Reshoring Reaches Mid-America

Our Small Cap Value team visited a small town in Kansas to witness how bringing production back to the U.S. can bolster small-cap companies and transform communities.

Key Takeaways

Panasonic expects to open a $4 billion electric vehicle battery plant in De Soto, Kan., by spring 2025.

Myriad enterprises will support this massive project. It has already attracted many ancillary businesses and suppliers.

In our view, Panasonic’s investment in this project demonstrates how reshoring to North America will likely benefit small-cap stocks.

What Is Reshoring and Why Does It Matter?

You may have noticed that “reshoring” has been grabbing the headlines lately.

For example, in early April, Taiwan Semiconductor Manufacturing Co. announced receiving $11.6 billion in grants and loans to jumpstart the chipmaker’s plans to build factories in Arizona.1 Two weeks later, Micron Technology Inc. received $6 billion in grants to build plants in Idaho and New York.2

These semiconductor grants are part of a critical Biden administration plan to restore the nation’s chip manufacturing prowess. The federal effort deems semiconductor production as an economic development initiative and a national security priority.

Reshoring refers to bringing business processes, manufacturing or services back to a company’s home country or moving them closer to its primary market. Conventional wisdom holds that reshoring benefits small-cap firms because they tend to derive most of their sales domestically. Revenue for small-cap companies is highly correlated to capital spending.

