Physical Risks of Climate Change: Threats to Corporate Asset Integrity

Extreme weather events threaten physical assets on corporate balance sheets and the infrastructure that powers the global economy.

Key Takeaways

More frequent severe weather is harming corporate assets and global infrastructure.

The damage is immediate (e.g., downed power lines, destroyed crops, flooded buildings) and long-lasting, raising risks and insurance premiums.

Corporations are learning to measure their physical risks. Investors should expect more risk-related disclosures in financial reporting.

Climate Change Jeopardizes Global Assets

Climate change isn’t just an environmental concern but a threat eroding the physical integrity and value of numerous assets crucial to the successful functioning of the global economy. Failing to recognize and address these threats could have significant financial implications for corporate profits and society’s ability to function.

When analyzing a company’s operations, we believe investors should consider how climate change might jeopardize key assets and potentially limit production and services.

Floods or droughts can destroy crops, harming agricultural businesses and raising consumer prices.

Wildfires can destroy timberland, preventing lumber and paper production.

Rising ocean temperatures and acidity can decimate fish and seafood stocks, affecting over 3 billion people and 10% to 12% of the world’s population that rely on them.

Coastal storms and floods can down power lines and damage buildings.

Heavy rains and mudslides can buckle roads, blocking trucks from transporting goods.1

Extreme weather events brought about by climate change are causing CFOs, insurance companies and investors to reexamine the concept of “force majeure” (or “Act of God”), which often appears in legal documents and corporate risk disclosures.

What used to be boilerplate language covering rare events now has serious implications, as it determines who pays for damages due to more frequent and severe “forces of nature.” Paying to maintain the integrity of physical assets on corporate balance sheets or to restore them when natural forces damage them has become part of the annual budgeting process.

Understanding these climate risks requires informed discussions of what is at stake for companies and shareholders. Climate change threatens the physical integrity and value of assets on corporate balance sheets. This article discusses why climate risk has tangible, measurable financial implications, including asset impairment, increased costs and lost revenue.

