Intermediate Duration Brings Balance to Corporate Bonds

Easing duration exposure in longer corporate credit portfolios may enhance clients’ risk/return profiles.

Key Takeaways

We expect economic and market uncertainties to prevail as a looming U.S. slowdown will likely trigger weaker growth globally.

This outlook highlights the importance for corporate bond investors to assess exposure to credit and interest rate risks.

We believe an active investment approach focusing on high-quality, intermediate-duration corporate bonds may help balance clients’ risk profiles.

With a slowdown looming in the U.S., we believe the global economy is nearing an inflection point. However, many economic uncertainties remain related to inflation, growth, employment and the monetary policy response.

As this dubious journey unfolds, interest rate volatility and market risks will likely prevail. We believe this scenario underscores the importance of corporate bond portfolios striking a balance between credit and duration risks.

Steady economic growth, a three-year bout of elevated inflation, and Fed tightening have pushed bond yields to multiyear highs. Given this backdrop, we believe high-quality intermediate-duration corporates may offer investors attractive yield and performance potential with an appropriately moderate exposure to interest rate risk.

Economic Slowdown and Its Impact on Corporate Bonds

Consumers have powered solid U.S. economic growth since mid-2022. A post-pandemic spending spree, financed largely by massive COVID-era government support programs, propped up U.S. GDP even as inflation raged. Meanwhile, growth in other developed countries faltered, where fiscal support was limited.

