Making Progress Toward Sustainability: An Exxon Case Study

How engaging with management helped orient Exxon toward implementing a sustainability plan.

Key Takeaways

Until recently, we believed that Exxon had little interest in developing a plan to reduce CO2 emissions.

Our engagement, alongside efforts from other investors, led to the appointment of new directors who prompted Exxon to adopt a sustainability strategy.

Exxon’s business has grown since it adopted its sustainability plan, showing that moving toward a low-carbon economy doesn’t compromise the bottom line.

In 2020, the CEO of Exxon Mobil, Darren Woods, said something that caught our attention.

He told investors that competing oil and gas companies’ pledges to reduce carbon dioxide (CO2) emissions would do little to solve the climate change crisis. Woods called his rivals’ emissions-reduction promises nothing more than a “beauty competition” that Exxon would ignore as it sought other strategies to address the industry’s impact on climate change.1

The American Century Global Value team interpreted his comment as proof of Exxon's lack of commitment to the energy transition. In the years since, however, we think Exxon has adopted a more serious approach to sustainability within its operations and in addressing the broader climate issue.

Exxon is the type of business to which the Global Value Transition* portfolio gravitates: Companies transitioning to sustainability for their business operations and the world around them. Exxon also exemplifies how the investment team applies key performance indicators (KPIs) to evaluate whether to invest in a company and how our engagement with management can guide its progress toward sustainability.

We believe the result is a more sustainable and, at its core, a better-run business.

Our Journey with Exxon: From Disinvestment to Engagement

The American Century Global Value team invested in Exxon in the early 1990s. However, by 2016, we had sold our position in the company for a few reasons. For one, we believed Exxon made questionable investments in high-cost assets in the U.S., Russia, and Canada, saddling the company with an asset portfolio that we deemed lower quality than its peers. We were also concerned about the company’s strategic vision, especially its lack of focus on and planning for the energy transition.

Woods’ “beauty competition” comment in 2020 led us to engage with Exxon, even though we didn’t own shares in the company. This engagement left us doubtful that the company had adopted a meaningful energy transition plan.

Exxon’s Sustainability Pivot: How Investor Activism Catalyzed Change

We doubted Exxon’s willingness to craft a sustainability plan because we had previously asked company management how it would react to an activist investor seeking to influence change. Exxon’s response suggested it would resist such efforts.

But in February 2021, an activist investor tested the company. Engine No. 1, a small hedge fund and an unlikely foil for a behemoth like Exxon, took a stake in the oil and gas company. The hedge fund broadly publicized its efforts because Exxon’s management had been dragging its feet on addressing climate change.

It appeared that Engine No. 1 had brokered some level of dialogue with Exxon’s board of directors, leaving us with the impression, for the first time in five years, that investors could influence the company to improve its strategic direction. We initiated a position in Exxon in 2021 and coalesced around the push to make Exxon more sustainable.

Later that year, investors nominated a slate of directors keen on lowering Exxon’s emissions. A close proxy vote resulted in three new directors on Exxon’s board — directors we supported — marking a surprising turn in favor of the energy transition and sustainability. The proxy vote was close enough that we believe new directors would not have reached the board without votes from shareholders like us.

Exxon’s Energy Transition Acceleration: Net-Zero Goals and Strategic Investments

The events of 2021 quickly redirected Exxon’s focus toward the energy transition. In January 2022, the company announced a plan to achieve net-zero Scope 1 and Scope 2 greenhouse gas emissions by 2050. Woods, who had been dismissive of emission pledges two years earlier, said that Exxon was “committed to playing a leading role in the energy transition” and “developing comprehensive roadmaps to reduce greenhouse gas emissions from our operated assets around the world.”2

Exxon has since launched aggressive goals to reduce emissions in the Permian Basin, the highest-producing U.S. oilfield. In 2023, Exxon announced plans to acquire Pioneer Natural Resources, a top oil producer in the Permian Basin. Upon announcing the acquisition, Exxon accelerated Pioneer’s net-zero emissions target from 2050 to 2035, which is expected to close in the second quarter of 2024.

