Durable Trends Underpin the Outlook for Global Equities

U.S. stocks have excelled, but non-U.S. equities continue to present compelling opportunities.

Key Takeaways

The Magnificent Seven helped drive a significant portion of U.S. stock market returns last year, but more companies could make gains in 2025.

Germany and Taiwan showed progress in 2024. Japan continues to hold promise.

China’s precarious property market continues to weigh on the country’s consumers and businesses, but the government is working to increase demand.

U.S. equities posted another year of banner performance in 2024, with the S&P 500® Index notching a 23% gain.1 It marked the index’s fourth 20%+ advance since 2019.2

The Magnificent Seven again keyed the performance story as their combined share of the index’s market capitalization climbed to more than 33% by the end of 2024.3 Excluding these tech+ stocks, gains would have been limited to approximately 12%.4

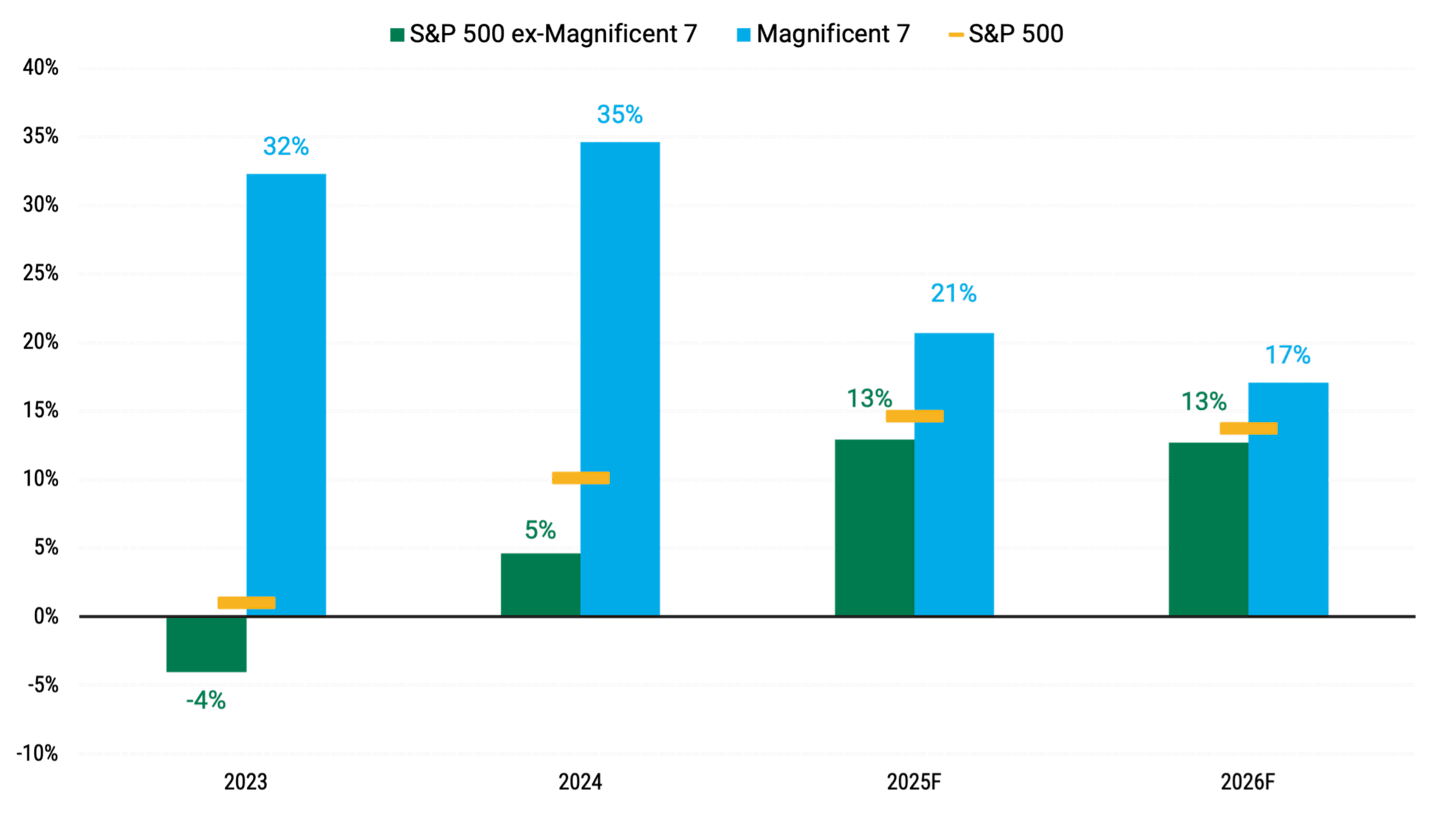

Although much of U.S. growth can be tied to the largest tech companies, we believe equity gains will broaden to include more businesses. Forecasters expect a smaller gap between the Magnificent Seven and the rest of the S&P 500 companies, as shown in Figure 1.

Figure 1 | EPS Forecasts Predict a Smaller Gap Between Mag Seven Stocks, Others

Data from 1/1/2023 – 12/31/2026. Source: FactSet. 2025 and 2026 forecasts are as of 9/25/2024. Subject to change. Forecasts are not a reliable indicator of future performance.

While it remains to be seen whether 2024’s strong performance will continue through 2025, we believe artificial intelligence (AI), digitization and other themes that helped fuel recent returns will still propel earnings growth. We also think there are opportunities beyond the most high-profile names, including businesses based outside the U.S.

As a result, we could see growth expand beyond 2024’s top performers.

Mixed Non-U.S. Equity Results with Emerging Bright Spots

The MSCI Europe Index rose by approximately 2% last year.5 The region’s largest industries — including automakers, industrial manufacturers and luxury goods companies — face difficult conditions due to weak demand from businesses and consumers in China.

