How Interest Rates Hurt and Then Helped Real Estate

Real estate investment trusts are benefiting from increasing demand and lagging supply, particularly senior housing, data centers and retail.

Key Takeaways

Higher interest rates have curtailed new real estate development, which puts the owners of existing facilities in a strong position.

We see strong demand in sectors like senior housing, data centers and shopping centers where the supply of new facilities is limited.

The lengthy process for getting new facilities ready for occupancy gives owners of existing properties a pricing advantage.

There’s little question that higher interest rates have bedeviled real estate investment trusts (REITs).

After an extended period of near-zero interest rates following the COVID-19 pandemic, the Federal Reserve (Fed) initiated a rapid monetary tightening policy in 2021 to combat the steepest rise in inflation since the 1970s. This policy has eroded property values and increased borrowing costs.

After three years of doldrums, we believe a favorable climate has emerged for REITs.

Moderating inflation and softness in the labor market's foundation over the summer prompted the Fed to start cutting interest rates in September. However, most Fed watchers agreed at least two months ahead of time that an easing cycle was about to begin.

The prospect of an improving interest rate environment boosted real estate stocks. Real estate was the second strongest sector during the third quarter, behind utilities.1

In a way, the elevated interest rates that troubled REITs are now helping fundamentals.

That’s because higher interest rates, which increased the cost of accessing capital, slowed new real estate development over the last three years. The result is a favorable supply-and-demand dynamic for most existing supply.

Current Real Estate Demand vs. Supply Challenges

Whether it’s senior housing or data centers, acquiring land, financing the project, obtaining permits and building a facility can take years.

And that assumes these projects can charge enough rent, given the higher construction materials and labor costs since the pandemic, to proceed with a viable plan.

This lack of supply and the delay in adding inventory means that certain types of REITs hold considerable pricing power in today’s market.

About 80% of our investible REIT universe is seeing materially lower supply growth today than at any time over the last five years. Single-family housing and data centers are notable exceptions. The data center sector is seeing record-breaking demand levels spurred by investments in artificial intelligence (AI).

Meanwhile, we feel bullish about senior housing, data centers and retail real estate.

Aging Boomers Drive Demand for Senior Housing

The pandemic was particularly troublesome for senior housing. Seniors were especially vulnerable to the severe impacts of the coronavirus, and living in close proximity increased their risk. As a result, occupancy rates fell to a low of 78%, down from 87% in the first quarter of 2020 before the virus spread widely in the U.S.2

