In AI’s Promise, Small-Cap Companies May Be Poised to Flourish

Leading companies in artificial intelligence will need support from other enterprises whose innovations enable the growth of technology’s next frontier.

Key Takeaways

The rapid ascent of artificial intelligence (AI) since 2022 has benefited well-known companies like Nvidia and Microsoft.

This transformative technology will likely usher in beneficiaries that operate around its periphery.

Many potential beneficiaries are currently small-cap companies that often get overlooked in the AI discussion but may be worth watching.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Securities may or may not be current holdings.

The rise of the internet in the 1980s and 1990s propelled the fortunes of companies that helped pioneer the transformative technology. Some still exist today, like Cisco. Others, like CompuServe, didn’t last.

When the internet became part of everyday life by the mid-1990s, few could envision the society-changing businesses that would spring from it a few years later, like Amazon and Facebook.

For all those well-known companies that rose to prominence, other enterprises whose names are now consigned to obscure trivia, like Kalpana and Netcom, developed hardware and tools that helped shape the internet as we know it today.

The latest ascendant technology — artificial intelligence — has parallels to the internet’s trajectory.

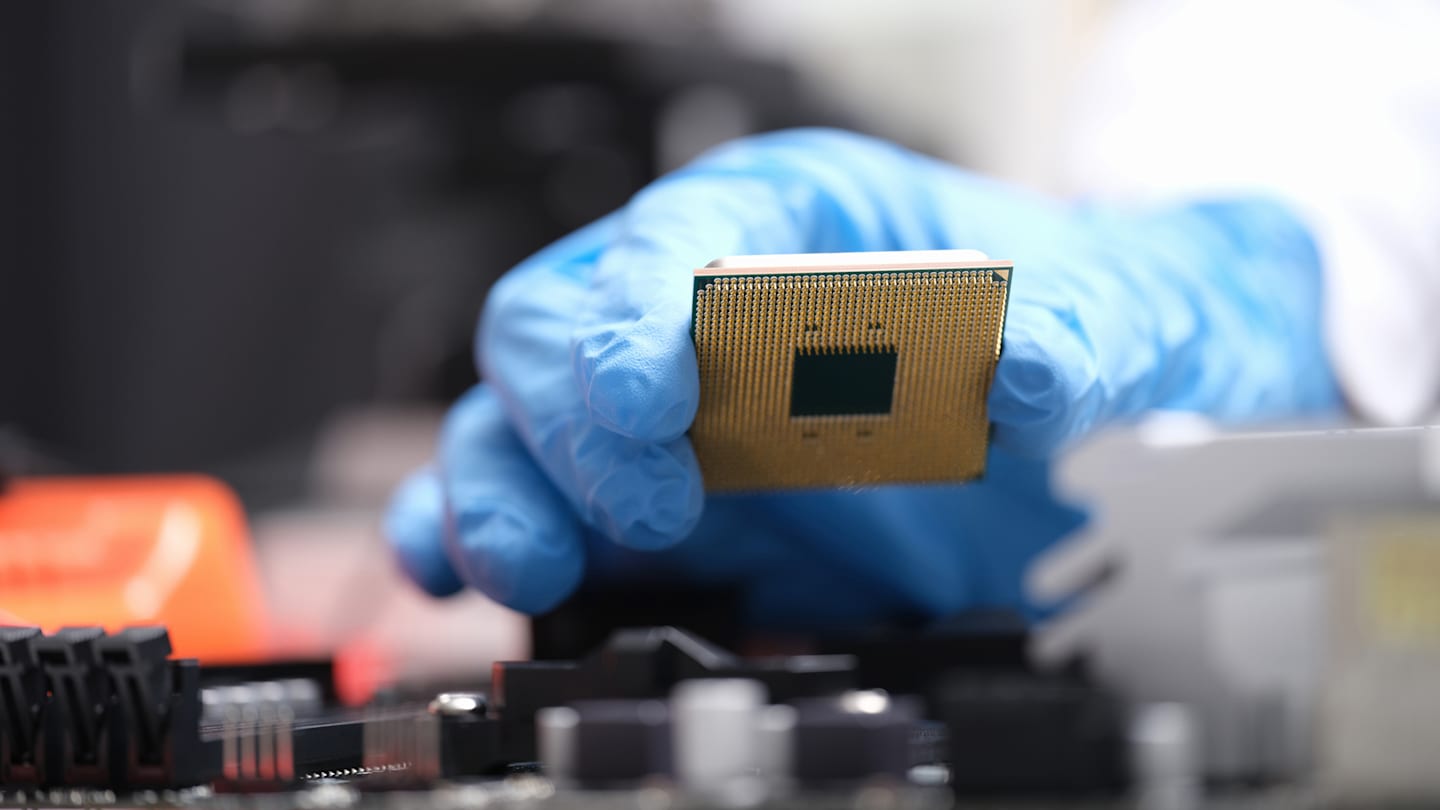

Chipmaker Nvidia reached a valuation of more than $2 trillion on AI’s promise to transform daily life in the decade ahead and beyond. But mega-caps like Nvidia are not the only stock play in AI’s rise.

Like with the internet, small- to mid-cap companies at this stage of AI’s evolution may not fetch broad attention like Nvidia. And it is important to realize that artificial intelligence is at an early stage of its hype cycle, making it difficult to spot potential winners and losers years later or precisely how it will change everyday life. But we believe AI will have a profound effect on business and society, and in the near- to intermediate-term, these are the types of companies that could shape how this innovation advances.

AI and Thermal Management Solutions for Small-Cap Companies

AI applications require immense energy use. Energy use generates heat. Technology that can manage both will prove useful for the buildout of artificial intelligence. Companies like Credo Technology Group develop products that help manage heat. Credo’s chips and power-saving cables, for example, solve those constraints for high-performance computing installations.

Along similar lines, anyone who has worked with a laptop with a spinning CD-ROM drive on their lap can attest to how hot they can become. As artificial intelligence scales up, cloud providers need distinct types of hardware for data centers that can manage thermal issues. Companies like Pure Storage develop all-flash or solid-state memory drives without spinning disks that produce heat, which would require additional cooling.

The way chips are packaged can also deal with the heat generated by computer components. One approach to solving thermal issues involves combining several chips into a single package, as Onto Innovation has done to ease heat constraints in modern chips.