However, we see pockets of strong performance. For example, despite poor economic growth, the MSCI Germany Index delivered its second consecutive year of double-digit returns.6 Automakers lagged, but German industrial companies benefited from global themes such as electricity generation and European defense spending.

In Asia, the MSCI Japan Index increased more than 8%.7 The long-dormant Japanese equity market has been revitalized by the return of inflation, changes in corporate governance and a larger focus on digitization initiatives.

Chinese stocks also ended last year in positive territory after the government announced multiple initiatives to reinvigorate demand.8 However, with 70% of China’s household wealth tied to the property market, weakness in the sector remains a major drag on the economy.9 Nonetheless, we expect the central government to keep finding solutions and policies to reignite growth.

Elsewhere, the MSCI Taiwan Index outperformed the S&P 500, and one of its key stocks, Taiwan Semiconductor Manufacturing Co. (TSMC), continues to enjoy strong demand.10 Meanwhile, the MSCI Korea Index lagged.11 Samsung, one of its major constituents, may face near-term headwinds due to sluggish demand for smartphones and PCs, but server demand is robust.

2025 Global Equity Market Outlook

Many growth drivers that fueled performance in 2024 appear durable, with long-running secular tailwinds influencing earnings. Our strategy is to remain selective. We believe the following themes could influence earnings growth in the months ahead.

AI Spending Trends and Potential Market Implications

Companies continue to invest significant resources in developing large-language models, directly benefiting semiconductor and software companies like TSMC.

AI could also become an incremental growth driver as more companies incorporate AI-powered agents and similar tools into their software offerings. PwC estimates AI could add $15.7 trillion to the global economy by 2030, with 45% of economic gains coming from product enhancements.12

Rising Energy Demand Promotes Infrastructure Spending

Artificial intelligence requires massive amounts of power. According to McKinsey & Co., U.S. data centers represent 3% to 4% of the country’s energy demand. This could grow to 11% to 12% by 2030.13

To meet AI’s energy needs and demand related to electric vehicles and renewables, utilities will likely need to spend more on power generation and upgrade their power grids.