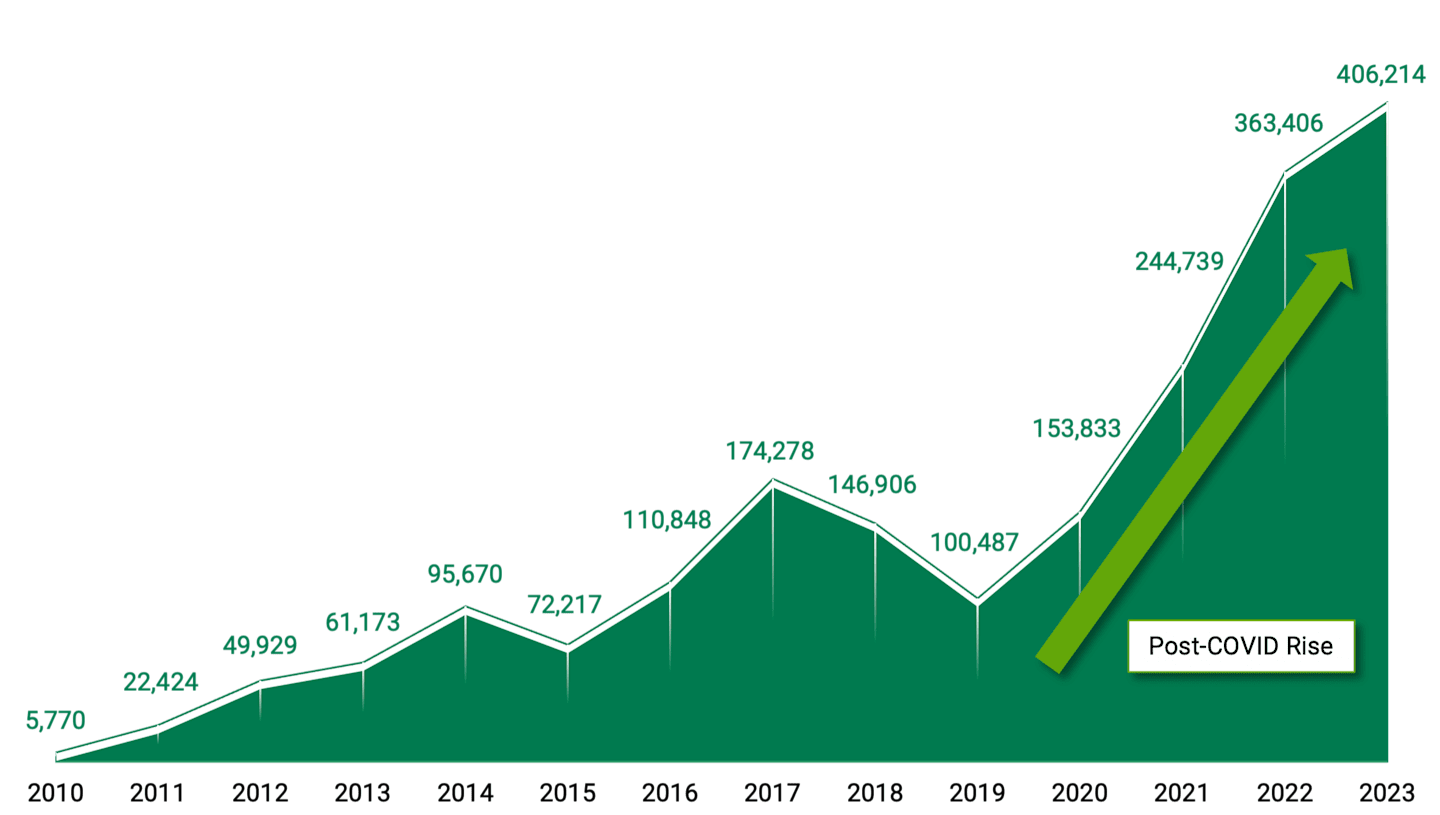

COVID-19 supply chain disruptions and rising geopolitical risks accelerated the trend of bringing back domestic manufacturing. Every year since the pandemic began, job growth tied to reshoring projects and foreign direct investment (FDI) has consistently increased, as illustrated in Figure 1.

Figure 1 | Reshoring Initiatives Fuel U.S. Job Growth

Data from 2010 – 2022. The data for 2023 is estimated. Source: The Reshoring Initiative.

The De Soto project illustrates the impact of a segment of the automobile industry returning to the U.S. Other industries with notable reshoring include medical device companies and pharmaceuticals. The trend has surged thanks to unprecedented fiscal stimulus totaling hundreds of billions of dollars provided by the CHIPS and Science Act and Inflation Reduction Act.

Inside De Soto’s Economic Makeover: Panasonic EV Battery Project Reshapes Kansas Landscape

American Century’s Small Cap Value team recently traveled to De Soto, Kan., to see a significant reshoring project firsthand.

An ex-urban town of about 6,200 residents on the outskirts of Kansas City, De Soto has been a bedroom community throughout its history. But that’s changing thanks to the most significant private economic development project in Kansas history.3 Panasonic Energy of North America will open a $4 billion lithium-ion electric vehicle (EV) plant there in spring 2025. The facility will add critical capacity to the nation’s EV battery supply chain.

The 5 million-square-foot plant will occupy a portion of 9,000 acres of prime real estate dormant since the early 1990s. The site previously housed the Sunflower Army Ammunition Plant, which employed more than 15,000 people in rocket propellant production during World War II and subsequent war efforts until closing in 1993.

Environmental contamination from the rocket powder manufacturing hamstrung efforts to redevelop the Sunflower site for years. However, developers remediated 300 acres for Panasonic to build its plant, with an option for a 300-acre expansion.

The Kansas Department of Commerce estimates the project will yield 16,500 construction jobs and 4,000 full-time jobs after the plant opens.

Oklahoma, Texas and Nevada tried to land the project. Panasonic chose Kansas after an intense effort by state lawmakers and economic development officials to lure the multinational company to De Soto. Lawmakers approved a new economic development tax incentive program, while regional electric utility Evergy committed to building additional substations to meet the battery plant’s electricity demands.

How Reshoring Projects Can Help Small-Cap Companies

A local official told us that the top five suppliers to Panasonic would receive the same tax incentive deal as Panasonic. H&T Recharge, a division of Germany-based Heitkamp & Thumann Group, has already agreed to manufacture and supply battery containers onsite at the plant.4 It’s unclear how many jobs H&T Recharge will bring to Panasonic, but they will be among the 8,000 residual jobs Kansas officials anticipate in conjunction with the EV battery plant.

