Health Care in Retirement: Plan for a Healthy Future

Learn what to know about health care costs as you plan for your retirement.

Key Takeaways

Health care may be one of the most expensive and misunderstood expenses for retirees.

Few people plan for what health care may cost them in their retirement budget.

Find out how planning for heath care costs may help you have a healthier retirement.

Taking care of your health isn't just about living a healthy lifestyle. It's also important to plan ahead for what you might have to shell out for medical expenses. Understanding the costs of health care in retirement—and what you can do to prepare—will help you create a retirement budget that lasts.

A Misunderstood Expense

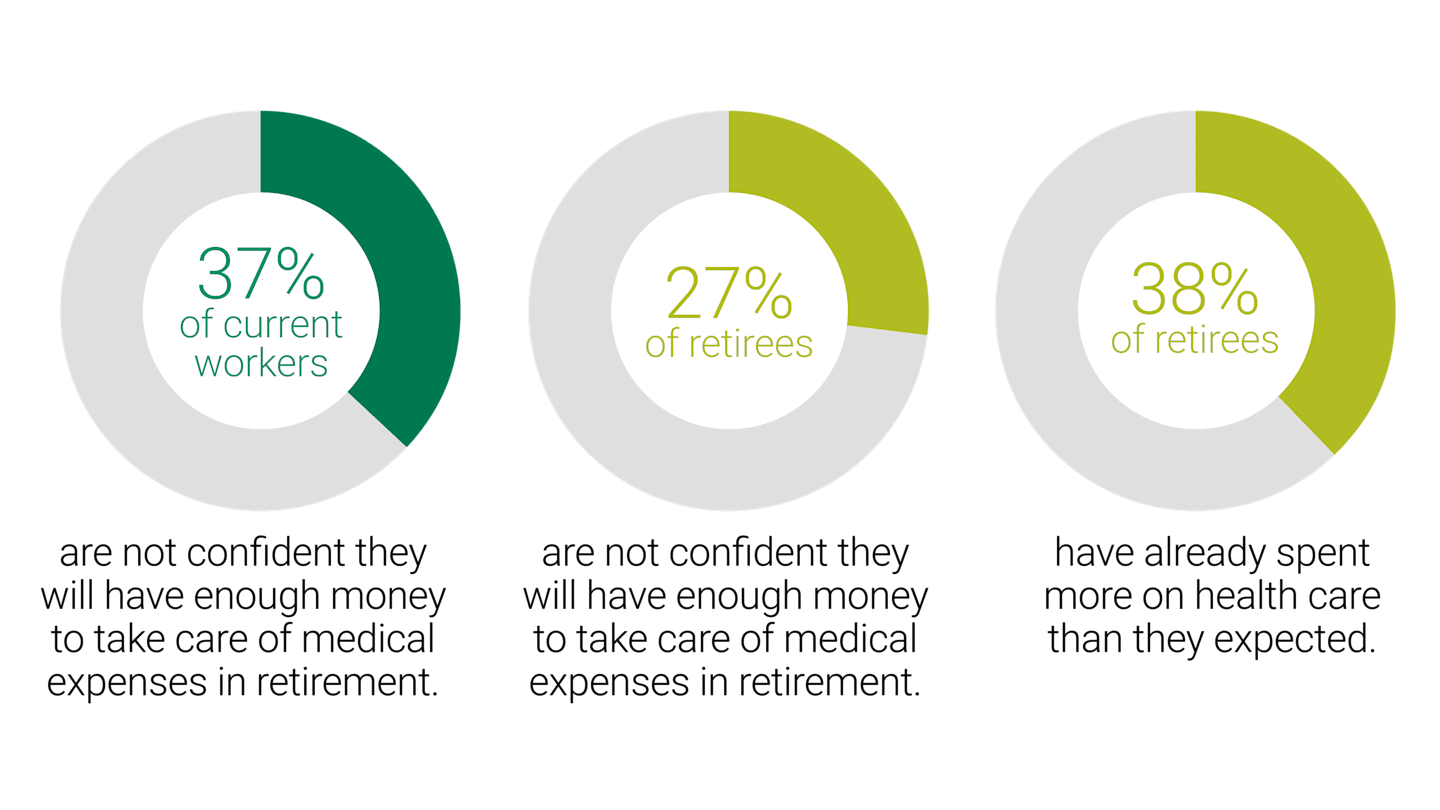

Health care could be one of the largest costs you'll face in retirement. It also may be one of the most underestimated—even for people who have spent years saving. One in three people are not confident they will have enough money to pay for medical expenses through retirement, and a higher percentage of retirees are already spending more than they planned for.* Why the divide between expected and actual health care costs?

