Why Dividends Still Matter to Your Portfolio

The concentrated market and recent volatility may make price returns difficult to achieve, bolstering the importance of dividends.

Key Takeaways

Dividend-paying stocks offer an alternative for income-oriented investors willing to take on equity market risk.

Dividends have accounted for 31% of the total return of U.S. stocks since 1930, underscoring their role in your long-term investment results.

Today’s expensive stock market may result in muted price returns, highlighting the importance of dividend-paying stocks in achieving total returns.

Entering 2025, investors had hoped that the Federal Reserve (Fed) would enact several interest rate cuts as inflation had moderated for much of 2024.

But the economic picture became difficult to decipher after the Trump administration on April 2 announced widespread and sweeping tariffs, which upended markets around the world and threatened to reignite inflation and slow global growth.

At the same time, the market has been highly concentrated over the last two years in a narrow band of technology stocks that have exposure to artificial intelligence (AI). As some investors have started to question whether high levels of AI spending can be sustained, investor preferences have started to rotate into less cyclical stocks.

Against this backdrop, we believe that price returns from expensive segments of the U.S. stock market are likely to be muted this year. We think this could potentially elevate the importance of dividends in your portfolio.

Recent Market Rotation Highlights Importance of Dividend-Paying Stocks

We tend to find dividend-paying stocks in the value-oriented areas of the equity market. Examples include utilities and consumer staples companies. These businesses have historically been more likely to pay dividends than fast-growing companies in cyclical sectors, like information technology.

Value stocks lagged growth stocks in 2023 and 2024 but have outperformed so far in 2025, as of April 11. The rotation back to value started in 2024 as some investors grew skeptical of massive AI spending that had produced few avenues to monetize the technology.

The swing toward value picked up speed this year when the Trump administration imposed tariffs on U.S. trade partners. The uncertain nature of Trump’s tariff policy has put investors on shaky footing and caused money to flow to more stable and less cyclical stocks.

Despite these significant shifts, the market remains concentrated in large technology stocks. Given their high valuations and the market's rotation, we think the upside price potential of those stocks is somewhat limited. Therefore, we believe dividend-paying stocks can help fill the vacuum, contribute to total returns and help investors diversify their portfolios.