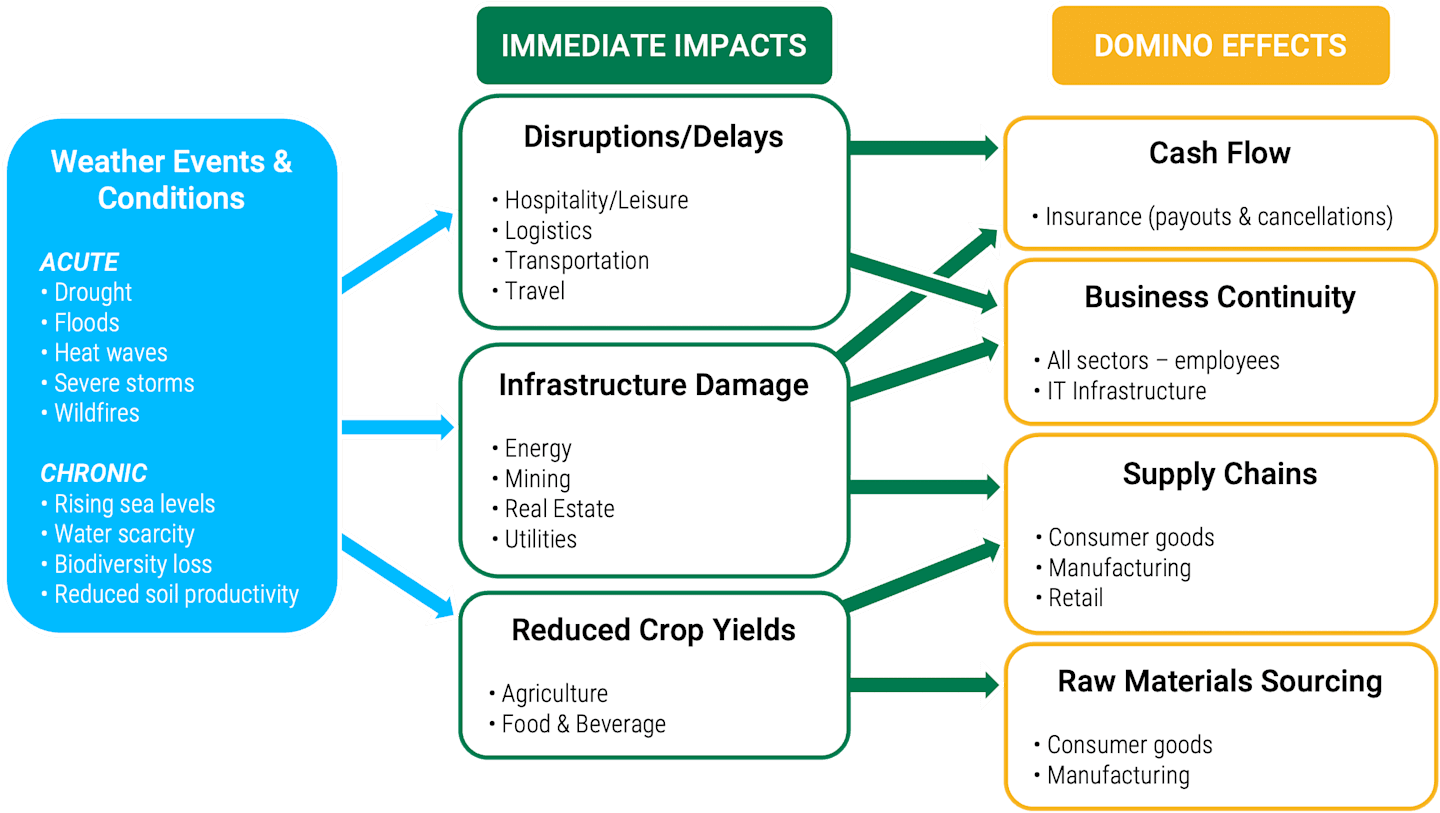

First- and Second-Order Effects and Costs of Extreme Weather Impacts

Severe weather events that damage a company’s physical assets can cause financial harm, not just due to the non-trivial cost of repairs but also because they may restrict or shut down business operations for extended periods. Beyond the immediate impacts of severe weather events, the significant second-order effects to consider include:

Insurance policies to cover repairs are becoming prohibitively expensive, and insurance companies are abandoning certain markets altogether.

Supply chain resilience is critical as rising sea levels threaten coastal infrastructure. Extreme weather events trigger cascading disruptions throughout supply chains, including the ability to transport raw materials and intermediate goods and deliver finished products to customers.

Climate change impacts the ability to grow certain crops and raise livestock on land where water is increasingly scarce, affecting the value of that acreage.

Data centers and health care facilities must pay for costly backup power supplies onsite to ensure the reliability of power grids.

Figure 1 | Extreme Weather Events Have Immediate and Longer-Term Secondary Effects

Source: American Century Investments.

Connecting Climate Change to Physical Risks and Financial Impacts

Climate change is intensifying, increasing the frequency of extreme weather events, causing more frequent, extensive and costly losses when assets are damaged, and reducing the recovery time between incidents. According to global reinsurer Swiss Re, a record-breaking 142 insured-loss natural catastrophes in 2023 led to roughly $280 billion in economic losses. Furthermore — and we think this is truly sobering — the growth rate in insured losses caused by these natural disasters has outpaced the growth in the global economy. Between 1994–2023, the burden of insured losses more than doubled, and Swiss Re projects that it will double again within the next decade.2

Real Estate Is Vulnerable

Rising sea levels are now affecting real estate values in low-lying coastal areas. Since 1880, global sea levels have risen an average of 8 to 9 inches (21 to 24 centimeters), mostly due to melting glaciers and ice sheets and an expansion of seawater as it warms. By 2050, sea levels are projected to rise as much as 12 inches along the U.S. coastline. Almost 30% of the U.S. population lives in coastal areas where rising sea levels play a role in flooding, shoreline erosion and storm hazards.3

As shorelines erode, flood risk increases. This threatens the infrastructure in these areas, including roads, bridges, subways, water supplies, oil and gas wells, power plants, sewage treatment plants, and landfills. Companies must carefully evaluate these risks when deciding where to establish or expand operations.

Financial Impacts of Physical Risks and Threats to Asset Integrity

How financially material are these threats? Severe weather events can force companies to recognize impairments or increase loss reserves on their balance sheets, while expensive clean-up and repairs can hit profits. Figure 2 summarizes the widespread nature and potential costs that these threats represent.

Figure 2 | Climate-Related Financial Risk Is Everywhere

# of Industries | % by Market Cap* | Total Market Cap* | |

|---|---|---|---|

Physical Risk | 36 of 77 | 55% | $28.2 trillion |

Transition Risk | 57 of 77 | 85% | $43.4 trillion |

Regulatory Risk | 40 of 77 | 29% | $14.7 trillion |

Any Climate Risk | 68 of 77 | 89% | $45.1 trillion |

* Represents the market capitalization of S&P Global 1200 companies that are reasonably likely to be exposed to each risk type. Data as of 4/7/2021. Source: Sustainability Accounting Standards Board, “Climate Risk Technical Bulletin,” 2021.

The cost of addressing these risks can be seen as an investment in adapting to, mitigating and helping to prevent physical damage caused by climate change if we fail to meaningfully reduce carbon emissions globally. For example, a food company heavily reliant on crops from regions experiencing more frequent and severe droughts may spend money now on developing drought-resistant crops. While this is an expense today, it could prevent financial catastrophe in the future.