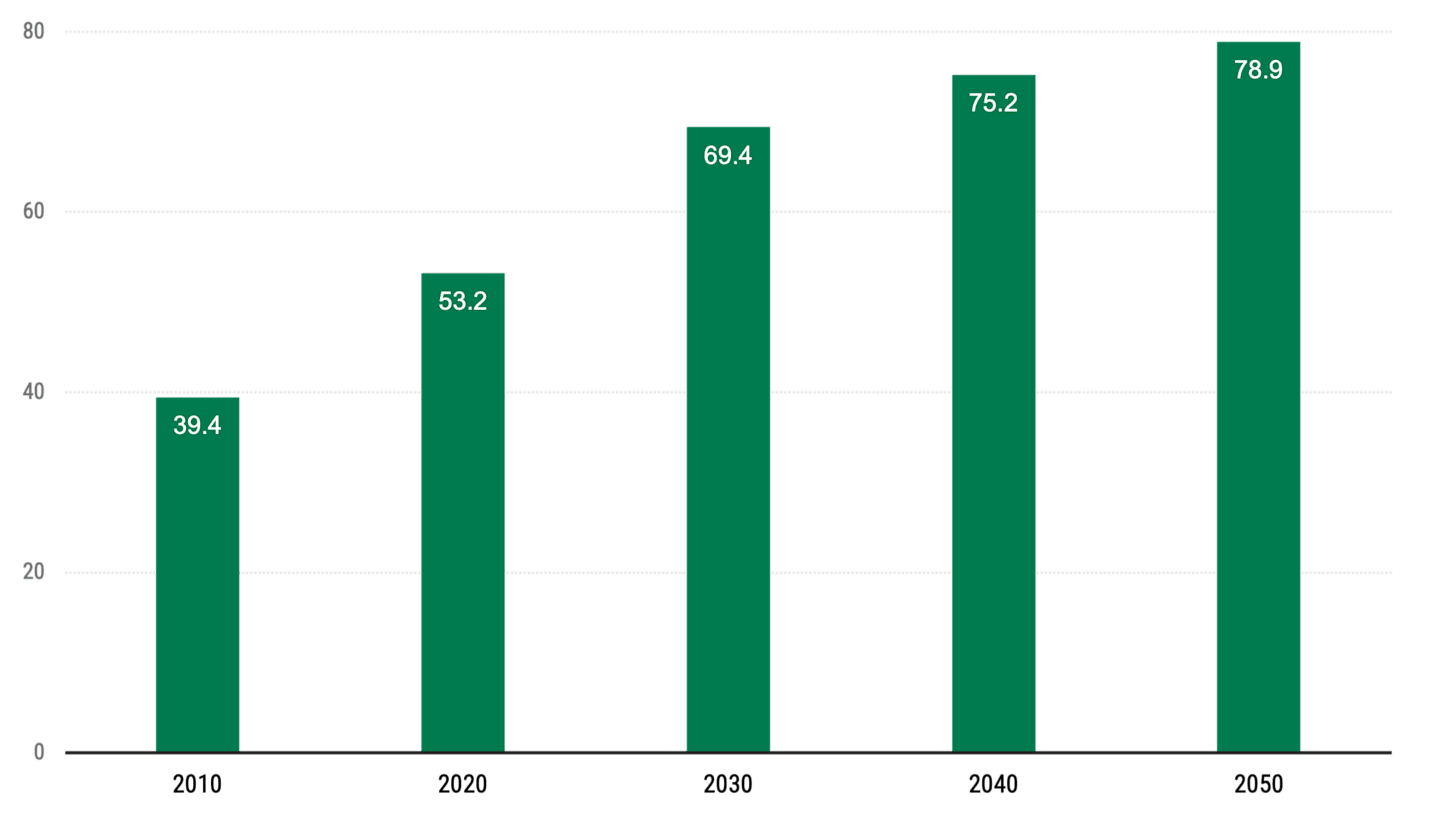

Since then, occupancy levels in senior housing haven’t quite reached pre-pandemic levels. We expect occupancy to reach pre-COVID levels in two to three years, and at the same time, owners are raising rental rates well above inflation. Even beyond the next few years, hundreds of thousands of people each year in the U.S. will soon need senior housing, as shown in Figure 1.3

