Top Risks in a Highly Concentrated Market

The extended bull market has masked underlying vulnerabilities that could transform today's speculative investment landscape.

Key Takeaways

Equities have enjoyed a prolonged rally, propelled by technology stocks and higher-risk assets.

Several risks could upend the market, including market concentration and an economic slowdown.

We believe diversified portfolios with low-volatility and defensive holdings could help mitigate these risks.

MicroStrategy, a company that began as a software business, emerged as one of 2024's hottest stocks.

MicroStrategy has attracted attention because of its significant Bitcoin holdings. This year, as Bitcoin's value has surged — partially due to expectations that Donald Trump's presidency will positively impact cryptocurrencies — MicroStrategy's stock has increased even faster. Currently, the company's market capitalization surpasses the total value of the Bitcoin it holds on its balance sheet.1

We believe that MicroStrategy lacks a compelling business case. While its stock has benefited from its connection to Bitcoin prices, owning it would put our clients at unnecessary risk if cryptocurrency prices declined. In our view, latching on to a stock that’s essentially a proxy for a risky asset like Bitcoin is just one example of outsized risk-taking in today’s speculative stock market.

When investors aggressively pursue risk, they often ignore or underestimate factors that could change market leadership or trigger a correction. As risk-aware investors, we consider the risks and returns of investing in individual companies. Our portfolios seek to mitigate risk in these periods of changing market leadership.

As we examine today’s investment landscape, we see several lurking risks that could transform the risk-on environment to one that may potentially reward investors diversified in low-volatility and high-quality portfolios.

Understanding Market Concentration Risks

Much has been made about the market’s concentration in stocks associated with artificial intelligence (AI). Beyond that, however, it’s worth pointing out the degree to which U.S. stocks are concentrated in global indices.

