Recession Odds Fade, but a Slow-Growth Economy Seems Likely

Views You Can Use: With resilient economic data and reduced global trade tensions masking signs of slowing growth, how should investors respond?

Key Takeaways

U.S. recession worries have diminished amid resilient economic data, tax policy clarity and a de-escalation in the global trade war, but challenges persist.

We believe an economic backdrop featuring slow growth, moderating inflation and Fed easing will likely unfold over the next few months.

Diversifying with higher-quality equity and fixed-income securities may offer value to investors amid lingering uncertainty and volatility.

While headwinds facing the U.S. economy continue to blow, they’re not as powerful as they once were. President Donald Trump’s tariff policy, which created gale-force winds earlier this year, has proven more manageable than many expected. Similarly, consumer data have held up relatively well.

We don’t believe the economy is out of the woods yet, but we do think recession odds have declined. Our cautious optimism is largely due to the de-escalation in the global trade war and some generally positive news, including:

The U.S. economy expanded at a better-than-expected 3% (annualized) pace in the second quarter, bouncing back from a first-quarter contraction of -0.5%.

The recently passed One Big Beautiful Bill Act prevents a year-end income tax hike and provides other individual and corporate tax breaks and investment incentives.

Initial jobless claims have trended downward since early June.

Business and consumer confidence have recently improved.

Inflation and Labor Market Remain Crucial Economic Drivers

With tariff policy taking shape, inflation has recently inched higher. But the pace has remained slightly slower than expected under a higher tariff regime, which has helped calm some prior worries. The Federal Reserve (Fed) has indicated that the inflation/tariff dynamic is a key metric keeping interest rate policy on hold.

Labor market data, which, until recently, appeared fairly stable, also remains a main driver of the economic outlook and Fed policy. The August 1 nonfarm payrolls report slashed by 258,000 the job gains logged in May and June. Furthermore, while the report showed job growth improved in July, it indicated the economy created 37,000 fewer jobs than expected.

These data points suggest the labor market may be cooling more rapidly than many observers anticipated. However, the unemployment rate continued to reflect broad labor market stability, as workforce growth has slowed alongside weaker job growth. It inched higher, from 4.1% in June to 4.2% in July, aligning with market expectations and staying within its 14-month range of 4% to 4.2%.

