Making Progress Toward Sustainability: A Heineken Case Study

We examine the business strategy behind Heineken’s efforts to reduce water use and promote responsible alcohol consumption.

Key Takeaways

Heineken aims to reduce water usage in brewing beer, particularly in water-stressed emerging markets.

The company has allocated part of its advertising budget to promote the responsible consumption of alcoholic beverages.

Heineken has also developed low- or no-alcohol products to encourage moderation and capitalize on the growing interest in non-alcoholic beverages.

Heineken's Sustainable Growth and Social Responsibility

Brewing beer requires a lot of water.

The brewing process involves crops like barley and hops grown on irrigated farms. The product itself, a pint of beer, is almost entirely water.

Brewing beer is a water-intensive process that is problematic for a company like Heineken, NV. The Dutch brewer’s beverages are popular in water-stressed emerging markets like Cambodia and Egypt, and Heineken is using innovative technologies to reduce water usage in its brewing processes.

The company has also been a leader in promoting responsible alcohol consumption. While moderate alcohol use can be a social lubricant, alcohol abuse is unhealthy for the individual and results in broader societal ills. Heineken has dedicated about 10% of its advertising to messages encouraging moderate and responsible consumption.1

Heineken has also developed nonalcoholic (NA) offerings that represent an increasing percentage of its product offerings. Offering zero-alcohol choices encourages responsible consumption and helps the company’s bottom line. Consumers are increasingly focused on health and wellness, and nonalcoholic offerings allow people to enjoy a beer without the health consequences of alcohol.

Heineken’s portfolio has grown its sales of non-alcoholic beer both in the Americas — a 23% increase in 2023 from the year before — and globally, where sales of its “Heineken 0.0” zero-alcohol beer grew by double digits in 16 markets to become a market leader in non-alcoholic brands.2

As investors, the American Century Global Value Transition* team thinks Heineken’s commitment to sustainability, shown by its efforts to make its production processes less water-intensive and promote responsible alcohol consumption, exemplifies a transitional company committed to improving its sustainable business model.

This shift benefits its customers and the countries where it operates and enhances the quality of its business. Using less water lowers input costs, and products like Heineken 0.0 help the company capture part of a fast-growing segment of beer drinkers who want less or no alcohol.

Heineken's Strategy for Sustainable Industry Leadership

We think Heineken has several attractive characteristics. The brewer generates stable free cash flow and operates with relatively low leverage, allowing it to take advantage of opportunities and navigate industry and economic downturns.

The company also has a strong brand portfolio across diverse geographies, from developed markets like Europe to emerging countries like Vietnam. In our view, this diversification supports Heineken’s durable, sustainable franchise.

A few large companies dominate global beer markets, resulting in rational competitive behavior and significant pricing power. This allows companies like Heineken to navigate external shocks like commodity price spikes by adjusting their prices to maintain profitability.

For example, in 2021, when the prices of commodities such as barley and aluminum surged, Heineken and its competitors were able to increase their prices. Without this pricing power, we estimate the earnings of global beer companies like Heineken could have declined by about 25%.

Evolution of Heineken's Sustainable Business Practices

Heineken also demonstrates how we use key performance indicators (KPIs) and a tailored engagement approach to encourage the company’s progress toward sustainability.

We set several KPIs for Heineken, including reducing water usage. As a baseline, in 2005, Heineken used five hectoliters (hl) of water to make one hectoliter of beer. By 2023, this had dropped to 3.2 hl. Heineken has set a target to reduce water usage further to 2.9 hl by 2030.3

This water consumption plan reduces the impact of Heineken’s brewing operations in markets like Egypt and Mexico, where water is scarce. Water is also an input cost, so reducing water use improves operating margins.

