The Broad Impact of a Strong U.S. Dollar

The strength of the U.S. dollar has economic effects on global trade and individual investors.

Key Takeaways

Fed policy, market volatility and a healthy U.S. economy have helped the dollar remain strong relative to other currencies.

Dollar superiority could continue if interest rates and economic uncertainty remain elevated.

Who gains? Who loses? The strong U.S. dollar affects economies and companies differently.

The Federal Reserve’s (Fed’s) aggressive post-pandemic rate-hiking and higher-for-longer rate strategy has helped underpin the U.S. dollar. This has significant consequences for global economies, currencies and inflation.

Who are the winners and losers, and how long can this dollar strength last?

Factors Behind the Strong U.S. Dollar

The Fed’s aggressive rate hike campaign to combat inflation affected both sides of the supply/demand equation . Higher interest rates effectively removed dollars from the supply by increasing the cost of borrowing. At the same time, rising rates created attractive yields for some dollar-denominated investments, which attracted foreign investors and increased demand for U.S. currency.

Slowing global economic growth and market uncertainty also affect demand for the dollar. The U.S. economy remains relatively strong compared to other markets, making it attractive to foreign investors who must purchase dollars to invest here.

At the same time, the relative strength of the domestic economy and stock market may be keeping American investment dollars at home. Some U.S. investors may be less inclined to increase their overseas holdings, which would require selling dollars to buy foreign currencies.

The dollar also benefits from its status as the world’s reserve currency. Central banks hold dollars in their foreign exchange reserves for deals with other countries. Commodities like gold and oil are priced in dollars, and many international transactions and cross-border loans are executed in dollars.