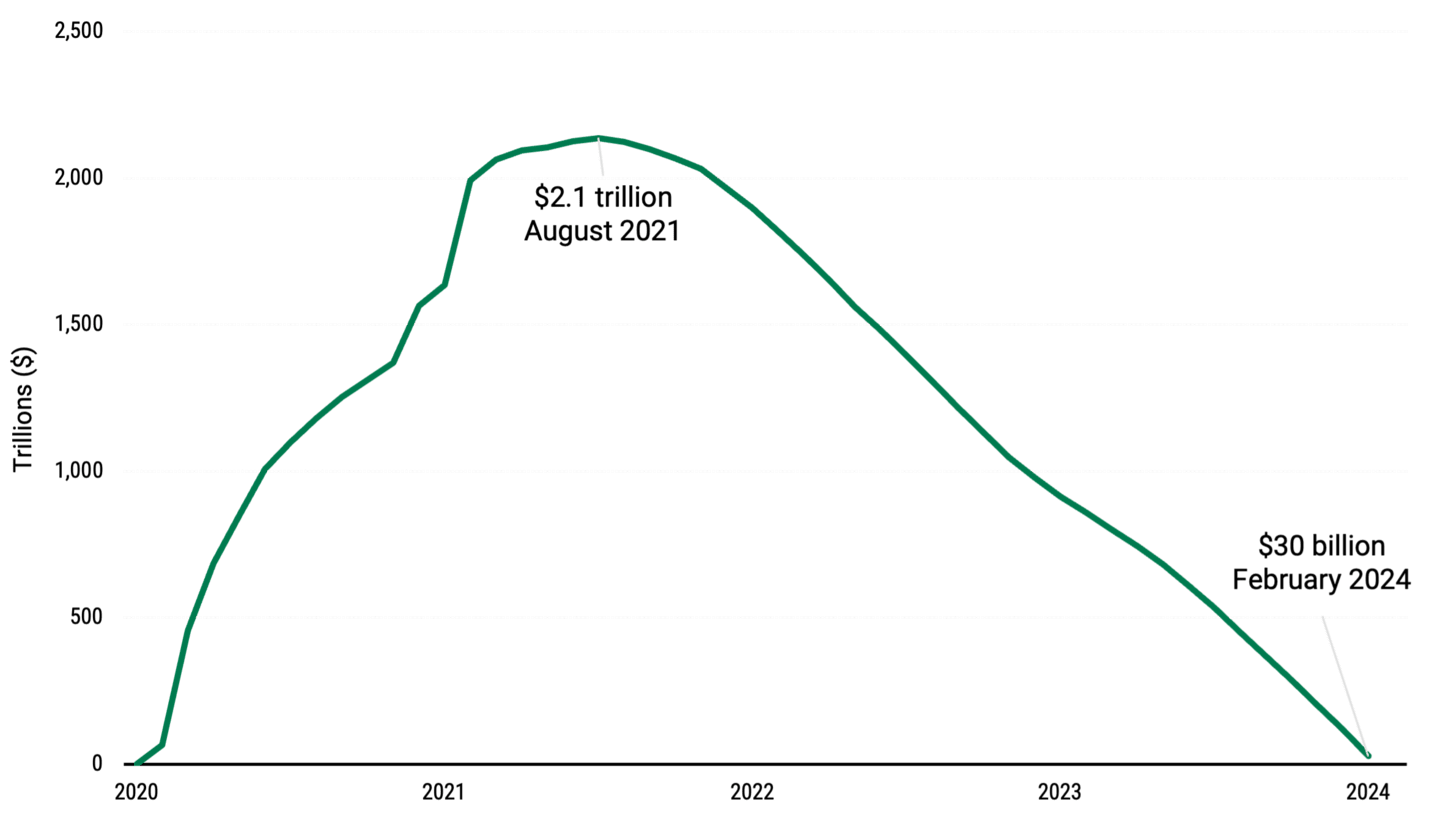

But it appears U.S. consumers may be pulling the plug on their spending surge. Most notably, Americans have depleted the excess savings they accumulated during the pandemic, as Figure 1 illustrates.

Figure 1 | Excess Savings Have Been Spent

Cumulative Aggregate Pandemic-Era Excess Savings

Data from 1/1/2020 – 2/29/2024. Source: FactSet, Federal Reserve Bank of San Francisco. Personal Savings Pre-COVID Trend: 3/31/2016 – 2/28/2020; Personal Savings Forecast: Excess savings calculated as the accumulated difference between actual personal savings and the trend implied by data for the 48 months leading up to the first month of the 2020 recession as defined by the National Bureau of Economic Research.

Additionally, recent U.S. labor market trends suggest additional consumer pressures are mounting:

Total layoffs in 2023 soared to nearly 722,000, or 98% higher than the 2022 level. Year to date through May, U.S.-based employers announced 386,000 job cuts, more than half the layoffs announced in all of 2023.1

The hiring rate has steadily declined since late-2021 and dipped to 3.5% in March, blow the 21st century average of 3.7%.2

Average hourly earnings have also slowly declined since March 2022, when they increased at a year-over-year rate of 5.9%. By May 2024, the annual increase had slowed to 4.1%.3

Consumer spending typically accounts for nearly 70% of GDP. Therefore, a stall in spending should lead to weaker U.S. economic growth.

How Does Market Volatility Affect Corporate Bonds?

The likelihood of an economic slowdown paired with elevated inflation has created a conundrum for global central banks, particularly the Fed. Fearing an uptick in inflation, policymakers have been reluctant to launch the rate-cut campaign they teased in December 2023. But waiting too long to start easing could trigger a bigger economic headache.