Exxon also announced a corporate plan to spend $17 billion on lower-emission investments to reduce greenhouse gas emissions from its operations and that of its customers.

Exxon’s Sustainable Growth Story: Doubling Share Value Amid Energy Transition

Exxon’s business hasn’t suffered during its sustainability journey. When we reinitiated with the company in 2021, we bought Exxon for $50 a share. At the end of 2024, it traded at around $107 a share. Its balance sheet is as strong as ever as the company approaches a net cash position. It is sustaining its franchise with a deep reserve base, and its portfolio of assets, which we soured upon in 2016, has improved with new investments in Guyana, the Permian Basin and liquified natural gas.

To us, Exxon is a rich example of why we believe Global Value Transition’s approach works:

We invest in companies whose progress toward sustainability has been overlooked by the market.

We actively engage with management teams to ensure the companies we invest in continue their sustainability journeys.

We can escalate our engagement to reorient companies toward the targets we set for them in our KPIs.

Our investment targets become better-run enterprises due to their business model progression.

Driving Sustainable Progress: Our Proactive Engagement Approach

We actively engage with the companies we invest in. With some companies, we escalate our engagement activities to ensure that the company continues to progress toward sustainability, whether through proxy voting or, in some cases, board-level conversations.

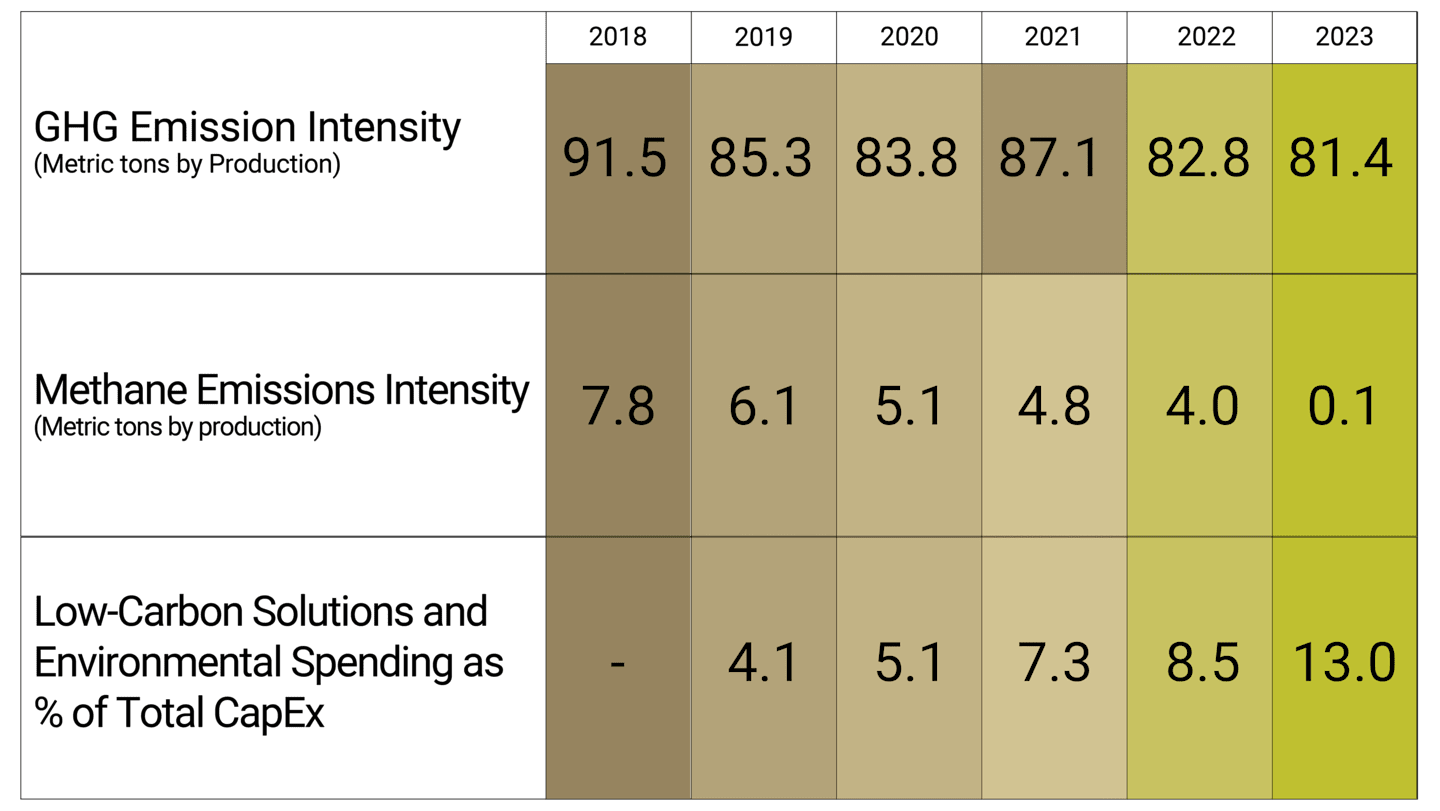

As part of our engagement plan, we identify KPIs for each company that set a baseline for improvement and allow us to measure progress toward sustainability. Figure 1 details some of the specific KPIs we monitor for Exxon.

Figure 1 | Monitoring Exxon’s Carbon Footprint

Representative KPIs measuring the company’s progress toward sustainability

Data from 2016 – 2023. Source: Exxon.

The substantial shifts in Exxon’s approach to sustainability underscore the power of investor engagement in driving corporate change. By rallying around a common goal of reducing emissions and committing to a sustainable future, investors helped reshape Exxon’s strategic vision and demonstrated that a responsible, environmentally focused business model can enhance long-term profitability.

We have established a set of specific, relevant, and measurable KPIs tailored to each company within the Global Value Transition strategy. This comprehensive framework allows us to assess and track the progress of our investee companies as they navigate their unique transition journeys toward sustainability and improved value creation.

Authors

Effective August 15, 2024, Global Sustainable Value was renamed Global Value Transition.

