Retirement Income: The Bucket Strategy

When it’s time to start spending your retirement money, the right income strategy is important. A retirement bucket strategy can help you convert savings into an income stream while managing risk over time.

Key Takeaways

Dividing your retirement money into buckets helps you plan for an income stream.

Each bucket should have its own time frame, investment allocation and income goal.

Keeping the money separate can also help you manage risk over time.

Early in your career, retirement saving is like a game of checkers: Earn more, invest more, repeat. As you think about transitioning to retirement, planning becomes more like chess and should be more strategic. Your goals in this “game"? Plan for your money to outlast you and create a retirement income stream to live on.

If you want to stop working at age 65, financial experts suggest planning for an additional 30 to 35 years in retirement—in other words, estimate that you still have about a third of your life ahead of you. (Learn more about longevity risk.)

It may sound daunting, sure. But long-term planning can go a long way toward helping you stay at the top of your retirement game: namely, creating sufficient retirement income.

What Is the Retirement Bucket Strategy?

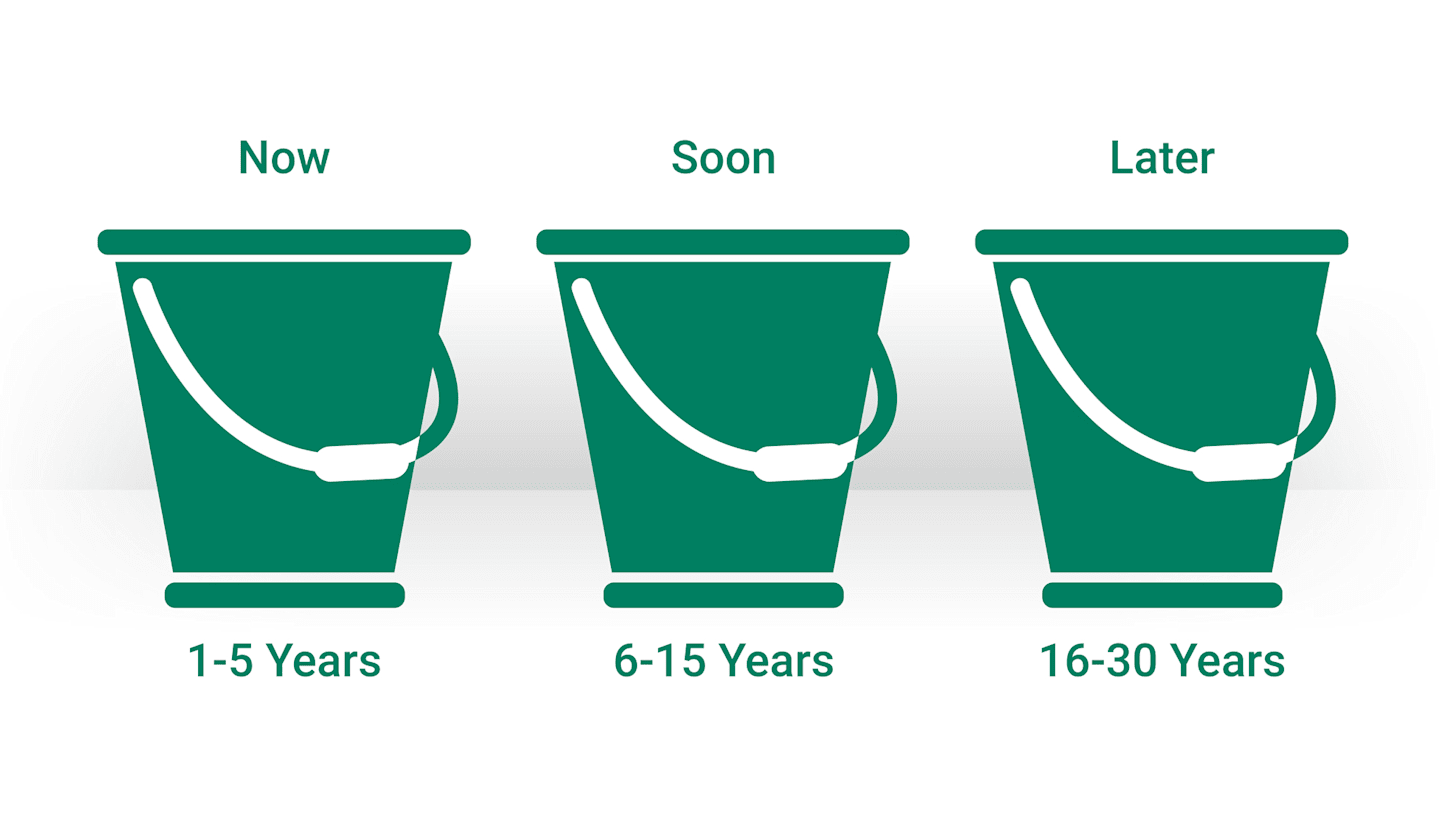

How can you plan to have your money last? One common way to plan for retirement income is to use the “bucket strategy.” Here’s how it works: You divide your portfolio into specific buckets for shorter- and longer-term goals: now, soon and later.

The “now” bucket includes money needed over the first one to five years of retirement. It’s used to cover expenses needed beyond any income you have coming in at the time, such as Social Security, rentals, pensions or part-time income.

Money in the “soon” bucket is for expenses beyond five years, such as 6 to 15 years, and the “later” bucket is broadly calculated to replenish “now” and “soon” buckets when needed.

Generally, shorter-term buckets carry less risky investments, and longer-term buckets carry more risk (according to your tolerance).

