Major Shift Rejuvenates Japan’s Financial Markets

Investors have tended to dismiss the world’s third-largest economy, but that’s changing.

Key Takeaways

For years, a combination of factors, including demographics, policy, and economics, constrained Japan's investment appeal.

While inflation hamstrung most global economies, it helped kickstart Japan’s.

Corporate governance reforms in Japan should deepen the pool of potential holdings for investors focused on high-quality companies.

Reforms Help Revitalize Japan's Financial Markets

Perhaps no world economy achieved more than Japan’s in the mid-to late-20th century. Dubbed the “Japanese Economic Miracle,” its dramatic growth trajectory after World War II thrust the nation to the forefront of global economic and geopolitical power.

That power waned in the 1990s amid economic and demographic challenges. Flourishing financial markets accompanying the nation’s post-war ascent stagnated along with economic growth. Despite efforts by the government and monetary authorities, Japan has struggled to regain its economic footing.

But now, after three decades largely characterized by inertia, Japan’s economy and financial markets appear revitalized.

For one thing, the surge in global inflation in the wake of the COVID-19 pandemic that hindered most economies has eased the nation’s deflationary spiral.

Meanwhile, recent corporate governance reforms aim to make businesses more accountable to their shareholders in a country with a years-long dearth of appealing investment opportunities. That’s welcome news for investors seeking high-quality companies with sound balance sheets, consistent profitability and attractive returns.

Global investors grew accustomed to shunning Japan’s financial markets for much of the 21st century. But these recent trends may position these markets for more attention than they’ve received since the “miracle” days — a potentially enticing development for investors.

Post-War Struggles Led to Remarkable Growth for Japanese Equities

Decimated at the end of World War II, Japan’s per-capita economic output registered just one-ninth that of the U.S. But driven by unprecedented expansion in industrial production, a burgeoning domestic market and aggressive exports, output took just a decade to return to pre-war levels.

Japan’s economy continued expanding rapidly, increasing almost 10% a year through the early 1970s. By the 1980s, the nation appeared on the way to overtaking the U.S. as the world’s largest economy, having grown roughly 20 times larger since the end of the war.1

In the process, investors in Japanese stocks reaped substantial rewards. A $100 investment in the Nikkei 225 Index at the beginning of 1950 would have yielded $35,847.33 by the time the index reached its all-time high after the last trading session of the 1980s.2

In those 40 years, the index posted an annual loss just 11 times. Conversely, it produced an annual return exceeding 10% twice as often, averaging an 18.7% yearly gain during the entire period.

Japan’s Economic Decline Began in 1990

Japan’s bubble burst in 1990. The Nikkei 225 plunged 38.7%, beginning a string of three straight annual losses that reduced its value by more than half.

Property values plummeted along with stocks. As asset values retreated, companies started cutting debt, consumers reduced spending, and wage growth stalled.3 That triggered a deflationary spiral that persisted until recently — particularly as demographic trends deteriorated.

Japan has the world’s oldest population, with 30% of the population aged 65 or older and one in 10 people beyond 80.4 The country’s population peaked at 128.1 million in 2009 and has dropped by 5 million. If current trends persist, the United Nations projects that it will drop below 100 million in the second half of the century and below 75 million by 2100.5

These challenges have hastened a decline in labor productivity that presaged Japan’s economic and financial stagnation. For years, it has ranked lower than all other Group of Seven developed economies and currently sits about 40% below U.S. productivity.

Perhaps not surprisingly, the Nikkei 225 Index has yet to scale its previous peak, remaining about 20% below the record high it hit almost 34 years ago.

Abe's Three Arrows Targeted Challenges

The late Prime Minister Shinzo Abe spearheaded a three-pronged approach to address Japan’s short- and long-term challenges when he took office for the second time in 2012. He previously served as prime minister in 2006-07.

Popularly termed the “three arrows of Abenomics,” the approach consisted of ultra-easy monetary policy, fiscal stimulus and structural reforms. The latter included business deregulation, liberalized labor rules to encourage more workers and corporate governance changes designed to benefit shareholders and investment.6

Abe served until 2020, which is longer than any prime minister in Japanese history. During his tenure, the Bank of Japan maintained interest rates near zero — even implementing negative rates. It wasn’t until 2023 that the central bank essentially abandoned its seven-year experiment with yield controls.7

In addition, Japan’s government opened its stimulus spigot, which has stayed open. Since the onset of the pandemic, it has injected almost $4 trillion into the economy and recently began considering another package to address the rising costs of living.8

Structural and corporate governance reform has lagged, however. Moreover, despite the flood of fiscal stimulus and easy money, deflation and slow growth maintained their grip throughout Abe’s tenure.

