The Case for Non-U.S. Growth Equities

Diversifying across markets may mitigate portfolio risk.

Key Takeaways

Strong U.S. gains have overshadowed other markets but haven’t diminished the opportunities and diversification benefits of investing outside the U.S.

Attractive valuations and the historical tendency for market leadership to rotate support maintaining exposure to non-U.S. stocks.

Non-U.S. earnings growth turned positive in 2024, and key sustainable trends are set to sustain earnings growth for select businesses in 2025.

U.S. stocks delivered strong results in 2024 as the nation’s economy outperformed most developed and emerging markets. The S&P 500® Index left a trail of new highs on the way to delivering the second consecutive year of double-digit gains.

While recency bias may cause many to expect such dominant performance to continue, history has demonstrated that market leadership tends to shift over time. Given the significant uncertainties in geopolitics, policy and trade affecting global markets, we believe now is an opportune time to review portfolio allocations to ensure adequate non-U.S. exposure.

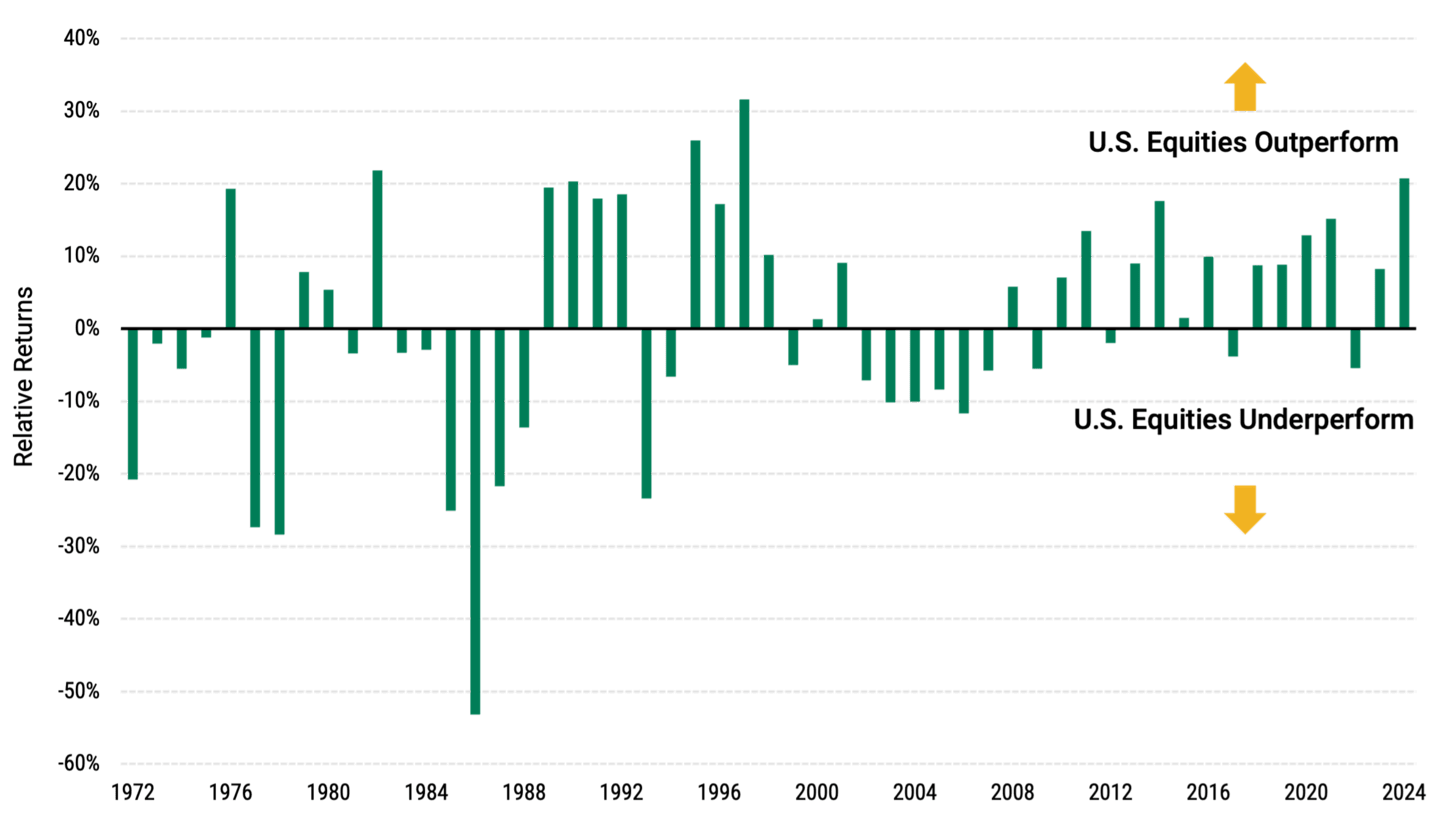

Cyclical Leadership in U.S. and Non-U.S. Equity Markets

Over the last 53 years, there’s been roughly an even split between periods of U.S. and non-U.S. market leadership. As Figure 1 illustrates, each has experienced extended periods of dominant performance.

