Assessing Opportunities in the Venture Capital Landscape

Key Takeaways

Venture Capital (VC) investors have an attractive opportunity after a recent period of subpar performance and fundraising that belied historical norms.

Economic and market conditions appear poised to benefit venture capital as 2024 proceeds.

Allocations to venture capital may enhance returns for broader investment portfolios, and their low correlation to traditional equity and fixed-income assets may also enhance their risk profiles.

Stirred by historically low interest rates and the push by startups to fight the impacts of COVID-19, venture capital fundraising reached record-high levels during the pandemic. Dealmaking surged, as did value of those deals.

Lately, though, venture capital has languished amid a series of challenges.

The Russia/Ukraine war heightened geopolitical risk and further disrupted global supply chains still recovering from the pandemic. At the same time, the worst inflation in four decades forced central banks to raise interest rates sharply.

Ironically, those challenges have created an environment that may now actually favor venture capital investors, especially if the market returns to normal.

Demand for startup capital has not disappeared, yet the weak market conditions have placed investors in an advantageous negotiating position. We believe that’s particularly true in areas rife with investment opportunities, such as healthcare and climate initiatives – areas further buoyed by government spending specifically targeting innovation.

We believe that after the recent downturn, venture capital appears ready for an upswing. Economic and market conditions should help provide fuel for it, and investment portfolios ultimately could benefit.

Reviewing the VC Market’s Drought

The venture capital market, by any measure, struggled in 2023.

Globally, startup firms attracted just $161 billion in venture funding, down almost half from $307 million the previous year.1 Finding buyers proved just as difficult, with about 700 startups selling to acquirers for a combined $26.7 billion, the lowest in a decade.2

Just two years earlier, in 2021, startup acquisition values totaled about four times that amount. U.S. venture capital funds raised a record-high $170 billion in new assets that year. That figure increased by $3 billion in 2022 before plunging 61% to $67 billion last year, the lowest in six years.

Last year’s decline in venture capital investing occurred after VC fund returns collapsed in 2022. After quarterly returns peaked near 25% in 2021, VC funds have posted six straight quarters of losses dating to the start of 2022.3

The prolonged slide coincided with a drop in initial public offerings – a key exit mechanism for VC investors to realize profit. It also reflected turmoil in the U.S. banking sector that roiled financial markets in early 2023.

Seeds of a Rebound

As 2023 ended, though, the VC market began thawing. The number of deals involving early-stage startups rose to the third-highest quarterly level in the past decade.4

Those deals could portend an improving IPO market.

The value of publicly listed offerings for venture capital-backed firms soared to about $700 billion in 2021. But it plummeted to below $100 billion in the past two years as inflation and interest rates spiked.

However, inflation has slowed, and the Federal Reserve has not raised interest rates since mid-2023. The U.S. economy has remained resilient, avoiding recession despite the Fed’s rate hikes. Nonetheless, the Fed has stated it plans to cut rates three times this year, a prospect that has emboldened capital markets.5

J.P. Morgan says those factors could help re-open IPO markets this year, setting the stage for “normal” IPO markets in 2025. Moreover, supportive macroeconomic and market backdrops could lead smaller, higher-growth companies at earlier stages of profitability to launch IPOs by the middle of this year.

Discover American Century’s Approach to Venture Capital Investing

Additional Support

IPOs and venture capital tend to go hand-in-hand, but possible improvement in IPO markets isn’t the only positive development for VC markets. Financial support in the form of federal government subsidies also underpins innovation efforts in the startup space.

The 2022 CHIPS and Science Act steered $280 billion toward innovation, scientific research and technological development.6 In addition, the 2022 Inflation Reduction Act targeted up to $500 billion to reduce healthcare costs and promote clean energy efforts.7

The 2021 American Rescue Plan Act also reauthorized and expanded the $10 billion State Small Business Credit Initiative, designed to spur lending and investments in small businesses and startups.8

A Basic Demand for Cash

But perhaps the most elementary reason venture capital markets stand poised to rebound centers on a basic reality: Startups simply need the cash.

