Do’s and Don’ts During Market Volatility

With uncertainty surrounding the ongoing trade war, financial markets are experiencing historic volatility. How should investors position portfolios when markets are unpredictable?

Key Takeaways

Short-term volatility in investing is a given, so a long-term focus is key to managing your retirement portfolio.

Investors should avoid panic selling in bear markets and speculative buying in bull markets.

It’s important to review your portfolio on a regular basis and stick to a well-structured financial plan.

There are very few absolute certainties in the investment business. Volatility, however, is one of those certainties. Even if this most recent spate of volatility has a different cause, your retirement portfolio and other assets still require a long-term focus.

The “Don’ts” When Markets Are Volatile

A key tenet of successful investing: Don’t knee-jerk react.

Don’t Speculate

Strong markets can often drive investors to speculate, or make risky purchases in anticipation of market peaks and higher returns. They take chances in the hope that the market will continue to go up—and may not have a plan if it doesn’t. This is captured by the phrase “fear of missing out,” or FOMO. Speculation, or buying something just because it goes up and you’re afraid of missing out, rarely pays off.

Don’t Panic Sell

On the other hand, panic selling amid market declines may result in investors locking in losses rather than waiting out the downturn and potentially benefiting from a rebound. Panic selling during volatility is driven by fear or an overreaction to current market performance. It’s not based on investment fundamentals and is never the wisest course of action.

Both are the opposite of what a well-structured financial plan would have you do. If you bought after an asset rose and sold after it fell, you’d be violating the cardinal rule to “buy low and sell high.” These knee-jerk reactions—decisions based on emotions and gut feelings—have no place in a successful investment strategy.

Plans are better than panic. You should decide on your goals and your tolerance for risk before you ever make your first investment. Ad hoc decisions for an existing plan are rarely the best way to reach your goals and objectives, whether the markets are calm or not.

The “Do’s” When Markets Are Volatile

Sticking to your plan doesn’t mean you shouldn’t do anything at all.

Do Keep Investing Automatically

If you have an automatic investment plan, it may not be wise to stop investing, even if volatility has you worried. After all, you set up your contributions to keep adding money to your portfolio over time.

Consistent investing—in good markets and in bad—allows you to average your purchase prices over time. Known as dollar-cost averaging, this strategy helps you manage variable market conditions over the life of your portfolio.

Do Monitor and Rebalance

As the market moves up and down, the value and proportion of your portfolio's investments will change. Rebalancing gets you back to your original, long-term target. This has the advantage of forcing you to systematically sell high and buy low.

Asset allocation is the percentage of different types of investments (stocks, bonds and cash equivalents, like money markets) in your portfolio. Your allocation should be based on your risk tolerance, your goals and the amount of time until you need the money.