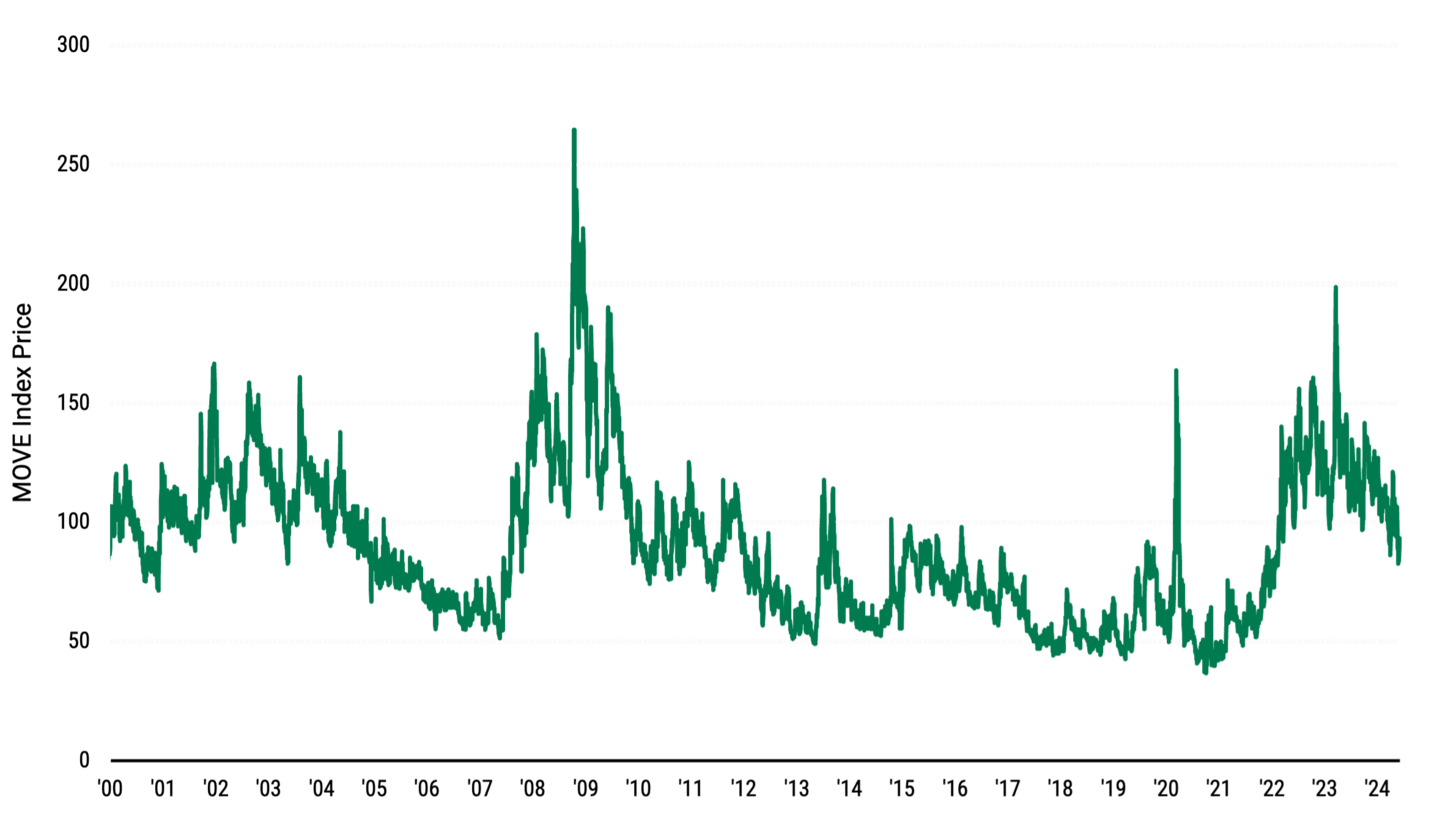

Ultimately, we expect the current monetary policy cycle to track historical trends. A slowing economy should help tame inflation closer to target and coincide with Fed rate cuts. However, the timing remains unclear, and in the interim, we expect market volatility, as highlighted in Figure 2, to persist.

Figure 2 | Uncertainty About Inflation, the Fed and the Economy Fuels Volatility

Treasury Volatility

Data from 12/31/1999 – 5/31/2024. Source: Bloomberg.

Fiscal policy also contributes to market uncertainty. Massive federal spending has led to record-high debt levels (more than $34 trillion) and soaring interest payments ($2.9 billion per day). This imbalance combined with structurally higher inflation suggest that interest rates may have a higher floor than in prior cycles.

Benefits of Intermediate Duration, High-Quality Corporate Bonds

Amid all this uncertainty, there is some good news. Yields have moved higher across the maturity spectrum. Because of this, bond investors can now capture attractive yield and performance potential without taking on excessive interest rate risk or credit risk.

In our view, a renewed focus on investment-grade intermediate-duration U.S. corporate bonds makes sense in today’s market environment. These securities offer less interest rate risk than traditional corporate bond indices, mitigating exposure to ongoing rate volatility.

With yields higher across the quality continuum, there may be little need for standalone allocations to lower-credit-quality bonds to achieve yield and return objectives.

