The Power of Compounding: Why People Invest

Compounding returns is the powerful concept behind investing that gives people the potential to build more wealth over time.

Key Takeaways

Money you invest has the potential to grow exponentially. It’s known as compounding—one of the most powerful ways to build wealth over time.

Compounding is sometimes described as the snowball effect, with money building on itself over time. It can work for you—and against you.

Automatic investing strategies and compounding is a potent combination that can help pave your way to your financial goals.

Why do people invest? Unlike money stuffed in the proverbial mattress or coffee can, money you invest has the potential to grow exponentially over time. It’s known as compounding—and it’s one of the most powerful ways to build wealth over time.

Let’s dig deeper into compounding and how it can work for you, and against you, when investing for your future.

Ways Investments Compound

Stocks, bonds, mutual funds and exchange-traded funds have the potential to earn more money than traditional savings accounts if you’re comfortable taking on the risks of investing.

Compounding interest - By reinvesting a bond’s interest payments, you get the power of compound interest. The interest earned on a traditional bond investment is added back to the principal at the end of each year. Interest is then calculated on the new, larger principal amount going forward. (Some bond funds may compound more frequently, like quarterly or even daily, depending on the specific fund structure.)

Compounding dividends - If you choose to reinvest an equity investment’s dividend payments, you’re compounding dividends and buying more shares in a fund or individual stock—generating returns on the higher amount.

Compounding earnings - The collective effect of reinvesting the money earned on an investment, including interest, dividends and capital gains, is known as compounding earnings.

Compounding returns - Although it’s often used instead of compounding earnings, compounding returns is generally a broader reference to reinvesting all of the money you earn on an investment.

Total returns - Compounded earnings PLUS changes in the prices of securities encompasses an investment’s total return. The longer compounding works in your favor, the bigger your total return.