Inflation Provided Tailwind to Japan's Economy

Despite consistently applying the first two Abenomics arrows in recent years, Japan didn’t see a material economic change until a confluence of unexpected events — the COVID-19 pandemic and how global governments responded to it. The inflationary pressures they eventually wrought ended Japan’s stubborn deflation without the dramatic interest rate increases employed by most central banks.

Inflation that has settled in the 3%-3.5% range this year has made it more acceptable for companies to introduce revenue-enhancing price increases.9

But perhaps the most attractive feature of Japan’s financial markets moving forward entails the long-awaited implementation of the final Abenomics arrow: structural reforms, including changes to corporate governance.

As Japanese corporations embrace better governance, more will focus on streamlining their businesses — shedding poor businesses, raising prices and emphasizing profit margins. These are potential inflection points that will expand the universe of opportunities in Japan’s market.

‘Comply or Explain’ Rule Sparks Corporate Transformation

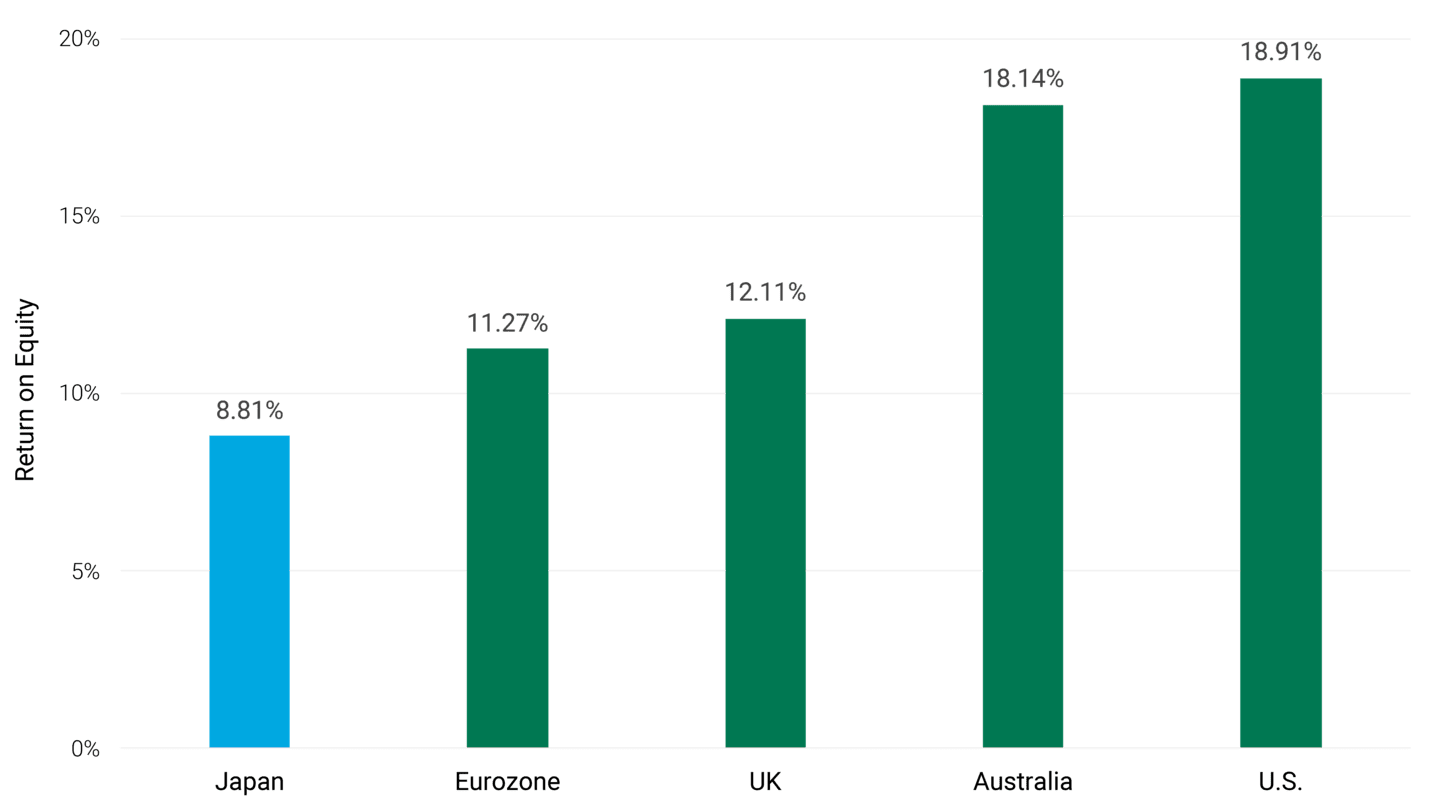

The stock market bust of the 1990s triggered an era of corporate risk aversion, leading many companies to hoard cash. Japan’s stock market went nowhere, with shareholder returns that substantially trailed other developed markets. See Figure 1.