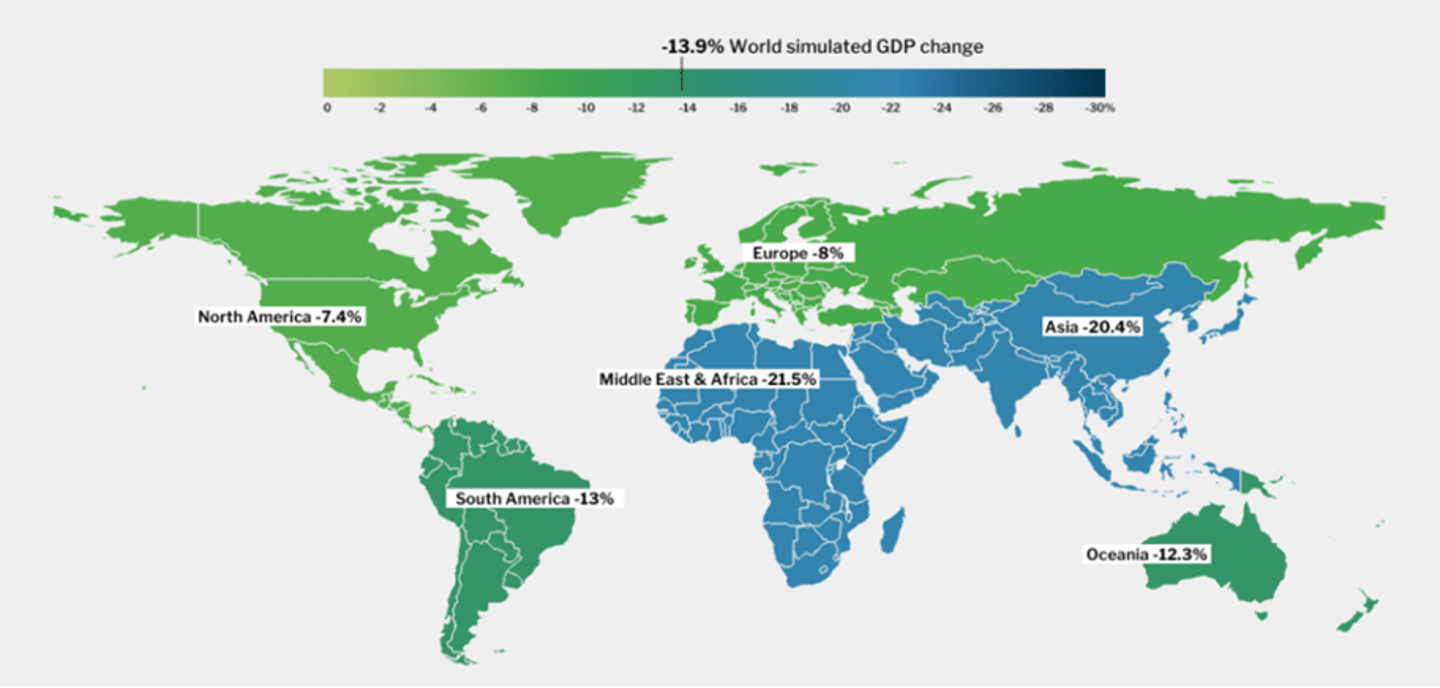

Economies Everywhere Face Physical Risks From Climate Change Impacts

While the severity of its impacts varies geographically, no nation is immune from climate change. Due to the global economy's interconnected nature, a climate-related disruption in one country can have ripple effects on many others through trade, supply chain disruptions and economic instability.

As shown in Figure 3, the Swiss Re Institute estimates the potential change in gross domestic product (GDP) if global temperatures increase by 2.6°C by 2050 compared to a “no change in temperatures” scenario. Its forecast shows that global GDP will likely decline by almost 14%. Even under a scenario where the temperature increase is well below 2.0°C, global GDP is expected to start declining in 2033 — less than 10 years from now.4

Figure 3 | Simulated GDP Changes in 2050 Under a 2.6°C Increase in Global Temperatures

Source: Swiss Re Institute, “The Economics of Climate Change: No Action Not an Option,” April 2021.

Climate Change Has Wide-Ranging Impacts on Asset Integrity

Global temperatures are expected to increase unless greenhouse gas emissions are significantly curtailed. This means destructive weather events will become more frequent and intense, causing more damage to the physical assets that underpin corporate revenues and profits. Three types of increasingly common extreme weather events with direct impacts on profitability include:

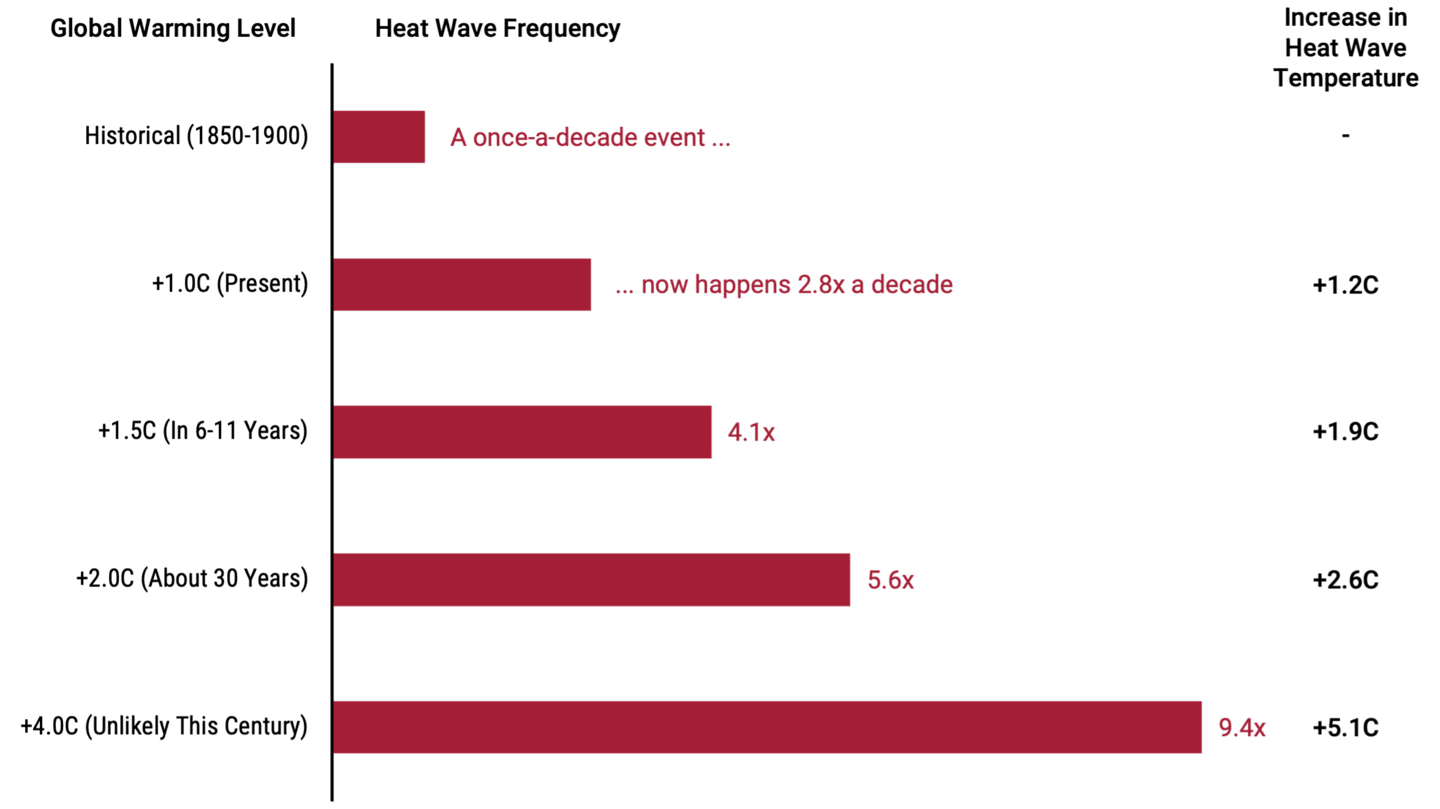

1. Heat Waves

A U.S. Senate report says extreme heat significantly impacts the U.S. economy, particularly in agriculture, mining, construction, manufacturing and transportation.5

Extreme heat reduces labor productivity and causes roads, airport runways and railroad tracks to buckle, disrupting travel and global trade.6

Hot, dry conditions feed destructive wildfires that can destroy power lines, homes and other structures, driving up insurance costs.

Air pollution from wildfires affects human health. In June 2023, smoke from Canadian wildfires put roughly 100 million people across 16 U.S. states under air quality alerts in a single day.7 Crop workers in the U.S. die of heat-related illnesses at 20 times the rate of other civilian workers.8

Average global temperatures have increased by at least 1.0 degrees Celsius (+1.0C) compared to the pre-industrial era. Figure 4 shows that “once-a-decade” heat waves now occur almost three times per decade; expect four such events over the next six to 11 years.

Figure 4 | Once-a-Decade Heat Waves Are More Frequent and Intense

Source: Intergovernmental Panel on Climate Change, “Summary for Policymakers,” Climate Change 2021: The Physical Science Basis, August 9, 2021.