We believe companies in this sector are attractively priced. Specifically, we see opportunities in businesses exposed to the natural gas industry, such as The Williams Cos. and Cheniere Energy. Nuclear power is another area of interest, as represented by companies like Curtiss-Wright Nuclear, BWX Technologies and Mitsubishi Heavy Industries.

Positive Outlook for Financial Services Firms in 2025

Increased activity in capital markets could drive earnings for financial services companies. Contributing factors include a more supportive regulatory environment in the U.S. and stabilization of interest rates, which could lead to increased debt trading and issuance. A lack of organic growth in Europe could encourage businesses to seek growth through mergers and acquisitions.

Globally, the market value of M&A deals rose in 2024, up roughly 15% from 2023, which was a low point compared to recent years.14 We foresee continued growth in M&A, with potentially transformative effects on the firms involved in these deals. Joining forces could improve the companies’ competitive positions, increase their margins and support top-line growth.

How Japan’s Reforms Could Lead to Stronger Performance

We expect Japan’s commitment to governance reform, technology investment and other improvements to strengthen companies further there. Japanese companies are also players in fields like power generation, which is experiencing increased demand globally.

Digitization stands out as a growth catalyst. Because of inflation, an aging population and increased competition for workers, corporations are investing in IT to make their employees more productive. BayCurrent Consulting, Hitachi and NTT Data are among the potential beneficiaries of this trend.