Our Outlook Is Leaning More Optimistic

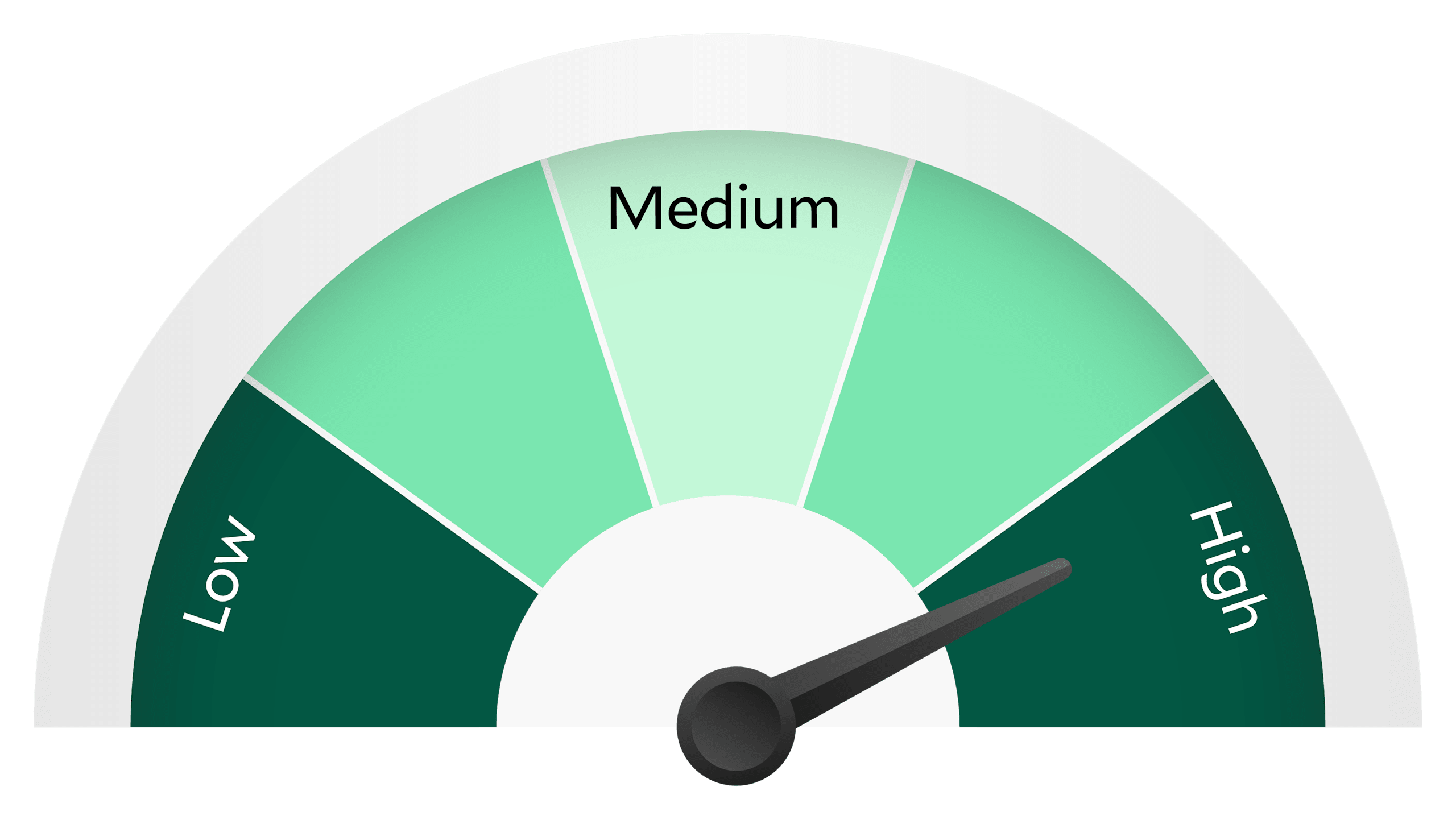

Overall, our economic outlook has shifted from earlier this year. Our analysis of four potential economic scenarios reflects a bit more optimism:

Slowdown/Recession: In our view, recession risk has notably subsided, thanks to generally resilient economic data. We believe slow growth is the most likely outcome, as tariffs seem unlikely to trigger the dire effects many pundits previously feared. We expect inflation to moderate slowly on waning demand, enabling the Fed to relaunch interest rate cuts before year-end.

