Investing in an Election Year: Four Myths, Debunked

Debunking myths about election-year investing to help stay focused on your financial goals.

Key Takeaways

As the presidential race heats up, it’s important to remember that the economy is the biggest driver of market performance.

U.S. stocks have historically averaged positive returns regardless of election outcomes, so staying invested may mean benefiting from those returns.

Be aware of your biases and emotions during an overheated political race and remain confident in your long-term financial plan.

With the U.S. presidential election making headlines, it’s easy to feel uncertain about your investment strategy. As the political rhetoric and election promises heat up, we think it’s essential to keep your emotions in check and ignore the common misconceptions about how elections affect the economy and the markets.

Here are our top four myths about ways this year’s election could impact your portfolio:

Myth #1: The U.S. economy does better under a specific party.

Reality: Economic growth is influenced by many factors, including global economic conditions, technological advancements and demographic changes, not the political party in power.

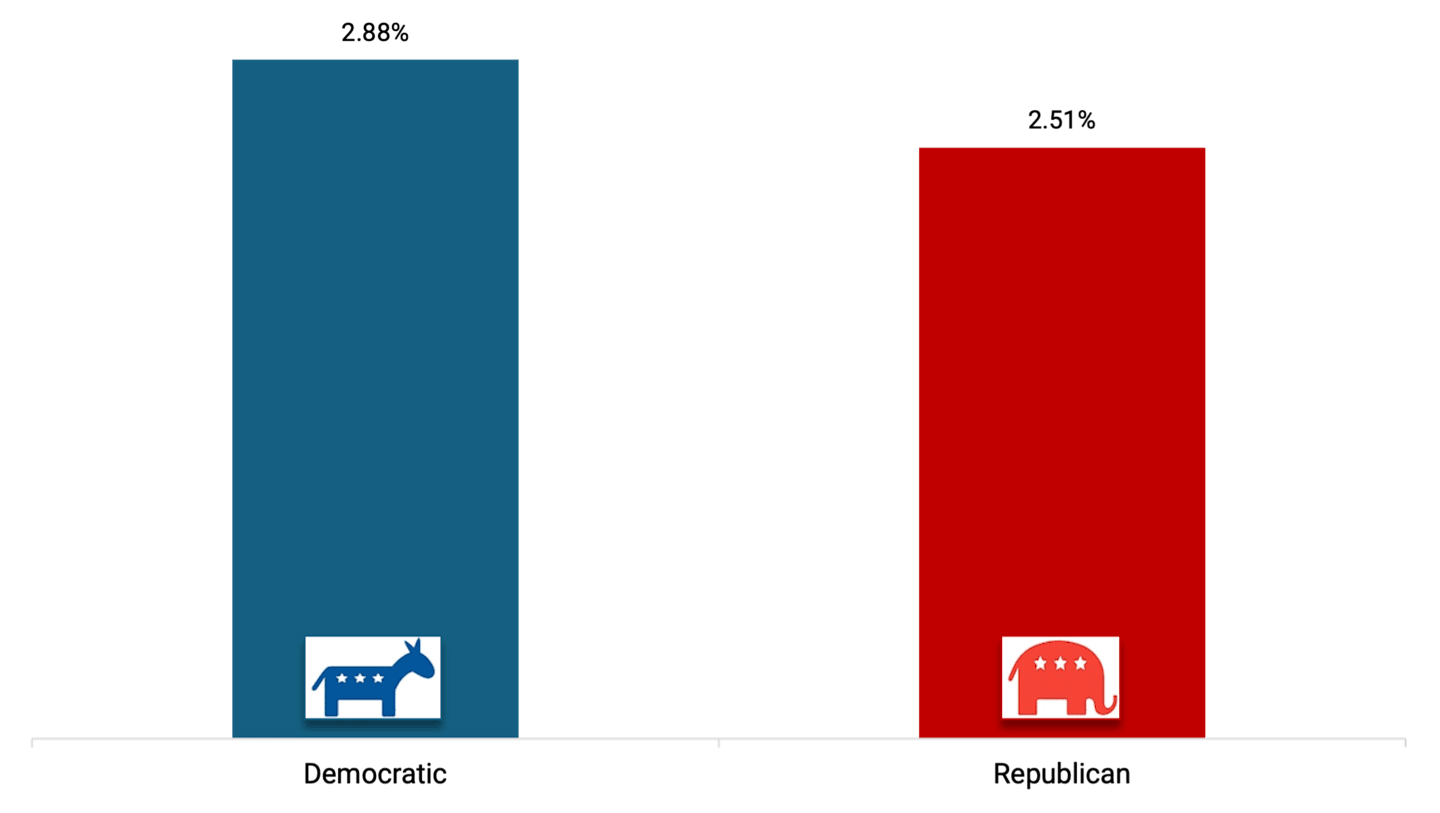

We looked at gross domestic product (GDP) growth rate by year going back to 1980. Figure 1 shows that economic growth has historically been similar under each party. While different parties may prioritize various economic policies, the overall growth trajectory of the economy is shaped by long-term trends and structural factors that transcend political cycles. Therefore, attributing economic success solely to the party in power oversimplifies the complex dynamics that drive economic growth.