Valuation Disparities: Growth vs. Value Stocks

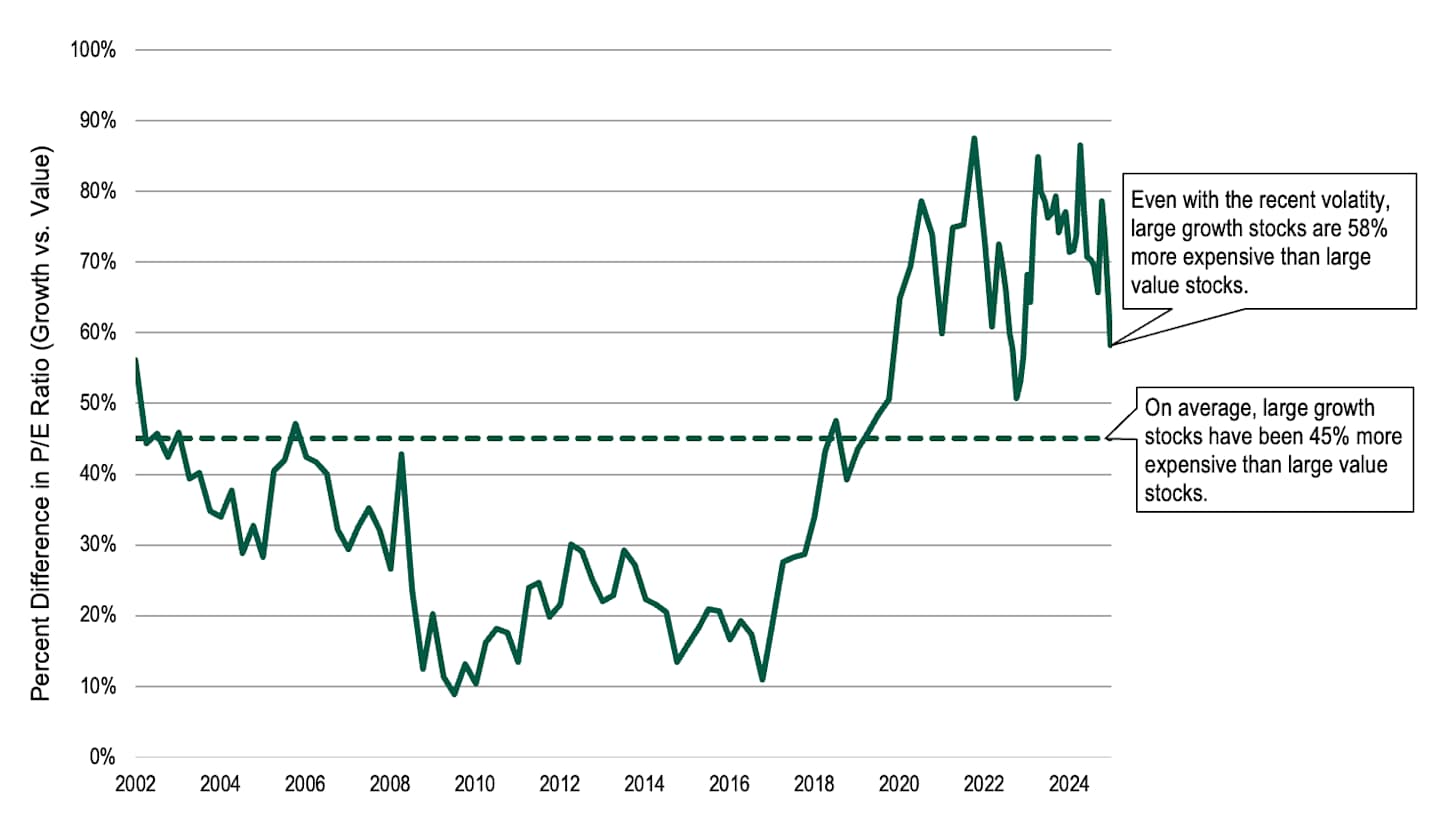

Even accounting for recent market volatility, there’s still a wide gap in valuations between growth and value stocks. See Figure 1.

Figure 1 | Large-Cap Growth Stocks Are Still More Expensive than Large-Cap Value Stocks

Data from 3/28/2002 to 3/21/2025. Source: FactSet. Large growth and large value stocks are represented by the Russell 1000 Growth and Russell 1000 Value indices, respectively. In our glossary, we define price-to-earnings (P/E) ratio.

As of March 2025, large-cap growth stocks were 58% more expensive than their value counterparts, well above the long-term average of 45%.

We think the long period of valuation disparity heightens the chances for the prices of value stocks to increase and the prices of growth stocks to decline. Our experience from prior cycles indicates this reversal of trends can happen quickly, as it did when investors started to grow concerned about tariff threats and the sustainability of massive AI spending.