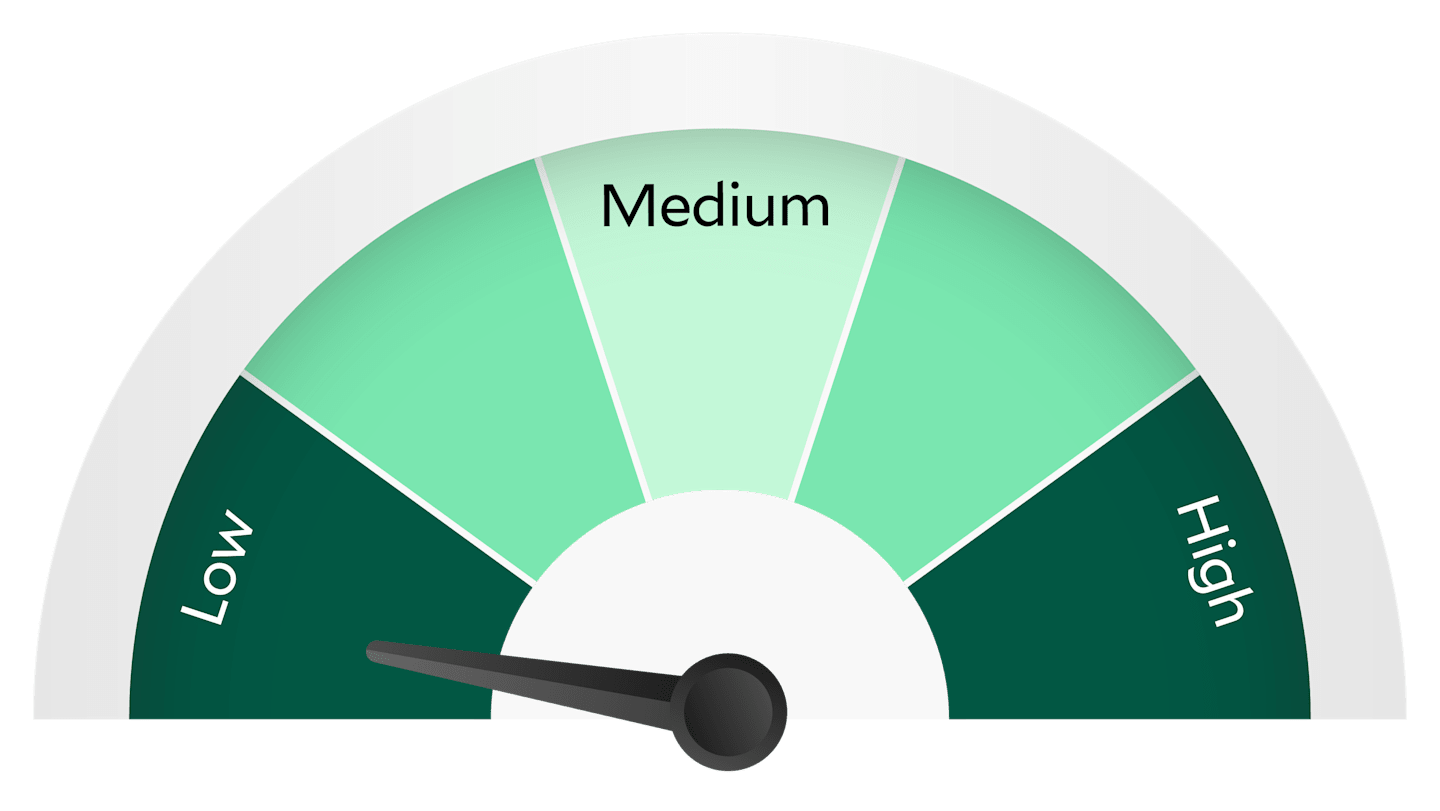

Stagflation: Our forecast still includes the potential for higher inflation and weak economic growth, but we think the probability for persistent stagflation is low.