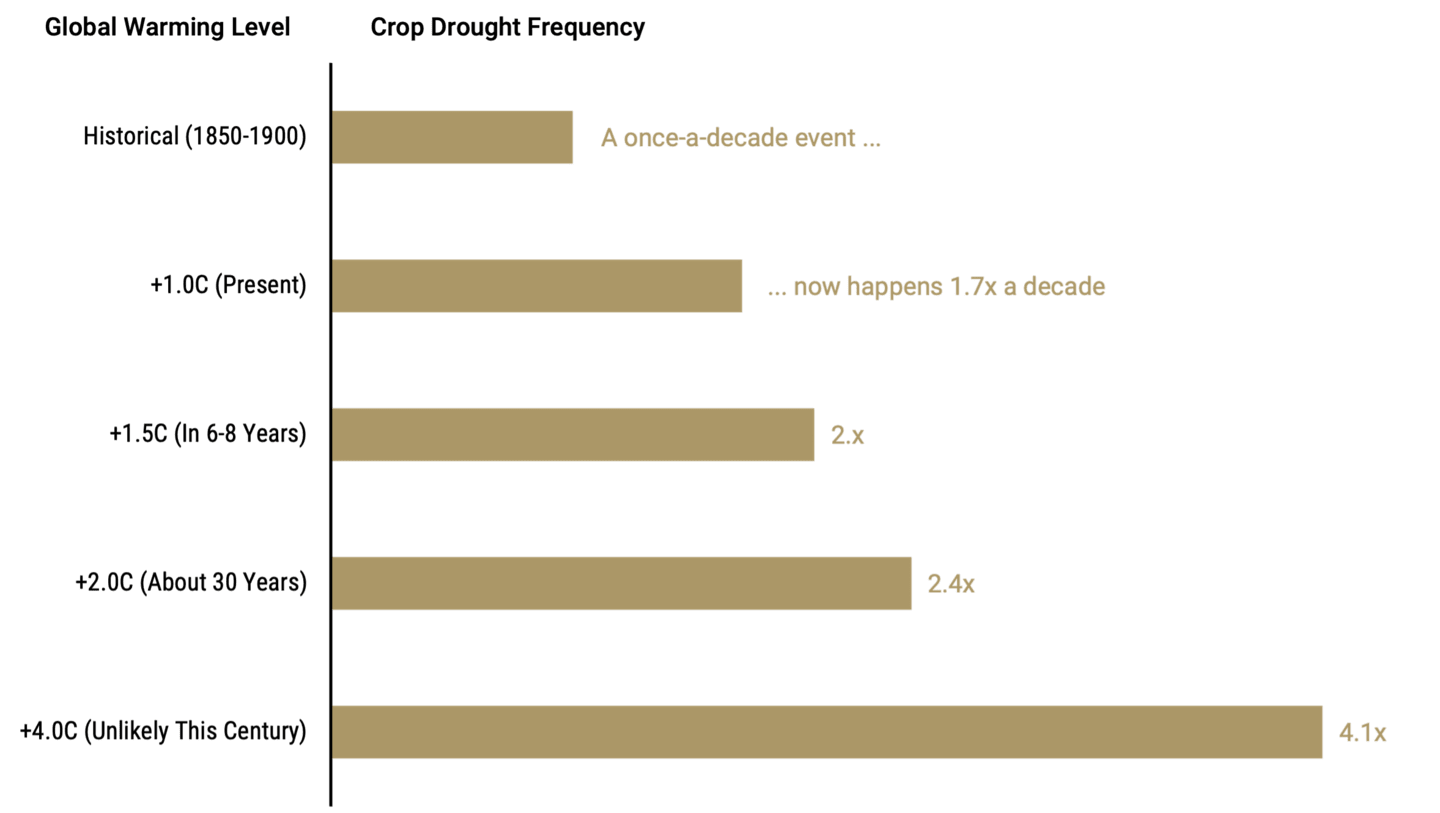

2. Droughts

Drought reduces crop yields, reducing the amount and quality of food, which hurts profits in the agricultural, food and beverage, and restaurant industries. As over 60% of crops are used to feed livestock, crop drought also affects meat and dairy production costs.9

Drought leads to higher food prices as farmers raise prices to cope with lower yields. This contributes to inflation and can reduce consumer spending elsewhere, having a trickle-down effect on an economy.

Severe drought can lead to famine. In the Horn of Africa, drought put 22 million people at risk of starvation.10

As Figure 5 shows, once-a-decade crop drought events now occur every six years and, like heat waves, are forecasted to become more common with rising temperatures. Agricultural and food companies will have to seek drought-tolerant alternatives, raise prices or abandon products that aren’t sustainable.

Figure 5 | Once-a-Decade Crop Droughts Are More Common

Source: Intergovernmental Panel on Climate Change, “Summary for Policymakers,” Climate Change 2021: The Physical Science Basis, August 9, 2021.

