Won’t Get Fooled Again: Global Firms Secure Their Supply Chains

Businesses are reshoring, nearshoring and friendshoring operations to avoid repeating the supply chain snarls set off during the pandemic.

Key Takeaways

Mexico, South America and Europe are poised to benefit from nearshoring at the expense of China and other emerging markets.

Bringing operations closer to home could favor smaller companies, especially those in the information technology and industrials sectors.

Geopolitical risks threaten the reliability of global supply chains.

Relocating Supply Chains Brings Advantages and Repercussions

Many companies are ramping up their logistics operations in the wake of pandemic supply chain disruptions, the war in Ukraine, rising tensions with China and pushback against globalization.

We’re seeing U.S. businesses shifting operations to the U.S. and nearby, lower-cost locations in Mexico and South America. Similarly, European companies are moving production to “friendlier” and lower-cost areas such as the Czech Republic, Hungary, Romania and Poland.

Such shifts offer the advantage of operating in the same or adjacent time zones as suppliers and partners. As a result, simplified scheduling helps reduce costs and improves collaboration and communication. Conducting business in these markets may also offer access to English-speaking workforces (the language of global trade).

These operational shifts fall into three broad categories:

Reshoring, or onshoring, brings back management and operations to the company’s home country.

Nearshoring moves company operations to neighboring countries. For example, some U.S. companies are helping secure their supply chains by shifting operations to Mexico and South America.

Friendshoring relocates processes to countries deemed political or economic “friends” regardless of location. Some European companies are shifting operations to the Czech Republic, Hungary, Romania and Poland.

IT, Industrials Sectors Likely Poised for Gains

Information technology companies, especially those in IT services, logistics software and semiconductor supply chains, appear to be forerunners of reshoring and nearshoring.

In industrials, manufacturers need dependable sources of raw materials and components. Moving operations closer to home may help tighten the supply chain, although upfront capital investment expenditures and labor costs might be higher.

Government and corporate preferences are also aligning to avoid a repeat of recent disruptions. This includes the Biden administration’s moves to support “strategic” industries, which should help the makers of semiconductors, electric vehicle components, and health care supplies and tools.

Closely watched supply chains, such as those for new smartphone launches, sit at the forefront of this trend. Apple reportedly intends to rely less on suppliers in China and Southeast Asia in favor of closer, easier-to-manage options.

China and Other Asian Trading Partners May Bear Initial Losses

As companies reshore jobs and operations, we expect China and other Asian emerging markets to be affected sooner than other suppliers.

Investors remember the profound impact of China’s zero-COVID policies shutting down transportation hubs. Factories and ports idled throughout Southeast Asia as ships sat offshore the mainland, Taiwan, Los Angeles and other ports. These shipping backups crippled supply chains across multiple industries.

Global firms have no appetite for reenacting that scenario, so they are casting their nets in other waters.

We’re monitoring the potential effects on China’s export business and view government comments in the U.S. and elsewhere as encouraging.

For example, at recent International Monetary Fund and World Bank conferences and the G7 summit, U.S. officials reiterated their desire to de-escalate geopolitical tensions and reduce reliance on Chinese products and supply chains rather than decouple entirely from the nation.