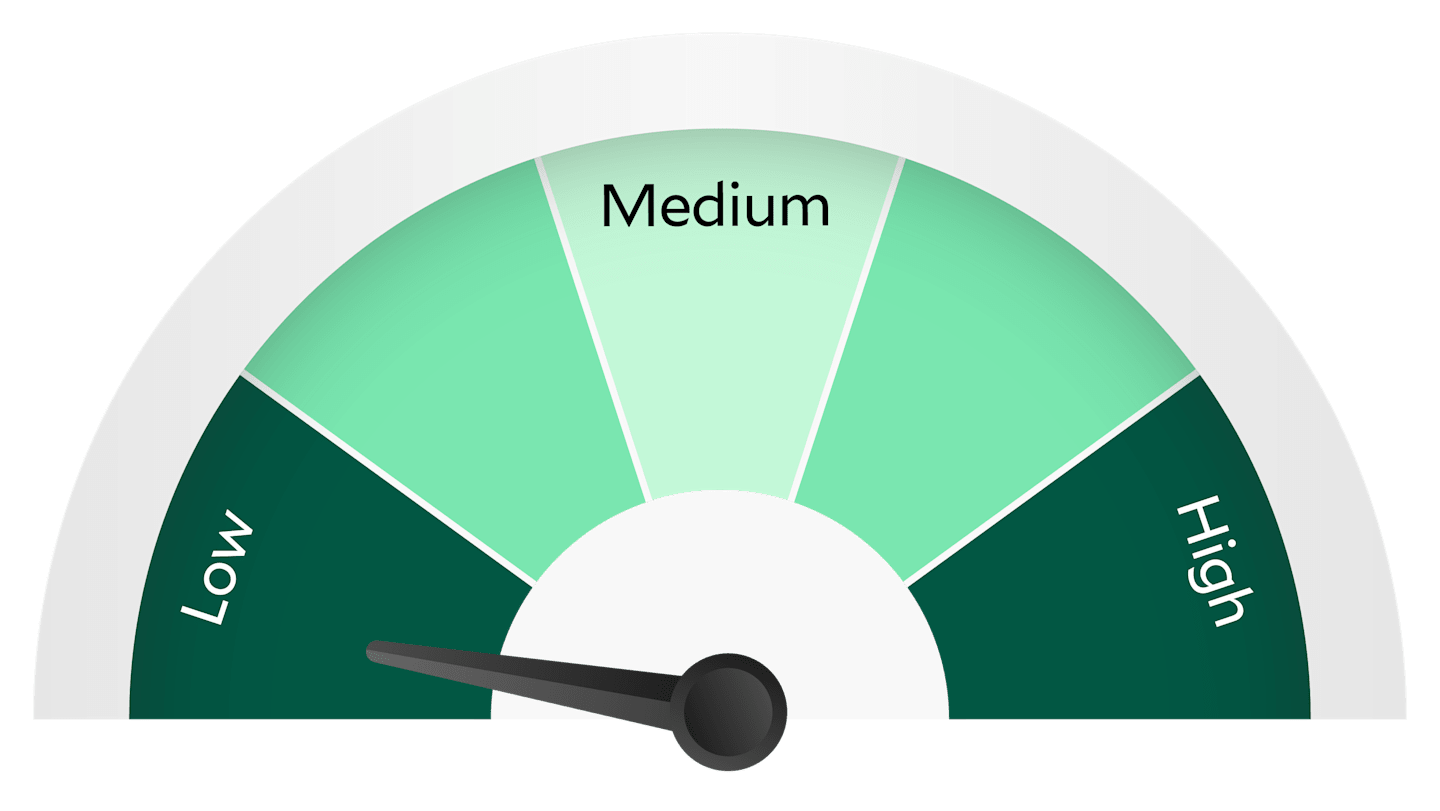

Growth Surprise: We believe the chance of growth surprising to the upside has increased modestly in recent weeks. Nevertheless, we gauge the odds of above-trend economic growth, above-target inflation and tight financial conditions as slim.