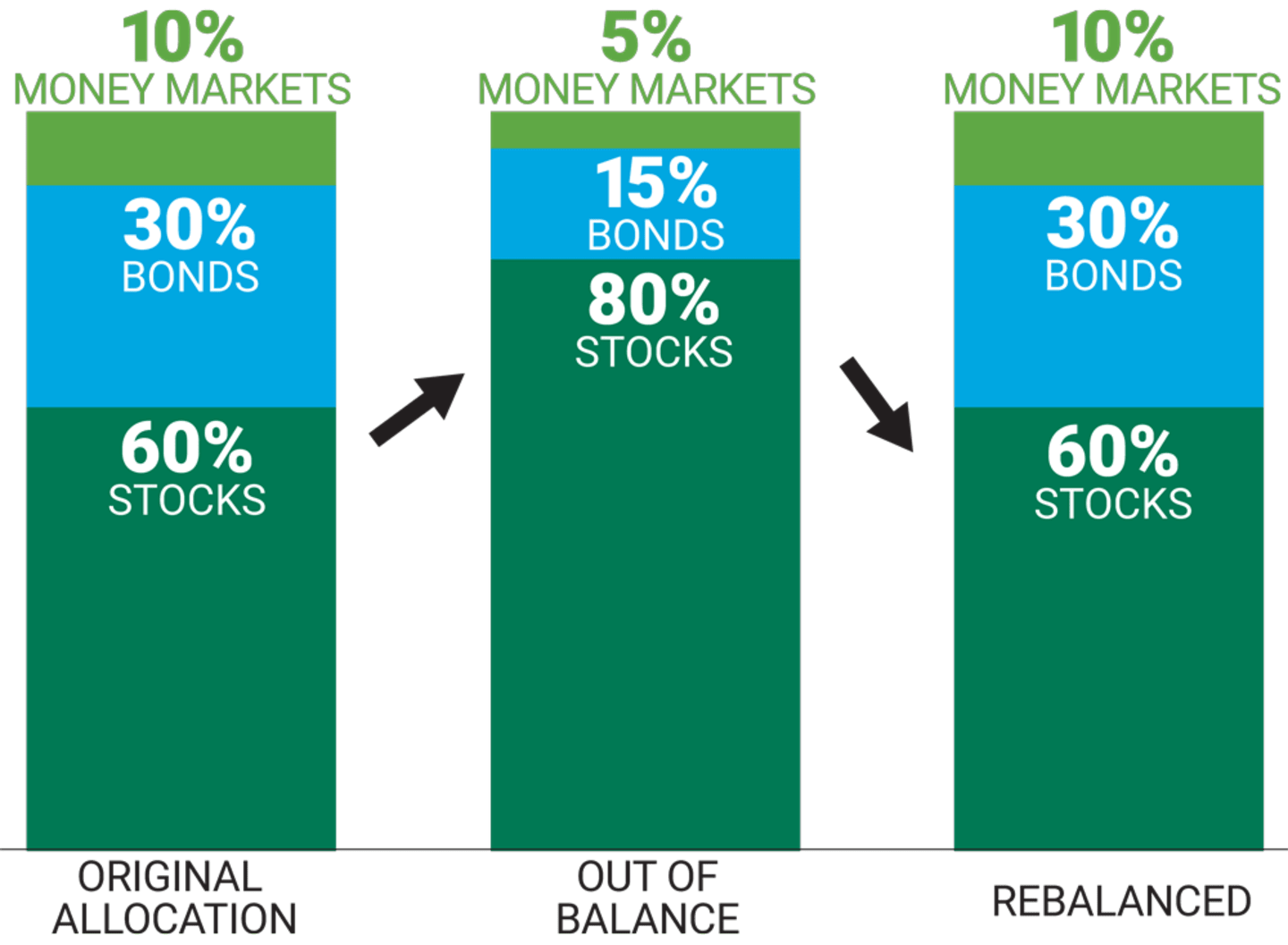

But the amount of each type of asset in your portfolio is constantly changing with market fluctuations. Instead of letting the market determine your asset allocation, you may need to rebalance to get back to your original target. Here’s what that might look like.

Rebalancing Your Mix

Hypothetical Portfolio

Rebalancing the Mix

Original Allocation: For example, you may have decided to allocate 60% of your portfolio to stocks, 30% to bonds and 10% to cash equivalent investments like money markets.

Out of Balance: If market activity causes the value of your stocks to increase, for example, you'll have a larger percentage invested in stocks, leaving you exposed to more risk than you intended.

Rebalanced: Rebalancing—selling stocks and buying more bonds and money markets—gets you back to your original 60/30/10 mix.

With asset allocation funds, investment professionals do all the rebalancing for you. Explore how asset allocation funds work.

Where Do You Go From Here?

Markets can change quickly for several reasons, and it’s important to be comfortable with your plan and your emotions in the face of uncertainty. With stocks at record highs, your stock allocation may be significantly above your intended target. Now may be a good time to rebalance back to your original plan.

We can help you determine what's appropriate for your needs, so you can be ready for what's ahead.

Authors

Let’s Do This Together

We’re here to help you manage portfolio risk during volatile times.

Rebalancing allows you to keep your asset allocation in line with your goals. It does not guarantee investment returns and does not eliminate risk.

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.