Source: The 2023 Retirement Confidence Survey, Employee Benefit Research Institute, April 2023.

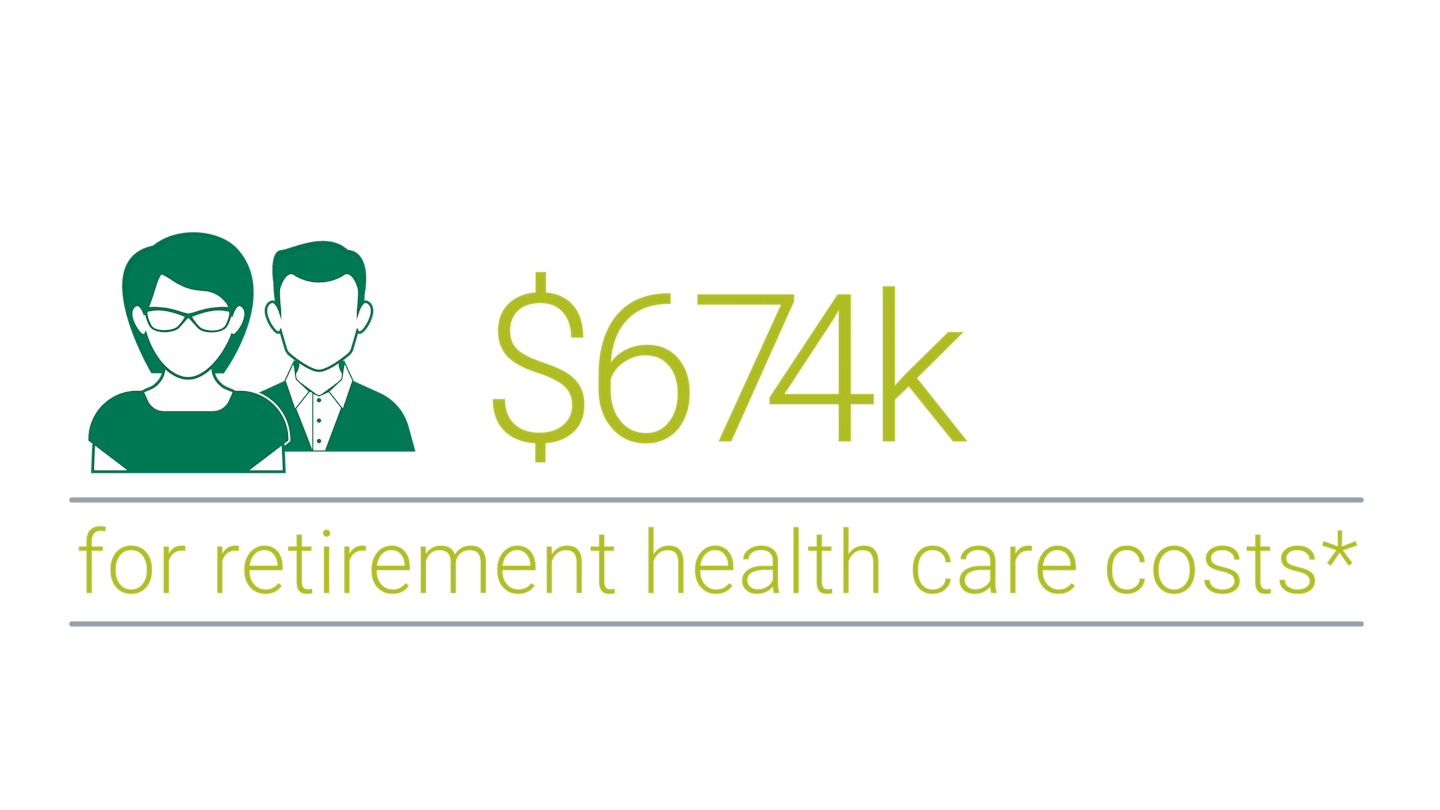

An average 65-year-old married couple retiring today may pay:

*Includes all average expenses not covered by Medicare, such as additional premiums for Medicare Parts B and D, supplemental insurance, deductibles, co-pays, and costs for hearing, vision and dental care.

Source: HealthView Services 2022 Health Care Cost Data Report.

