Changing Weather Patterns Bring Higher Insurance Premiums

Increasingly powerful hurricanes and widespread tornado activity spurred by climate change significantly impact whether we can buy insurance and how much we must pay.

Key Takeaways

Destructive hurricanes and the rise of severe convective storms in mid-America and the Southeast are reshaping insurance pricing and availability.

Insurance companies are losing money in many states due to the challenges of modeling natural disasters attributable to climate change.

The economic impact of climate threats may be severe as high insurance costs siphon off dollars that could be spent on other discretionary purchases.

Although climate change is a politically charged topic, it has real implications for the investment landscape. The Mid-Cap Growth Team at American Century Investments is increasingly identifying risks and opportunities that transcend political rhetoric. The insurance industry and a constellation of related companies lie at the heart of this activity.

Rising Insurance Premiums in 2024: Insurers Battle Climate Threats

From an insurance perspective, we’ve seen an undeniable increase in the frequency and severity of climate events over the last decade. Just this fall, high winds, tornadoes and flooding from hurricanes Helene and Milton took a heavy toll on lives and property. Warm water helps storms quickly intensify, and scientists believe unusually warm water in the Gulf of Mexico due to climate change made these storms more severe.1

Moody’s estimates the privately insured losses from Helene alone could be $11 billion and losses to the National Flood Insurance Program could top $2 billion.2 Moody’s estimates for Milton weren’t available at the time of this writing. Large losses like these have caused insurers to raise premiums in Florida or withdraw from the market altogether.

Beyond hurricanes, secondary perils are becoming more prominent for homeowners and insurers. They include wildfires in the western U.S. and convective storms in middle America that are reshaping U.S. insurance pricing and availability. Convective storms are severe thunderstorms that may include heavy rainfall, hail, strong winds and tornadoes.

We’ve seen tornado activity move east from the less populated parts of Oklahoma and Kansas into the more densely populated sections of the lower Ohio River Valley.3 Assuming they can get coverage, residents of these newly threatened areas are seeing double-digit increases in their homeowners’ insurance premiums.4