Demand for capital from early-stage companies, which accounted for 70% of all VC deals last year, has reached its highest point since startups’ demand for cash surpassed supply in early 2022.9 Conversely, capital availability has fallen to the lowest point in a decade.10,11

That has placed VC investors – particularly those targeting early-stage companies – in their most advantageous position in years to influence terms of deals they negotiate with startups.

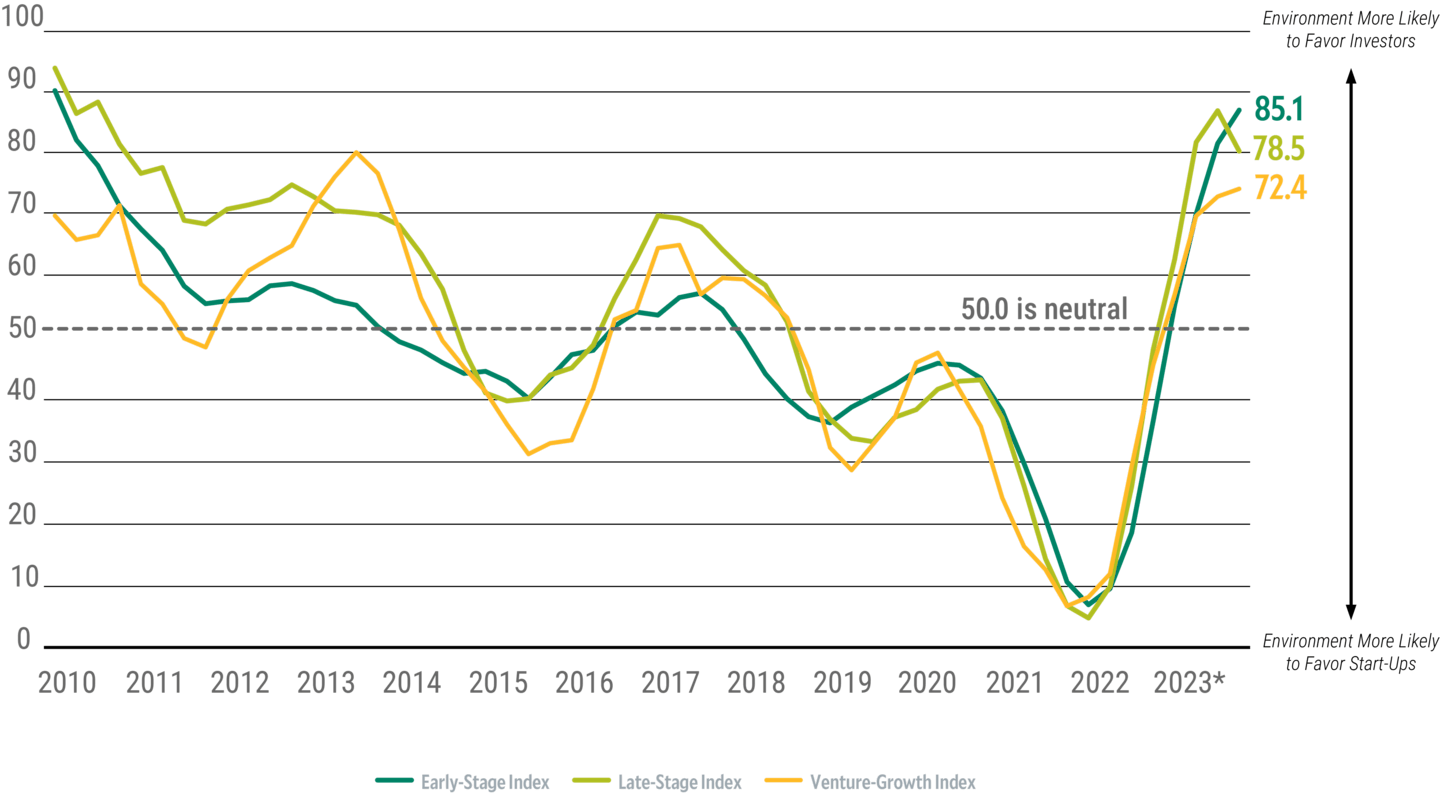

Figure 1 | Pitchbook VC Dealmaking Indicator

Pitchbook defines Venture Capital (VC) funds as pools of capital raised for the purpose of investing in the equity of startup companies. In addition to funds raised by traditional VC firms, PitchBook also includes funds raised by any institution with the primary intent stated above. Funds identifying as growth-stage vehicles are classified as PE funds and are not included.