How Does the Bucket Strategy Work?

First, divide your portfolio into two to six buckets, each with its own mix of investments and income goal. For this article, we’re using three buckets as an example, but you can decide how many work best for your time frame and overall goals.

Each bucket should have a set degree of liquidity and risk. Money in shorter-term buckets would need to be more readily available than longer-term buckets. This helps you plan for immediate monthly income in retirement while helping you plan for future years. Investments in your longer-term buckets will eventually be moved to shorter-term buckets, helping you convert retirement savings into income.

An important benefit of the bucket strategy is that you can match your income timing with risk. Keeping your short-term money separate from your long-term money can help you manage risk while still maintaining stock exposure during volatile markets.

One drawback of keeping your money separated this way is that it can be more complicated to manage several accounts, and you could incur taxes when you move money. Many investors find it difficult to determine when to rebalance or replenish their short-term buckets with the longer-term buckets. That’s where a financial planner can come in and help to create a disciplined strategy.

The bucket strategy may be best for retirees who have predetermined shorter- and longer-term goals. It can also help retirees who are anxious about risk and are seeking a way to maintain steady income over the duration of their retirement.

Investing for a Three-Bucket Retirement Strategy

The Now Bucket

Investment ideas: The goal is to preserve the income stream you’re relying on now. Money market mutual funds, certificates of deposit or bank savings accounts are all relatively low risk, easily accessible and can help you avoid the market fluctuations of riskier investments.

The Soon Bucket

Investment ideas: Your near-term investments should still be fairly conservative but with enough growth potential to combat the effects of inflation over this time frame. Investments that hedge against inflation, pay dividends or provide income can help you balance these needs. Real estate (in the form of real estate investment trusts, or REITs) could also fit into this bucket.

The Later Bucket

Investment ideas: This bucket will eventually be used to refill your Now and Soon buckets, so you need to plan for long-term growth potential. Riskier stocks (growth-oriented companies, emerging markets, etc.) or high-yield bonds could help keep your portfolio growing. With a longer time frame, you have the opportunity to recover from any downturns.

Are There Other Income Strategies?

In addition to the bucket strategy, “interest-only” and “total-return” strategies are also useful.

With the interest-only strategy, you live off the interest your investments make and avoid touching the principal. You choose lower-risk investments for the portfolio to manage volatility, but you may have trouble keeping up with inflation.

A total-return strategy features a broadly diversified portfolio designed for higher, risk-adjusted return potential. Diversification can help, but this strategy can leave you exposed to market volatility, which could be challenging right before or right after you retire.

Where Else Can You Look for Income in Retirement?

Here are some income sources you may already have and others to consider to complement a bucket strategy in retirement.

Social Security Benefits

While Social Security payments may not be enough to fully fund the retirement of your dreams, every bit helps. Knowing how much your benefits will be and how your retirement age impacts your payments is essential when considering how to maximize Social Security.

For anyone born in 1960 or later, full retirement benefits are payable at age 67. You may take benefits as early as age 62, but your monthly payment will be reduced by 30% monthly for the length of your retirement. However, if you wait until age 70, you’ll be rewarded with 124% of the monthly benefit instead.* That doesn’t mean waiting is right for everyone, because there are specific reasons why people may want to claim Social Security early.

RMDs From Retirement Accounts

When you reach age 73 (age 75 in 2033), you must begin taking annual withdrawals from most retirement accounts, excluding Roth IRAs. Except for your first year taking required minimum distributions (RMDs), you must take distributions by December 31 to avoid a hefty penalty.

The amount you need to withdraw depends on your economic situation. Our RMD calculator can help you see how much you should withdraw.

Strategic Withdrawals From Your Investments

Outside of RMDs, when it’s time to withdraw from your retirement savings, which should you draw from first if you have multiple accounts? Consider starting with the least to the most tax-efficient accounts.

Every financial situation is different, but financial experts often recommend this order because of tax implications and the assumption that your taxes will be lower later in retirement:

Taxable accounts: non-retirement accounts.

Tax-deferred accounts: traditional IRAs and 401(k)s, which defer taxes until you begin spending from the account. The longer you wait, the more the account potentially grows tax-free.

Tax-exempt accounts: Roth IRAs. Since these are funded with post-tax dollars, there are advantages to using this money (once it’s held for the required period) and enjoying tax-free withdrawals.

Important Questions When Setting Up a Bucket Strategy

To help prepare your bucket strategy and determine your income goals, here are some questions to explore:

Immediate retirement costs

Do you have a retirement budget?

Where will you live, and what’s the cost of living?

Will your car last, or should you plan to buy a new one?

Have you accounted for unexpected costs and health care expenses?

Retirement lifestyle plans

Will your hobbies or time be filled with expensive or inexpensive things?

Do you want to travel or get a part-time job to boost retirement income?

Will you spend time volunteering with your favorite group or cause?

Planning your legacy

What do you plan to leave behind for your family?

Are there certain charities or causes you wish to support?

Get Help With Your Strategy

While retirement planning can feel overwhelming, breaking down your portfolio with the bucket strategy as you near retirement and understanding the income sources may help you plan for the income you’ll need.

Authors

Financial Consultant

Need help or have questions about this or other retirement strategies?

Talk to a financial consultant.

Social Security Administration, www.ssa.gov/benefits/retirement/planner/1960-delay.html , accessed July 2024.

As with all investments, there are risks of fluctuating prices, uncertainty of dividends, rates of return and yields. Current and future holdings are subject to market risk and will fluctuate in value.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.