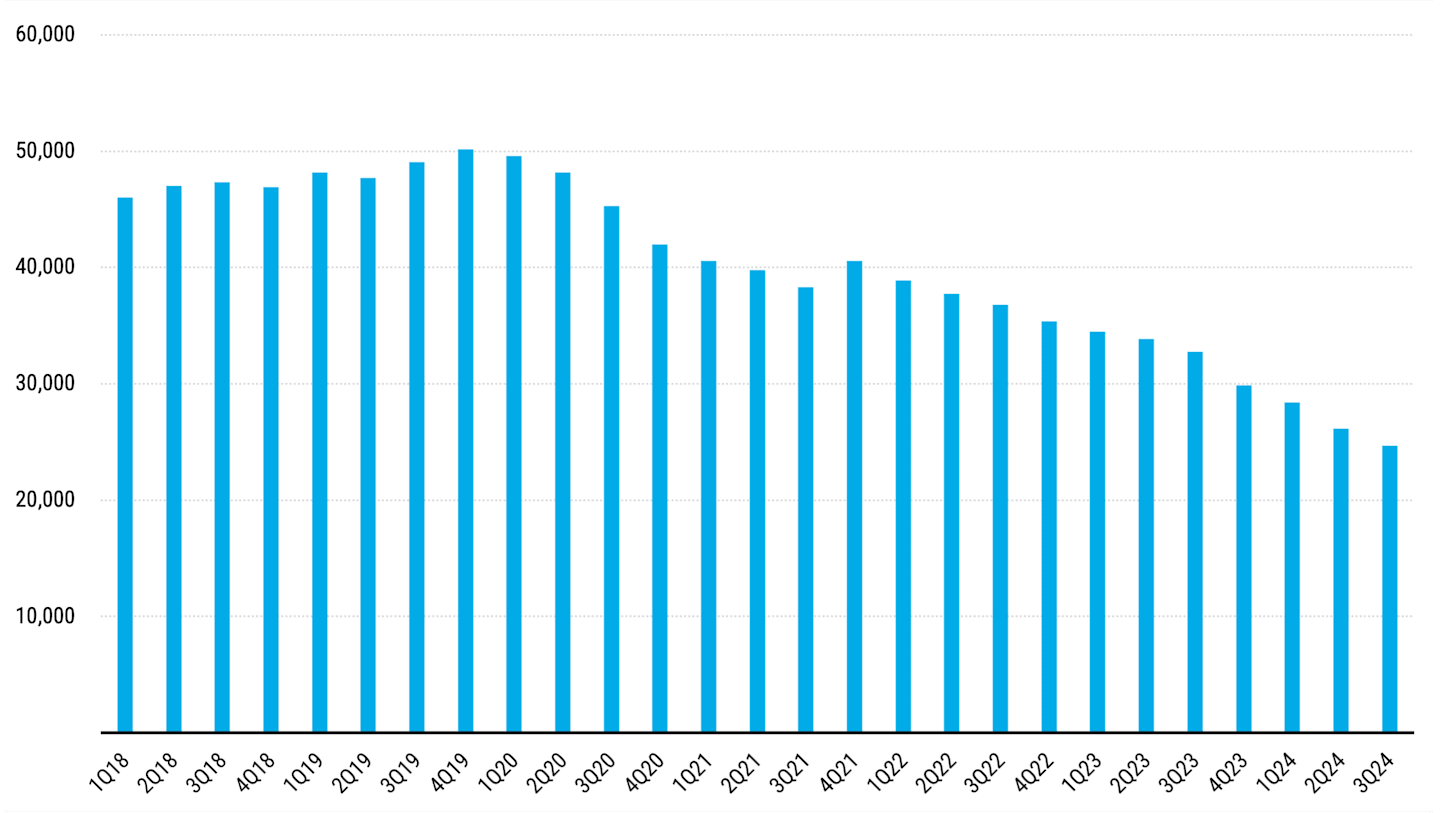

At the same time, construction of new senior housing units has dwindled, as illustrated in Figure 2. Access to and the cost of capital and labor and construction material costs are to blame for the slowdown in construction.

Figure 1 | As the Population of Retirement-Ready Individuals Grows …

U.S. Population Over Age 65 (Millions)

Data as of 9/30/2024. Source: U.S. Census Bureau.

Figure 2 | … New Senior Housing Units Under Construction Fall

Number of Senior Housing Units Under Construction per Quarter

Data from 1/1/2018 – 9/30/2024. Source: NIC MAP Data Service, Evercore ISI Research.

Construction loans have recently commanded interest rates between 9% and 10%, a significant premium over the last decade. And cost inflation has outpaced rental inflation.

These factors make it hard, financially speaking, to build new senior housing. We expect this to continue until rents catch up to the elevated cost structure of construction.

For now, the imbalance in favor of demand means senior housing owners have favorable pricing power, which benefits health care REITs.

U.S. health care REIT Welltower reported that the second quarter marked the seventh consecutive quarter of net operating income growth of more than 20% in its senior housing portfolio. Its second-quarter revenue growth in senior housing was more than 8% due to solid occupancy and rate growth. Meanwhile, lowering inflation eased expense pressures.4

We believe demographic trends — namely, aging Baby Boomers — should continue to favor senior housing. Industry estimates forecast a need for 806,000 additional senior housing units by 2030.5 A widening supply-and-demand gap should benefit existing senior housing landlords if construction activity remains muted.

How AI Electrifies Demand for Data Centers

OpenAI unveiled ChatGPT in November 2022. The large language model answered users’ questions with speedy and precise results.

It also captured the public’s imagination about how powerful advancements in AI could fundamentally reshape how the world lives and works. An astonishing wave of investment in artificial intelligence quickly followed and persists today as companies look to capitalize on and outmaneuver competitors.

One byproduct of AI is its insatiable appetite for computing power. The average ChatGPT search requires about 10 times more electricity than a Google search. AI’s computing needs rely on the availability of data centers — large, nondescript buildings full of servers, routers and other components.

As AI becomes an increasingly common aspect of everyday life, Goldman Sachs anticipates that data center demand will grow 160% by 2030.6

Like senior housing, developers can’t build data centers at a moment’s notice. These buildings have highly technical and specialized specifications. They often require state and local subsidies, which take time to secure. This is another scenario where the extended time horizon for building new facilities creates pricing power advantages for owners of existing data centers.