Health Care Costs Can Grow Quickly

The good news is that medical advances allow retirees to turn more to medical interventions. But longevity may also come with a higher price tag. The rate of growth of health care costs—known as health care inflation—has historically been 1.5 to 2 times the rate of the Consumer Price Index (CPI), one of the Federal Reserve’s indicators of overall inflation.* However, in recent years, inflation has been significantly higher and health care inflation has not kept the same or a greater pace. This is unusual but time will tell how health care and CPI will compare in the future.

Retirees Shoulder More Out-of-Pocket Expenses

In their working years, many employees participate in comprehensive medical, dental and vision benefits through their employer, which also pays a sizeable share of the insurance premiums. Upon retirement, coverage premiums are borne by the individual, making health care costs jump higher.

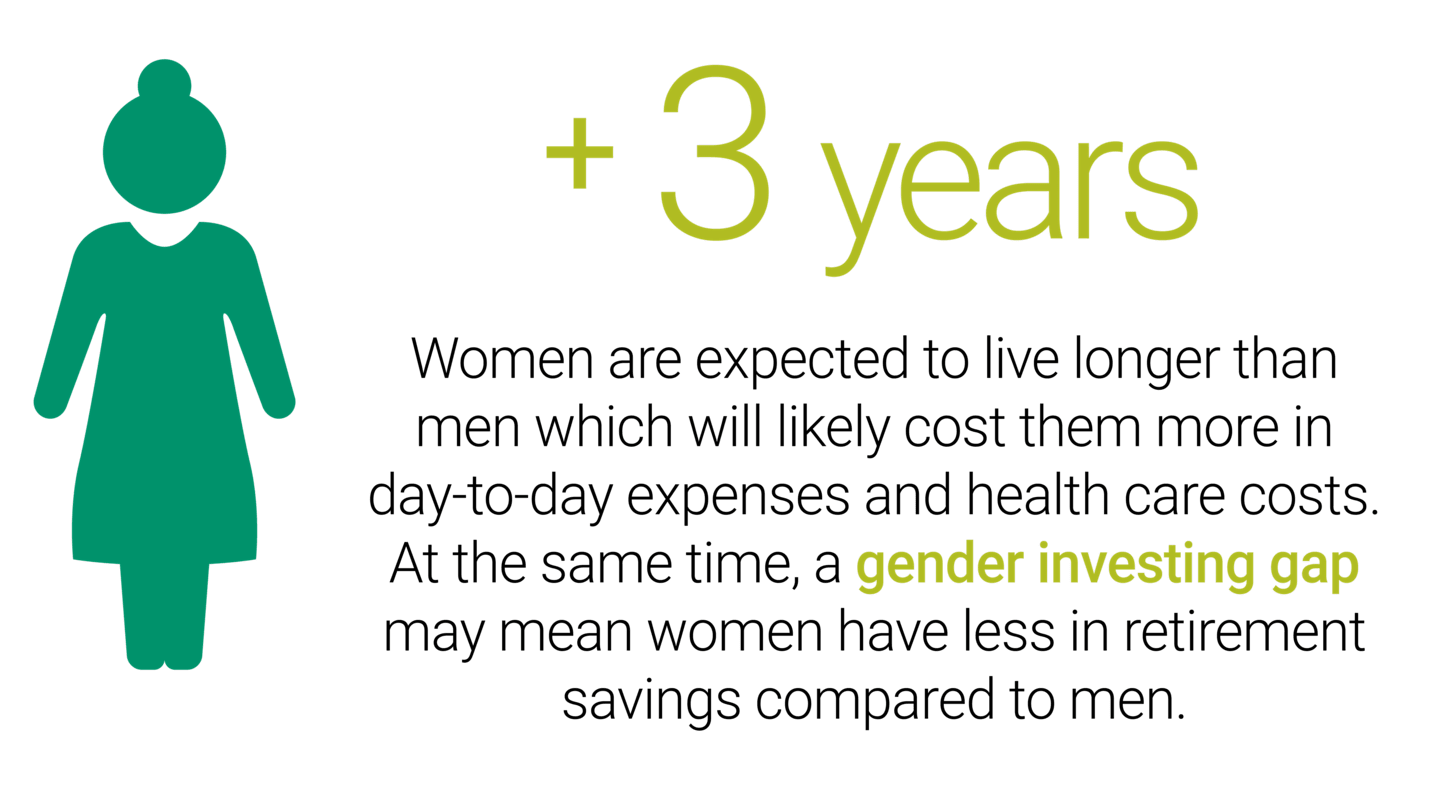

Women May Spend More on Health Care in Retirement

Women outlive men on average by several years and will likely have more health care costs because of it. On the flip side, they may have less money in retirement due to time away from work caregiving for aging parents, spouses and children. While female partners may help their male partners save on some health care costs by caring for them in retirement, women may add to their own expenses from the stress of caring for others and by neglecting their own health. Jobs and income are likely impacted by caregiving, adding a challenge to saving for retirement.