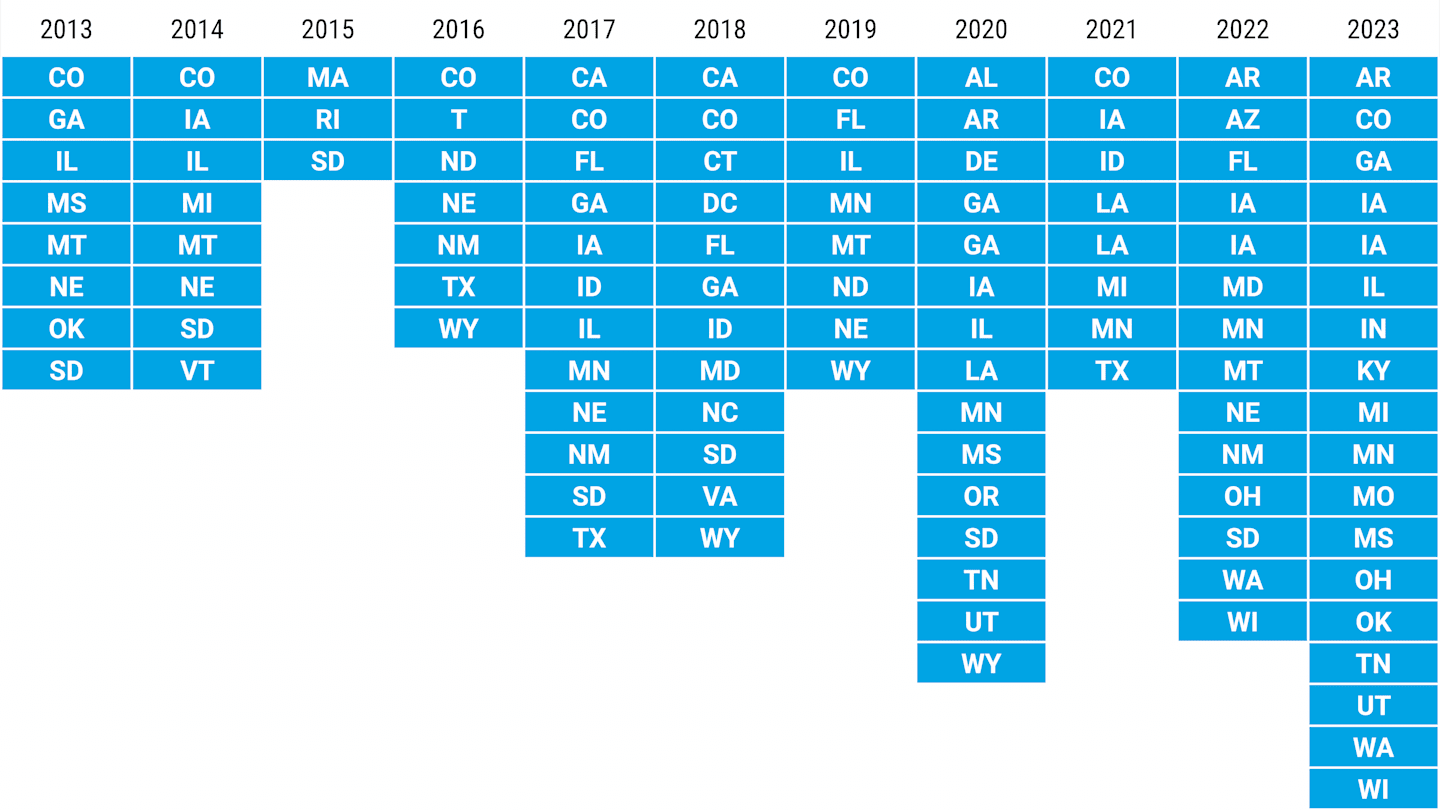

Figure 1 helps illustrate why premiums are rising in the lower Ohio River Valley: Ohio, Indiana and Kentucky are among the growing number of states where underwriting homeowners’ policies isn’t profitable for insurers.

Figure 1 | Insurers Are Losing Money in a Growing Number of States

States Where Homeowners Insurance Was Unprofitable

Data from 2013 - 2023. Source: AM Best.

Natural Disasters Upend Insurance Pricing Models

Pooling uncorrelated risks is the core concept behind insurance. When modeled correctly, this allows premium revenue from some members of the pool to offset insured losses from others. However, insurers lose money when they can’t model risks accurately and, thus, are unable to correctly price the growing number of perils to the same insured risk pool.

The industry typically relies on historical frequency, severity and geographical data to set insurance pricing. This has tended to work well with hurricanes because we have a long history of these events. But we have a lot less history with severe convective storms. As Figure 2 shows, such storms accounted for the bulk of the largest loss events in the U.S. last year.

For the increasing number of recent nature-related perils, we lack enough historical loss experience to accurately price these risks. As long as these mispriced loss events pile up, insurers will likely keep raising rates or withdraw coverage altogether. We think the inability to obtain insurance will negatively affect asset purchases, business formation and risk-taking — all of which are critical to growth in economic activity.

Figure 2 | Severe Storms Account for Large Losses

10 Largest U.S. Insured Loss Events in 2023

Dates | Event | Location | Deaths | Economic Loss ($ millions) |

|---|---|---|---|---|

Jan 1 - Dec 31 | Drought | United States | N/A | 14,000 |

Mar 1 - Mar 3 | Severe Convective Storm | Southeast, Midwest | 13 | 6,200 |

Aug 8 - Aug 17 | Wildfire | Hawaii | 100 | 5,500 |

Mar 31 - Apr 1 | Severe Convective Storm | Midwest, Plains, Southeast | 37 | 5,500 |

Jun 21 - Jun 26 | Severe Convective Storm | Plains, Southeast | 7 | 5,350 |

Jun 10 - Jun 15 | Severe Convective Storm | South, Plains | 3 | 3,950 |

Jun 15 - Jun 20 | Severe Convective Storm | Midwest, Southeast | 5 | 3,800 |

May 9 - May 14 | Severe Convective Storm | Midwest, Plains | 1 | 3,650 |

Aug 27 - Aug 31 | Hurricane Idalia | Southeast | 2 | 3,500 |

Apr 18 - Apr 22 | Severe Convective Storm | Southwest, Midwest | 0 | 2,950 |

Source: Aon, 2024 Climate and Catastrophe Insight.