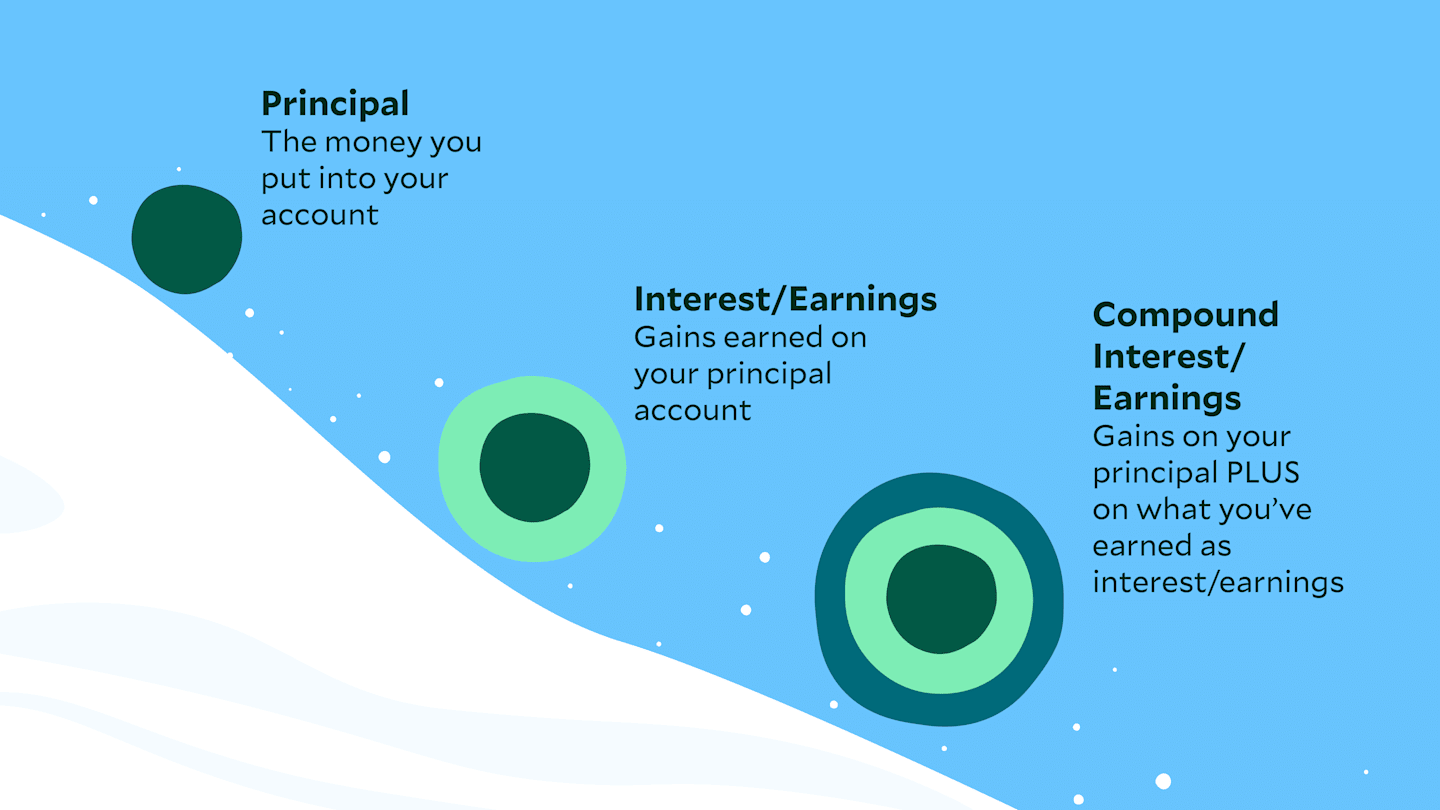

However compounding occurs, the concept is the same.

"Money makes money. And the money that money makes, makes more money."

Benjamin Franklin

The Snowball Effect and Compounding

As a snowball might roll down a hill and get larger and larger, compounding is money building on itself over time.

Source: American Century Investments.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

The Math—How Compounding Works

Here’s an example of compounding in action.

Let’s say you start with $1,000 in an account earning 3% interest, compounded annually. Remember, compound interest builds on the principal balance plus accrued interest.

Year 1: You’ll earn $30 in interest on the $1,000 principal.

Year 2: You’ll earn $31 in interest based on your account balance of $1,030.

After 25 years, your account balance will be $2,093.79—approximately twice the original principal amount.

While compounding can lead to exponential growth with positive returns, negative returns can erode capital. And the more a portfolio loses, the more it must gain to get back to even.

Source: American Century Investments; Compound Savings Calculator from Dinkytown.net, March 2025.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