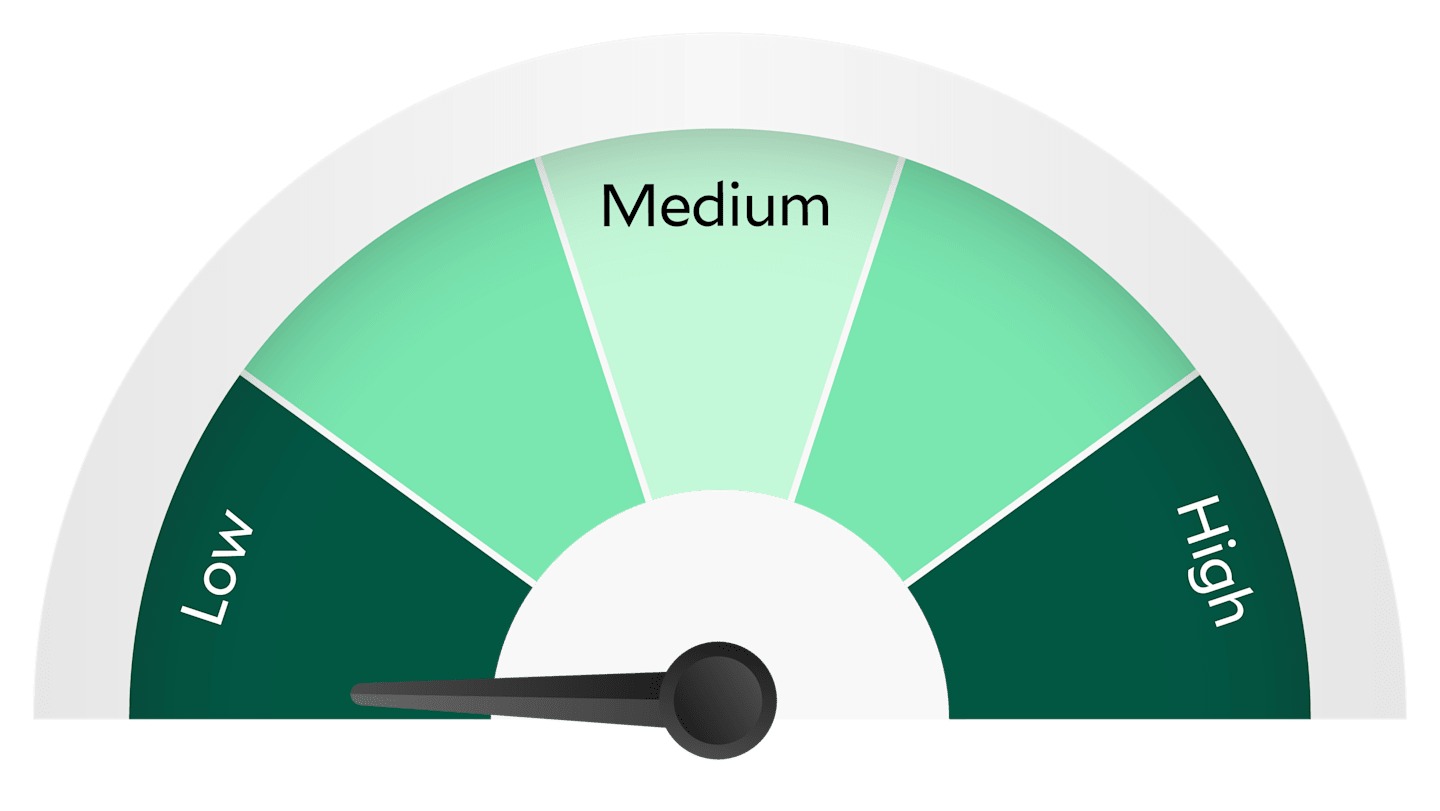

Goldilocks: The potential for a Goldilocks economy has returned to our outlook. However, we believe a scenario of “just right” growth, inflation and Fed policy remains a long shot.

What Would a Slowdown/Recession Mean for Investors?

As the economy slows, U.S. Treasury yields will likely fall. We also expect credit spreads to widen.

While inflation should slowly moderate, tariff-policy uncertainties may create temporary price bumps in the road. Overall, we believe a slow-growth economy will outweigh temporary price hikes, prompting the Fed to resume its easing program. We estimate the Fed will cut rates one or two times by year-end.

Slowdown/Recession: Potential Investment Implications

We believe slow growth is now much more likely than a recession.

Fixed Income

In a slow-growth economy, investors should consider:

Shifting to shorter duration. We believe short-duration assets may help manage near-term interest rate volatility. Furthermore, along with generally offering higher yields than cash equivalents, short-duration assets also tend to offer price appreciation potential in a declining rate environment.

Balancing duration exposure. Core bond strategies with intermediate-duration exposure may offer diversification and potential performance advantages as rates broadly decline and equity market volatility rises.

Staying high in credit quality. In addition to delivering diversification to investor portfolios, a modest allocation to high-quality investment-grade credit may now provide more attractive yields. However, we believe credit selection is critical to avoid weaker, economically sensitive issuers.