Read more about the gender investing gap.

Sources: Worldometer Life Expectancy in the U.S., July 2023. National Institute on Retirement Security, Still Shortchanged: An Update on Women’s Retirement Preparedness, May 2020.

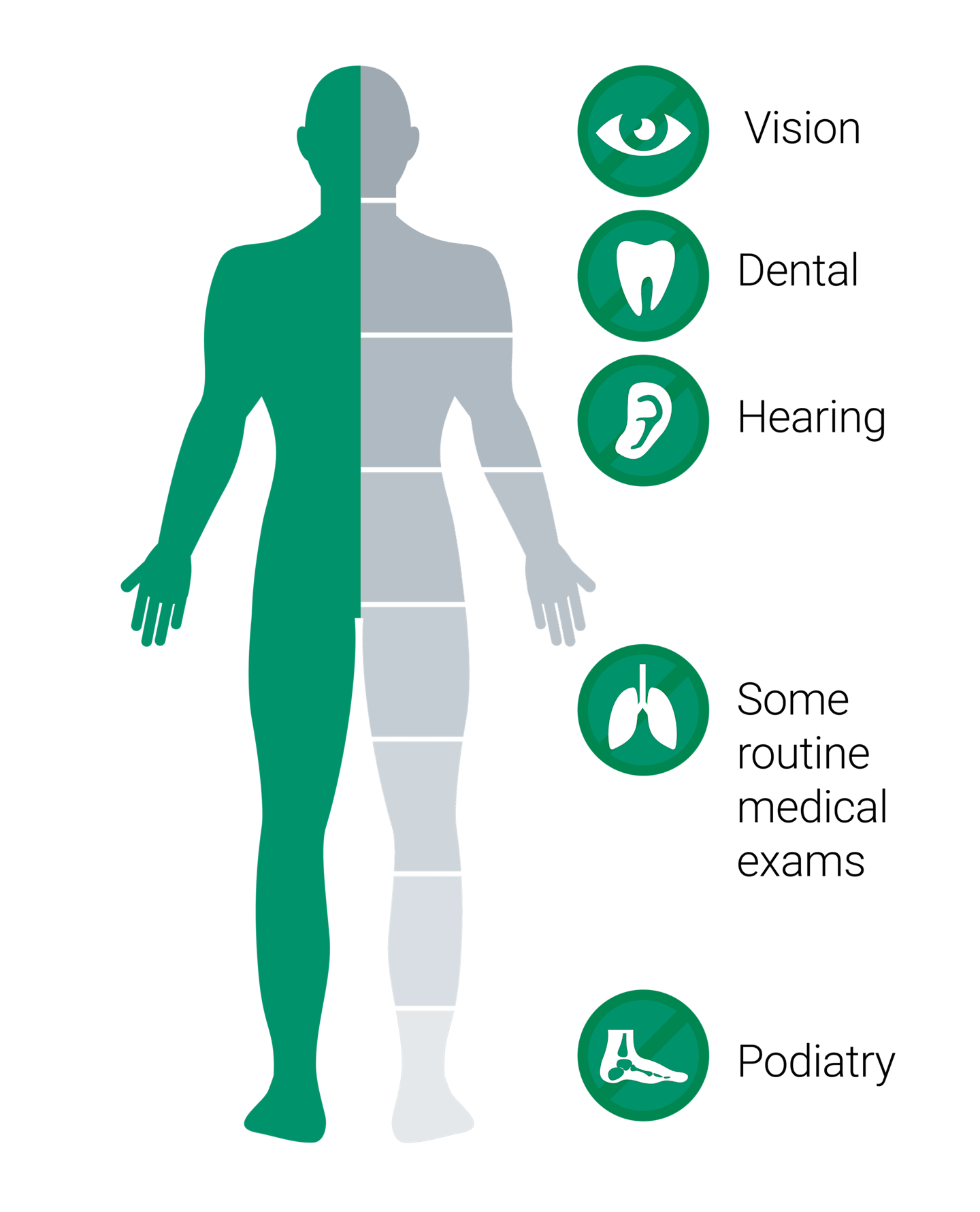

What Medicare Does (and Doesn’t) Cover

When you turn 65 years of age, you are eligible to purchase federal health insurance called Medicare. However, its benefits may not be as comprehensive as you think.