Figure 1 | Japan Has Trailed Other Developed Markets for Decades

Data from 1/1/1990 - 12/31/2023. Source: MSCI.

But in what one asset manager called a “game-changing moment,” the Tokyo Stock Exchange (TSE) finalized a market restructuring rule that requires companies to “comply or explain” if their market value falls below a price-to-book ratio of 1.10

This directive encourages companies to use capital more efficiently and places increased importance on profitability.

Currently, more than 60% of listed Japanese companies return less than 8% of equity to their shareholders and have a price-to-book ratio of less than 1. By comparison, the S&P 500® Index in the third quarter of 2023 had an average ROE of 16.7%, with an aggregate price-to-book ratio near 4.11

Companies failing to comply with this rule and others could face delisting as early as 2026. Most analysts don’t think the market’s structural reforms will end there.

At this point, the exchange’s directives only constitute strong encouragement. However, investors have already noticed as Japan’s stock market climbed more than 20% in 2023.12

No less than famed investor Warren Buffett has attempted to take advantage. In spring 2023, he raised his stakes in the country’s five largest trading firms to a collective 7.4%.13 Those firms helped launch Japan onto the global stage decades ago and conduct business in various products and industries.

Meanwhile, a Nikkei study shows Japan’s share buyback level in the fiscal year ending March 31, 2023, reached the highest in 16 years.14

Japan's Resurgent Financial Markets May Present Opportunities

For understandable reasons, investors have tended to ignore Japan’s stagnant economy and inert financial markets for much of the past 30 years.

But while some developed global markets battle high inflation, elevated interest rates and slowing growth teetering on recession, we think Japan may represent an attractive outlier.

The country’s accommodative monetary policy, relatively moderate inflation and relatively cheap equity market valuations have raised eyebrows from global investors. The recent corporate government reforms – with more likely to come – should only increase their interest.

As a result, once-buoyant but long-avoided Japanese financial markets finally appear to be regaining their footing. And for investors, we believe that warrants a closer look.

Authors

Okazaki Tetsuji, “Lessons from the Japanese Miracle: Building the Foundations for a New Growth Paradigm,” Nippon.com, February 9, 2015; Macrotrends, “Japan GDP 1960-2023,” accessed December 18, 2023; Statista, “Estimated Annual Gross Domestic Product (GDP) of the Second World War’s Largest Powers from 1938 to 1945,” January 1, 1998.

Macrotrends, “Nikkei 225 Index – 67-Year Historical Chart,” accessed December 18, 2023. (Based on the static exchange rate between the yen and the dollar.)

Keith Breene, “Why Is Japan’s Economy Shrinking?” World Economic Forum, February 16, 2016.

Charlotte Edmond and Madeleine North, “More Than 1 in 10 People in Japan Are Aged 80 or Over. Here’s How Its Ageing Population Is Reshaping the Country,” World Economic Forum, September 28, 2023.

Macrotrends, “Japan Population 1950-2023,” accessed December 19, 2023.

BBC News, “Abenomics: How Shinzo Abe Aimed to Revitalize Japan’s Economy,” July 8, 2022.

Trading Economics, Japan Interest Rate, 1972-2023, accessed December 19, 2023; Editorial Board, “The Yield of Japan’s Bad Policies,” Wall Street Journal, October 31, 2023.

Leika Kihara and Tetsushi Kajimoto, “Japan unveils $708 billion in fresh stimulus with eye on post-COVID growth,” Reuters, December 8, 2020; Hikari Hida, “Japan Approves a $490 Billion Economic Stimulus Package as the Pandemic’s Effects Linger,” New York Times, November 19, 2021; Leika Kihara and Daniel Leussink, “Japan Unveils $200 Billion in New Spending to Ease Inflation Pain,” Reuters, October 28, 2022; Satoshi Sugiyama and Tetsushi Kajimoto, “Japan to Compile Economic Package to Ease Inflation Pain, September 25, 2023.

Trading Economics, “Japan Inflation Rate 1958-2023,” accessed December 19, 2023.

Clement Tan, “Japan Optimism Has Been Fueled by ‘Game-Changing’ Reforms and Warren Buffett: Here’s What You Need to Know,” CNBC, June 12, 2023.

CSI Market, “Total Market Management Effectiveness Information and Trends by Quarter, ROE, Return On Assets, Return On Investment from 3 Q 2023 to 3 Q 2022,” accessed December 20, 2023; Guru Focus, “S&P 500 Price to Book Value,” accessed December 20, 2023.

Source: MSCI Japan Index.

Jonathan Stempel, “Buffett Boosts Stakes in Japanese Trading Houses, May Invest More,” Reuters, April 11, 2023.

Nikkei Asia, “Japan Companies’ Stock Buybacks Soar to Highest in 16 Years,” March 31, 2023.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.