Maintaining inflation protection. We believe inflation strategies still appear attractive, given that inflation expectations remain higher than average, largely due to tariff policy uncertainty.

Equities and Real Assets

In a slow-growth economy, investors should consider:

Emphasizing quality stocks. Quality companies with higher profitability and healthy balance sheets may offer attractive potential. Investors tend to favor quality companies in more defensive sectors, such as utilities, health care and consumer staples. Additionally, we think select dividend-paying stocks that tend to provide consistent income streams are attractive.

Looking to sustainable growth. Companies with dependable, sustainable earnings growth have tended to outperform competitors with weaker earnings profiles during economic slowdowns. Economically sensitive value sectors, such as financials, industrials and energy, have tended to lag alongside lower growth expectations.

Treading carefully in the commodities market. As consumer and industrial demand wanes, commodities typically lose their luster. However, we believe gold may continue to shine amid falling interest rates and heightened economic and market uncertainty.

Maintaining selective exposure to real estate stocks. Lower interest rates may boost the attractiveness of real estate investment trusts (REITs) if growth doesn’t slow to recession levels. In such a scenario, we prefer to rely on our REIT managers to identify the best opportunities.

What Would Stagflation Mean for Investors?

In our view, stagflation would push the 10-year Treasury yield higher amid significant volatility as slow growth and high inflation collide. We also believe the two-year Treasury yield could increase as the Fed maintains tight financial conditions. Meanwhile, credit spreads may widen amid weak economic growth, particularly in the high-yield sector.

Stagflation: Potential Investment Implications

We believe stagflation is unlikely but slightly more possible than a Goldilocks scenario.

Fixed Income

If stagflation emerges, investors should consider:

Maintaining inflation protection. We believe inflation-protection securities, particularly with short durations, are attractive as rates rise and inflation remains elevated.

Focusing on quality credits. Higher-quality short-duration strategies may offer benefits if yield outweighs the effects of spread widening. Given the pressures on corporate fundamentals from inflation, rising rates and muted growth, a focus on credit quality will be important.

Equities and Real Assets

If stagflation emerges, investors should consider:

Focusing on traditional value sectors. The energy and basic materials sectors have typically benefited from higher commodity prices. Utilities have generally provided dependable cash flows and dividends despite higher inflation and interest rates.

Favoring quality stocks. In this challenging environment, we believe higher-quality companies with less debt, higher profit margins and reliable cash flows from operations should hold up better. We expect the market to reward firms with pricing power and unique competitive advantages.

Gauging commodities. Commodities have historically provided high average returns during periods of elevated and rising inflation. However, we believe astute management is required because geopolitics and supply chain issues may heavily influence performance.

Limiting exposure to real estate. As mortgage rates rise and the housing market slows, REITs may underperform their long-term averages.

What Would a Growth Surprise Mean for Investors?

If economic growth surprises to the upside, inflation would likely remain above the Fed’s target. A growth surprise scenario could keep financial conditions tight and trigger renewed Fed rate hikes.

Growth Surprise: Potential Investment Implications

We believe the likelihood of economic growth improving has slightly increased.

Fixed Income

If growth accelerates, investors should consider:

Focusing on credit-sensitive assets. Riskier fixed-income securities, including high-yield corporate bonds and bank loans, may offer attractive return potential when the economy is growing.

Maintaining inflation protection. We believe inflation-protection securities, particularly with short durations, are attractive as rates rise and inflation remains elevated.

Avoiding longer-duration assets. With the Fed in tightening mode, we expect longer-duration securities to underperform as interest rates rise.

Equities and Real Assets

If growth accelerates, investors should consider:

Focusing on traditional value sectors. The energy and basic materials sectors have typically benefited from higher commodity prices. Utilities have generally provided dependable cash flows and dividends despite higher inflation and interest rates.