Role of FGPAs in AI Applications

Technologies as simple as digital stopwatches and as complex as supercomputers rely on semiconductors. But semiconductors used in basic devices don’t work in advanced computers. Field-programmable arrays (FPGAs) are a type of semiconductor designed by small-cap firms, including Lattice Semiconductor Corp., which are used in fast-growing applications like edge computing, artificial intelligence, 5G and factory automation.

How Small-Cap Companies Harness AI’s Data Deluge

Large language models that power generative artificial intelligence, now and in the future, generate more data by orders of magnitude than most anyone envisioned a few years ago. Moving that data between data centers and users will require upgrading existing optical long-haul networks.

The optical communications sector faces a cyclical downturn. Still, an eventual shift to 800G optics from the existing 200G/400G standard may accelerate demand for companies that develop optical technology and supporting gear, including Ciena and Fabrinet, for major optical networking companies.

There is also the matter of storing and managing the data developed by AI. Developers need vast amounts of data to train the large language models that produce artificial intelligence, which requires innovative ways to store and manage specific data types, such as Box’s cloud-based management software.

And then there’s the need to write code for new software, which is hard work. And AI adoption will need plenty of new software. At some point — it’s hard to know when — machines may end up taking on the work of software developers. That will require companies that develop code management and distribution platforms, like those from JFrog, to support increased and more efficient software production.

Navigating AI's Diverse Impacts

Artificial intelligence may benefit businesses in an untold number of ways. Large language models will likely become narrower and more tailored for specific needs and sectors. Take supply chain management, for example, which may benefit from a provider like Manhattan Associates’ knowledge in warehouse management to train AI to resolve supply chain management issues.

On the other hand, policymakers worldwide are concerned about how bad actors can and will use artificial intelligence. Implications range from misinformation to cyber threats to corporations. The emergence of artificial intelligence will likely represent an inflection point for spending on cybersecurity software developers like Tenable Holdings.

From the Gold Rush to AI Revolution

Those who dug up gold during the California Gold Rush needed someone to sell them pickaxes and shovels. Those who developed the Internet needed someone to invent and deploy the hardware to connect computers across the globe. And leading AI companies will need support from other enterprises whose innovations enable the technology’s growth.

Companies like NVIDIA and Microsoft have emerged as early frontrunners in the AI hype cycle. Other lesser-known small- and mid-cap companies will also likely benefit. Artificial intelligence will lead to technologies and innovations that can’t even be imagined today.

Author

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.