Is It a Good Time to Consider High-Yield Bonds?

Investors seeking to reduce cash and add portfolio risk may be able to capture higher yields and attractive prices.

Key Takeaways

Investors earning high yields on their higher-than-usual cash balances should remain mindful of reinvestment risk ahead of likely Fed rate cuts.

Some investors may want to consider shifting cash-equivalent investments into higher-risk bonds, which we believe offer attractive yields.

In our view, high-yield bond market metrics suggest this asset class may offer advantages versus investment-grade corporates but with higher risk.

Amid a yield surge over the last two years, investors have stashed hordes of cash in money market funds and other high-quality, short-maturity instruments. For example, assets in U.S. money market funds reached a record-high of $5.9 trillion in late 2023 and topped $6 trillion in mid-February 2024. This marked a 25% increase from the end of 2021 when assets totaled nearly $4.8 trillion.1

Thanks to the Federal Reserve's (Fed's) aggressive rate hikes, investors in money market funds and other high-quality, short-maturity securities have enjoyed generous yields. Since the first half of 2023, U.S. Treasury bill yields have remained at or above 5%.2 Yields haven’t been that high since the global financial crisis of 2007-2009.

But with the Fed likely to cut rates in 2024, reinvestment risk is rising. Reinvestment risk refers to the possibility of investors being unable to reinvest cash assets at a rate similar to their current return rate.

Once the Fed starts easing, we expect yields across all maturities, including money market securities, to likely decline. At the same time, bond prices will likely rise. We believe investors who wait to add back risk and duration to their portfolios may face a less-attractive market backdrop.

Waiting to Re-Risk May Be Risky

Investors waiting for the “best” time to add back risk to their portfolios could potentially miss the opportunity to lock in attractive yields. For those willing to accept the higher credit risk and liquidity risk of high-yield corporate bonds, we believe today’s climate offers attractive opportunities.

High-yield bond prices tend to gap, and outsized returns have historically occurred over short time horizons. For example, during the five years ended December 31, 2023, the ICE BofA US High Yield Constrained Index returned 5.2% annualized.

For investors who were out of the market during the five best-performing months of this period, the annualized total return declined to 0.3%. The annualized total return dropped to -3.9% for investors who missed the best 10 months during the five-year period.3

Today’s High-Yield Metrics Appear Historically Attractive

The high-yield index’s yield to worst was close to 8% in mid-February, historically an attractive entry point for investing in high-yield bonds.4 This level put the index in the cheapest yield quintile of the last 10 years.5

In our view, investors trying to time their high-yield allocations face a challenging task. They risk missing the few days or weeks of performance that could contribute disproportionately to longer-term returns.

Bond Outlook Favors High-Yield Over Investment-Grade Corporates

We remain upbeat about the performance prospects for high-yield and investment-grade corporate bonds in 2024. But we believe high-yield bonds may offer potential benefits in today’s environment:

Rates: All else equal, the yield advantage over investment-grade corporates may help high-yield bonds outperform in a flat or gradually declining rate environment.6 If rates unexpectedly move higher, we believe the high-yield market's shorter duration would likely boost outperformance versus longer-duration credit.