Early stage: For a deal to be classified as early-stage VC, the company must be founded fewer than five years by the time of the deal, and if a series is specified, it should be a Series A or B.

Late stage: For a deal to be classified as late-stage VC, the company must be five years old or older regardless of series. Alternatively, if a series is specified, it should be a Series C or later regardless of time since founded.

Venture growth: Rounds are generally classified as Series E or later (which we typically aggregate together as venture growth) either by the series of stock issued in the financing or, if that information is unavailable, by a series of factors, including the age of the company, number of VC rounds, company status and participating investors.

Source: PitchBook. Geography: U.S. *As of December 31, 2023.

Pitchbook, in its 2024 U.S. Venture Capital Outlook, predicted capital demand-to-supply ratios will remain elevated, “maintaining an investor-friendly dealmaking environment.”12 Not only have market valuations come down, but more startup founders express willingness to offer investors equity in their companies. Increasingly, that option beats borrowing money at the highest loan rates in two decades.

Venture Capital’s Allocation Attributes

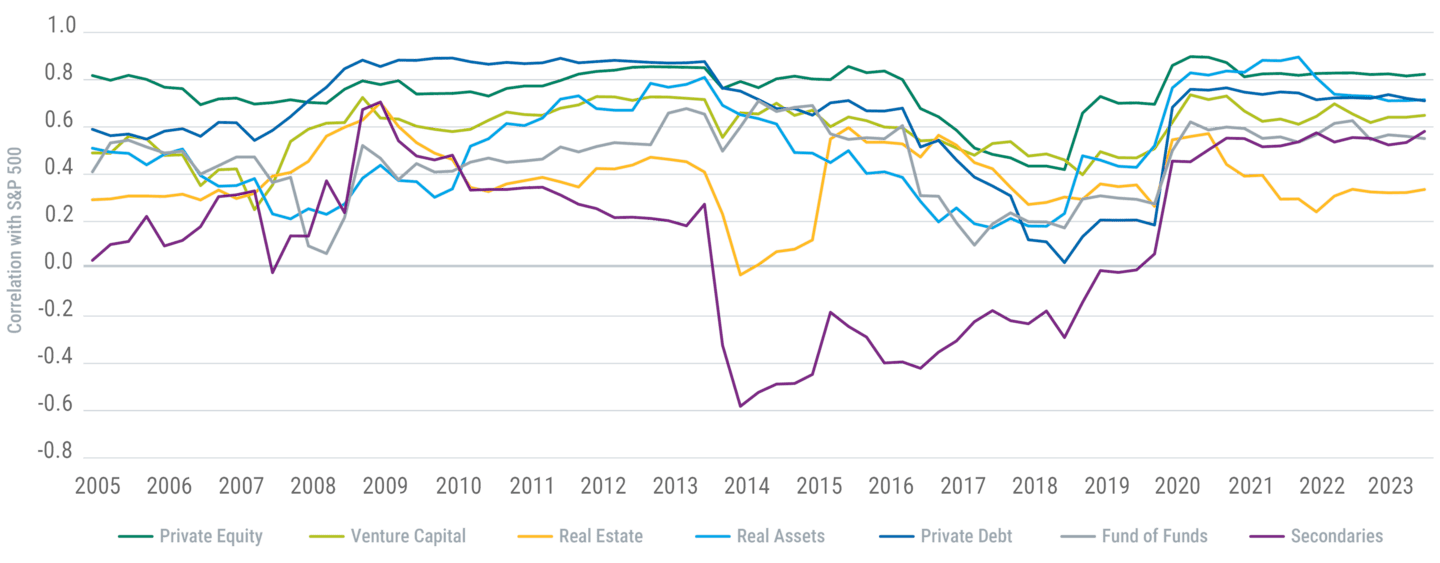

For investors, the opportunity in venture capital doesn’t just apply to investment potential within that asset category. Because of its low correlation with traditional equity and fixed-income assets, exposure to venture capital can offer attractive diversification for broader investment portfolios, even those comprising other private assets.

