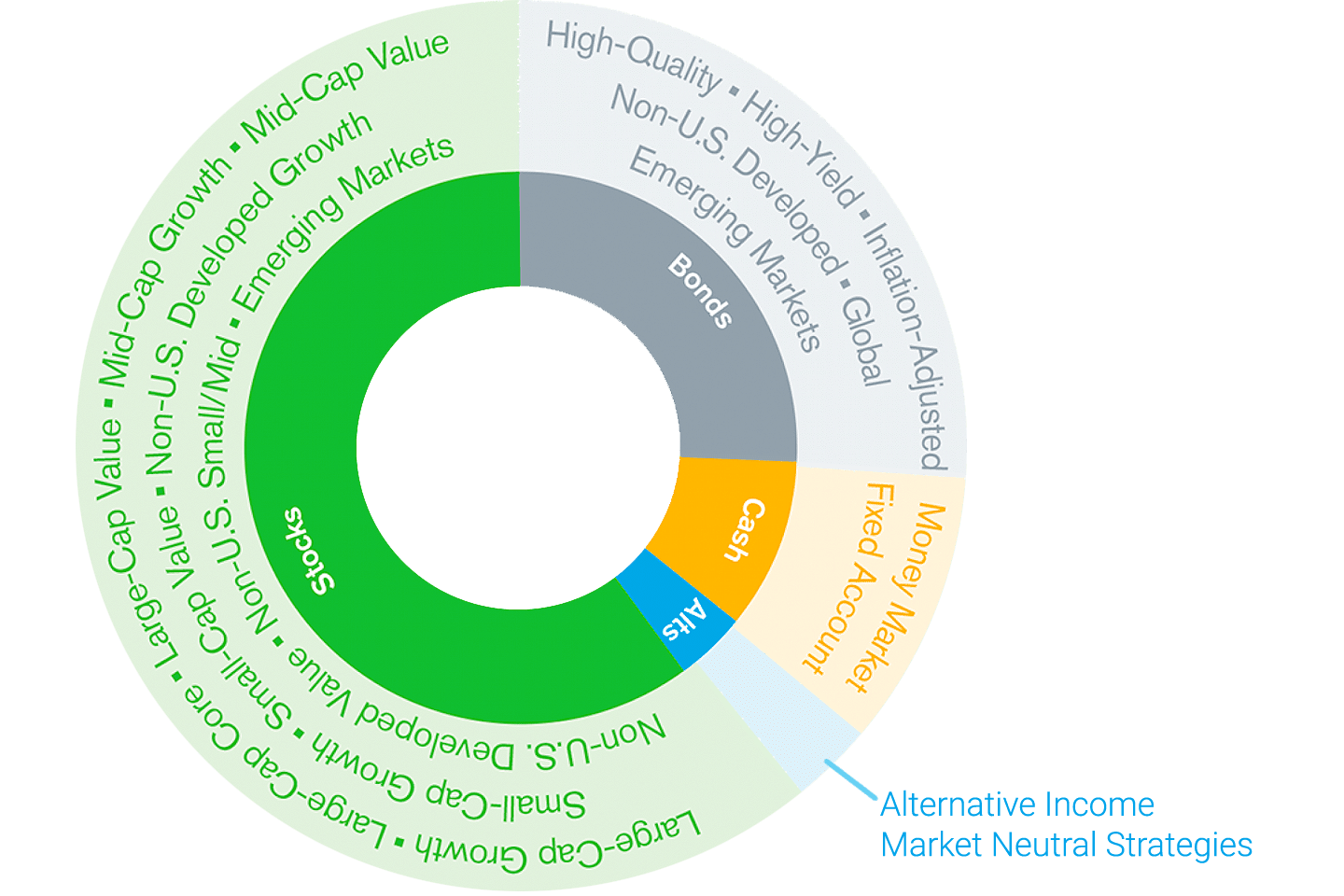

Understanding the broad asset classes of stocks, bonds and cash is a good place to start when beginning your investment journey. Learn about the most common types of investments and how they can help you put your money to work for the future.

Stocks

Add Potential to Grow Your Assets

Investing in the growth of different companies and the economy in general gives you higher return potential than bonds and cash, but also a greater risk of losses.

Bonds

May Provide Income and/or Less Volatility

Higher-quality bonds tend to do well when stocks decline, which may help manage risk. Bonds also may give you an income stream. Just remember that generally the higher the yield potential, the lower the credit quality—meaning there’s a greater risk the issuer could default on payments.

Money Market Funds

Give Access to Money and Help Preserve Capital

These funds typically hold fixed-income securities that mature in less than one year, such as U.S. Treasury bills. Although that offers a low average annual return, it provides more stability of principal as you get closer to withdrawing money from your portfolio.

Alternatives

May Help Manage Market Swings

Alternative investments like precious metals, commodities and infrastructure are often called nontraditional assets because they do not perform the same way as stocks, bonds and cash. You’ll want to consider their particular risks before adding to your portfolio.

Putting It All Together

The right mix for you should take into account your age, risk tolerance and goals for the future. Having a diversified portfolio is key to managing risk and smoothing out performance over time.

Choosing an Investment Vehicle

Don’t want to build and manage your own portfolio, buying and selling individual securities? You can combine your money with other investors in an investment vehicle that holds a basket of individual stocks, bonds and other securities. The two most common investment vehicles are mutual funds and exchange-traded funds (ETFs).

All mutual funds and ETFs have specific investment objectives, features and costs to consider. And you can combine them, along with individual stocks and bonds, to customize your portfolio.

The primary difference between mutual funds and ETFs is in how they are bought and sold:

A mutual fund's net asset value (NAV), or the price of a single share, is calculated once per day after market close. All trades are based on the day's NAV.

ETFs are securities that trade like individual stocks on an exchange, and as a result, can experience price changes as they are bought and sold throughout the day. Generally, an ETF's price is the market value of the underlying securities at the time of the trade.

Log in to your brokerage account to trade American Century{SUP}®{/SUP} ETFs commission free or open an account today.

Start Investing With More Confidence

Plan for the future with more confidence by understanding what’s in your portfolio. You can then strike the right balance between the potential for losing money with the potential for earning returns—ultimately helping you get to your financial goals.

Need help building your portfolio? One option is to use a robo-advisor to receive a recommended portfolio based on a short series of questions about you and how you feel about risk.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.