Aligning Capital and Human Needs

Improving human wellness represents a daunting and underfinanced challenge. Investors may be able to make a difference.

Key Takeaways

How society addresses human wellness will help shape progress in the 21st century.

Inadequate financing remains an obstacle in attempting to improve the human condition. Investment can help clear that hurdle.

Opportunities for investors within the climate and healthcare spaces – two areas directly affecting human well-being – promise to expand for years to come.

Multiple scientific studies have shown how sustaining human life burdens the environment. Producing the food we eat, the energy to keep our vehicles and technology running, and the buildings where we live, work, and play all deplete the earth’s resources—and when they’re not done in an environmentally sensitive way, the effects are amplified.1 Yet financing for non-fossil-based energy, non-toxic materials, and clean water and nutritious food and other solutions remains insufficient to move the needle as much as most experts deem necessary.

Likewise, advances in medical care increasing life expectancies globally have created healthcare challenges of their own. Aging populations increasingly tax health care systems even as unforeseen events – think Covid-19 – present new dilemmas.

Both the climate and healthcare speak to the overriding topic of human wellness. Efforts to improve the human well-being simply require more financing, however.

Underinvestment implies opportunity. The persistent search for climate and healthcare solutions will underpin an ongoing demand for capital that’s critical to finding them. The former can’t happen without the latter.

The Need for Solutions

The need to improve human wellness has grown increasingly profound. According to the World Health Organization and the National Resource Defense Council:2

Two billion people worldwide lack safe drinking water.

600 million people suffer from foodborne illnesses annually; children under the age of five account for 30% of foodborne fatalities.

Heat-related deaths in people aged 65 and older have increased 70% in the past two decades.

Air pollution (which has also been attributed to contributing to climate change) generates more than $800 billion in annual health costs in the U.S.

Health care, biotech and medical device companies – long reliant on venture capital and investment to further innovation – have equally complex challenges to tackle. Already, scientists have identified 200 human diseases and more than 1,000 different pathways of transmission aggravated by climate change.3 By 2050, the WHO estimates climate change will cause an additional 14.5 million deaths and $12.5 trillion in economic losses globally.4

Meanwhile, PwC estimates the world needs to “decarbonize” at seven times the current rate. At least, that’s the rate needed to keep global temperatures within the internationally recognized benchmark of 1.5 degrees Celsius compared with pre-industrialization.

Chronic Underinvestment

Funding the necessary investment required to adequately address human wellness challenges has proved consistently challenging, however.

The International Energy Agency, for instance, notes that global investing in clean energy last year rose to an estimated $1.8 trillion. That’s an all-time high. But it’s well short of the $4.5 trillion the IEA projects as needed by the early 2030s to keep global temperatures within the 1.5 degrees Celsius criterion.5,6 Further, more than a third of the emissions reductions needed by 2050 rely on technologies still in development stages.7

If climate goals are to be achieved, both adaptation and mitigation financing would need to increase many-fold.

Similarly, health research funding has somewhat stalled. From 2010 through 2020, support for climate change and health research from the National Institutes of Health hovered near just $10 million annually. That’s a mere fraction of the $26-56 billion required annually to adapt global health care systems to the 21st century climate environment, according to McKinsey.8

Historically, startup companies have sparked much of the innovation yielding answers to complex problems. But health care and climate startups in recent years have struggled to secure adequate capital.