Figure 1 | The Economy Has Grown Steadily No Matter Which Party Occupies the White House

Average Annual GDP Growth Rate from 1981-2023 by Political Party

Data from 1/1/1981 - 12/31/2023. Source: Federal Reserve Board of St. Louis. Past performance is no guarantee of future results.

Myth #2: The stock market is too risky during election years.

Reality: Stocks have historically fared well in election years, generating, on average, high-single-digit returns.

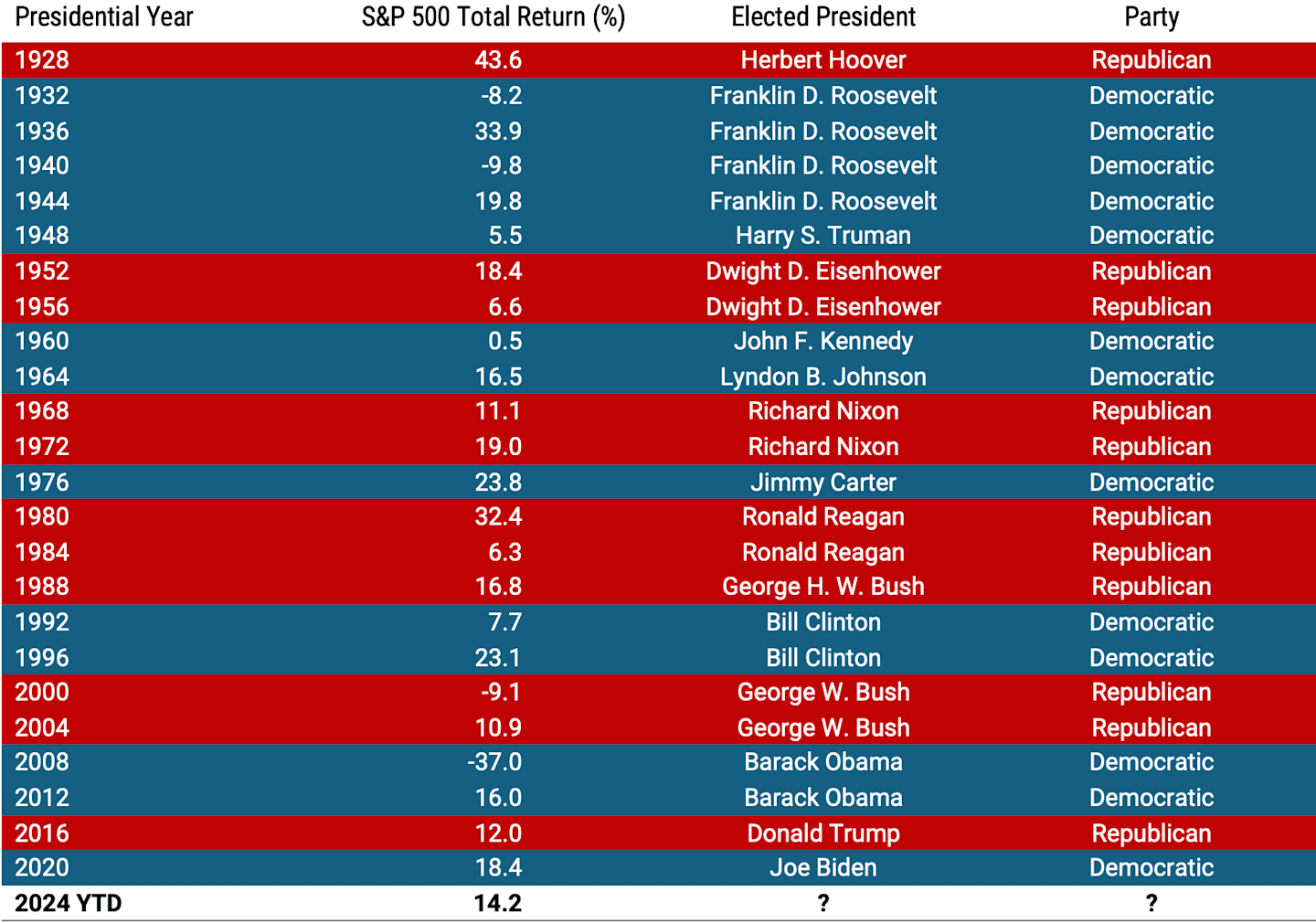

Over the long term, election-year performance is no better or worse than any other one-year period. Figure 2 shows that in most election years, stocks have performed well. The only times the U.S. stock market fell during an election year were because of unprecedented economic events:

1932: The stock market crashed in 1929, resulting in the Great Depression.