There are two ways to get Medicare: traditional Medicare (Part A and B) or a Medicare Advantage Plan (Part C). Additionally, you may optionally purchase Part D to get coverage for prescriptions and Medigap coverage to help pay for coinsurance and out-of-pocket expenses within Original Medicare, such as 20% coinsurance on Part B.

- Part A: Hospital Insurance

- Part B: Medical Insurance

- Part C: Medicare Advantage is private insurance bundling Part A, B, and usually D.

- Part D: Prescription Insurance

- Plan G or Plan K: Medicare Supplemental Insurance—Medigap Medicare doesn't cover all types of medical expenses or long-term care in most cases.

Source: Medicare.gov, July 2023.

Source: Medicare.gov, July 2023.

How To Plan for Rising Health Care Costs for Retirement

Managing your retirement health care costs now may help prevent you from using all your retirement savings on your health. The key is to start planning now.

Explore Your Medicare Options

Learn your Medicare options.

Before you retire, take time to understand your choices: Parts A and B or Medicare Advantage Part C. Sound like alphabet soup? It's beneficial to consider your options before you're eligible.Explore supplemental medical coverage.

Medicare supplement insurance is private health care that helps cover some out-of-pocket expenses that Medicare does not, including deductibles, co-pays and coinsurances. Policies differ from state to state and provider to provider, so it's important to do your homework.

Health Care Options for Retirees Without Medicare

Sometimes Medicare may not be the best option for health insurance. For instance, you cannot access the coverage if you retire before age 65. Also, Medicare doesn't provide insurance for dependents if you need to insure partners or children, and there may be lower-cost options for you to gain insurance. Medicare alternatives to explore include:

Negotiate a Benefit Extension With Your Employer

In some cases, you may negotiate a continuation of health insurance as part of a retirement or severance package. This is somewhat rare but can happen and it may offer comprehensive coverage at a low cost.Stay On a Partner’s Plan

If your spouse or partner works and participates in an employee plan, adding you to the plan is likely a low-cost way to stay insured.Buy COBRA Through Your Employer

If you are close to the eligible age, you can opt to purchase COBRA coverage to continue the health insurance coverage you had through your employer for up to 18 months. This will be more expensive because your employer will no longer subsidize the premiums.Pay for Private Insurance

You may buy private coverage on your state’s exchange or through a professional association; however, this option might be expensive. You may also seek to purchase private vision, dental and hearing coverages even if you purchase traditional Medicare.

Consider a Health Savings Account (HSA)

If you're still working and your employer provides this benefit, you might want to take advantage of it. Health savings accounts can give you triple tax savings while saving and paying for medical expenses now and in retirement. It's a good idea to learn about HSAs. You may also want to talk to an advisor about how much you invest in an HSA versus your retirement accounts.

Investigate Long-Term Care Coverage

Long-term care insurance covers expenses for extended medical needs. It can include in-home services or treatments in a facility. You can choose options that fit you. Things to consider in purchasing it now are your age and your health.

What Affects Your Health Care Costs When You Retire?

Your Health

Take care of your health today. Leading a healthy lifestyle or making changes to be healthier now can help reduce medical costs in the future. Check in with your doctor and see what changes you could make.

Your Geography

The cost-of-living differences between different states can vary greatly. While traditional Medicare coverage is the same everywhere, supplemental, prescription Part D and private insurances can vary across states, and within states as well sometimes.

Your Retirement Age

Besides adding to a longer period of health care costs in retirement, retiring prior to 65 can be costly because you don’t have access to Medicare programs.

The Insurance You Choose

Purchasing additional coverage—through Medigap, Part D and private insurance—will increase your fixed health care costs (monthly premiums), but may reduce unexpected out-of-pocket costs arising from a health event.

Your Income

If you have put aside a considerable amount for retirement or are still engaged at your job after signing up for Medicare, you may need to expend more for premiums because the government won't give as much financial aid for your expenses.

How you live in retirement may depend on how you prepare today, especially when it comes to health care expenses. Taking some of these steps can give you the confidence and peace of mind to help as you prepare yourself emotionally for retirement. Do your homework now and plan to live your best life.

Paying for Health Care in Retirement Takes Planning

Understanding Medicare benefits and planning for potential health care costs can give you a better chance of making your retirement money last.

Access More Info with Our Retirement Income Guide

HealthView Services 2022 Healthcare Cost Data Report Brief. March 2022.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.