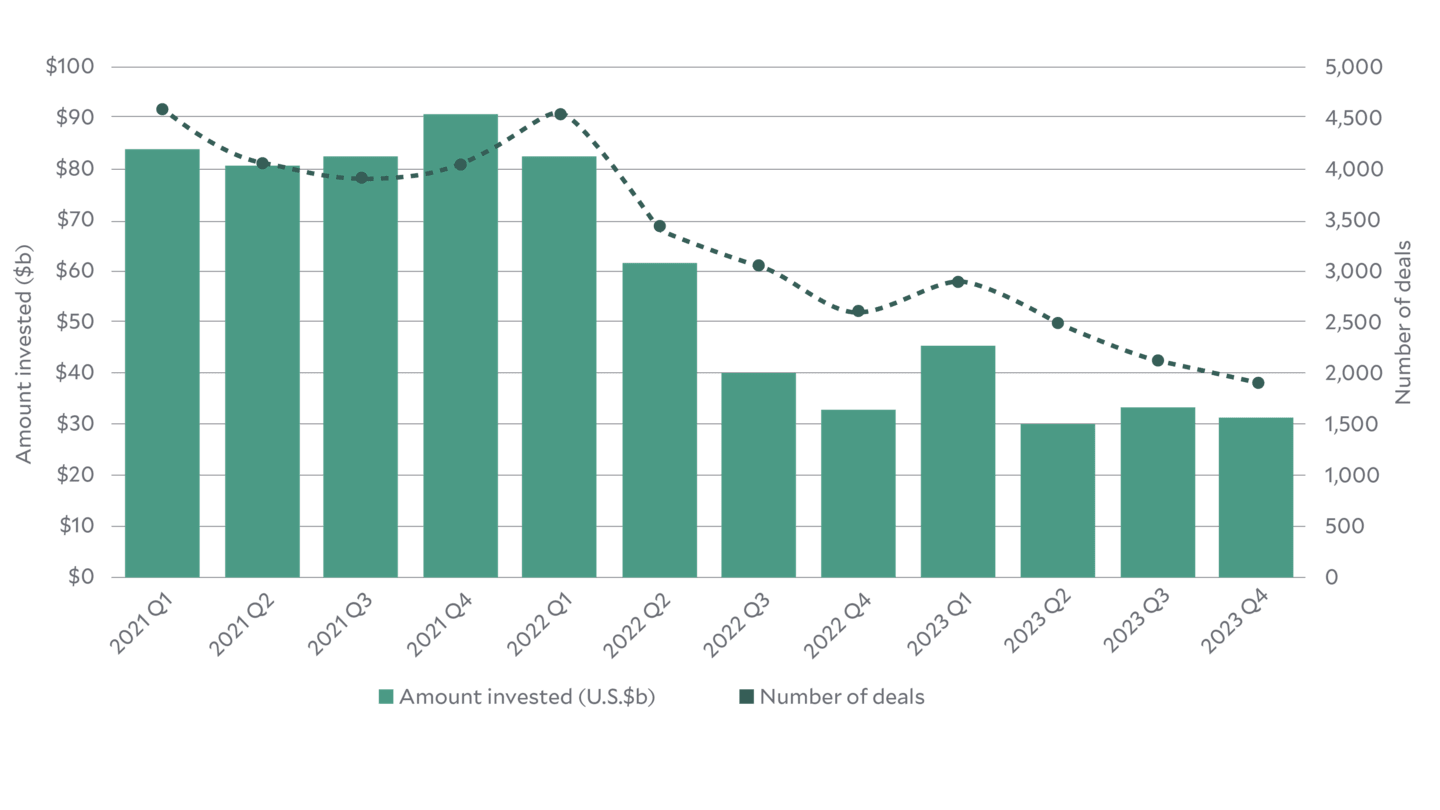

That struggle reflects a broader slump in venture capital investment coinciding with surging interest rates, surging public markets, and a lack of distributions form the venture asset class. Overall venture capital investments in the U.S. declined by almost three-quarters in the roughly two years after the Federal Reserve began raising interest rates in 2022.9

Figure 1 | Venture Capital Market to Seek New Floor in 2024

Sources: Crunchbase as of January 2, 2024, Crunchbase, www.crunchbase.com, EY analysis. Equity financing data has been included in VC-backed companies headquartered in the U.S. Sources of cash investments include, but are not limited to, VC firms, corporate investors, other private equity firms and individuals.

Within health care, VC investments last year totaled half their 2021 level.10 VC investments in clean energy and related startups fell 30% last year, with investments in important early-stage companies plunging 41%, marking the first decline since at least 2020.11

Seeds of Opportunity

The Fed’s rate-hike cycle certainly contributed to the recent ebb in VC investments. It also contributed to the lowest level of initial public offerings – a key exit strategy for VC investors – since 2016. As a result, cash on the sidelines available for potential VC investments (called “dry powder” in industry vernacular), swelled to $317 billion, a record high.12

However, that cycle has ended. In September, two-and-a-half years after it started raising rates to battle inflation, the Fed cut its benchmark interest rate by 50 bps. Another 25-bps cut followed in November. The moves will reduce borrowing costs. It also, margin at least, will ease competition for investment capital from income-producing bonds and other yield-oriented asset classes.

Perhaps sensing the Fed’s eventual rate cuts, 70% of CEOs in one survey earlier this year said they planned to increase VC investments in 2024.13

That survey’s results in part reflect increasingly attractive values in the marketplace. For instance, the marketplace value of health care startups fell to an average of three times estimated annual revenue at the start of 2024 – a 75% drop from their peak three years ago.14

Clean energy and healthcare startups offer another potential appealing feature for investors: They increasingly attract talented professionals to move them forward. A Harvard Business Review study, for instance, found that companies with strong sustainability programs have a 25% higher likelihood of attracting top talent.15 Business schools in North America and Europe have expanded core courses and flagship MBA programs to specifically include sustainability topics.

In addition, younger generations tend to veer toward jobs that align with their values. Three-quarters of Generation Z and millennials say an organization’s societal impact is a key factor when considering a potential employer. Two in 10 already have changed jobs to better align their employment with their values.16

Finally, government funding buttresses private sector efforts in climate and health care. Since the beginning of the pandemic, global fiscal stimulus for green energy stimulus totals $1.8 billion – three times the amount spent to lift economies out of the 2008-09 global financial crisis. That includes the 2022 Inflation Reduction Act, which steered $369 billion in federal funding toward clean energy ventures.17

Nonetheless, climate and health care startups can’t rely solely on government funding. As we’ve outlined, investment capital remains vital for them to meet their potential.