Figure 2 | Rolling 5-Year Correlation with S&P 500®* Quarterly Returns Using Adjusted Private Capital Returns**

Private Equity: Unless otherwise noted, PE fund data includes buyout, diversified PE, growth and restructuring/turnaround funds. PitchBook defines middle-market funds as PE investment vehicles with between 100 million and 5 billion USD or EUR in capital commitments.

Real estate: We define real estate funds as pools of capital raised for the purpose of investing in the equity of properties that currently have or are intended to have tenants. Funds using core, core plus, value-add, distressed and opportunistic strategies are included in real estate fundraising data.

Real assets: We define real assets funds as pools of capital raised for the purpose of investing in the equity of infrastructure, oil & gas, timber, metals and mining, agriculture and other natural resource assets. Infrastructure funds are categorized by strategy in the fundraising data, divided into infrastructure core, core plus, value-added, opportunistic and greenfield strategies.

Private debt: We define private debt funds as pools of capital raised for the purpose of lending to private companies, including those held by PE funds, VC funds (referred to as ‘venture debt’), real estate funds (referred to as ‘real estate debt’) and infrastructure funds (referred to as ‘infrastructure debt’). Private debt includes the following sub-strategies: direct lending, credit special situations, distressed debt, mezzanine, bridge financing, real estate debt, infrastructure debt, and venture debt.

Fund of funds: Fund of funds (FoF) are defined as pools of capital raised to invest in several different funds rather than into individual assets or companies. FoF managers are unique in that they act as a GP for the LPs investing into their own fund while playing the role of an LP in the funds in which they invest. While some FoF managers and funds invest opportunistically across asset classes and geographies, some dedicate funds to specific asset classes, such as real estate, or specific geographies.

Secondaries: Secondary funds are defined as pools of capital raised to acquire existing LP interests in funds or stakes in GP-backed companies. While many secondary managers and funds invest opportunistically across asset classes and geographies, some dedicate funds to specific secondaries strategies, such as real estate, infrastructure or private debt, or specific geographies.

*The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

**The Adjusted Private Capital Index reflects reported private capital index returns. Pitchbook applies a first-order autoregressive function to these returns, which allows Pitchbook to estimate the economic returns from the reported return series. Pitchbook supplements its indexes with adjustments to address the traditional 'smoothness' of private market returns. Its adjusted return data is meant to provide more realistic volatility measures and correlation analysis, enhancing the robustness of risk/return modeling parameters. Pitchbook's team gathers data on more than 2.3 million investments and 126,663 funds around the world. It organizes the data across 25 unique datasets, including those related to private investments.

Source: Morningstar, PitchBook. Geography: U.S. As of September 30, 2023.

Such exposure also has produced annualized returns outpacing leading global equity indices in the past four decades. Moreover, VC investors haven’t had to endure substantially more volatility to obtain those returns, even as venture capital investments inherently carry more risk than publicly traded assets.

Category | Annualized Return (%) | 1 Year* | 3 Year* | 5 Year* | 10 Year* | Annualized Standard Deviation |

|---|---|---|---|---|---|---|

Cambridge Associates Venture Capital Index | 13.20 | -8.89 | 14.85 | 17.24 | 17.18 | 18.56 |

Cambridge Associates U.S. Venture Capital-Early Stage Index** | 14.66 | -10.90 | 19.27 | 20.58 | 18.66 | 21.72 |

8.41 | 19.59 | 8.44 | 8.03 | 9.81 | 16.06 | |

7.72 | 7.23 | 5.79 | 1.02 | 5.21 | 21.44 | |

8.31 | 18.50 | 7.75 | 7.36 | 9.30 | 16.70 | |

5.75 | 22.26 | 3.07 | 0.58 | 1.11 | 18.87 |

Cambridge Associates’ benchmarks, including those for Venture Capital and U.S. Venture Capital-Early Stage, are fully composed of institutional-quality funds, and the underlying information that contributes to the quality and integrity of our data is sourced directly from the quarterly fund financial statements provided by the fund managers. They provide horizon index data for select asset classes.