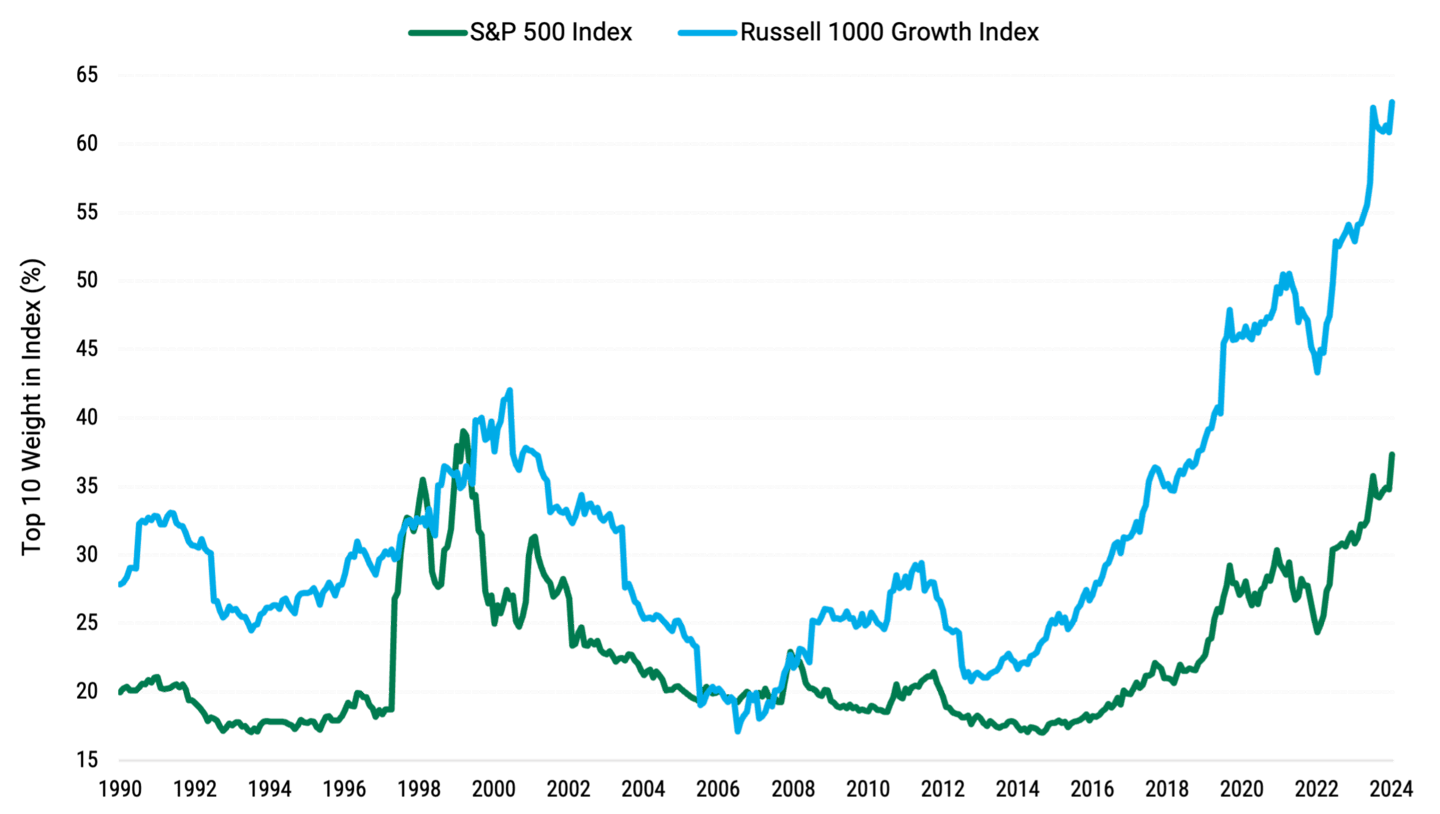

Based on market capitalization, the concentration in the 10 largest stocks in the Russell 1000® Growth Index and S&P 500® Index is at an all-time high, exceeding 60% for the Russell 1000 Growth and approaching 40% of the S&P 500 as of December 31, 2024. See Figure 1. These levels exceed the historically high concentrations seen during the late 1990s and early 2000s tech bubble.

Figure 1 | The Weights of Top Stocks Show an Increasingly Concentrated Market

Data from 12/31/1990 – 12/31/2024. Source: FactSet.

On the other hand, the concentration of assets in the Russell 1000® Value Index is at the low end of its normal range, with top 10 holdings constituting roughly 17% of the benchmark’s weight. We believe this shows the diverging expectations for growth and value.

The Magnificent Seven, the technology-related stocks that have enjoyed extended rallies due to their direct or indirect exposure to AI, have market capitalizations that exceed the Russell 2000® Index.

Though owners of U.S. large-cap stocks have benefited from robust performance, markets don’t roar endlessly. Therefore, we believe the market’s concentration in a relative handful of stocks is risky, especially given signs of a potential economic slowdown.

Expectations for AI's benefits have been rising, and much of the performance is based on high — and potentially unrealistic — expectations for future growth.

News related to changes in expectations can result in violent stock price movements. For example, a single underwhelming U.S. jobs report helped trigger a global sell-off in August 2024.

More recently, the news that Chinese startup DeepSeek developed a powerful AI model for a fraction of the cost of competing applications led to a $1 trillion market rout.

How Consumer Stress Affects the Market

The U.S. economy continues to expand, supported in no small measure by strong consumer spending.2 The resilience of U.S. consumers in the face of ongoing inflation pressures has been remarkable.

However, there are clear signs of financial stress among consumers. Most of the savings consumers accumulated with the help of COVID-19 stimulus checks are gone. As a result, more spending is being charged to credit cards.3 We’re beginning to see an increase in delinquencies, which is concerning, given that they were at multi-decade lows following the pandemic.4

Automobile loan delinquencies of 60 days or more have climbed to a 15-year high, another sign of growing consumer pressure.5

The stress is particularly evident among lower-income consumers. This is reflected in the dismal performance of dollar stores as consumers cut back on spending. Dollar General and Dollar Tree have dialed back sales estimates as the weight of inflation hits the wallets of lower-income consumers.6 This is also evident in Walmart's strong performance, which has benefited from consumers trading down from more expensive stores.

If consumer weakness continues or spreads to middle- or high-income groups, it could negatively impact all companies' economic growth and earnings. If struggling consumers begin shopping at less expensive retail stores for everyday items, what might the future sales implications be for more expensive products like iPhones and Teslas?

Unsteady Trends in the Manufacturing Sector

Due to flagging demand, the U.S. manufacturing sector spent much of 2024 in contraction territory. A weak manufacturing climate suggests companies are less willing to invest in their businesses or add to their inventories while demand remains low.

The ISM Manufacturing Index posted better results in November 2024 as orders improved after seven months of contraction. Uncertainty about the economy's direction continues to pose challenges for the manufacturing sector.

Pressure on manufacturing and early-stage industrials is a concern, given that market expectations remain for continued strength in the industrial economy.

Weakening Global Economic Growth in 2025

China’s weak economy has had worldwide impacts. Its economic stagnation is largely the result of high debt levels used to fuel economic growth and speculative overbuilding in its real estate sector. These debt levels are unsustainable, with many Chinese developers having declared bankruptcy. This dilemma is further illustrated by the 90 million empty apartments in China.7

Many companies have already seen diminished earnings from China, and it’s hard to be optimistic about the future. Overdevelopment and debt will likely hinder the country’s growth for years to come, reducing the government’s ability to support global economic growth and robust earnings growth.8

Economic growth remains tepid in Europe, particularly compared to the U.S.9 Compounding matters are the shaky foundations of once-solid European economies. In late 2024, deepening fiscal deficits in France contributed to Prime Minister Michel Barnier's no-confidence vote.10 Meanwhile, German Chancellor Olaf Scholz’s governing coalition collapsed after disagreements over government spending on economic growth and support for war-torn Ukraine.11

Economic growth in the U.S. remains strong, leading to higher stock valuations. While expectations for economic growth in the U.S. remain solid, ongoing global weakness could create challenges for future U.S. economic growth.