A business model predicated on getting money from the government isn’t a business model.

Meeting the Moment

Certainly, global governments have recognized the importance of finding ways to improve outcomes related to human wellness. They’re funding initiatives at a higher level than ever to find them.

Arguably, the private sector has not picked up the slack. A significant gap remains between existing capital and what’s required to mitigate the impacts of climate change and address increasing health care challenges.

Declining investment in climate- and healthcare-oriented startups in recent years illustrates that disconnect. The Fed’s rate hike cycle played perhaps the biggest role in that decline.

That cycle, though, has ended. In its wake, many startups appear more attractively valued than they have in years, and their borrowing costs likely will head lower. Meanwhile, they’re luring top-notch talent from a younger generation bent on aligning their careers with their societal virtues.

Combined, that makes the environment for investing in startups aimed at improving human wellness more enticing than at any point since before the pandemic. Investors may want to take notice.

1William J Ripple, Christopher Wolf, Jillian W Gregg, Johan Rockström, Michael E Mann, Naomi Oreskes, Timothy M Lenton, Stefan Rahmstorf, Thomas M Newsome, Chi Xu, Jens-Christian Svenning, Cássio Cardoso Pereira, Beverly E Law, Thomas W Crowther. “The 2024 state of the climate report: Perilous times on planet Earth,” BioScience, Volume 74, Issue 12, December 2024, Pages 812–824

2Dr. Vijay Limaye. “The Costs of Inaction: The Economic Burden of Fossil Fuels and Climate Change on Health in the U.S.” NRDC website May 20, 2021

3Johanna Benesty, Emily Serazin, Hannah Short, and Sifan Zheng. “Addressing Challenges at the Intersection of Climate and Health,” BCG website, January 4, 2024

4Green Climate Fund. “Bridging the climate-health gap” May 29, 2024

5Jennifer Chu. “Explained: The 1.5 C climate benchmark,” MIT News website, August 27, 2023

6Emma Cox, Will Jackson-Moore, Leo Johnson, Tarik Moussa. “State of Climate Tech 2023: How can the world reverse the fall in climate tech investment?” PwC Global, October 17, 2023

7Jennifer Turliuk. “Why Does Climate Tech Venture Investing Matter?” Forbes website, May 21, 2024.

8Claudia von Hammerstein, Matt Craven, Oliver Walker, Benjamin Coghlan, Dinesh Arora, Guto Luiz Galvão, Mário Santos Moreira, Mauricio Barreto, Paulo Gadelha Vieira, Kay van der Horst, Paula Navajas Ergüín. “Health-related climate adaptation: How to innovate and scale global action for local needs,” McKinsey Health Institute, August 20, 2024.

9Barbara Tague. “Venture Capital Trends and Outlook for 2024,” AlphaSense website, April 29, 2024.

10Jackie Spencer, Kale Frank, Raysa Bousleiman, Bill Sideris, Dennis He. “Healthcare Industry Trends: Mid-Year 2023 Update,” Silicon Valley Bank website, July 2023.

11CTVC staff. “$32bn and 30% drop as market hits pause in 2023,” CTVC website, January 5, 2024.

12Barbara Tague. “Venture Capital Trends and Outlook for 2024,” AlphaSense website, April 29, 2024.

13Jeffrey Grabow. “Will venture capital market rebound in 2024 or seek new floor?” EY website, January 29, 2024.

14Stephen Hays. “Healthcare Valuation Trends in 2024,” Disruptive Healthcare website, January 1, 2024.

15Anna Frazzetto. “The hidden benefits of ESG: Are sustainable practices the key to retaining top talent?” Staffing Industry Analysts website. February 22, 2024.

16Deloitte. “2024 Gen Z and Millennial Survey,” Deloitte website, June 2024.

17Emma Newburger. “Schumer-Manchin reconciliation bill has $369 billion to fight climate change — here are the details,” CNBC website. July 28, 2022.

18Emma Cox, Will Jackson-Moore, Leo Johnson, Tarik Moussa. “State of Climate Tech 2023: How can the world reverse the fall in climate tech investment?” PwC Global, October 17, 2023

No solicitation, offer, or distribution of any investment, security, financial instruments, or financial interest of any type is being made or is intended by any of this material. This material is provided for informational and educational purposes only.

Nothing herein constitutes a recommendation of any investment, security, financial instruments, financial interest of any type, or any investment strategy.

No representation or warranty is being made regarding the suitability of any investments, securities, financial instruments or strategies for any investor. The material on this site is provided “as is.” American Century does not warrant the accuracy of the materials provided herein, either expressly or impliedly, for any particular purpose and hereby expressly disclaims any warranties or merchantability or fitness for any particular purpose.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.