Signs Point to Opportunities in Global Real Estate

Interest rate hikes pummeled real estate. But a more stable environment, propelled by strong fundamentals and valuations, suggests a turnaround.

Key Takeaways

Interest rate hikes were painful for real estate, particularly among publicly listed real estate investment trusts.

We believe rates have stabilized and may even see cuts later this year.

Lower rates, combined with solid fundamentals and attractive valuations in some REIT sectors, could create favorable conditions for the asset class.

Few market sectors have suffered as much from steep interest rate hikes as real estate.

Publicly listed real estate investment trusts (REITs) performed relatively well in 2021 as the fog of the COVID-19 pandemic started to dissipate. But inflation triggered a swift series of rate hikes — the Federal Reserve (Fed) increased rates 11 times in 17 months, beginning in March 2022 — that shocked the REIT market.

REITs started 2024 down 1% for the first quarter, with returns slightly positive for the trailing three- and five-year periods. That’s a far cry from the long-term returns of 8% and 13% produced during the 10- and 15-year periods, respectively.

We’ve spotted conditions in the market that point to REITs potentially outperforming from this point forward:

Strong fundamentals and attractive valuations.

Stabilization of interest rates.

Supply and demand imbalances.

For one, we believe the Fed enacted its final rate hike for this cycle in July 2023. While inflation remains stubbornly above the Fed’s 2% target, we think rates will come down. Combining the potential for rate cuts with favorable fundamentals and valuations relative to other asset classes and supportive supply and demand dynamics, we believe the investment outlook for REITs will continue to improve.