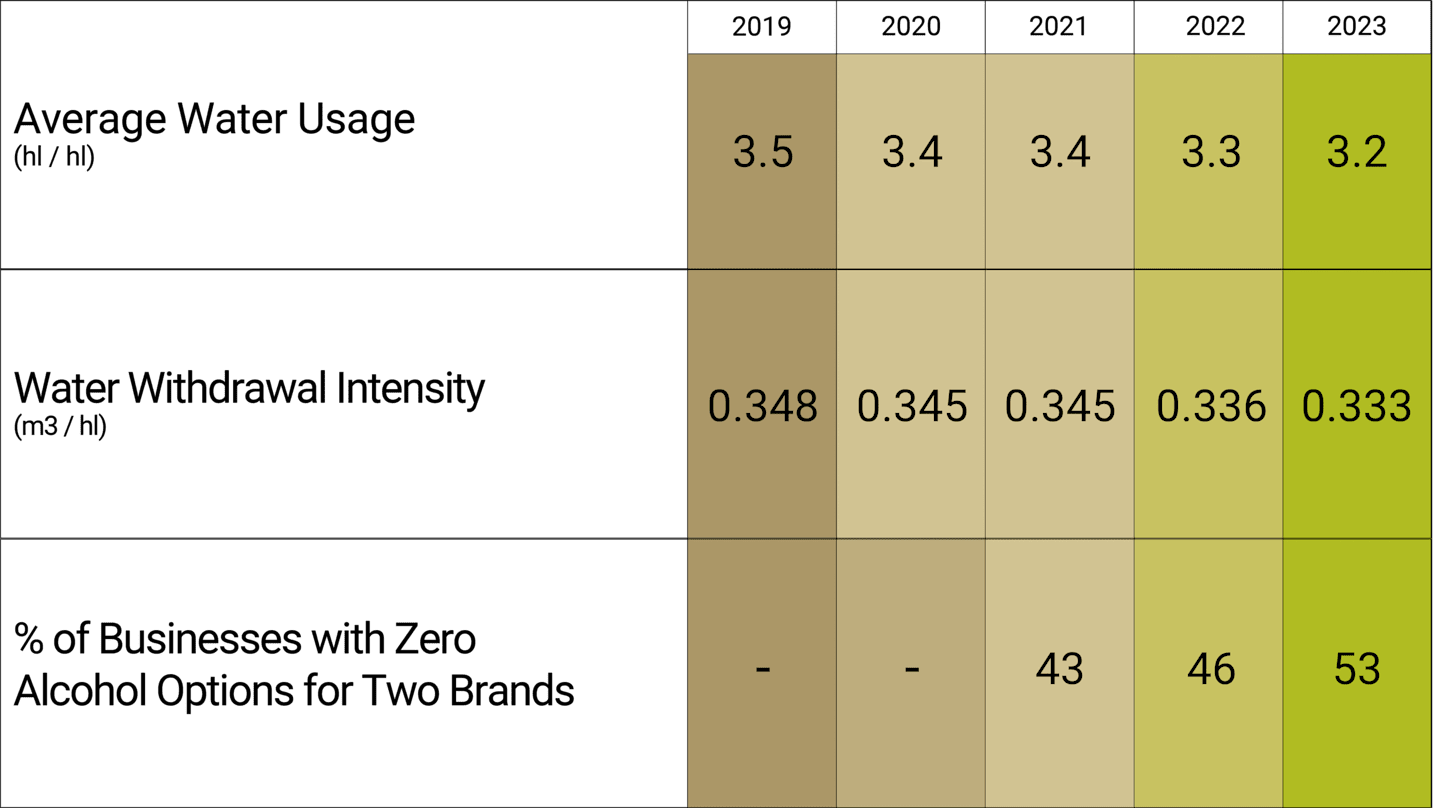

Figure 1 shows some industry- and company-specific KPIs we developed for Heineken.

Figure 1 | Monitoring Heineken’s Water Footprint

Representative KPIs measuring the company’s progress toward sustainability

Data from 1/1/2019 - 12/31/2023. Source: Heineken and American Century Investments.

Active Engagement: Heineken's Path to Sustainability

Our Global Value Transition team actively engages with our investee companies. In some cases, we escalate our engagement to encourage companies to continue making progress toward sustainability, whether through proxy voting or, in some instances, disinvestment.

Heineken has continually made progress on the KPIs we laid out for management. Therefore, our engagement has been focused on encouraging the company to continue its journey toward greater sustainability.

Our well-defined engagement plan allows us to continuously monitor the company’s progress and escalate our engagement, if necessary.

Authors

Heineken may or may not be a holding.

Effective August 15, 2024, Global Sustainable Value was renamed Global Value Transition.

Heineken, Heineken N.V. Annual Report, 2023.

Ibid.

Heineken, Heineken Holding N.V. Annual Report, 2019; Heineken, Heineken N.V. Annual Report, 2023.

Many of American Century’s investment strategies incorporate sustainability factors, using environmental, social, and/or governance (ESG) data, into their investment processes in addition to traditional financial analysis. However, when doing so, the portfolio managers may not consider sustainability-related factors with respect to every investment decision and, even when such factors are considered, they may conclude that other attributes of an investment outweigh sustainability factors when making decisions for the portfolio. The incorporation of sustainability factors may limit the investment opportunities available to a portfolio, and the portfolio may or may not outperform those investment strategies that do not incorporate sustainability factors. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and for certain companies such data may not be available, complete, or accurate.

Sustainable Investing Definitions:

Integrated: An investment strategy that integrates sustainability-related factors aims to make investment decisions through the analysis of sustainability factors alongside other financial variables in an effort to make more informed investment decisions. A portfolio that incorporates sustainability factors may or may not outperform those investment strategies that do not incorporate sustainability factors. Portfolio managers have ultimate discretion in how sustainability factors may impact a portfolio’s holdings, and depending on their analysis, investment decisions may not be affected by sustainability factors.

Sustainability Focused: A sustainability-focused investment strategy seeks to invest, under normal market conditions, in securities that meet certain sustainability-related criteria or standards in an effort to promote sustainable characteristics, in addition to seeking superior, long-term, risk-adjusted returns. Alternatively, or in addition to traditional financial analysis, the investment strategy may filter its investment universe by excluding certain securities, industry, or sectors based on sustainability factors and/or business activities that do not meet specific values or norms. A sustainability focus may limit the investment opportunities available to a portfolio. Therefore, the portfolio may underperform or perform differently than other portfolios that do not have a sustainability investment focus. Sustainability-focused investment strategies include but are not limited to exclusionary, positive screening, best-in-class, improvers, thematic, and impact approaches.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.