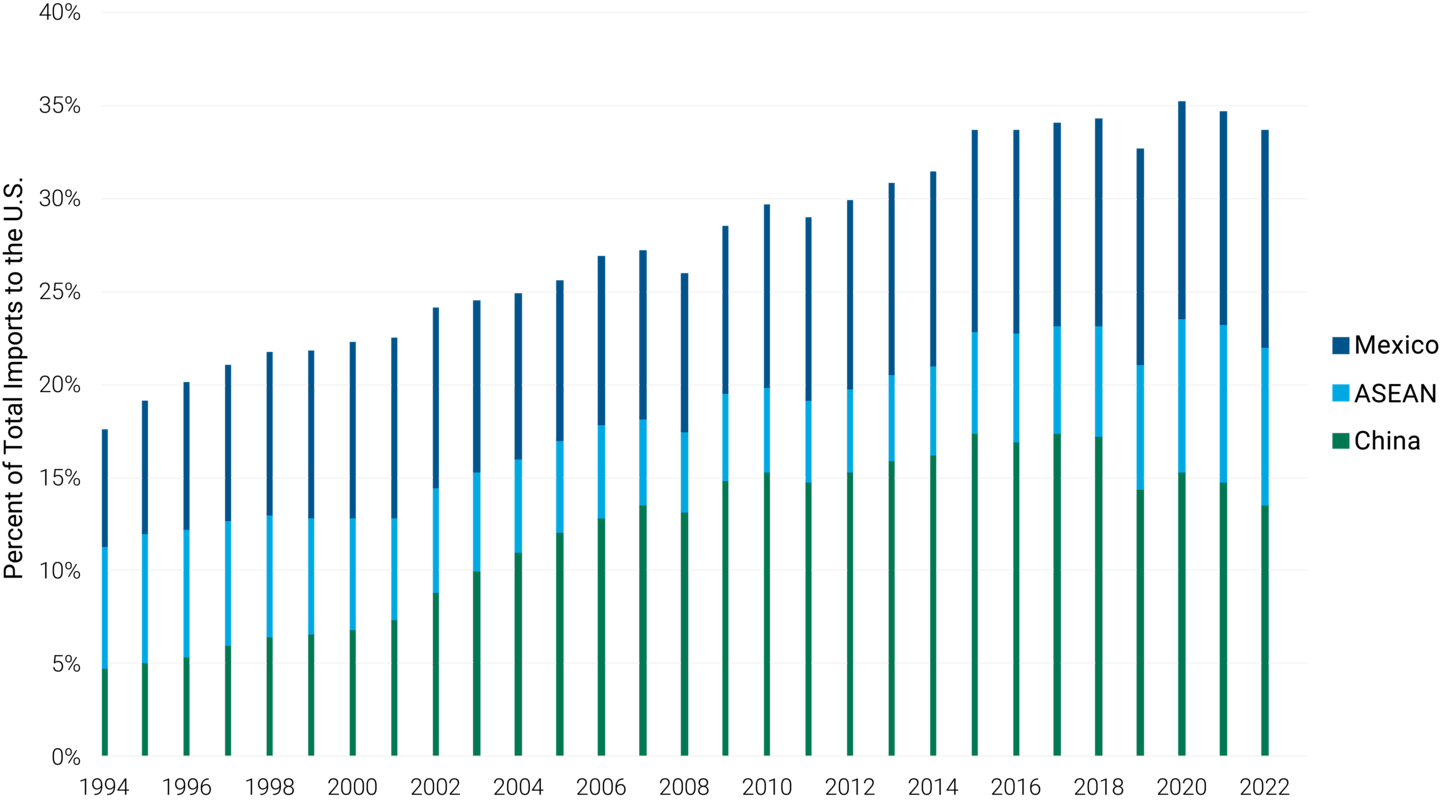

Figure 1 shows the drop in U.S. imports from China since the mid-2010s. This decline has presented opportunities for closer, friendlier and more dependable partners among the Association of Southeast Asian Nations (ASEAN) and Latin America. It has also helped solidify operations for U.S. and European companies previously reliant on China as a principal supplier of raw materials.

Figure 1 | U.S. Imports From China Have Dropped Since 2017

U.S. Imports as a Share of Total Imports

Data from 12/30/1994 – 12/30/2022. Source: U.S. Census Bureau, Empirical Research Partners Analysis. ASEAN comprises Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

Geopolitics and Shoring Initiatives

China’s drift toward Russia has complicated international diplomacy amid the ongoing war in Ukraine. Some countries may find themselves reluctantly lining up behind China or the U.S. as this situation intensifies.

In a 2022 speech to the Atlantic Council, U.S. Treasury Secretary Janet Yellen noted China’s “pivotal” role in helping end the conflict and the international cooperation needed to help mitigate the war’s global economic impacts.

To avoid countries with geopolitical and security risks, she advocated friendshoring by deepening “economic integration and the efficiencies it brings — on terms that work better for American workers. … with the countries we know we can count on.”1

For the U.S. and Europe, this could mean allying with Mexico, South Korea, Japan and Australia.

Shift Toward Deglobalization Could Favor Small-Caps

We believe the shift to reshoring and nearshoring should favor small-cap stocks. Reasons for this thinking include the following:

Reshoring implies increased capital expenditure as companies build new facilities at or near home. Small-cap revenue growth has historically shown a high correlation with CapEx spending, according to Bank of America research.

New production facilities require vast support networks. For example, spurred by the availability of federal subsidies in the CHIPS Act, Taiwan Semiconductor Manufacturing Co. (TSMC) will invest $40 billion to open two chip plants in North Phoenix, Arizona. TSMC Arizona and its workforce will need new infrastructure, housing, restaurants, retailers, medical facilities and more. We expect the new jobs in TSMC’s supporting industries to skew toward small-cap companies.

Small-caps tend to derive more revenue generation and earnings growth from local operations than large-caps, given their greater domestic focus. We believe this should bode well for them in a reshoring environment.

Embracing Change: Thriving in the Evolving Supply Chain Landscape

The global business landscape is undergoing a significant transformation as companies take proactive measures to secure their supply chains and mitigate future disruptions.

Reshoring, nearshoring and friendshoring initiatives are gaining momentum, with Mexico, South America and Europe emerging as potential beneficiaries at the expense of China and other emerging markets.

We believe companies in the IT and industrial sectors may be well-positioned in this environment.

Authors

U.S. Department of the Treasury, “Remarks by Secretary of the Treasury Janet L. Yellen on Way Forward for the Global Economy,” Press Release, April 13, 2022.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.