Favoring cyclical stocks. Economically sensitive sectors, such as financials, communication services and industrials, have tended to benefit from strong economic activity.

Gauging commodities. Commodities have historically provided attractive returns during periods of economic growth and elevated inflation. However, we believe astute management is required because geopolitics and supply chain issues may heavily influence performance.

Adding exposure to real estate. REITs may outperform their long-term averages as the economy remains robust.

What Would a Goldilocks Scenario Mean for Investors?

If growth reaches trend or above-trend levels and inflation quickly drops to 2% or lower, the Fed would likely remain on pause. We would also expect Treasury yields and mortgage rates to decline, and credit spreads to tighten.

Goldilocks: Potential Investment Implications

We believe a Goldilocks economy is unlikely.

Fixed Income

In a Goldilocks economy, investors should consider:

Evaluating higher-risk bonds. We believe credit-sensitive securities may offer outperformance potential, particularly high-yield bonds and bank loans, which have historically benefited during economic expansions.

Focusing on nimble duration management. Modest growth, lower inflation and an extended Fed pause suggest active duration management may be warranted as markets and rates adjust to the changing backdrop.

Maintain inflation exposure. With the potential for above-trend growth, inflation could gain traction. We believe maintaining exposure to Treasury inflation-protected securities (TIPS) may be prudent.

Equities and Real Assets

In a Goldilocks economy, investors should consider:

Looking to growth stocks. Pro-cyclical, growth-oriented sectors have historically outperformed in lower-rate, strong-demand environments. This has been particularly evident in the information technology and communication services sectors, where revenues rely on capital expenditures and advertising spending.

Assessing cyclical sectors and small-caps. Economically sensitive holdings, such as banks and consumer discretionary and industrial stocks, have tended to benefit from increased economic activity. Investors typically focus less on fundamentals, such as quality cash flows, in favor of market beta, at least initially. Small-cap stocks could also offer appeal.

Allocating to REITs. We expect REITs to outperform as the housing market recovers. Additionally, lower interest rates typically boost the attractiveness of REIT yields.

Limiting exposure to certain commodities. We believe industrial metals and other pro-cyclical commodities may outperform as economic activity and demand pick up. However, softer inflation correlates with lower prices for energy and food.

Is a Diversified Portfolio Still a Sound Approach?

We believe maintaining a broadly diversified portfolio is a prudent policy regardless of the economic climate. In our experience, investors who maintain their long-term strategies may persevere as markets gyrate. However, we also believe specific investment characteristics deserve consideration in today’s environment.

While we believe the economic outlook has improved from earlier in 2025, we are cautious of lingering issues:

Tariff negotiations with China and other trading partners are ongoing and may trigger near-term volatility and pricing pressures.

Interest rates remain somewhat restrictive as the Fed seeks clarity on tariffs and their effect on inflation.

Businesses are reluctant to boost spending, as they await the outcomes of key trade negotiations.

The recent slowdown in job growth.

Nevertheless, we don’t expect these prevailing issues to stall or sink the economy.

Given our view that economic growth should persist slowly, we believe overweighting duration relative to market benchmarks may deliver advantages if interest rates fall. Additionally, select agency mortgage-backed securities (MBS) and collateralized mortgage obligations (CMOs) may offer defensive characteristics and attractive yields.

Among stocks, rather than focusing on growth versus value, we generally favor quality, such as dividend-paying companies in defensive sectors (health care, utilities, consumer staples). Additionally, sustainable growth companies with stable earnings and strong competitive advantages will likely be more resilient to trade disruptions and tariffs.

Authors

We’re here to help you reach your investment goals.

Explore these opportunities.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investments in fixed income securities are subject to the risks associated with debt securities including credit, price and interest rate risk.

In certain interest rate environments, such as when real interest rates are rising faster than nominal interest rates, inflation-protected securities with similar durations may experience greater losses than other fixed income securities. Interest payments on inflation-protected debt securities will fluctuate as the principal and/or interest is adjusted for inflation and can be unpredictable.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.