Real Estate Fundamentals and Attractive Valuations

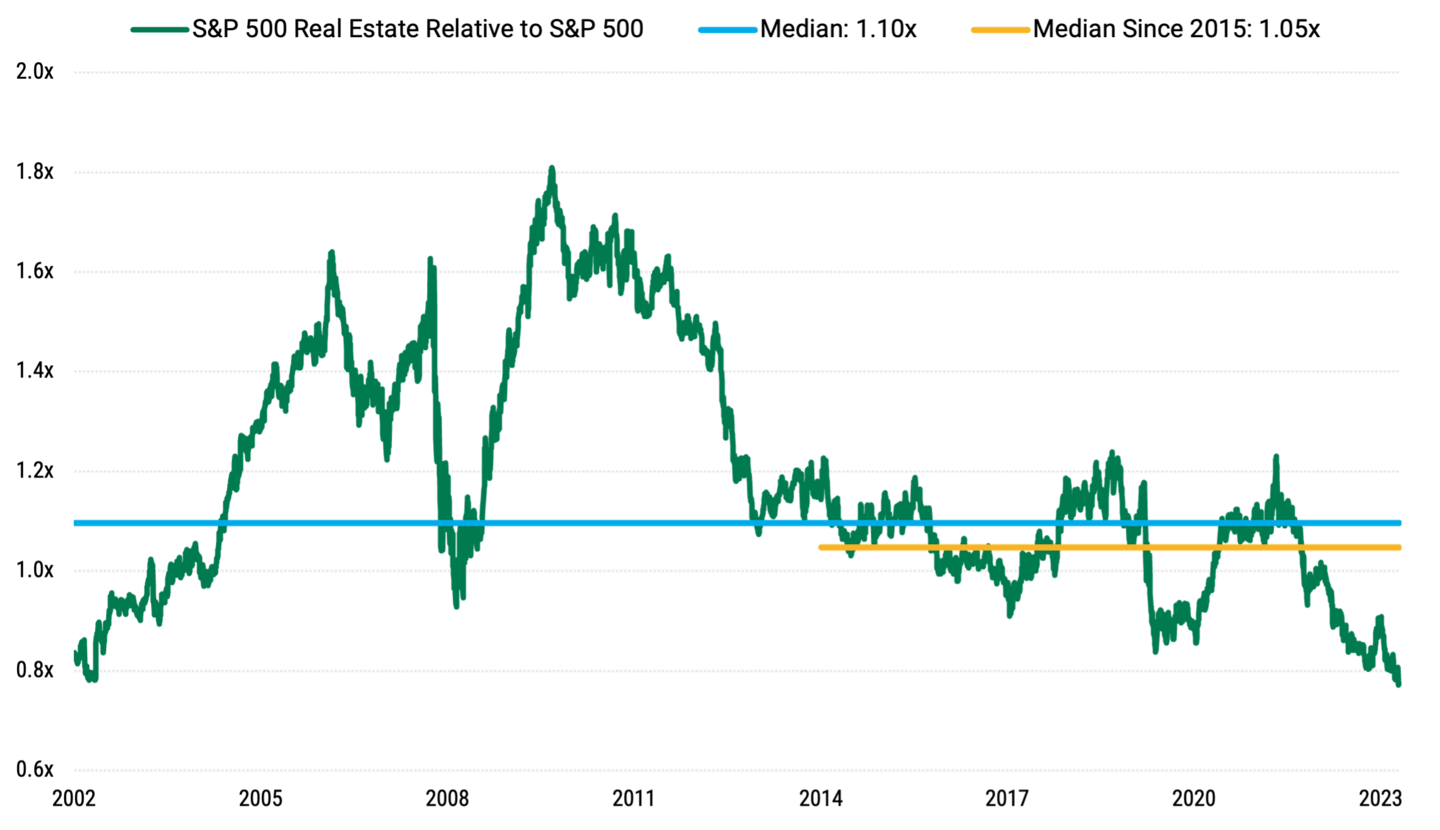

Global REITs have traded relative to general equities at levels unseen since the Great Financial Crisis (GFC). This time, REITs are enjoying strong balance sheets and underlying fundamentals. In addition, Figure 1 shows that interest rates have pressured real estate’s relative multiples to GFC levels with wide discounts to equities and private markets.

Figure 1 | S&P 500 Real Estate Relative Multiples

Data from 12/31/2002 – 4/15/2024. Source: FactSet, Raymond James Research.