Most recently, U.S. stocks, especially those of large-cap tech firms, have generated robust earnings growth and delivered attractive returns.

However, there’s no guarantee this handful of stocks can sustain their momentum, particularly given estimates that earnings growth will broaden in 2025.

After a period of underperformance, non-U.S. equity valuations also appear more attractive. There is a noticeable gap between the forward price-earnings (P/E) multiple for the MSCI EAFE and MSCI U.S. indices – more than two standard deviations from the 20-year average.1

Figure 1 | Market Leadership Moves Between U.S. and Non-U.S. Equities

Data from 12/31/1971 – 12/31/2024. Source: FactSet. Past performance is no guarantee of future results.

Five Trends Fueling Non-U.S. Earnings Growth

In addition to attractive valuations and a history of rotating market leadership, we believe there are solid fundamental reasons why investors can invest confidently outside the U.S. Even in cases of macro weakness, growth is still possible. The MSCI Germany Index rose by 11.03% in USD terms last year despite a depressed economy.2

We believe these five trends could fuel a positive inflection in earnings growth in non-U.S. companies.

Ongoing AI Infrastructure Boom

Artificial intelligence (AI) continues to be a durable theme, benefiting semiconductors, hyperscale data centers and related businesses.

Taiwan Semiconductor Manufacturing Company (TSMC), which produces advanced chips for AI, is one notable example. In 2023, the company held roughly 28% of the global market share for semiconductors, not counting memory.3

SAP, the Germany-based provider of enterprise software, has reported increasing demand for its cloud offerings and a growing backlog. Several of its recent deals involved use cases involving artificial intelligence.4

Rising Power Demand in Global Markets

AI’s vast need for electricity has also helped spark growing demand for power generation and distribution, though AI isn’t the only driver. The shift to sustainable energy, growth in electric vehicles and the need to upgrade aging infrastructure also contribute to demand. This supports energy, construction, materials, industrials and other businesses, such as Schneider Electric and Siemens Energy.

Government stimulus programs in several countries are reinforcing the AI and power trends. Policymakers have launched programs to aid the renewable energy, construction materials and semiconductor industries, as well as the utilities and industrials sectors.

Resilience of Non-U.S Consumer Spending

Real wage growth could improve in many nations as unemployment remains low and inflation continues to ease. This may help consumer spending, bolstering consumer staples and consumer discretionary. In particular, China has announced support for further stimulus to encourage demand in its market. The government is emphasizing consumption-driven spending, which could aid multiple industries.

We like On Holdings, a Swiss-based athletic shoe and apparel company that has beat earnings expectations. Online travel booking businesses such as MakeMyTrip of India and Trip.com of China also present opportunities, as does Italian automaker Ferrari.

Growth and Efficiency Through Non-U.S. M&A

Meanwhile, increased mergers and acquisitions (M&A) activity could benefit investment banks in the financials industry, make these businesses more competitive and raise their profits. We expect increased activity in capital markets due to a more supportive regulatory environment in the U.S., corporate governance reforms in Japan and a lack of organic growth in Europe.

Digitization Is Transforming Japan’s Economy

Finally, we like Japan-based companies benefiting from improved corporate governance standards and the rising digitization of the Japanese economy. Compared to the U.S., IT spending has been anemic, but that is changing as Japan invests in technology to improve efficiency and address rising inflation. NTT Data, a Japan-based IT services and consulting company, could benefit from this.

Stimulus May Serve as a Catalyst

Sluggish growth has weighed on investor sentiment, particularly in Europe. Weak cyclical demand, especially related to Chinese consumption, has hurt large European industries such as German autos and French luxury goods. The conflict in Ukraine and President Donald Trump’s proposed tariffs have also exacerbated the bearish outlook.

However, new stimulus could improve this outlook. Many central banks continue to cut interest rates, and China has signaled that it will take more action to improve its economy.5 A resolution to the tariff risk and a ceasefire in Ukraine might lift some geopolitical concerns.

No one can predict what 2025 will bring, but we believe investors who diversify across markets will be better prepared for whatever occurs.

Authors

FactSet, data from December 31, 2004, to December 31, 2024.

FactSet, data from December 29, 2023, to December 31, 2024.

TSMC, 2023 Annual Report, March 12, 2024.

SAP, “SAP Announces Q3 2024 Results,” Press Release, October 21, 2024.

Xinhua News Agency, “The Central Economic Work Conference Was Held in Beijing, and Xi Jinping Delivered an Important Speech,” December 12, 2024.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Diversification does not assure a profit nor does it protect against loss of principal.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and are subject to change without notice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.