The Impact of Rising Geopolitical Risks

Ukraine is finding it increasingly hard to sustain its defense against Russia. Political support for ongoing aid to Ukraine is diminishing in the U.S. and possibly among European NATO countries.

Israel and Hezbollah reached a ceasefire, as did Israel and Hamas, but alleged violations of the agreement continue.12

Beyond these direct conflicts, western nations remain concerned about the possibility of a Chinese incursion in Taiwan, amplified by Chinese military drills simulating an attack on the island.13 Trump has moved to impose tariffs on China, which could heighten tensions between the countries.

Investors largely ignored these issues in 2024, but any of them could threaten global stability and economic growth.

Inflation Remains Above Target and Debt Is Climbing

While inflation cooled significantly over the last year, it remains stubbornly above the Federal Reserve’s (Fed’s) 2% target. In late 2024, inflation showed slight signs of increasing again, prompting the Fed to pause future interest rate cuts.

If imposed as Trump has described, potential tariffs against Canada, Mexico, China and Europe would likely reignite inflation. Tariffs would lead to higher costs for consumers on various products and potentially result in a delay of interest rate reductions or even an increase in rates going forward.

This would disappoint investors who were hoping for lower rates. Meanwhile, the Fed’s tightening policy from 2022 to mid-2024 continues to have lagging effects on consumers, governments and corporations.

We all pay higher interest expenses because of elevated interest rates. In addition, interest is applied to worldwide debt, which has reached all-time highs.

The Institute of International Finance said the world’s debt reached $323 trillion as of late 2024, more than a threefold increase from 2003.¹⁴

In the U.S., the debt has grown to the point where, for the first time, the interest paid on federal debt exceeds government spending on defense.15

Every dollar spent on interest is a dollar that can’t be spent elsewhere. With so many dollars flowing to interest on debt, the U.S. will find itself constrained in how it can respond to an emergency if one arises. A period of higher sustained rates will call into question government spending and corporate earnings, resulting in pressure on stock valuations.

Finding Lower-Risk Opportunities in a Speculative Market

The appetite for risk in today’s market suggests investors aren’t worried about these issues.

However, we believe there are ample opportunities to explore lower-risk investments in today’s speculative market. Sectors like consumer staples and health care, both of which tend to exhibit less risk and less volatility, are trading at what we think are attractive prices, partly because of the heightened appetite for risk elsewhere in the market.

Our strategies are designed for investing rather than speculating. Given the market's risks, we believe it’s a good time to revisit allocations to high-quality, risk-aware value portfolios.

Author

As of 1/27/25; Andrew Bary, “MicroStrategy Is Finally Offering a Preferred Stock Worth Buying,” Barron’s, January 27, 2025.

Paul Wiseman, “U.S. economy grows at 2.8% pace in third quarter on consumer spending, unchanged from first estimate,” Associated Press, November 27, 2024.

Federal Reserve System Board of Governors, “Consumer Credit - G.19, December 2024.

Federal Reserve Bank of St. Louis, “Delinquency Rates on Credit Card Loans, All Commercial Banks,” November 19, 2024.

Bryce Elder, “Is the surge in U.S. auto loan defaults to 15-year highs a reason to panic?” Financial Times, September 13, 2024.

Melissa Repko, “Dollar stores are struggling to win over bargain hunters – here’s why,” CNBC, December 3, 2024.

Rebecca Feng, “China’s Housing Glut Collides with Its Shrinking Population,” Wall Street Journal, September 30, 2024.

Keith Bradsher, “Foreclosures in China Soar, Threatening to Choke Off Bank Profits,” New York Times, November 4, 2024.

Eurostat, “GDP up by 0.4% in the euro area and by 0.3% in the EU,” October 30, 2024.

Liz Alderman, “Collapse of France’s Government Further Burdens Its Weak Economy,” New York Times, December 4, 2024.

Andreas Rinke and Tom Sims, “Olaf Scholz signals willingness for earlier German confidence vote,” Reuters, November 10, 2024.

Ephrat Livni, “Why Israel and Hezbollah Are Still Firing Amid a Lebanon Cease-Fire,” New York Times, December 3, 2024.

BBC News, “What's behind China-Taiwan tensions?” October 14, 2024.

Libby George, “Global debt surges past $320 trillion as risk appetite returns - IIF,” December 3, 2024.

Benn Steil and Elisabeth Harding, “For the First Time, the U.S. Is Spending More on Debt Interest than Defense,” Council on Foreign Relations, May 23, 2024.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.