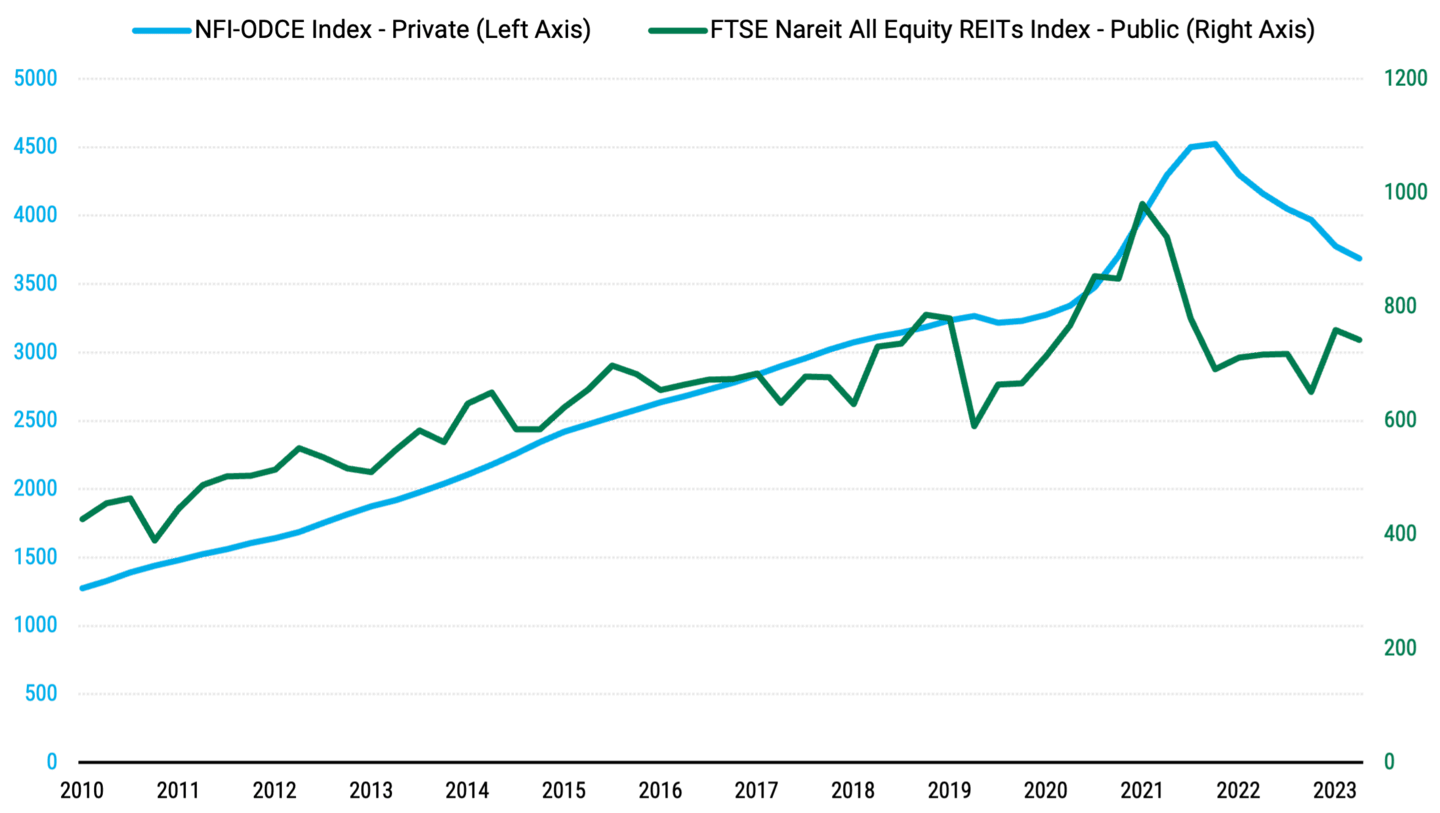

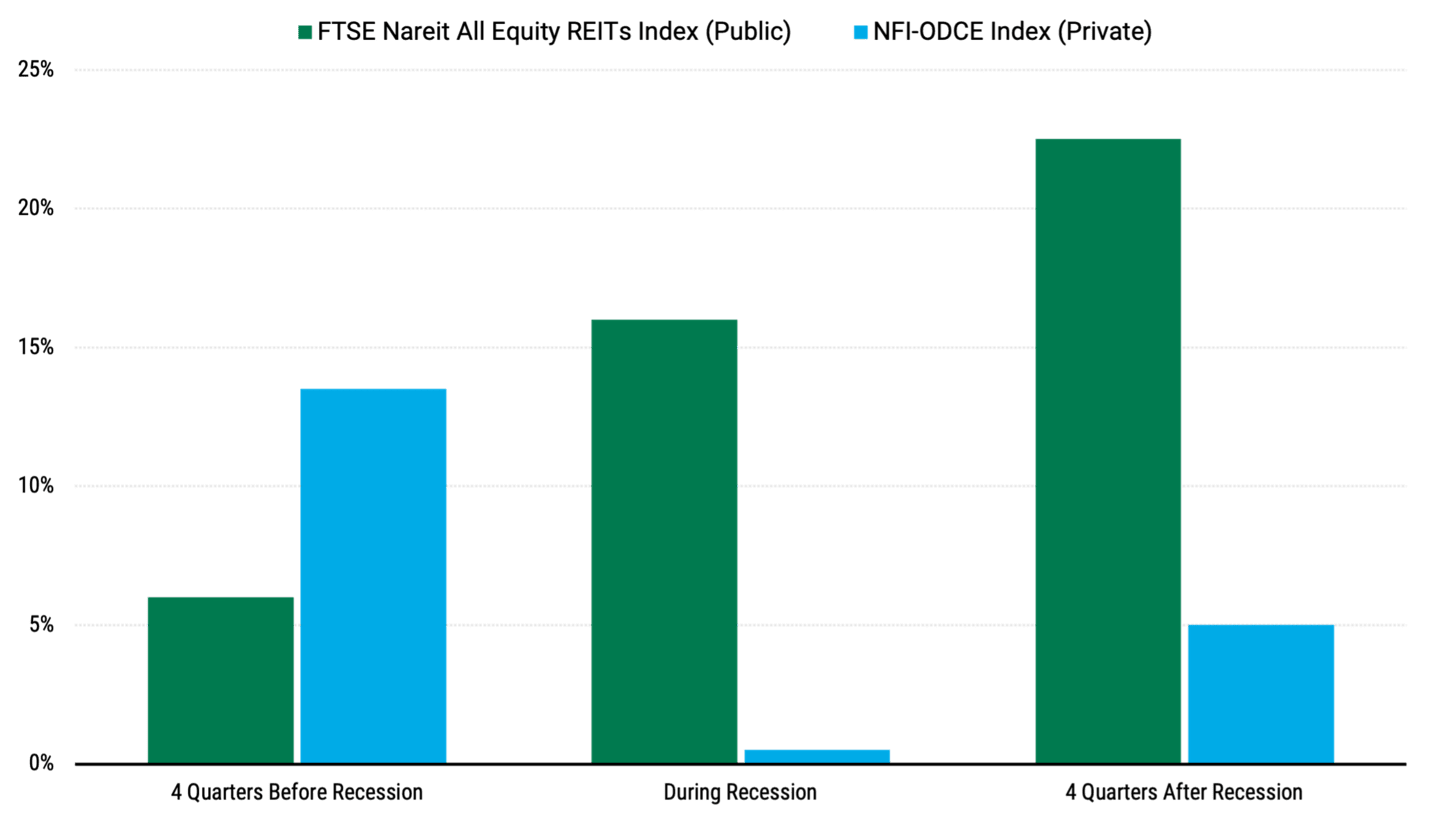

History has shown REITs outperformed after periods of trading at extreme discounts. Also, publicly listed REITs were up 18% in the fourth quarter of 2023 compared to private REITs, which were down 4.8%. We believe public REITs had priced in a recession while private REITs were slow to mark down their assets. See Figures 2 and 3.