Kevin Crowley, “Exxon CEO Calls Rivals’ Climate Targets a ‘Beauty Competition,’’ Bloomberg News, March 5, 2020.

Nermina Kulovic, “ExxonMobil Joins Pledge for Net Zero in Oil & Gas Operations by 2050,” Offshore Energy, January 18, 2022.

Many of American Century's investment strategies incorporate sustainability factors, using environmental, social, and/or governance (ESG) data, into their investment processes in addition to traditional financial analysis. However, when doing so, the portfolio managers may not consider sustainability-related factors with respect to every investment decision and, even when such factors are considered, they may conclude that other attributes of an investment outweigh sustainability factors when making decisions for the portfolio. The incorporation of sustainability factors may limit the investment opportunities available to a portfolio, and the portfolio may or may not outperform those investment strategies that do not incorporate sustainability factors. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and for certain companies such data may not be available, complete, or accurate.

Sustainable Investing Definitions:

Integrated: An investment strategy that integrates sustainability-related factors aims to make investment decisions through the analysis of sustainability factors alongside other financial variables in an effort to make more informed investment decisions. A portfolio that incorporates sustainability factors may or may not outperform those investment strategies that do not incorporate sustainability factors. Portfolio managers have ultimate discretion in how sustainability factors may impact a portfolio's holdings, and depending on their analysis, investment decisions may not be affected by sustainability factors.

Sustainability Focused: A sustainability-focused investment strategy seeks to invest, under normal market conditions, in securities that meet certain sustainability-related criteria or standards in an effort to promote sustainable characteristics, in addition to seeking superior, long-term, risk-adjusted returns. Alternatively, or in addition to traditional financial analysis, the investment strategy may filter its investment universe by excluding certain securities, industry, or sectors based on sustainability factors and/or business activities that do not meet specific values or norms. A sustainability focus may limit the investment opportunities available to a portfolio. Therefore, the portfolio may underperform or perform differently than other portfolios that do not have a sustainability investment focus. Sustainability-focused investment strategies include but are not limited to exclusionary, positive screening, best-in-class, improvers, thematic, and impact approaches.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.