One example is Iron Mountain, a REIT best known for its document storage business but has an expanding data center segment. Its global data center business reported nearly $300 million in revenue during the first half of 2024, an almost 30% increase compared to the same period in 2023. Iron Mountain’s quarterly report cited improved pricing as a reason for the revenue growth (although adjusted EBITDA margins were down due to higher pass-through power and overhead costs).7

Iron Mountain CEO William Meaney discussed the company’s advantage in pricing at a conference presentation in September:

Jonathan Atkin, RBC Capital Markets Analyst: Any changes in customer preferences and/or willingness around different deal structures, whether it’s powered shell versus turnkey, things like cost variability going forward if you want to maybe not beat all the risk? I’m wondering, has that balance of power in the negotiation in the last couple of years shifted at all?

Meaney: Well, for sure, because of the constraints on power, right? And the insatiable demand for … AI, and you see it in the pricing, is the power has shifted to the data center providers.⁸

We think interest in AI is in its early innings and that demand for data centers will endure well into the coming years.

Retail Shopping Centers: Performance and Trends

Among the myriad effects of the pandemic was grocery stores' failure to open new locations. Consumers held back on spending in the initial stages of the pandemic, and government restrictions on indoor gatherings made it impractical for grocers to expand, even though they emerged as one of the better-performing retailers during the pandemic.

Then came stimulus checks meant to keep households afloat during the crisis. In the years since the pandemic eased, consumer spending has been strong, supporting the U.S. economy.