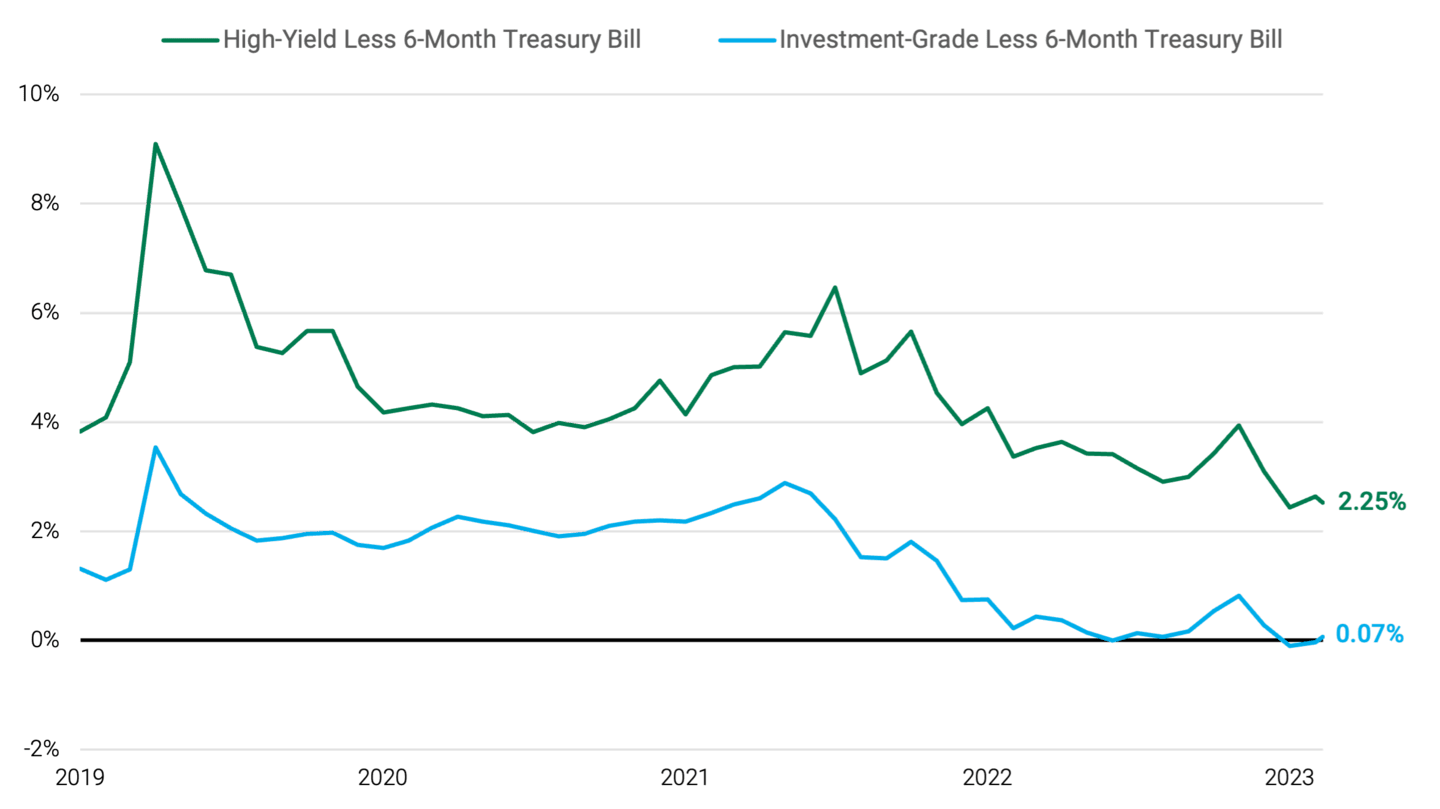

Yield: Investors using their cash-equivalent investments to re-risk their portfolios may want to consider high-yield bonds. Compared with six-month Treasury bills, high-yield bonds (shown in green) recently offered a yield pickup of 2.25 percentage points, as Figure 1 illustrates. Investment-grade corporates (shown in blue) provided a yield pickup of only 0.07 percentage point.

Figure 1 | Yield Pickup Favored High-Yield Bonds

Data as of 2/9/2024. Sources: Bloomberg, ICE BofA High Yield Constrained Index and ICE BofA Corporate Index. The ICE BofA High Yield Constrained Index is composed of U.S. dollar-denominated corporate debt publicly issued in the U.S. market rated BB through B, based on an average of Moody's, S&P and Fitch ratings, with issuer exposure capped at 2%. The ICE BofA Corporate Index tracks the performance of U.S. dollar-denominated investment-grade corporate debt publicly issued in the U.S. domestic market. Lines show yield to worst minus six-month Treasury bill yield. Yield to worst represents the lowest possible yield an investor can expect to receive from a bond, assuming the bond is held until its earliest possible redemption date or maturity without defaulting.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

Economy: We believe investment-grade corporates would likely outperform in a hard economic landing where spreads widened and Treasury yields declined. However, given the economy’s persistent strength, we don’t believe there’s a high probability of a hard-landing scenario.

Brett Collins, CFA, is a client portfolio manager in the New York office of Nomura Corporate Research and Asset Management, Inc. (NCRAM). Primarily engaged in managing assets consisting of U.S. high-yield corporate bonds, NCRAM also manages emerging market debt, U.S. leveraged loan portfolios, global high yield and European high yield.

Nomura Holdings and American Century Investments forged a strategic partnership more than seven years ago that is rewarding for each firm’s clients. In May 2016, Nomura Holdings acquired a non-controlling, 41% economic interest in American Century Investments. Nomura Holdings, Inc. holds two of 11 seats on the board of directors at American Century Companies, Inc.

Author

Investment Company Institute, taxable and tax-exempt money market fund assets, as of February 21, 2024.

Wall Street Journal, “Bonds & Rates,” February 11, 2023, through March 19, 2024.

Nomura Corporate Research and Asset Management.

Yield to worst is a measure of the lowest possible yield that a bondholder can receive at the bond’s earliest allowable retirement date.

ICE BoA US High Yield Constrained Index and Nomura Corporate Research and Asset Management data. Based on daily observations of the yield to worst of the ICE BoA US High Yield Constrained Index. As of mid-February, the yield was in the cheapest quantile versus the trailing 10 years of data. In other words, more than 75% of the time over the last 10 years, the index's yield to worst was lower than it was in mid-February.

As measured by the ICE BofA US Corporate Index.

This document is prepared by Nomura Corporate Research and Asset Management Inc. (NCRAM) and is for informational purposes only.

An investment in high-yield instruments involves special considerations and certain risks, including credit risk, liquidity risk, default risk and price volatility, and such securities are regarded as being predominantly speculative as the issuer’s ability to make payments of principal and interest.

The views and estimates expressed in this material represent the opinions of NCRAM and are subject to change without notice and are not intended as a forecast or guarantee of future results. Such opinions are statements of financial market trends based on current market conditions. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied upon as legal or tax advice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.