Potential for Broader Market Growth in 2025

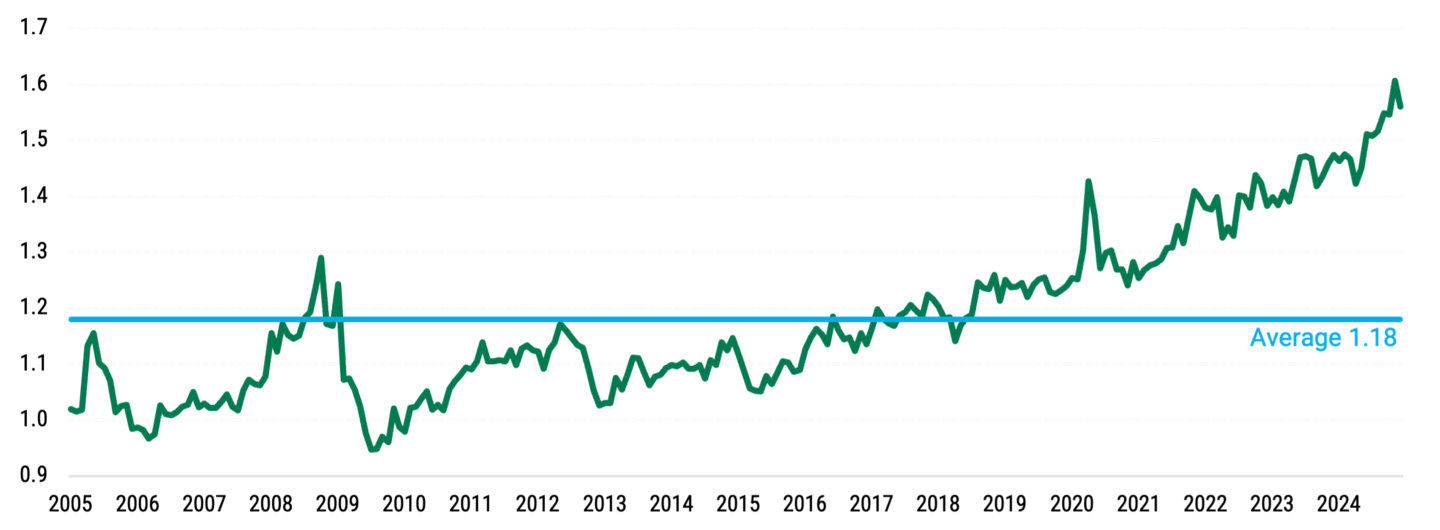

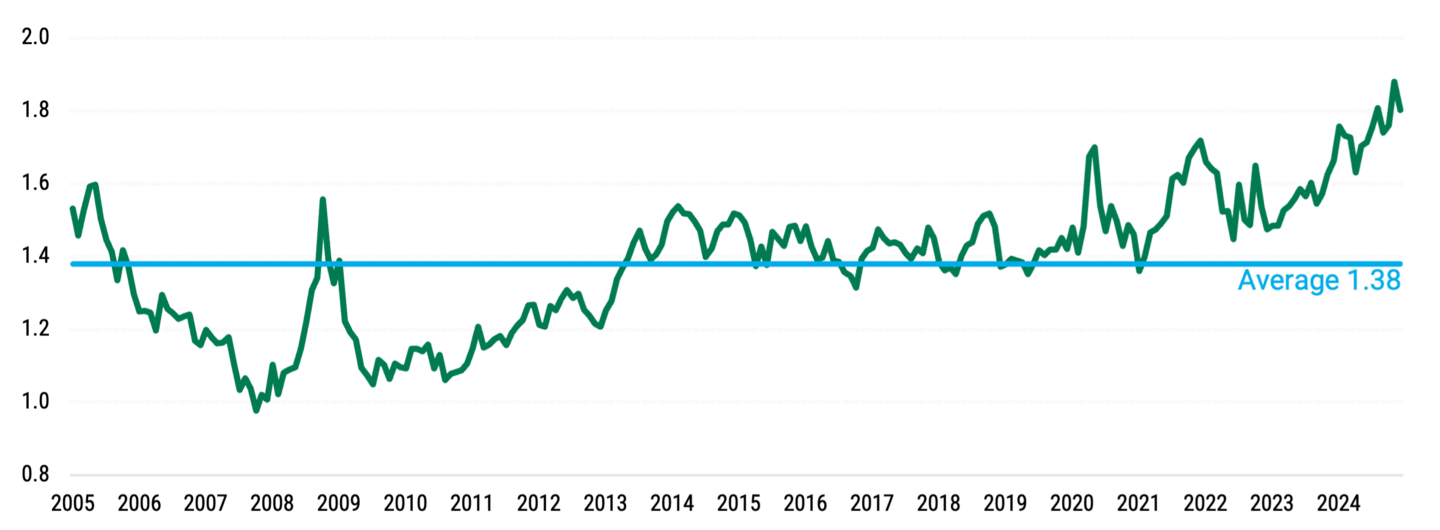

U.S. outperformance has created a large valuation gap compared with non-U.S. developed and emerging markets. As seen in Figure 2, this gap has exceeded two standard deviations from the 20-year historical average.

Figure 2 | Valuation Gap Between U.S. and Non-U.S. Markets

Data from 1/1/2005 – 12/31/2024. Source: FactSet. Past performance is no guarantee of future results.

However, this gap may not always be so wide. No single market has a monopoly on exceptional performance. Companies outside the U.S. can tap into a global customer base while seizing opportunities unique to their home markets.

Investigating potential investments in multiple countries can help diversify portfolios and provide the flexibility to pursue opportunities unbound by borders.

Authors

S&P Dow Jones Indices, U.S. Equities, December 2024.

FactSet as of 12/31/2024.

FactSet as of 12/31/2024.

S&P Dow Jones Indices, U.S. Equities, December 2024.

MSCI Europe Index as of 12/31/2024.

FactSet as of 12/31/2024.

MSCI Japan Index as of 12/31/2024.

FactSet as of 12/31/2024.

Micah McCartney, “Three Issues That Could Shake China's Vulnerable Economy in 2025,” Newsweek, January 3, 2025.

FactSet as of 12/31/2024.

FactSet as of 12/31/2024.

PwC, “Sizing the price: What’s the real value of AI for your business and how can you capitalise?” 2017.

Alastair Green, Humayun Tai, and Jesse Noffsinger, et al., “How data centers and the energy sector can sate AI’s hunger for power,” McKinsey & Co., September 17, 2024.

David Harding, Dale Stafford, and Kai Grass, et al., “Looking Back at M&A in 2024: Dealmakers Adapt as the Market Idles,” Bain & Co., December 2024.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.