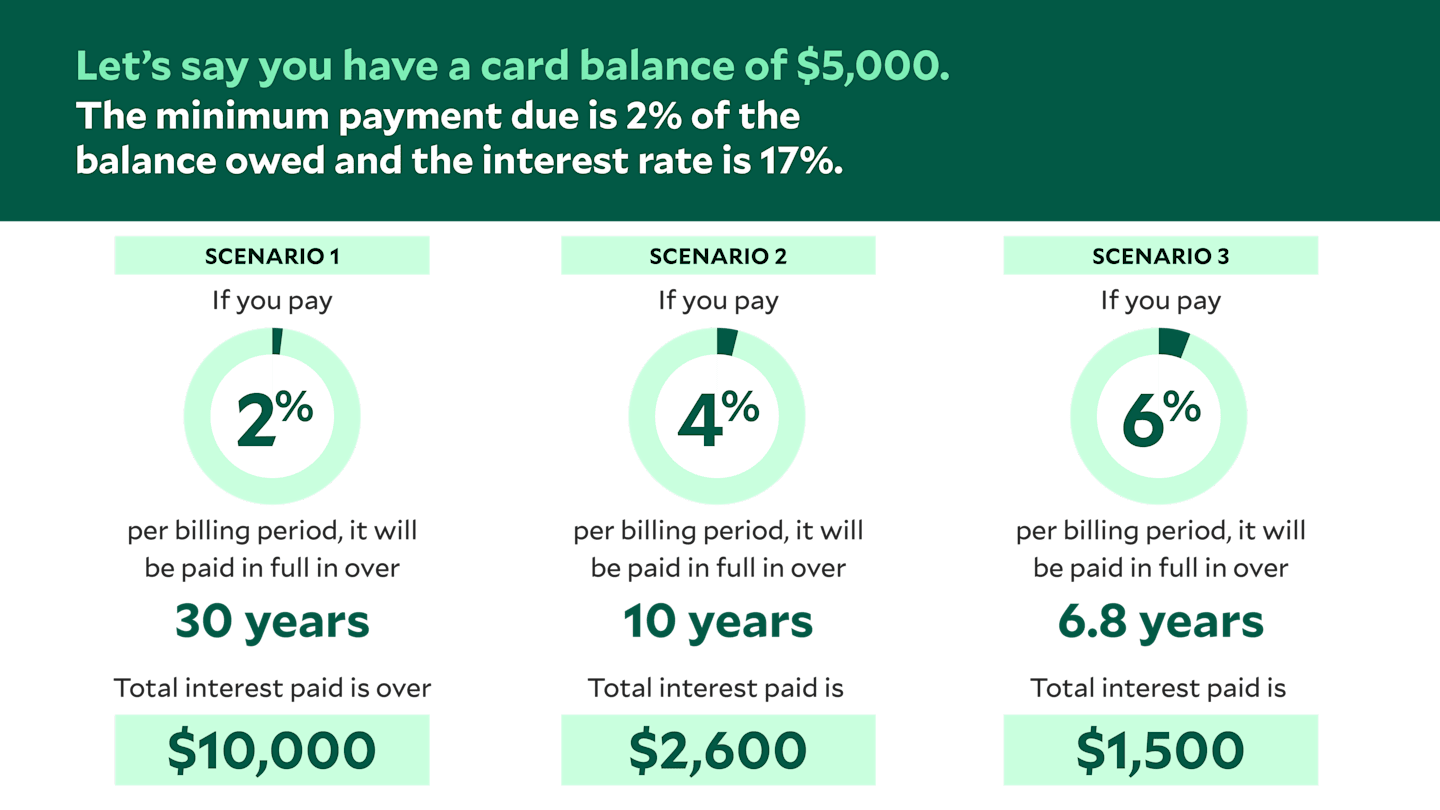

The Snowball Effect on Debt: Reversal of Fortune

Compounding can also work against you. Some lenders, most notably credit card issuers and payday lenders, charge compound interest on loans. That means interest is calculated on the total balance, including any interest that has already been charged. The longer you take to pay the loan back, the more the balance can grow.

Even when you make payments, your account balance can become larger than the amount you initially borrowed. That’s why you want to pay more than the minimum monthly payment, consider making extra payments toward principal and prioritize paying off high-interest debt.

Here’s an example from credit reporting agency TransUnion on the costs of making payments on the balance of a credit card rather than paying it off before interest starts incurring.

Source: TransUnion LLC.

While compound interest is calculated on the principal amount and the accumulated interest, simple interest is calculated on only the principal. Simple interest is more favorable to borrowers because balances grow more slowly. But it’s less favorable for investors because they don’t earn interest on interest.

Pursue the Power of Compounding With Automatic Investments

Consider combining compounding with automatic investing strategies. One of the best examples is money invested in employer-sponsored retirement plans.

By agreeing to contribute money deducted from your paycheck every pay cycle into a 401(k) or other retirement account, you:

Add to your balance.

Receive tax advantages.

Get money added into your retirement savings account if your employer matches your contribution.