The Power of Compounding Through Dividend Reinvestment

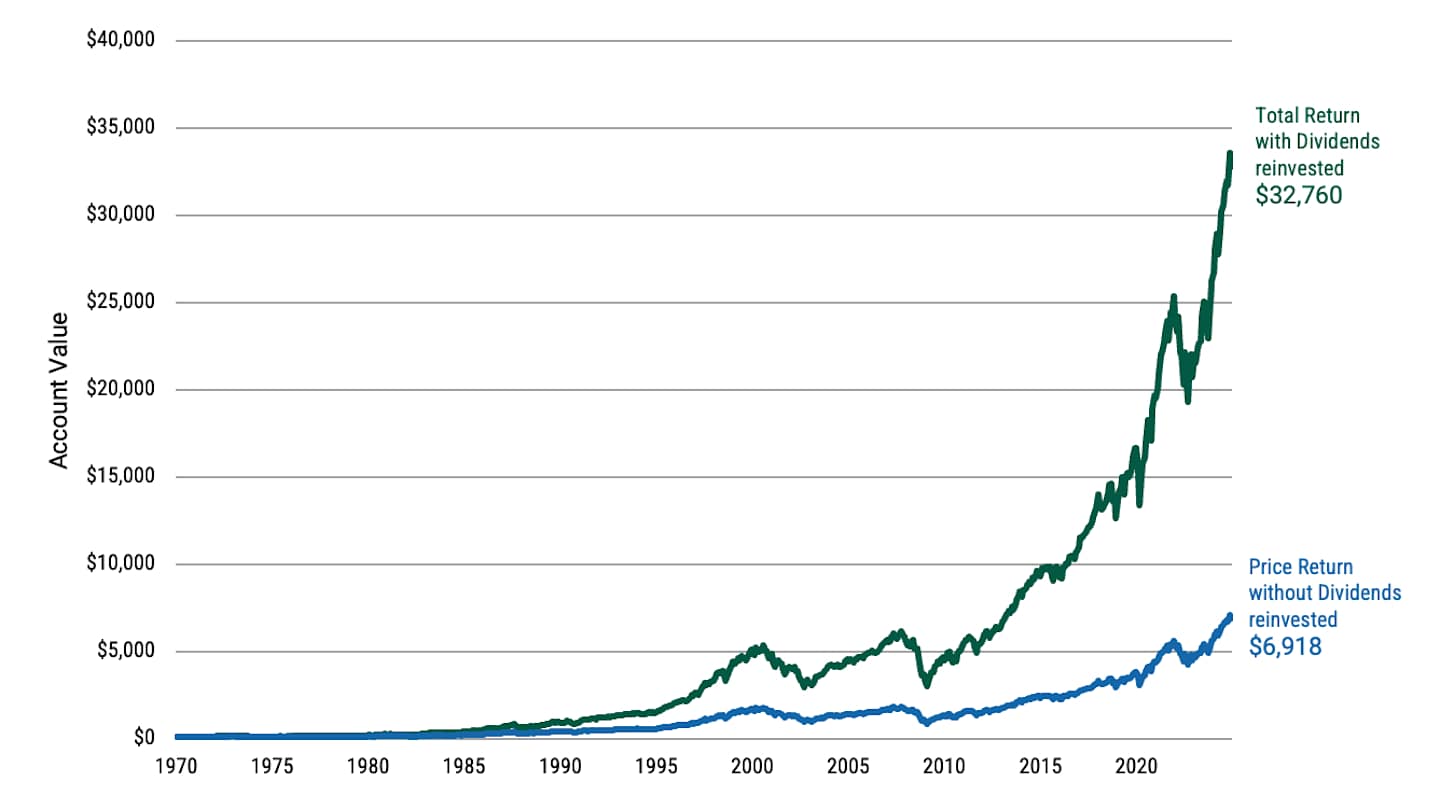

Since 1930, dividends have constituted approximately 31% of the total return of U.S. stocks. Figure 2 shows how vital dividends — and dividend reinvestment — have been to the value of a hypothetical $100 investment in the S&P 500® Index over 40 years.

Figure 2 | Dividends Make a Difference

Data from 1/31/1970 to 12/31/2024. Source: FactSet. Performance in USD. Past performance is no guarantee of future results. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Reinvesting regular dividend payments has historically boosted investment returns over time thanks, in part, to the power of compounding. Reinvesting dividends to buy more shares means any future earnings and dividends are paid on a higher number of shares.

Dividends May Help Fortify Portfolios

We believe stock dividends can play an important role in the long-term growth of an investor’s diversified portfolio. Dividend payouts have generally recovered from recent setbacks, and the power of compounding can bolster investment returns over time. We also believe a sustained market rotation from growth to value would bode well for dividend-paying stocks.

Authors

Senior Client Portfolio Manager

Check Out Our Value Capabilities

Dividends and yields represent past performance and there is no guarantee that they will continue to be paid.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.