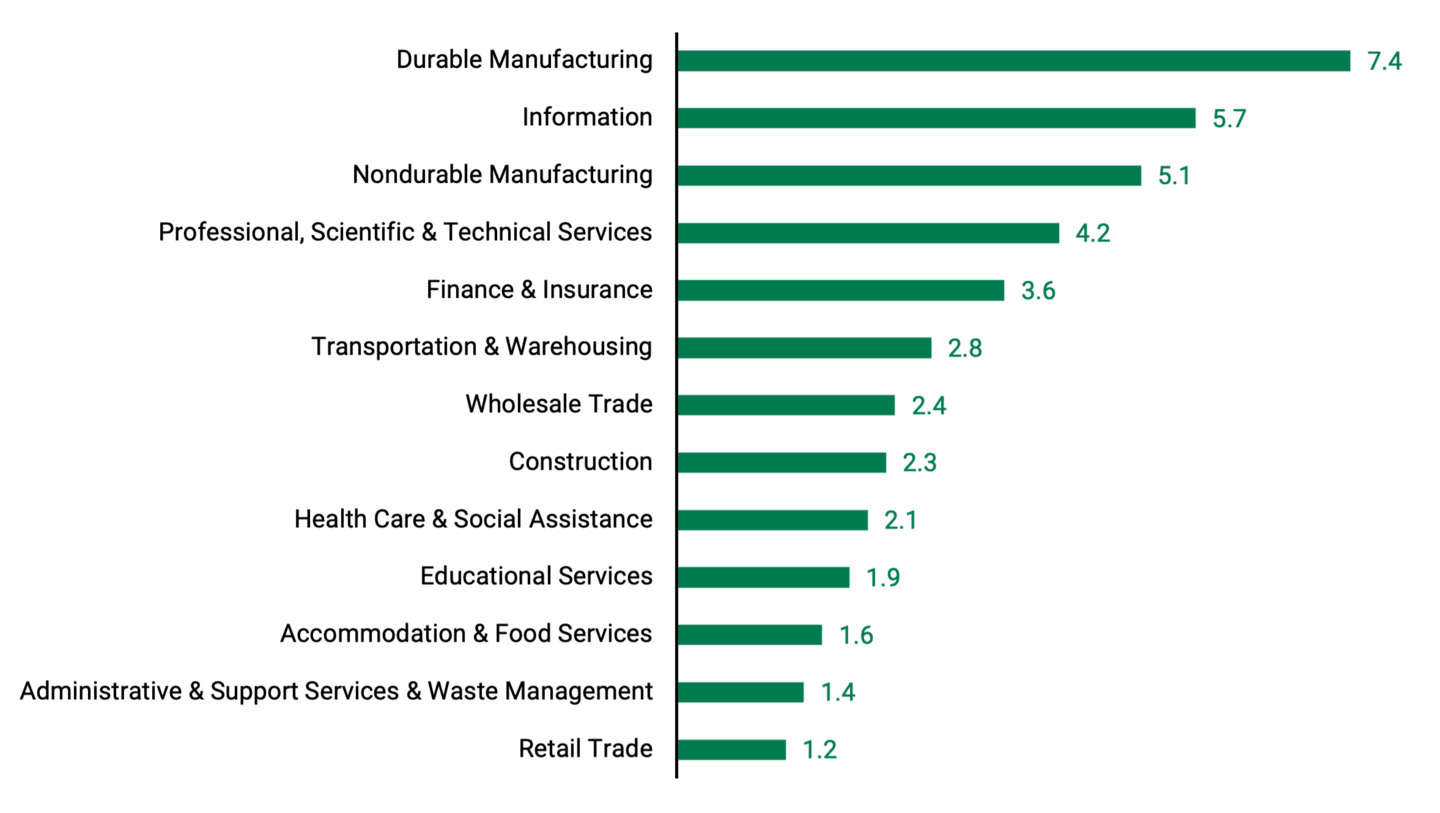

According to the Economic Policy Institute, reshoring projects like this create a multiplier effect on jobs. Employment multipliers gauge how the growth or decline of production or jobs in a specific industry affects overall employment across the economy. As shown in Figure 2, the institute estimates that 7.4 new jobs are created in other industries for every durable manufacturing job generated by a reshoring project.