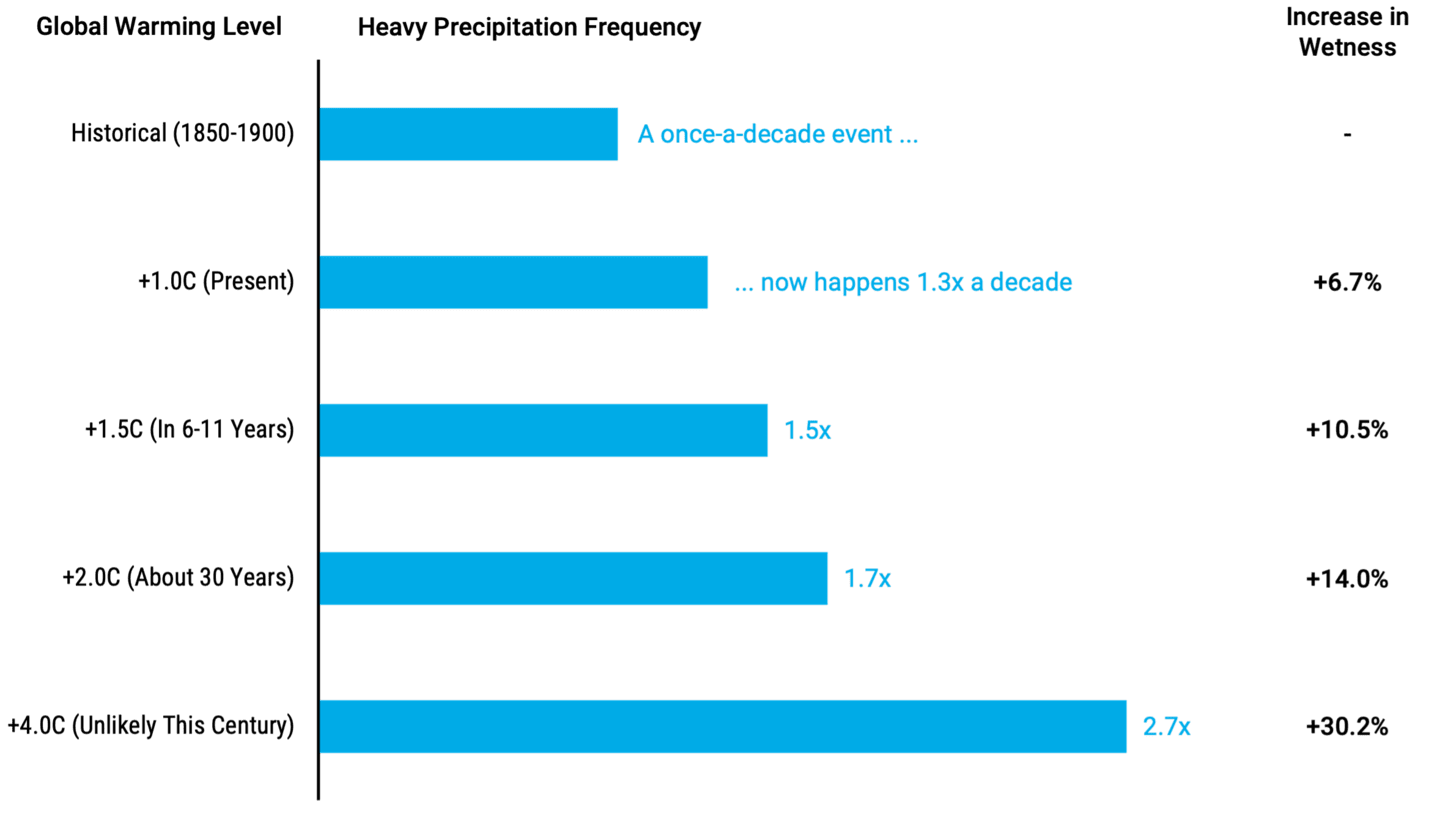

3. Heavy Precipitation

Heavy precipitation (i.e., substantially more than normal) damages crops, erodes the soil needed to grow crops and increases flood risk. It also affects farms, consumers, insurers and homeowners and disrupts travel.

Flooding can lead to injuries and drownings and disrupt power to hospitals, causing knock-on health effects.

Runoff can harm water quality as pollutants deposited on land wash into rivers and lakes.

Figure 6 shows that once-a-decade heavy precipitation events have already increased by 30%, but the greater frequency isn’t the whole story. Some insurers are raising premiums by 50% or more or pulling out of flood-prone areas they deem uninsurable. Some homeowners are choosing to forego insurance when their premiums skyrocket, placing them at risk of personal financial catastrophe.11

Figure 6 | Heavy Precipitation Events Are More Frequent

Source: Intergovernmental Panel on Climate Change, “Summary for Policymakers,” Climate Change 2021: The Physical Science Basis, August 9, 2021.