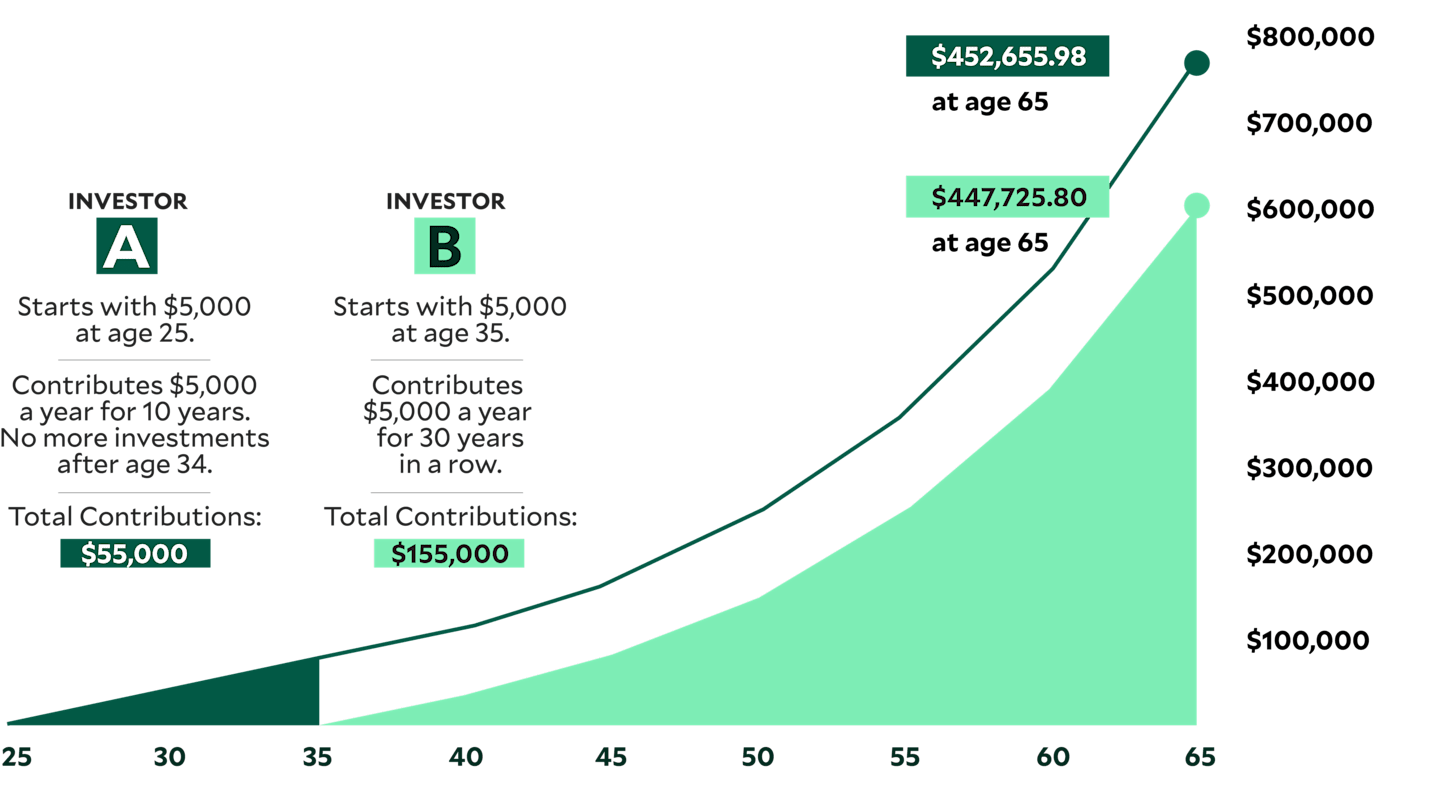

Automatic contributions and compounding are the reasons why young people who start investing early in a company retirement plan may be able to contribute less money over their careers and retire with a bigger nest egg than those who start investing later.

Automatic annual increases in payroll deductions also help—even small additions of 1% to 2%. These small changes may be so gradual that you don’t miss the money from your paycheck, but they add up over time.

Put Time on Your Side

The earlier a person takes advantage of compounding, the more time the money has to grow—and the less money a person may need to contribute to reach a goal.

Source: American Century Investments; Compound Savings Calculator, Dinkytown, Inc., March 2025. The calculation assumes a 6% rate of return compounded annually until age 65. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Financial Calculators from Dinkytown.net. Financial Calculators ©1998–2025 KJE Computer Solutions, LLC.

In the example above, the person who started earlier and contributed less to the account ended up with more money.

Investor A:

You end up with approximately $452,656 at age 65—from 11 out-of-pocket payments totaling $55,000.

You start investing at age 25 with $5,000 and add $5,000 every year for 10 consecutive years. After age 34, you make no additional investments, and the money is left to grow until you reach age 65.

Investor B:

You end with approximately $447,726 at age 65—from 31 out-of-pocket payments totaling $155,000.

You start investing at age 35 with $5,000 and add $5,000 every year for 30 consecutive years until reaching age 65.

