Fed Stays Put as Its Peers Start Cutting Rates

Despite recent progress on inflation, cautious policymakers now see only one rate cut this year.

Key Takeaways

The Fed, which again left its target lending rate unchanged, penciled in one rate cut by year-end, down from its December forecast of three.

While persistent inflation kept the Fed on hold, easing inflation in Canada and Europe recently prompted the first rate cuts in developed markets.

Amid slowing growth and inflation and the Fed’s timetable, we believe investors have time to pursue bond market opportunities before rates head lower.

The latest Federal Reserve (Fed) policy meeting concluded on June 12 the same way the previous six meetings ended — with interest rates on hold. Resilient growth and above-target inflation once again prevented policymakers from launching the rate-cut campaign they teased in late 2023.

While encouraged by modest progress on inflation, including a May slowdown in the Consumer Price Index (CPI), Fed officials held firm. They left the short-term interest rate target in a 23-year-high range of 5.25% to 5.5%, where it’s been for nearly a year.

Policymakers now expect only one rate cut before year-end, compared with the three cuts they forecasted in December. The Fed’s preferred inflation gauge, the core personal consumption expenditures index, has stalled at 2.8% (annualized) since March. Officials now expect core inflation to approach their 2% target next year.

The Fed’s announcement followed recent policy pivots from central banks in Canada and Europe, where inflation has slowed but hasn’t yet reached the target level. The Bank of Canada cut its primary interest rate by a quarter point to 4.75% on June 5. The next day, the European Central Bank announced quarter-point cuts to key lending rates, and the Bank of England may follow in late June.

Resilient Economic Growth and Persistent Inflation Shape Fed Policy

Post-pandemic, the U.S. has consistently logged stronger economic growth, lower unemployment rates and “stickier” inflation than most of its developed markets peers. In fact, the latest growth figures show the U.S. economy expanded at more than twice the pace of its closest competitor, as Figure 1 illustrates.

Figure 1 | U.S. Has Outpaced Its Peers

Country/Region | First-Quarter 2024 Annualized Gross Domestic Product (GDP) | 2023 Full-Year GDP Growth | Latest Unemployment Rate | Latest Annualized Headline Inflation Rate |

U.S. | 1.3% | 2.5% | 4% | 3.3% |

U.K. | 0.6% | 0.1% | 4.3% | 2.3% |

Canada | 0.4% | 1.1% | 6.2% | 2.7% |

Eurozone | 0.3% | 0.4% | 6.4% | 2.6% |

Australia | 0.1% | 2.3% | 4.1% | 3.6% |

Data as of 6/12/2024. Source: Trading Economics.

For most developed markets, weaker growth and higher unemployment rates have translated to slowing inflation rates. In Canada and the eurozone (and possibly the U.K.), the slowdown was sufficient to launch central bank easing. But with inflation yet to reach target levels and still a threat to growth, additional cuts remain data-dependent.

Meanwhile, the Fed has proceeded cautiously amid resilient growth and employment data and elevated consumer prices. Policymakers want more confidence that inflation is retreating to their target level before cutting rates. They don’t want to risk cutting too soon and reigniting inflation.

But waiting too long also has risks. If growth and employment weaken more than expected, the Fed may not be able to cut rates quickly enough to avoid a recession.