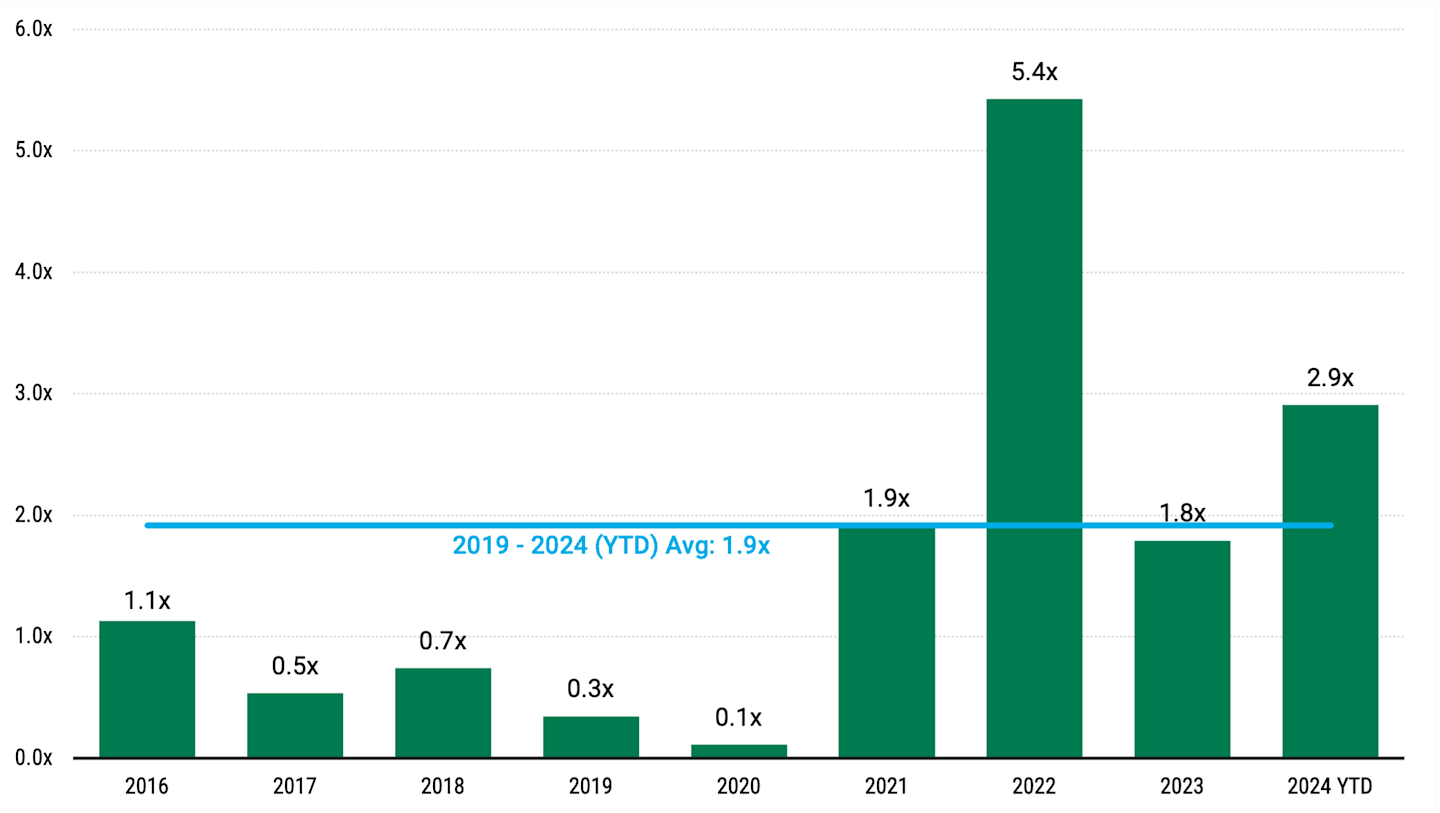

Those trends — along with retailers and grocers like Target, TJ Maxx and Kroger now opening new stores — have underpinned the strength of grocery-anchored shopping centers. Even so, supply remains below demand for retail stores. See Figure 3.

Figure 3 | Comparison of Retail Openings vs. Closings

Ratio of Announced Store Openings to Closings

Data as of 3/31/2024. Source: PNC Real Estate Research, Jefferies.

We see this property type as one of the better opportunities for retail REITs. Altus Group reported that at the end of 2023, occupancy at shopping centers anchored by a grocery store reached 92%, while occupancy at shopping centers without a grocery anchor fell below 90%.9

These strong leasing trends give grocery-anchored shopping centers pricing power, even with grocers and other large retailers opening new stores.

Kite Realty Group, a retail REIT focused on open-air shopping centers, is keen on grocery-anchored shopping centers.

In 2021, Kite completed a $7.5 billion merger with Retail Properties of America. This merger highlights the company’s orientation toward grocery-anchored neighborhoods and community centers, particularly in warmer and cheaper markets.10 Kite has seized on favorable supply-and-demand characteristics by continuing its focus on developing and redeveloping high-growth shopping centers.

Impact of Economic Conditions on Real Estate Dynamics

Economic shocks can disrupt the best assumptions about real estate.

We have predicted a soft landing for the economy, which has largely occurred up to this point, and we don’t think a cyclical slowdown will turn into a recession.

In such a case, we believe the favorable supply-and-demand dynamics in certain sectors will be resilient.

While a recessionary environment could change the environment for commercial real estate, we believe demand in data centers and senior housing would be relatively persistent and more insulated than other property sectors.

An economic downturn is unlikely to meaningfully change the number of aging seniors who need a place to live. Nor is it likely to cause companies to significantly abandon their AI-related plans and investments, so we believe data centers will retain strong demand.

It’s often said the first rule of real estate fundamentals is location, location, location. This adage may still be accurate, but we believe favorable supply-and-demand trends like the ones we have identified — senior housing, data centers and grocery-anchored shopping centers — carry as much weight in finding value in real estate.

Authors

S&P Dow Jones Indices U.S. Dashboard, October 31, 2024.

National Investment Center for Seniors Housing & Care, “Senior Housing Occupancy Increases for Eleventh Consecutive Quarter,” Press Release, April 4, 2024.

Lisa McCracken, “How Much Future Senior Housing Inventory Is Needed to Meet Demographic Demand?” National Investment Center for Seniors Housing & Care, January 4, 2024.

Welltower, Business Update Presentation, July 29, 2024.

Lisa McCracken, “How Much Future Senior Housing Inventory Is Needed to Meet Demographic Demand?” National Investment Center for Seniors Housing & Care, January 4, 2024.

Goldman Sachs, “AI Is Poised to Drive 160% Increase in Data Center Power Demand,” May 14, 2024.

FactSet, Iron Mountain, Inc., Form 10-Q, June 30, 2024.

FactSet, Corrected Transcript of Iron Mountain, Inc. Presentation, RBC Capital Markets Global Communications Infrastructure Conference, Chicago, IL, September 24, 2024.

Cole Perry, “Grocery-Anchored Centers Hold an Edge on Other Retail Formats,” Altus Group, January 24, 2024.

Kite Realty Group, “Kite Realty Group Announces Closing of $7.5 Billion Merger with Retail Properties of America: Creates a Top 5 Open-Air, Grocery-Anchored Shopping Center REIT,” Press Release, October 22, 2021.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

This information is for educational purposes only and is not intended as estate planning advice. Please consult an estate planner or attorney for advice regarding your situation.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.