Cambridge Associates monitors investments made by venture capital and other alternative asset partnerships. On September 30, 2023, 2,448 US venture capital funds from the years 1981 through 2023 were included in the sample. Partnership financial statements and narratives were the primary source of information concerning cash flows and ending residual/net asset values (NAV) for both partnerships and portfolio company investments. Vintage year is defined as the date of the fund’s first cash flow, defined as the date of the fund’s first LP contribution. Any investment activity taken prior to the first LP contribution is not taken into account.

*1-year period 9/30/2022-9/30/2023; 3-year period 9/30/2020-9/30/2023; 5-year period 9/30/2018-9/30/2023; 10-year period 9/30/2013-9/30/2023.

**Early-Stage companies for venture capital are generally those in the pre-seed stage, prior to official fundraising, or the seed stage, also known as Series A funding, when a company is early in its development.

S&P 500: The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

Russell 2000® Index: Market-capitalization weighted index created by Frank Russell Company to measure the performance of the 2,000 smallest of the 3,000 largest publicly traded U.S. companies, based on total market capitalization.

Russell 3000® Index: Market-capitalization-weighted index created by Frank Russell Company to measure the performance of the 3,000 largest publicly traded U.S. companies, based on total market capitalization.

MSCI EAFE (Europe, Australasia, Far East) Index: Designed to measure developed market equity performance, excluding the U.S. and Canada.

Data Sources: Cambridge Associates, FactSet. January 1981 – September 2023.

Past performance is no guarantee of future results.

The Current Landscape

It’s no secret that after a pandemic-era frenzy, venture capital markets have endured a rough patch recently. Falling valuations have crimped fundraising as borrowing costs and geopolitical concerns have increased.

The downturn, though, actually has turned the table in favor of investors. Startups still need increasingly scarce capital, and they’re more willing to give up equity stakes to obtain it. As a result, investors can negotiate more appealing terms than perhaps at any time in the past decade.

In addition, the downturn doesn’t mean attractive opportunities have disappeared. Investors simply have the advantage of taking a more discerning approach to those that exist. The long-term human welfare challenges posed by people living longer and climate change warrant continued investments in startups addressing those challenges.

VC investors will continue supplying the capital needed for healthcare and climate progress to persist. After the recent downswing, more favorable market conditions may entice them to do so with greater vigor moving forward.

Managing Money, Making an Impact

Learn more about how we help our clients Prosper With Purpose®.

"PitchBook-NVCA Venture Monitor First Look," PitchBook, January 3, 2024.

Marina Temkin, "VC-backed M&A spoils predictions, falling to decade low," January 24, 2024.

"US VC Fundraising From an LP Perspective," PitchBook, February 5, 2024.

"VC Valuations Report," PitchBook, July 2023.

Tim Smart, "Fed Signals Three Rate Cuts in 2024, End of Higher Interest Rate Cycle," U.S. News, December 13, 2023.

Brian Bushard, "CHIPS Act Passes: House Approves $280 Billion Bill To Boost Microchip Production And Counter China," Forbes, July 28, 2022.

Justin Badlam, Jared Cox, Adi Kumar, Nehal Mehta, Sara O'Rourke, and Julia Silvis, "The Inflation Reduction Act: Here’s what’s in it," McKinsey & Company, October 24, 2022.

"SSBCI Quarterly Report through September 30, 2023," U.S. Department of the Treasury, December 18, 2023.

"The venture market downshifts further in 2023, with dealmaking and funding totals falling to 6-year lows," CB Insights, January 4, 2024.

"Quantitative Perspectives: US Market Insights Q1 2024," PitchBook, February 9, 2024.

"Venture Monitor Q4 2023," PitchBook, December 2023.

"2024 US Venture Capital Outlook," PitchBook, December 18, 2023.

No solicitation, offer, or distribution of any investment, security, financial instruments, or financial interest of any type is being made or is intended by any of this material. This material is provided for informational and educational purposes only.

Nothing herein constitutes a recommendation of any investment, security, financial instruments, financial interest of any type, or any investment strategy.

No representation or warranty is being made regarding the suitability of any investments, securities, financial instruments or strategies for any investor. The material on this site is provided “as is.” American Century does not warrant the accuracy of the materials provided herein, either expressly or impliedly, for any particular purpose and hereby expressly disclaims any warranties or merchantability or fitness for any particular purpose.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.