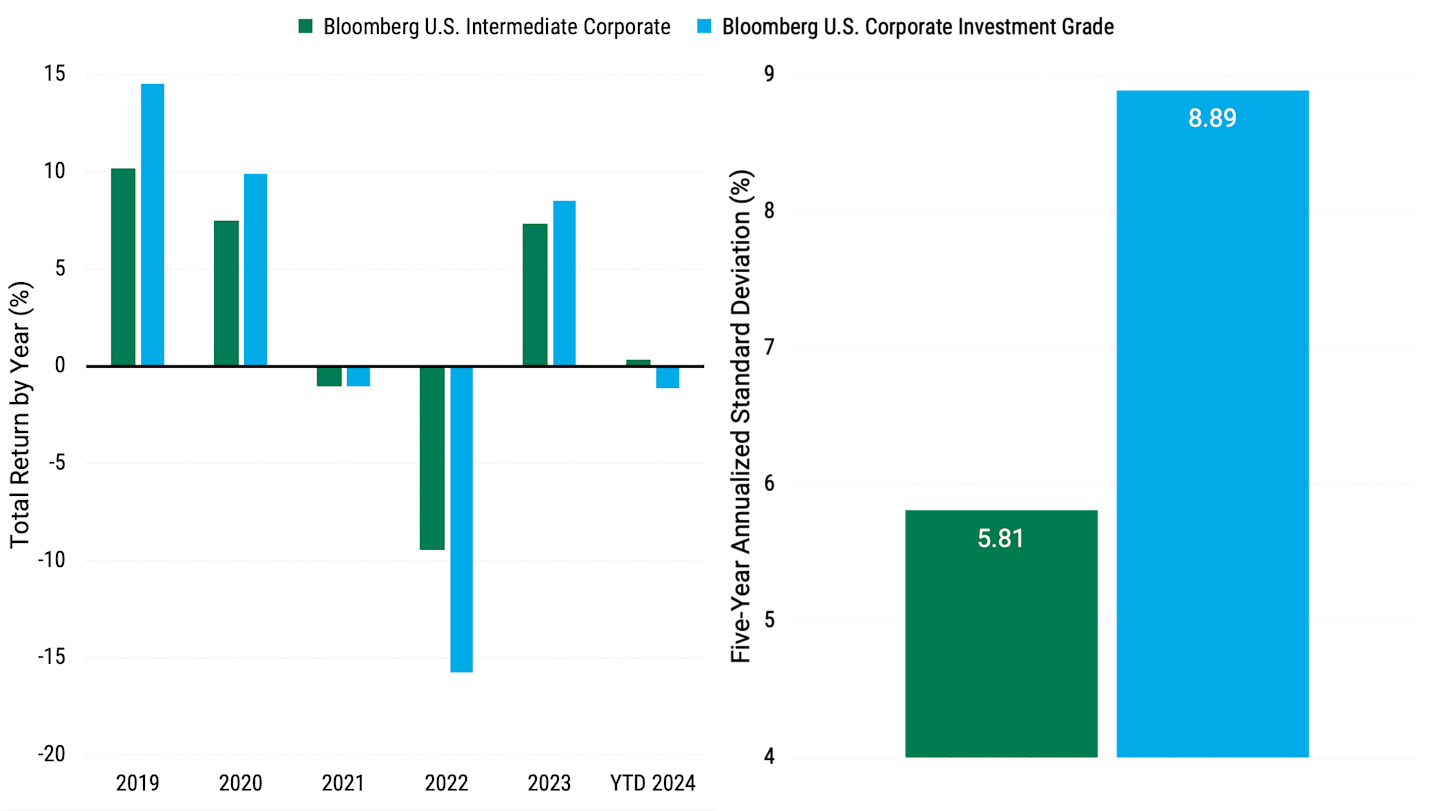

We believe these up-in-quality and lower-in-duration securities may offer a better balance between risk and return, as Figure 3 illustrates.

Figure 3 | Intermediate Duration Corporate Bonds: A Record of Attractive Returns With Less Volatility

Data as of 5/31/2024. Source: FactSet. Returns shown are in U.S. dollars and gross of fees. Past performance is no guarantee of future results.