Soaring Insurance Costs and Coverage Gaps Threaten Economy

So, what are the investment implications of rising insurance costs?

First, because most U.S. mortgages require a homeowner’s insurance policy from a sound underwriter, consumers will experience a higher cost of ownership. According to the ICE Mortgage Monitor, property insurance premiums now account for 9.4% of monthly mortgage payments compared with 7.7% in 2020. In high-risk areas, insurance’s share of monthly payments can be as much as 25%.5

Second, investors need to understand which companies will see higher insurance costs eat into their profits and which firms will choose to self-insure more of their risks. This is enormously important if being self-insured increases a company’s default risk. Of course, insurance company investments themselves need particular scrutiny due to earnings volatility from losses and favorable and unfavorable swings in the insurance pricing cycle.

Finally, if climate perils seriously damage our fragile agricultural and food systems or freshwater resources, some of our most basic needs will be repriced higher or less available. This could fuel civil unrest and introduce geopolitical risk.

Adapting to Climate Change May Present Investment Opportunities

The mid-cap growth team’s research pays increased attention to companies that offer adaptation and resilience solutions as part of their product suites. We find firms providing solutions across various industries, including building products companies with innovative construction materials and stormwater management products. We’ve also found examples among technology-related business and industrial companies.

We are also increasingly attracted to companies that can use big data, machine learning and artificial intelligence techniques to quickly modernize the task of accurately underwriting risks. Insurance carriers, brokers and data vendors are reshaping their ecosystem with updated modeling tools. Given the inflationary environment we have seen since the COVID-19 pandemic, the industry needs better estimates of replacement cost claims.

Secondary natural disaster perils often result in the need for repairs rather than complete replacement. This likely means more labor is required to settle the insurance claim, which makes estimating costs more challenging in a tight market for skilled tradespeople and construction laborers.

We’re confident the insurance ecosystem will be a significant buyer of services ranging from third-party catastrophe models, survey and data collection drones, and fraud detection and prevention software. We’re looking for the pick and axe suppliers to this modern “information rush” moment.

Climate Change and Insurance Costs: New Factors in Deciding Where We Live and Work

Beyond the politics of climate change, we must keep our insurance system affordable and functioning. This will require strategies for better underwriting and risk mitigation.

Ultimately, climate risks may figure more prominently in determining where and how we live. Insurance costs may become a more important part of the decision-making process rather than an afterthought. We need tools to help consumers predict the cost of living in harm’s way, similar to the school ratings we have for neighborhoods. And we need accuracy and transparency into these costs.

Author

Evan Bush, “Hurricane Helene Was Wetter and Windier Due to Climate Change, Report Finds – with Same Expected of Milton,” NBC News, October 8, 2024.

Moody’s Insurance Solutions, “Moody’s RMS Event Response Estimates U.S. Private Market Insured Losses for Hurricane Helene to Be Between US$8 Billion and US$14 Billion,” October 7, 2024.

Christopher Flavelle and Mira Rojanaskakul, “As Insurers Around the U.S. Bleed Cash From Climate Shocks, Homeowners Lose,” New York Times, May 13, 2024.

Rick Morain, “Climate Change Drives Up Homeowners’ Insurance Costs,” Bleeding Heartland, April 12, 2024.

Ice Mortgage Technology, “Mortgage Monitor,” October 2024.

Effective December 10, 2024, Sustainable Growth ETF was renamed Large Cap Growth ETF and the fund's ticker changed from ESGY to ACGR.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.