Figure 2 | Public and Private Real Estate Prices (‘10=100)

Data from 12/31/2010 - 3/31/2024. Source: FTSE Nareit U.S. Real Estate indices historical returns, Bloomberg.

Figure 3 | Real Estate Performance Around U.S. Recessions

Note: Averages include the last six U.S. recessions between Q4 1979 and Q3 2022. The FTSE Nareit All Equity REITs Index measures publicly listed REITs, and the NCREIF Fund Index measures returns of private real estate. Source: National Association of Real Estate Investments Trusts.

REITs offer an attractive yield and could grow dividends, creating a compelling total return for investors.

There has also been an uptick in mergers and acquisitions in the real estate market, which supports the notion of relatively cheap valuations in publicly listed REITs. Blackstone agreed to buy multifamily REIT AIR Communities for $10 billion, representing a 25% premium to its share price when the deal was announced in April. Blackstone also announced in January that it will take Canadian residential REIT Tricon private in a deal valued at $3.5 billion. We think these types of deals will continue as investors spot steep discounts for listed REITs.

Impact of Stabilizing Interest Rates on REITs

Interest rate increases generally don’t favor real estate. From 2022 to 2023, several short-term interest rate hikes were by far the biggest headwinds to listed REITs.

While we believe the Fed stopped increasing rates last year, inflation has proved more challenging to tame to the Fed’s liking. Even with the likelihood of rate cuts being pushed out until late 2024 or even 2025, we still believe that the total returns for REITs are poised to improve.