With the rising risk of an economic slowdown, we believe high-quality corporates provide the default and credit-volatility mitigation clients may need. Yields in the investment-grade universe have been historically elevated and attractive — important considerations as high-yield valuations have recently appeared overly rich relative to risk. However, we continue to assess and analyze the high-yield corporate market, dynamically allocating as opportunities arise.

Active Bond Management Seeks to Unleash Opportunity, Mitigate Risks

We believe active management of corporate bond portfolios is appropriate in all market climates. But it remains critical in the current backdrop of:

High macro risks.

More yield and tight valuations across the corporate bond universe.

Nuanced investment opportunities.

Active corporate bond managers can quickly respond to heightened interest rate volatility by adjusting portfolio duration to coincide with market risks. Conversely, many passive portfolios have higher duration profiles that reflect the static benchmark they track. Accordingly, these strategies may expose investors to unnecessary interest rate risk.

Additionally, actively managed portfolios seek to manage credit volatility, whereas index constraints may expose passive portfolios to undue credit risks. Credit markets are cyclical, requiring an active approach to capitalize on upside potential and manage through downturns. There will always be winners and losers among corporate bond issuers, and we believe active management can sort through this diverging opportunity set.

Furthermore, we believe that allocating opportunistically and dynamically to high-yield credit may add value during all phases of a credit cycle. Each cycle typically features two distinct periods for high-yield credit — cautionary and opportunity. The opportunity phase, in which increasing high-yield exposure may be beneficial, often quickly follows the cautionary phase.

Portfolios that passively track an index can’t take advantage of these rapidly changing opportunities.

Top-Down and Bottom-Up Analysis in Corporate Bond Management

American Century Investments’ actively managed approach integrates our team’s fundamental and quantitative expertise in pursuit of enhanced returns and limited risk. We combine top-down methodologies with bottom-up insights, emphasizing investment-grade credits and dynamically allocating to high-yield securities.

The team’s top-down insights help steer broad allocation decisions to investment-grade and high-yield credit. The team allocates a desired percentage of the portfolio to high-yield securities to help balance interest rate and credit risk.

Meanwhile, bottom-up analysis drives individual credit selections, focusing on bonds with sound fundamentals, low default risk and attractive valuations. Additionally, the team employs a proprietary quantitative credit valuation tool to confirm (or deny) the conviction in credit selections.

Enhancing Corporate Bond Investing with CREDIT Tool

In our view, traditional fundamental credit research alone is insufficient to tackle the corporate bond market’s complexity and size. Identifying alpha opportunities consistently, efficiently and repeatedly requires additional skills.

We developed a proprietary and quantitatively driven credit tool called CREDIT (Credit Risk Evaluation and Debt Investment Terminal) to meet this challenge. This comprehensive database and analytical tool bolsters our traditional fundamental research with quantitative assessments. CREDIT helps create a credit investment process appropriate for various market conditions.

We believe that delivering alpha in corporate credit portfolios hinges on the portfolio manager’s ability to capitalize on market dislocations. In our experience, properly combining quantitative tools and fundamental analysis provides a critical advantage in effectively identifying opportunities among dislocations.

This combination leads to greater conviction in our security selections and a stronger sell discipline when the market disruptions dissipate. Ultimately, we believe this process allows our portfolios to constantly focus on the team’s best ideas.

Adaptive Corporate Bond Strategy for Changing Conditions

In our view, current economic and market dynamics suggest that many corporate bond portfolios may have too much duration exposure. We believe striking a better balance between credit and interest rate risk is prudent.

A traditional index approach to corporate bonds could expose investors to unnecessary interest rate risk, particularly as volatility remains heightened. Instead, we believe emphasizing intermediate-duration corporate bonds is prudent as uncertainty reigns.

Within this duration stance, we favor investing in high-quality corporates while dynamically allocating to high-yield securities as valuations dictate. In our view, this active approach delivers a corporate bond solution attuned to changing market conditions.

Author

Challenger, Gray & Christmas.

U.S. Bureau of Labor Statistics.

U.S. Bureau of Labor Statistics.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.