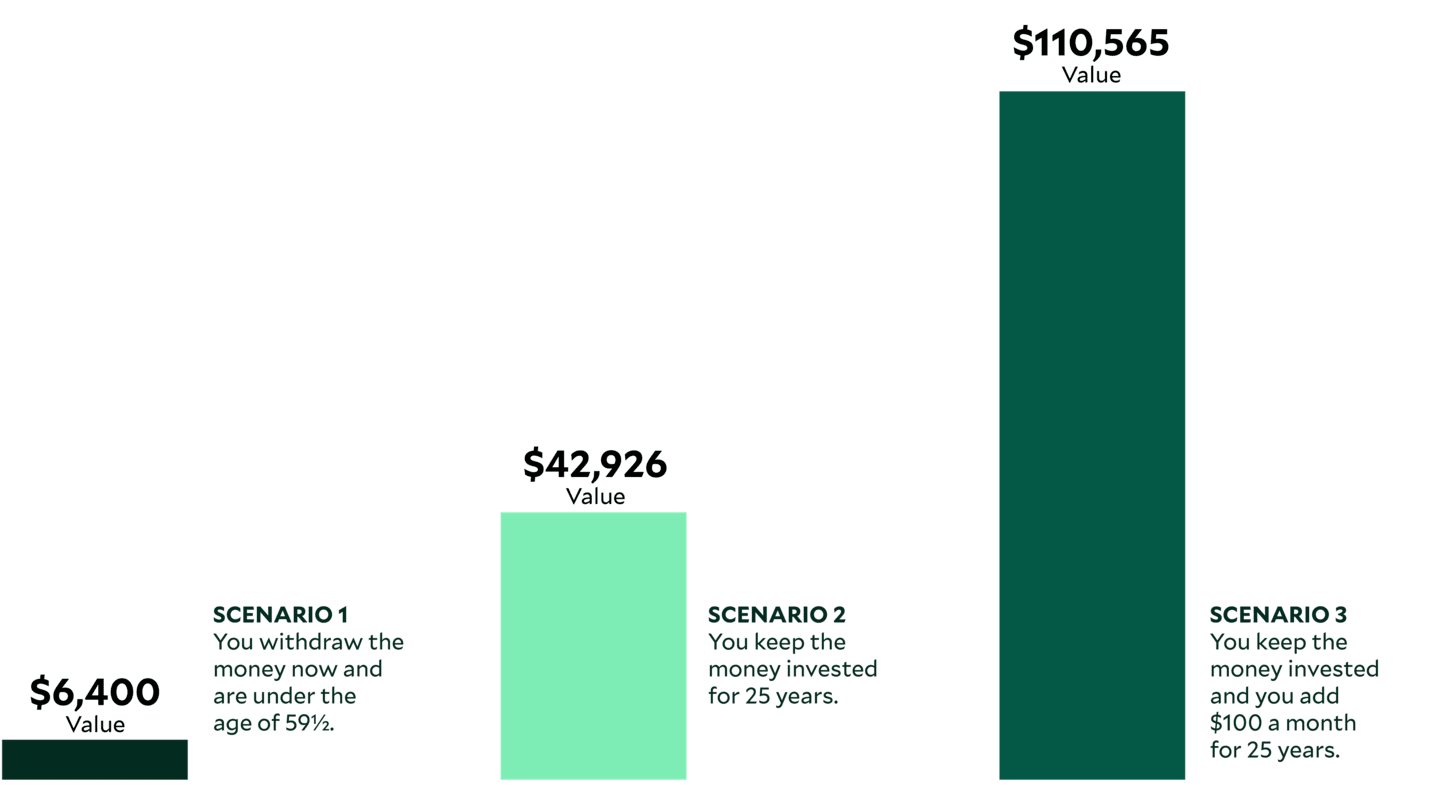

Withdrawals Are Difficult to Recover From

Of course, dipping into accounts can undo what compounding has built. It can be difficult to overcome the setback, and taxes and penalties from a 401(k) withdrawal carry a big financial cost. Instead, having both emergency and rainy-day funds can help you deal with unexpected expenses.

Below is an example that shows the money you could potentially forfeit if you withdraw just a portion of a retirement account today versus keeping it invested for 25 years—or keeping it invested and adding to it.

Let’s assume a beginning balance of $10,000

Source: American Century Investments; Future Value Calculator, Dinkytown, Inc., March 2025. The withdrawal value assumes the following: the 20% mandatory federal income tax withholding, 6% in potential state and local income taxes and a standard 10% penalty for early withdrawal ($6,400) and 6% returns for 25 years if the money ($10,000) stays invested. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance that similar results can be achieved, and this information should not be relied on as a specific recommendation to buy or sell securities. Financial Calculators from Dinkytown.net. Financial Calculators ©1998–2025 KJE Computer Solutions, LLC.

See How Compounding Might Work for You

Big financial goals may seem unachievable at times, but it’s why we invest. The power of compounding has the potential to put additional money toward your goals that you didn’t expect. Use our compound savings calculator to see how it might work for you.

Have You Saved Enough?

Find out how you compare.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

As with all investments, there are risks of fluctuating prices, uncertainty of dividends, rates of return and yields. Current and future holdings are subject to market risk and will fluctuate in value.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.