Historical Perspective on Dollar Strength

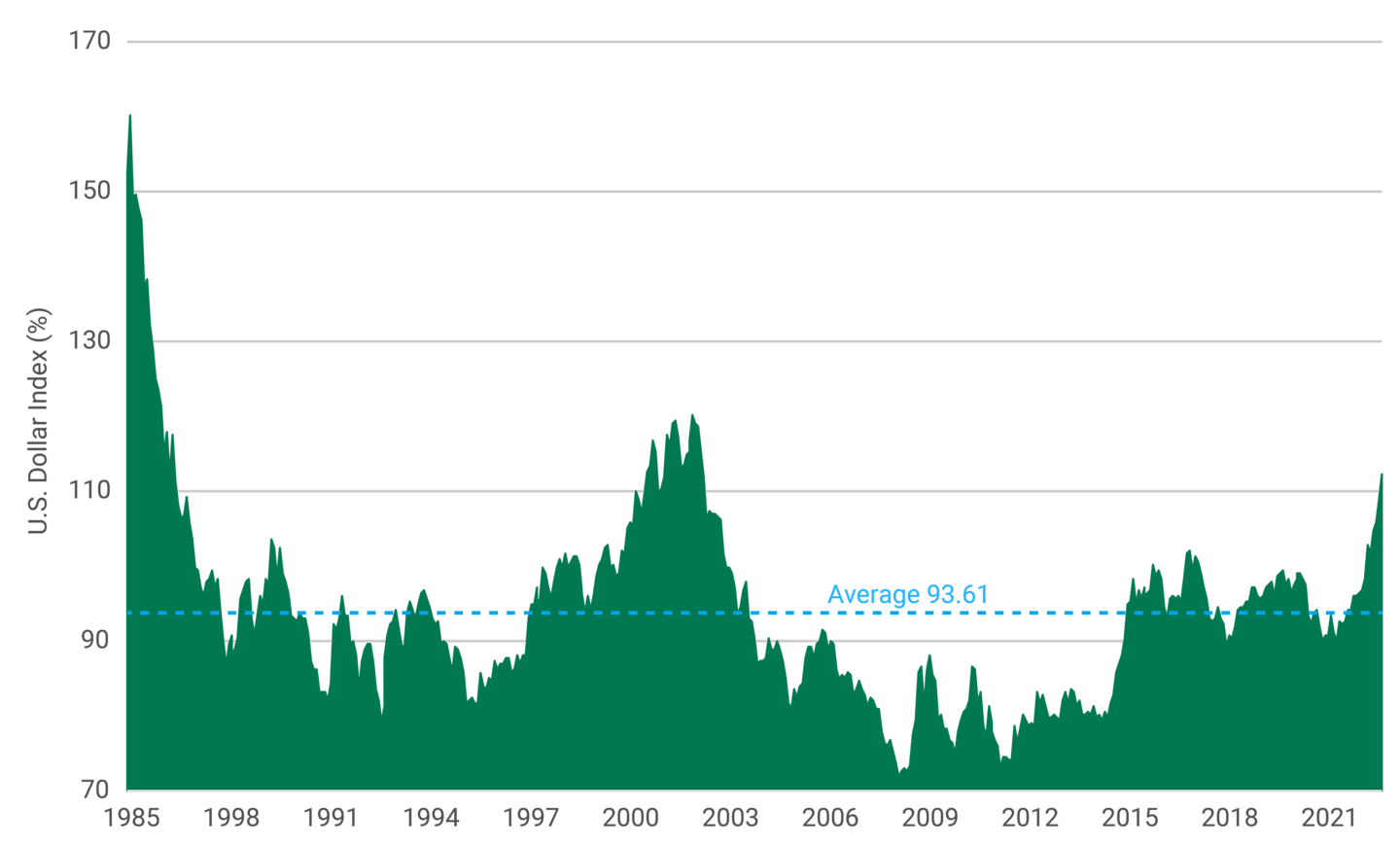

Despite its rise, the dollar isn’t as strong as it was during the mid-1980s. See Figure 1. Paul Volcker, chair of the Fed from 1979–1987, helped reduce inflation and strengthen the dollar’s value worldwide.

Figure 1 | The Dollar Is Strong, But Not at Historical Levels

Data from 7/1/1984 – 7/1/2024. Source: FactSet.

Who Benefits from a Strong Dollar?

U.S. importers benefit from the strong dollar because goods produced outside the country cost less in dollar terms when the value of the manufacturer’s currency declines. As a result, their profit margins may improve as the cost of acquiring goods from countries with weaker currencies declines. In turn, U.S. consumers could see lower prices if importers pass the lower costs to their customers.

Foreign companies generating significant sales in the U.S. also benefit because the revenue reported on their financial statements will reflect the higher value of U.S. currency.

Other beneficiaries include companies with the pricing power to withstand the inflationary environment that a strong dollar supports. Companies with firm-specific growth drivers can often pass higher materials and wage costs to their customers. Such companies tend to rely less on a robust economic environment. They are often innovators serving niche markets or offering best-in-class goods or services with few viable alternatives.

Challenges of a Strong Dollar

A strong dollar tends to be a headwind for U.S. exporters and U.S.-based multinational companies generating significant revenue overseas. When the dollar's value rises, U.S.-made goods are more expensive for local buyers.

Emerging markets (EM) suffer as investment capital flows to the U.S. and its stronger currency. The strong dollar puts pressure on countries that have issued dollar-denominated debt, which they must repay in a stronger currency rather than their own. EM economies that are net commodity importers will also feel the pressure of higher costs for energy, raw materials and grain.

Interestingly, the strong dollar creates winners and losers in the travel industry. For U.S. travelers, the strong dollar can reduce the cost of vacationing overseas. On the other hand, the exchange rate results in higher costs for foreign travelers visiting the U.S.

Investing Through Dollar Fluctuations

The dollar’s value fluctuates depending on market demand. And, with Fed policy and economic conditions evolving, the pendulum could swing from its currently strong position.

Rather than making investment decisions based on currency expectations, we believe staying broadly diversified with exposure to U.S. and non-U.S. stocks and bonds remains a prudent strategy.

Check Out Our 2024 Outlook for U.S. Stocks

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.