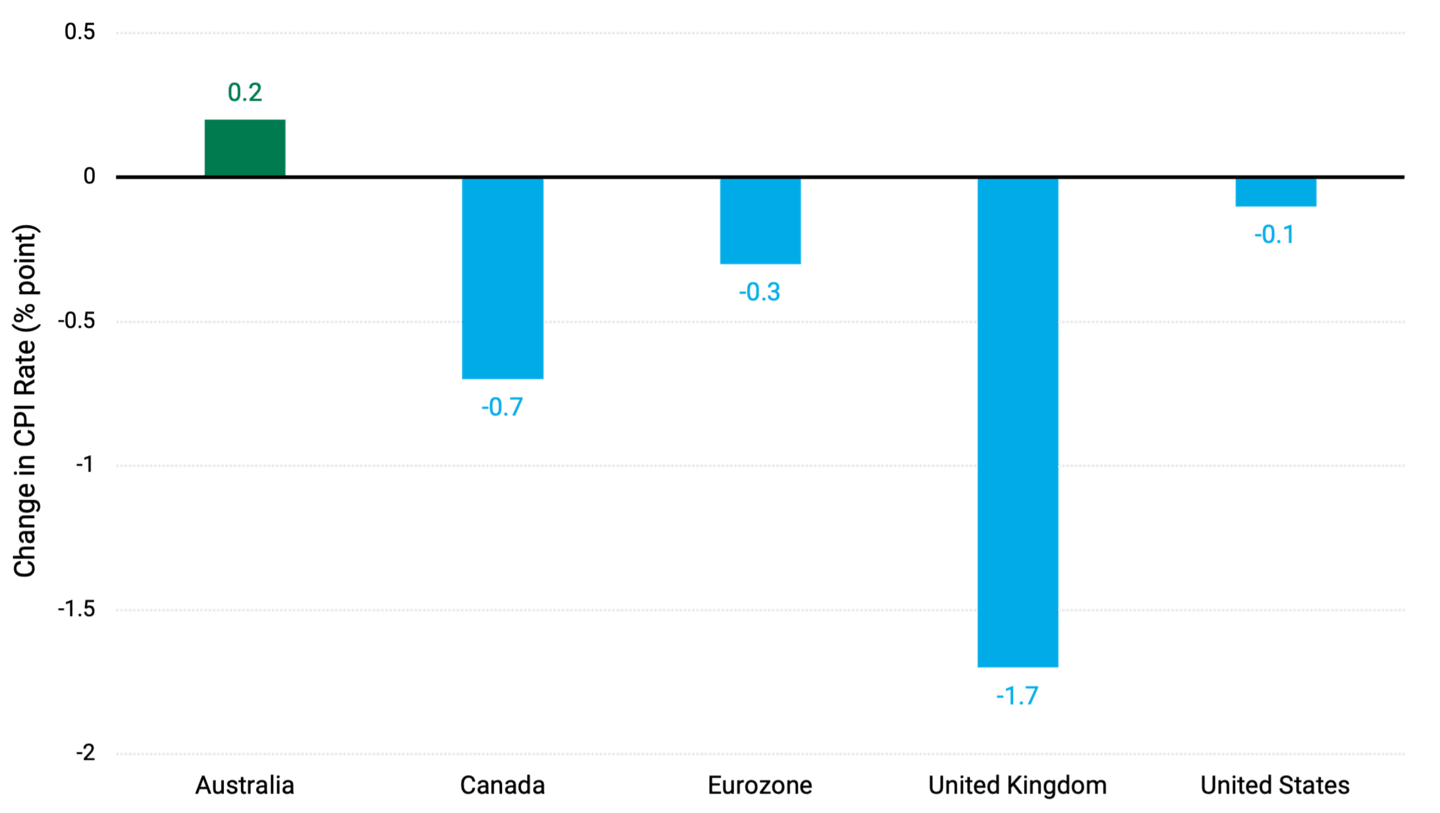

Year-to-Date Inflation Trends Differ in Developed Markets

As Figure 2 highlights, inflation has weakened in most developed economies — particularly the U.K. — compared with the end of 2023. Australia and the U.S. have been anomalies. Rising food, beverage and health care costs have largely pushed the Australian inflation rate higher year to date.

Figure 2 | U.K. Inflation Has Slowed Sharply in 2024

Most Recent Year-Over-Year CPI Rate Minus December 2023 Year-Over-Year CPI Rate

Data as of 6/12/2024. Source: Trading Economics.

High Housing Costs Have Driven U.S. Inflation in 2024

High housing-related costs have accounted for much of the inflation problem in the U.S. But we believe the tide may be turning.

The CPI’s shelter component, a large driver of CPI, advanced at an annualized pace of 5.4% in May. While still elevated, April’s reading cooled from December, when shelter costs rose at a 6.2% year-over-year pace.

CPI’s shelter calculation includes rental values, lodging away from home and owners’ equivalent rent (OER), the largest component. OER’s year-over-year increase was 5.7% in May, compared with 6.3% in December.

Along with slowing OER trends, other rent indices seem to be stabilizing. Additionally, occupancy rates in multifamily housing remain low relative to pre-COVID levels, which could ease prices. Furthermore, a robust supply of multifamily housing is coming to market, which may pressure vacancy rates and rent growth.

Economic Slowdown Highlights Sector Allocation Strategies

We believe slowing inflation will coincide with a broader pullback in U.S. economic growth. Consumers, the largest contributors to GDP, face challenges as wage growth slows and excess savings dwindle.

Additionally, the labor market’s strength appears to be abating. Recent data show the hiring rate and job openings are down year-over-year, while layoffs and the unemployment rate are up.1

As the slowdown persists, we believe the Fed will likely ease, and broader interest rates will likely decline. When this occurs, yields on Treasury bills, savings accounts and other cash equivalents will follow, while bond prices may rise. In our view, investors still have time to consider various fixed-income alternatives before the rate and pricing environment changes.

For example, we believe high-quality, short-duration bonds may help capture currently attractive yields and potentially lower interest rate risk. Additionally, during economic downturns, high-quality bonds may provide a cushion to higher-risk assets in a diversified portfolio. When rates decline, bond prices typically rise, potentially boosting total return potential.

Author

U.S. Bureau of Labor Statistics, June 4, 2024.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

In certain interest rate environments, such as when real interest rates are rising faster than nominal interest rates, inflation-protected securities with similar durations may experience greater losses than other fixed income securities. Interest payments on inflation-protected debt securities will fluctuate as the principal and/or interest is adjusted for inflation and can be unpredictable.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.