1940: The lingering impact of the Great Depression and the first full year of World War II negatively affected markets.

2000: The dot-com bubble burst, dragging down technology-related stocks and impacting the entire market.

2008: The global financial crisis affected stock markets globally, not just in the U.S.

In each of these years, the U.S. economy faced significant recessionary conditions that coincided with an election. But even in these extreme cases, the stock market rebounded over time.

Figure 2 | U.S. Stocks Have Mostly Performed Well During Presidential Election Years

Data from 1/1/1928 - 8/31/2024. Source: Morningstar Direct, American Century Investments. Past performance is no guarantee of future results. In our Glossary, we define the S&P 500® Index.

Myth #3: Some sectors will benefit depending on who wins the White House.

Reality: Campaign promises don’t always become policy because the new president must navigate congressional approvals, opposition and setbacks.

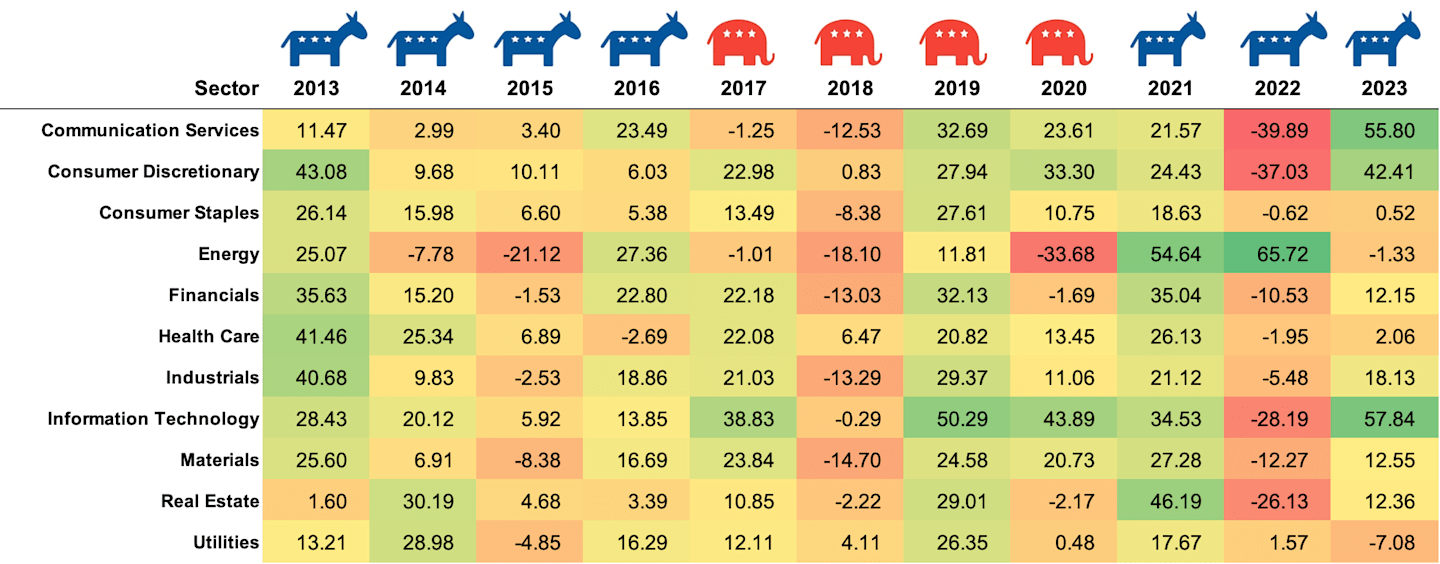

Every election season, each party focuses on hot-button policies that drive voter support, from defense spending and taxes to clean energy and health care. However, turning a campaign promise into policy is challenging, with negotiations and Congress often derailing a president’s agenda.

If a policy does make it through, specific sectors may get a slight, temporary boost. Figure 3 shows that over time, though, there’s no discernable trend that ties political parties to the fate of a particular sector. That’s why we believe long-term investment strategies should focus on stock fundamentals versus predicting winners and losers based on any candidate’s agenda.

Figure 3 | Sector Performance Under Different Political Parties

Data from 1/1/2013 – 12/31/2023. Source: Morningstar, American Century Investments. Past performance is no guarantee of future results.

Myth #4: Moving to cash until the race ends is a good idea.

Reality: Moving your portfolio into cash could be a costly mistake.

Money markets and other cash equivalents tend to get more traffic during an election year because investors perceive these instruments as lower risk in times of uncertainty. If you’re anxious about the election, moving to less risky assets may seem safer, but you may miss out on long-term returns.