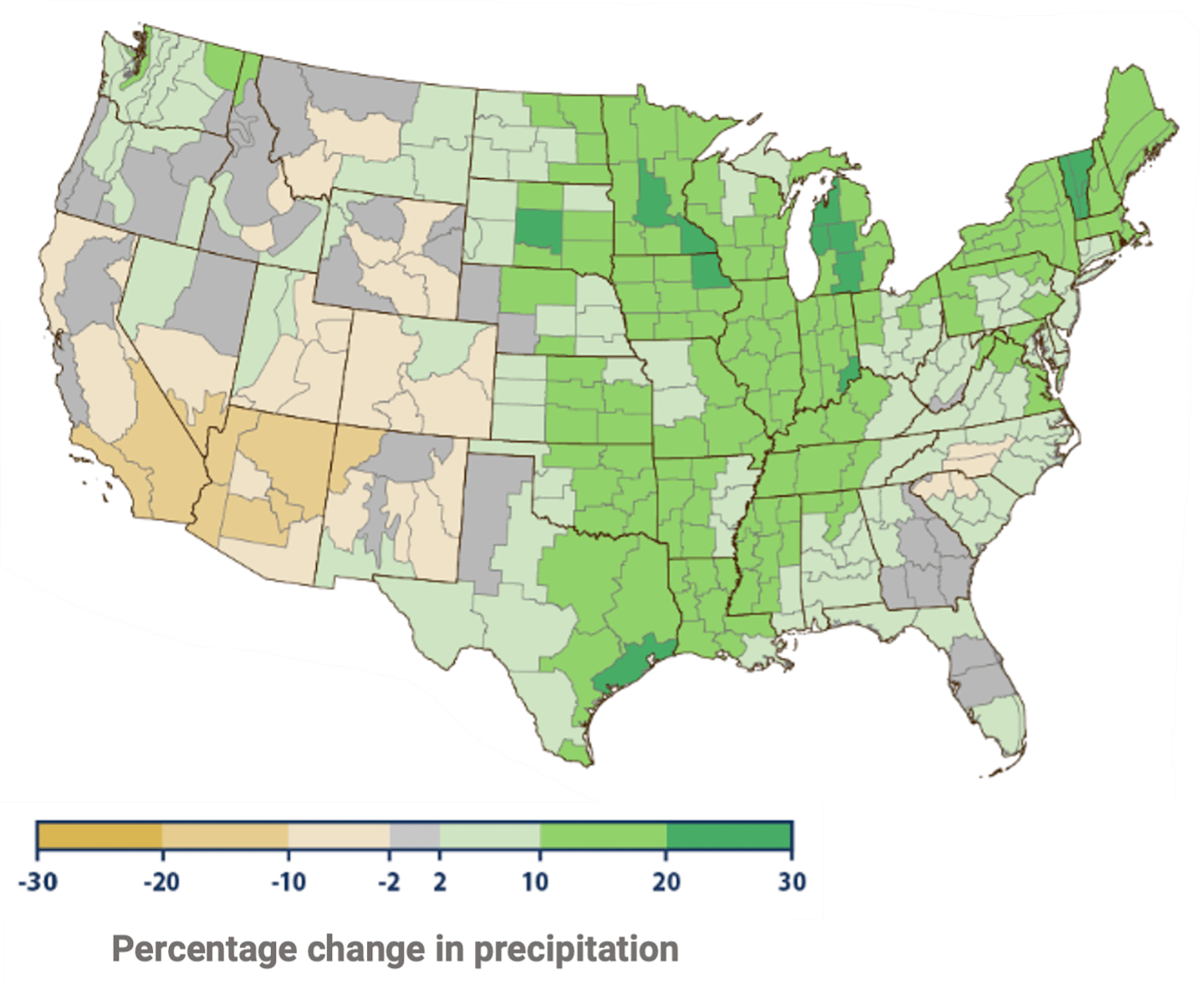

With heavy precipitation, it’s not just about how often but how much. Figure 7 shows the percentage change in precipitation across the lower 48 U.S. states from 1901 to 2021.12 Most areas experienced a meaningful increase or decrease in precipitation, often more than 10%.

Figure 7 | Changes in Precipitation in the U.S. Will Vary Widely

Data as of 2022. Source: National Oceanic and Atmospheric Administration.

Measuring and Describing Climate Change-Related Physical Risks

Disclosing how climate change may affect operations and profitability helps companies to meet their obligation to inform shareholders of financially material risks. However, we’re still in the early stages of defining ways to quantify and compare risks to physical assets.

While more work is needed, corporations are adopting a common vocabulary for discussing these risks. Look for these terms in discussions of physical climate risk across all industries:

Asset Integrity: This term refers to a physical asset's capacity to operate effectively and safely. For example, a factory in an area where intense heat waves are common must keep its equipment cool and thus will likely depend on increasingly scarce water resources. It must also protect employees onsite from dehydration and heatstroke. Temperature fluctuations can cause building materials such as concrete to expand and contract, putting stress on a structure, and higher moisture in the air can encourage mold growth.

Environmental Management System (EMS): This refers to a set of processes and practices that help a company reduce its environmental impact and increase operating efficiency. The International Organization for Standardization (ISO) details requirements for EMS that, when followed, should “provide reasonable assurance that the outputs from the system will have minimal negative environmental impact and improved environmental performance.”13 The ISO 14001 standard is focused on what companies should do, not how to do it. Over 300,000 organizations in 171 countries, including over 3,800 companies in the U.S., are ISO 14001 certified.14

Temperature Scenarios: Simulating feasible future climate change scenarios and their potential impacts on physical assets helps companies to prepare for and seek ways to reduce risks. The more global temperatures rise, the greater the likelihood of severe weather events such as extreme heat, drought, river and coastal flooding and crop failures. Asia is particularly vulnerable to climate change and has a high concentration of manufacturing entities that supply parts to electronics companies such as Apple and Samsung and the apparel, automotive, machinery, and chemicals industries.

Some scenarios involve a tipping point or critical threshold at which a relatively small change in conditions can cause dramatic, often irreversible, changes in a system. Climate science shows that under scenarios where temperatures rise “only” 1.5°C or 2.0°C versus the pre-industrial era, we may see “devastating domino effects, including the loss of whole ecosystems and capacity to grow staple crops, with societal impacts including mass displacement, political instability and financial collapse.”15

Awareness of Asset Integrity Issues in Climate Risk

In our view, assessing and protecting the integrity of physical assets, understanding the rising cost of insuring or repairing them, and addressing the potential liabilities they may represent are critical concerns for businesses and investors globally.

As active managers, our approach to analyzing a company’s sustainability includes understanding how its physical assets are vulnerable to climate risk. This encompasses immediate, longer-term and knock-on effects in an interconnected global economy. We evaluate the companies in our portfolio for asset integrity risks and engage with management to better understand what they are doing to address them.

Case Studies: Utilities Face Unique Climate Change Risks

Climate-related risk disclosures are particularly challenging for electric utilities. Downed or sparking power lines have been implicated in recent devastating wildfires, resulting in charges of negligence and overly aggressive cost-cutting:

Hawaiian Electric faces more than a dozen lawsuits claiming negligence in maintaining its infrastructure for its role in the fire on Maui in August 2023 that destroyed the historic town of Lahaina. Shortly after the fire, the company’s bonds were downgraded to non-investment grade. In addition to the property and lives lost, shareholder value was severely damaged.