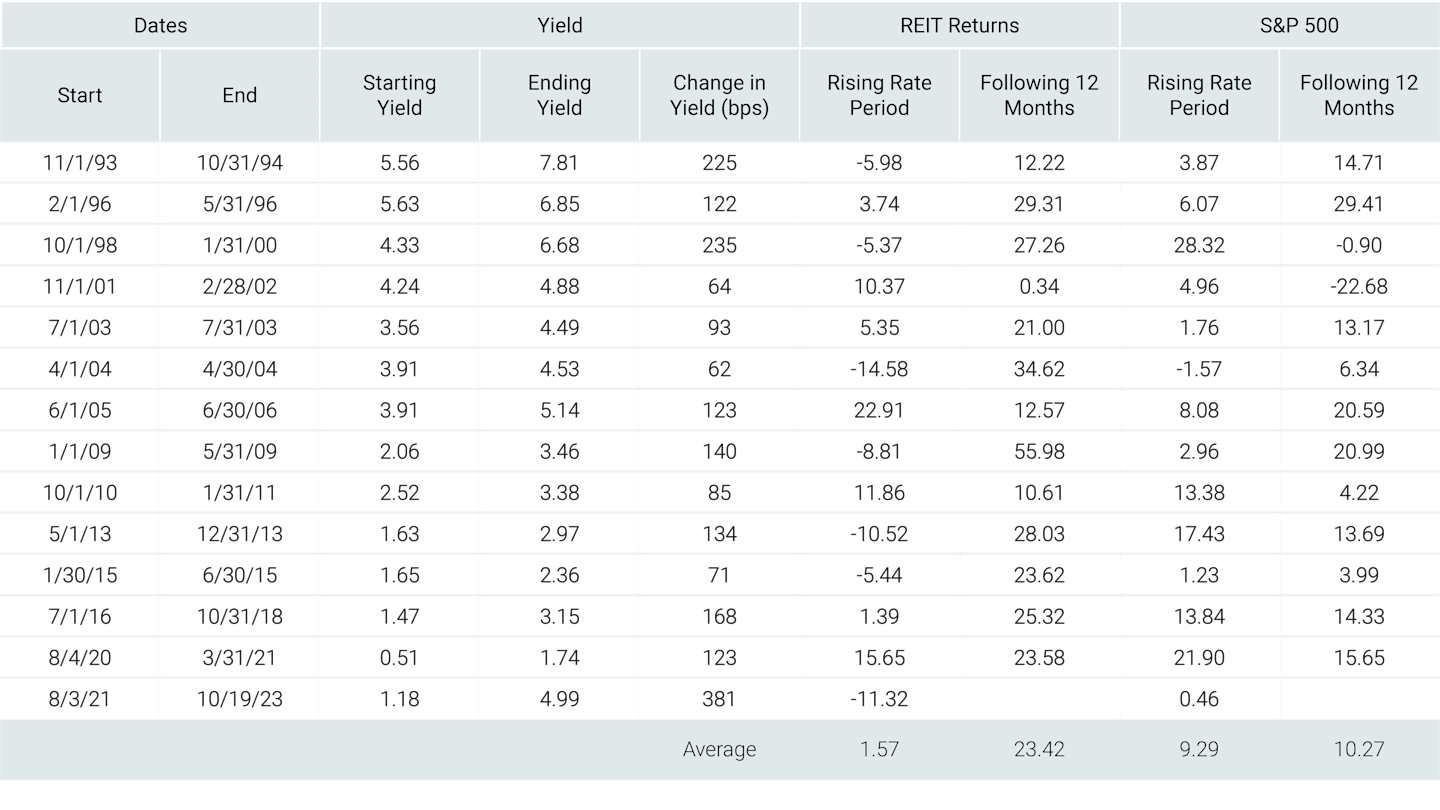

We developed our view from examining 30 years of data showing that listed REITs returned an average of 23.42% over the 12 months following the peak of an interest rate cycle, compared to just 10.27% for the S&P 500® Index. See Figure 4.

Figure 4 | Interest Rates Have Peaks

REIT Performance During and After Rising Yields

Data as of 3/31/2024. Source: FactSet. REIT Returns are FTSE Nareit All Equity REITs index total return. Yield refers to the 10-year U.S. Treasury yield. Past performance is no guarantee of future results.

We saw this play out recently as the U.S. 10-year Treasury declines benefited real estate stocks during the fourth quarter of 2023. The 10-year Treasury peaked at 4.99% on October 19, 2023, and fell to 3.89% by the end of the year. Real estate stocks performed well during this time. Rates shot back up to 4.65% earlier this year, creating a headache for real estate. Still, we think moderation in inflation and interest rates should help global REITs. While stabilizing interest rates should provide a catalyst for listed REITs, the asset class isn’t simply relying on Fed rate cuts.

Real Estate Supply and Demand Dynamics

Several economic conditions, some brought on by interest rates and inflation, have diminished new real estate development. Banks and lenders are less willing to extend debt for real estate projects on terms developers and builders would like if they’re extending debt. Labor and material costs have also increased, leading to fewer construction starts across asset classes and geographic locations.

The confluence of these factors has constrained real estate supply. However, it has also created opportunities in certain sectors. Take data centers, for example. Pinched supply chains, cost inflation and lack of available power have slowed the development of new data centers. The lack of supply, set against the extraordinary excitement and investment in artificial intelligence, has resulted in strong pricing power for data center REITs.

A similar situation has played out in residential real estate. Homebuilders have been slow to add new supply to certain markets, leading to higher home prices. When coupled with elevated mortgage rates, this has caused families to rent single-family homes for the space and convenience they provide compared to multifamily housing.

Construction starts, in aggregate, are down 30% from their peak in 2022. In addition, aggregate construction starts as a percent of total inventory now below long-term averages. We believe this fundamentally plants the seed for increased pricing power, all else equal.

This has created a favorable dynamic for REITs that own single-family homes, particularly in suburban markets.

REITs Outlook: Identifying Investment Opportunities

We are looking to other sectors with strong pricing power, including data centers and single-family housing. These include senior living facilities, class-A shopping malls and lodging.

Senior living has bounced back from pandemic-related challenges.

Strong demand has been met with a significant decline in supply, leading to significantly higher pricing power, returns on invested capital and earnings potential.

Hardly any new supply of class-A shopping malls has come online in recent years, resulting in existing locations producing higher occupancy levels and rent rates for owners. Shopping mall fundamentals are also supported by high employment, increasing personal net worth for consumers and online retailers expanding to store formats.

Like senior housing and malls, demand for hotels has been strong as the worst effects of the pandemic have lifted. Business travel has resumed, and revenge spending has continued while very little new supply has opened. One exception is resorts, where we think supply will grow and upper price points will be relatively modest over the next two years.

We have found attractive lodging opportunities in Japan, where continued negative real rates have supported higher asset values across several property types for property companies. We also believe management teams have improved their corporate governance by focusing more on investment returns.

The pandemic and subsequent efforts by central banks to shore up economies worldwide have been particularly challenging for real estate. However, we believe a shift in the market could ultimately benefit listed REITs as 2024 progresses.

Authors

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

This information is for educational purposes only and is not intended as estate planning advice. Please consult an estate planner or attorney for advice regarding your situation.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.