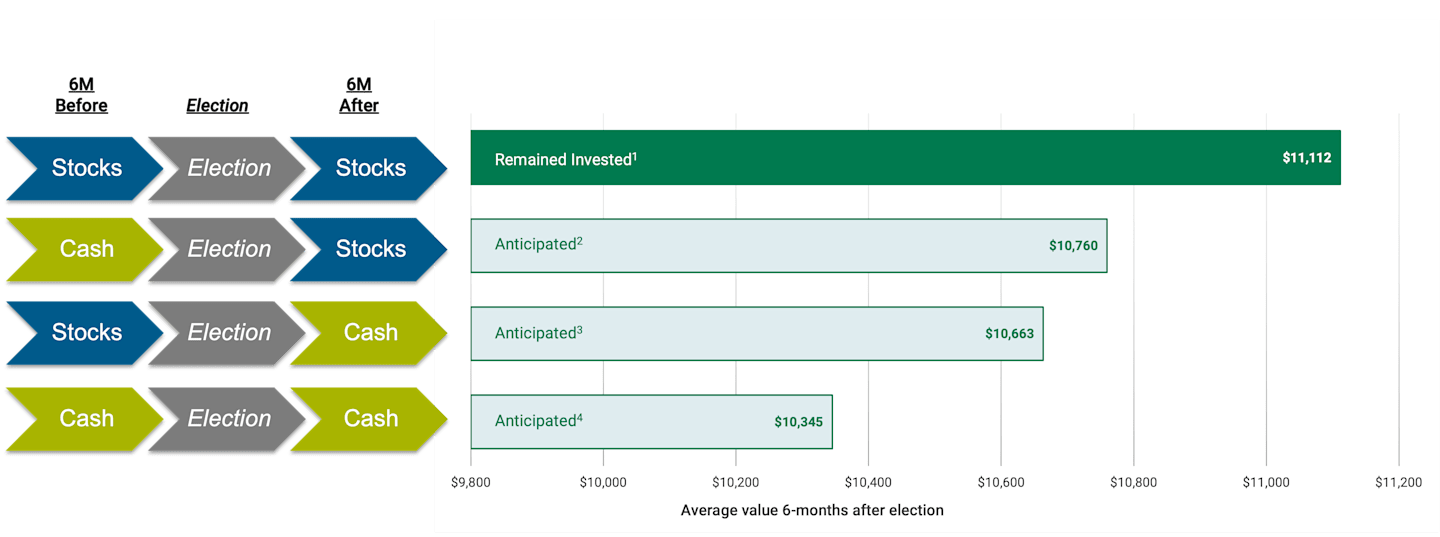

Our analysis shows, however, that it’s best to maintain a consistent approach by staying focused on your investment goals and not jumping in and out of the market. Figure 4 shows returns for different trading strategies around presidential elections.

Figure 4 | Staying Invested Through the Election Cycle Has Typically Been the Best Approach

Data from 4/30/1932 – 12/31/2021. Source: FactSet, Ibbotson and Associates, Inc., U.S. National Archives, American Century Investments. Four hypothetical investor scenarios were analyzed for each Presidential Election since 1932. Each investor invests $10,000 in stocks (equities) or cash six months before the Presidential Election and either remains invested in stocks or cash for the six months before and the six months after the election. Past performance is no guarantee of future results.

¹Remained Invested: Hypothetical investor remains fully invested in stocks the six months leading up to the election, during November and six months after the election.

²Anticipated: Hypothetical investor keeps $10K in cash the six months leading up to the election, during November and rotates to be fully invested in stocks for the six months after the election.

³Anticipated: Hypothetical investor is invested in stocks the six months leading up to the election, during November and rotates to be fully in cash for the six months after the election.

⁴Anticipated: Hypothetical investor keeps $10K in cash the six months leading up to the election, during November and six months after the election.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Equities represented by the S&P 500 Price Return from 4/30/1932 – 12/31/2021. Cash represented by 1-month Treasury Bill returns from 4/30/1932 – 12/31/2021. Average ending values of 23 elections from 1932-2020 (4/30/1932 - 5/31/2021). 6M Before: May-October of election year. Election: November of election year. 6M After: December-May after the election.

Final Thoughts on Election-Year Investing

It’s easy to get swept up in the divisive climate during an election year but remember that markets are truly nonpartisan; the economy drives performance.

Despite the many challenges in the past few years, the U.S. economy has remained resilient. Over the long term, U.S. stocks have averaged positive returns regardless of election outcomes.

The bottom line: Don’t fall for any of the common myths about investing in an election year. Instead, be aware of your biases and confident in your long-term financial plan.

Explore More Insights

Read our latest articles and market perspectives.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.