PG&E has paid hefty fines for its role in devastating and deadly wildfires in California. In recent years, PG&E equipment has caused 31 wildfires that wiped away towns and killed 113 people. The company pleaded guilty to over 80 counts of manslaughter for its role in a 2018 fire. In another incident, a tree marked for removal fell on one of its power lines and sparked a fire that burned 56,000 acres and killed four people. PG&E settled with the California Public Utilities Commission for $150 million.16

Xcel Energy has been sued for its role in the March 2024 fire in the Texas panhandle. Experts say the fire shows utilities must be ready for more extreme weather.

“We don’t have last century’s climate right now, and we won’t have last century’s climate for the many decades ahead as the impacts of climate change accelerate,” said Costa Samaras, a civil and environmental engineering professor at Carnegie Mellon University. Much of the U.S. utility infrastructure was built in the mid-20th century under less extreme weather than what Texas is now experiencing.17

Case Studies: Food & Agriculture Climate Change Vulnerabilities

Weather events can have near-term and long-term effects on food availability, prices and businesses.

Bad news for beef: The largest wildfire in Texas history, which began in late February 2024, killed thousands of livestock and destroyed crops and infrastructure. Cattle ranchers now face even more economic pressure because of the fire, and the state’s agriculture industry continues to face a widespread drought that has already forced ranchers to shrink their herds, contributing to a nationwide decline in beef production. Almost 15% of beef in the U.S. comes from Texas.18

Bad news for Mexican food fans: Chipotle’s 2023 Sustainability Report warned that increasing weather volatility and other global weather patterns could “have a significant impact on the price or availability of some of our ingredients,” adversely affecting the company’s operating results. The company said it may temporarily suspend serving guacamole or salsas rather than paying the increased cost for the ingredients.

Bad news for chocolate lovers: Drought and excess rain have affected the Ivory Coast and Ghana, which produce two-thirds of the world’s cocoa. Farmers there struggle to cope with climate conditions, and Mondelez International (maker of Cadbury and Toblerone chocolates) continues to expect substantial inflation in cocoa and sugar prices.

Author

The Nature Conservancy, “A Healthy Ocean Depends on Sustainably Managed Fisheries,” January 25, 2021.

Chandan Banerjee, Lucia Bevere, and Balz Grollimund, et al., “Sigma 01/2024: Natural Catastrophes in 2023,” Swiss Re Institute, March 26, 2024.

Sally Younger, “NASA Study: Rising Sea Level Could Exceed Estimates for U.S. Coasts,” NASA, November 15, 2022.

Swiss Re Institute, “The Economics of Climate Change: No Action Not an Option,” April 2021.

U.S. Senate Joint Economic Committee Democrats, “The Mounting Costs of Extreme Heat,” August 10, 2023.

Patricia Cohen, “The Economic Fallout from Extreme Heat Will Rise over Time,” New York Times, July 18, 2023.

Kiley Price, “Canadian Wildfire Smoke Is Triggering Outdoor Air Quality Alerts Across the Midwestern U.S.,” Inside Climate News, May 14, 2024.

Ibid.

Greenpeace, “Feeding the Problem: The Dangerous Intensification of Animal Farming in Europe,” February 12, 2019.

The Guardian, “Drought in the Horn of Africa Places 22 Million People at Risk of Starvation, Says UN,” August 19, 2022.

Ioana Agache, Vanitha Sampath, and Juan Aguilera, et al., “Climate Change and Global Health: A Call to More Research and More Action,” European Journal of Allergy and Clinical Immunology 77, No. 5 (May 2022): 1389-1407.

U.S. Environmental Protection Agency, “Climate Change Indicators: U.S. and Global Precipitation,” November 1, 2023.

American Society for Quality, “What Are Environmental Management Systems (EMS)?” accessed May 20, 2024.

Ibid.

Ajit Niranjan, “Earth on Verge of Five Catastrophic Climate Tipping Points, Scientists Warn,” The Guardian, December 5, 2023.

Dani Anguiano, “California Utility Avoids Trial for 2020 Wildfire That Killed Four,” The Guardian, May 31, 2023.

Emily Foxhall, “Texas Requires Utilities to Plan for Emergencies. That Didn’t Stop the Panhandle Fires,” Texas Tribune, March 8, 2024.

World Population Review, “Beef Production by State 2024,” accessed May 6, 2024.

Sustainability focuses on meeting the needs of the present without compromising the ability of future generations to meet their needs. There are many different approaches to Sustainability, with motives varying from positive societal impact, to wanting to achieve competitive financial results, or both. Methods of sustainable investing include active share ownership, integration of ESG factors, thematic investing, impact investing and exclusion among others.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Many of American Century's investment strategies incorporate sustainability factors, using environmental, social, and/or governance (ESG) data, into their investment processes in addition to traditional financial analysis. However, when doing so, the portfolio managers may not consider sustainability-related factors with respect to every investment decision and, even when such factors are considered, they may conclude that other attributes of an investment outweigh sustainability factors when making decisions for the portfolio. The incorporation of sustainability factors may limit the investment opportunities available to a portfolio, and the portfolio may or may not outperform those investment strategies that do not incorporate sustainability factors. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and for certain companies such data may not be available, complete, or accurate.