Figure 2 | Job Multiplier Effect by Industry Across the U.S. Economy

Data as of 1/23/2019. Source: Josh Bivens, “Updated Employment Multipliers for the U.S. Economy,” Economic Policy Institute.

Some of these residual economic impacts are tied directly to Panasonic. About a mile southwest of the battery plant, crews are constructing up to 5 million square feet of new warehouse space for the Flint Commerce Center. Panasonic will lease at least 1 million square feet. Savion LLC, a Shell Group portfolio company, is building a 3,000-acre solar farm south of the battery plant.

Companies involved in the construction of the broader development will also benefit from Panasonic’s investment. For example, the CEO of Summit Materials, a $7.5 billion market cap aggregate supplier, referenced the Panasonic plant as a significant project in Summit’s pipeline during a May 2023 earnings call with analysts.5

We saw 18-wheelers in all directions when we visited the Panasonic site, so we expect trucking companies like SAIA and Knight-Swift Transportation to benefit from these projects. Interstates 35 and 29 run through Kansas City and are often called North American Free Trade Agreement (NAFTA) superhighways.

Even retail companies — we spotted a Casey’s convenience store near the Panasonic plant — seem destined to expand and see more foot traffic.

Reshoring Revolution: Igniting Community Transformation in De Soto and Beyond

The city has outlined a $229 million infrastructure improvement plan to keep up with the nearby development. The biggest line item is $84 million in road improvements. Other upgrades include new sewer lines, wastewater treatment and a new fire station.

A local official told us that De Soto has approved up to 2,500 multifamily housing units to accommodate workers at Panasonic and its suppliers. Plans are underway for the construction of a new school.

These projects supporting De Soto’s expansion may help small-cap companies like GMS Inc., which develops and distributes building materials and products.

Similarly, De Soto will likely need another local bank branch. Kansas City is home to regional banks like Commerce Bank and UMB Bank.

De Soto’s water needs will likely grow as the city expands, which could benefit companies like Advanced Drainage Systems, which makes municipal stormwater piping, or Johnson Controls, which develops meter readers, leak-control systems and wastewater treatment pumps.

All these changes figure to reshape this small town on the western edge of the Kansas City metro. Other cities would likely see similar transformations from reshoring initiatives.

We believe the reshoring trend presents favorable impacts for small-cap companies because it allows them to potentially access new business opportunities that wouldn’t otherwise be available. As manufacturing operations return to domestic locations, smaller companies can benefit from increased demand for local suppliers, subcontractors and specialized services. Proximity to reshored manufacturing facilities may also enable small-cap companies to establish closer partnerships with larger manufacturers, leading to potential growth and expansion opportunities.

Author

Mackenzie Hawkins and Jennifer Jacobs, “TSMC Gets $11.6 Billion in U.S. Grants, Loans for Chip Plants,” Bloomberg, April 8, 2024.

Zacks Equity Research, “Micron (MU) May Get More Than $6B to Set Up Factories in the U.S.,” Yahoo Finance, April 18, 2024.

Kansas Department of Commerce, “Kansas Lands $4B, 4,000-Job Panasonic Energy Electric Vehicle Battery Plant,” Press Release, July 13, 2022.

Brian Kaberline, “Panasonic Signs Deal for Company to Produce Battery Cans at Kansas Plant,” Kansas City Business Journal, March 4, 2024.

FactSet, Summit Materials, Inc. Q1 2023 Earnings Call Corrected Transcript, May 4, 2023.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.