Global Small-Caps: A Source of Innovation in Sustainability

Small-caps are helping to drive sustainability-related trends and creating opportunities for investors.

Key Takeaways

Many small, fast-growing companies are pursuing opportunities in electrification and energy efficiency in manufacturing and renewable energy.

The management teams of these small-cap firms often have major “skin in the game” and combine innovation with sustainability to drive earnings growth.

Not all sustainability-focused companies are good investment opportunities. Company fundamentals always matter.

As the saying goes, “good things often come in small packages,” which we think applies to the small-cap universe. In this article, we address opportunities among small-cap companies that focus on innovations in renewable energy, energy efficiency and other environmentally supportive growth areas that can generate compelling investment returns.

The Global Small Cap team takes a bottom-up approach to identifying companies we believe are positioned to deliver accelerating and sustainable earnings growth that investors may overlook.

Due to their limited internal resources, small-cap firms typically provide fewer disclosures about their environmental, social and governance (ESG) practices than large firms. While this creates challenges when assessing these companies from a sustainability perspective, we think it presents opportunities for active investors.

Those willing to rigorously research and engage with small companies may identify overlooked firms benefiting from the growing demand to reduce carbon emissions, cut back plastic waste and protect biodiversity across industries.

Most small-cap companies have highly focused business models. Therefore, the new technologies and products they launch are more likely to significantly impact their financial metrics and earnings growth than we might see in larger, more diversified companies. With fewer layers of management, small companies are often more nimble than larger companies and can adjust to changing conditions more quickly to take advantage of emerging trends.

The Role of Small-Caps in Environmental Innovation

Innovative small companies can be vital parts of the supply chains of large companies and can play a critical role in helping reduce carbon footprints. These small companies include those that make industrial processes less energy-intensive and are developing approaches to electrify various processes in warehouses, agriculture, transportation and other industries.

Small-cap investors may reap outsized benefits from these nascent trends, which small companies recognize and seek to exploit. For example, a new water treatment technology or environmentally friendly packaging that is the sole focus of a small company could positively impact an entire industry. Small-cap companies can also find ways to help reduce the power needs of large, rapidly growing, energy-intensive businesses, such as the data centers that support artificial intelligence.

We see various opportunities in small-cap companies whose products help to improve their customers’ environmental sustainability.

Small-Caps Leading Renewable Energy Innovations

Climate change is predicted to have devastating consequences worldwide, including economic and physical damages and a decline in global gross domestic product (GDP).1 Some investors seeking to pressure companies to reduce their energy use focus on divesting from fossil fuel producers and other companies with large carbon footprints. However, other investors, including American Century’s Small Cap Equity team, prefer to be selective rather than completely avoid companies exposed to fossil fuels.

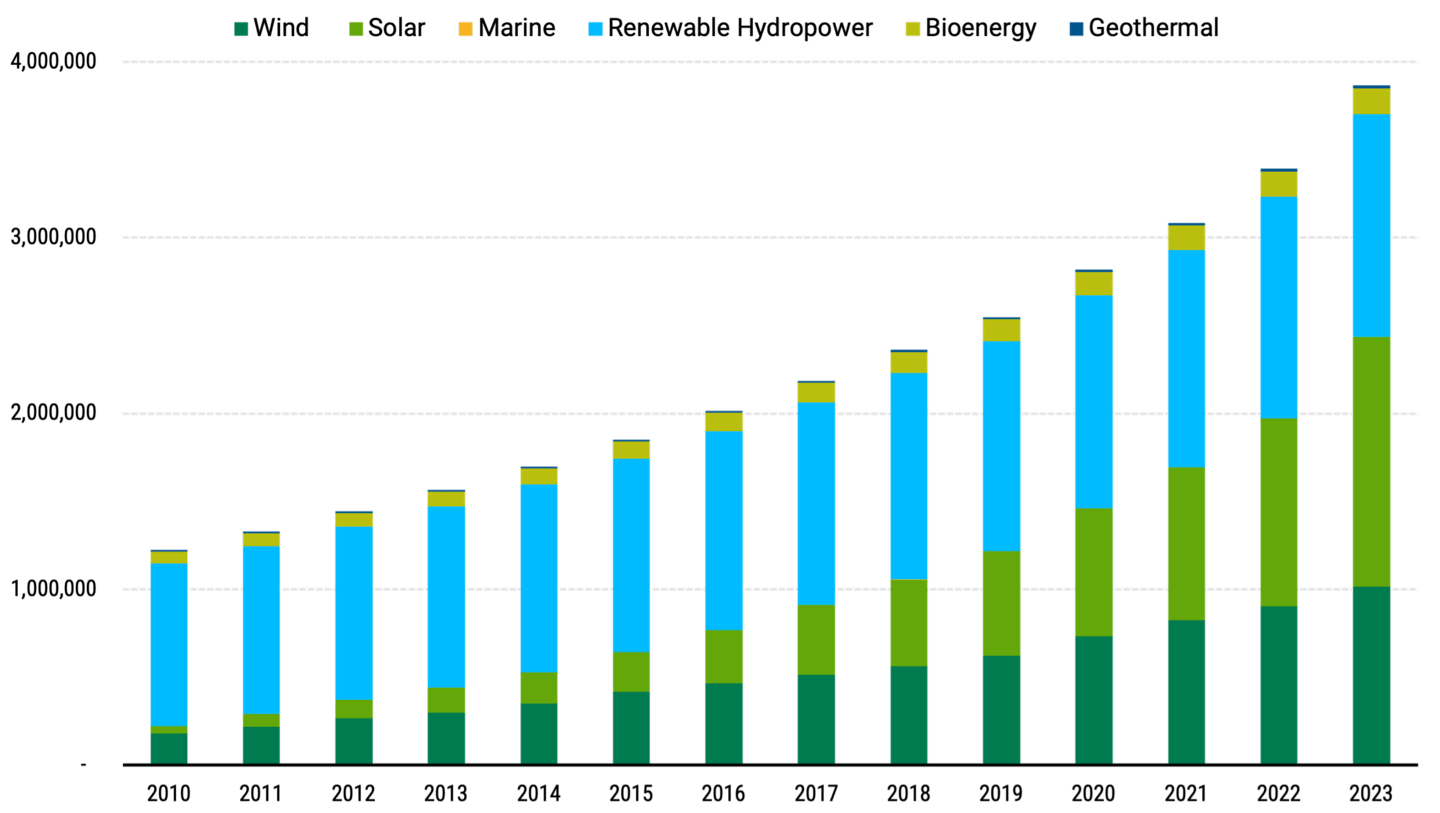

One such approach involves companies developing innovative ways to reduce carbon emissions by providing cleaner energy. The global small-cap universe contains many alternative and renewable energy providers producing solar, wind and geothermal power, which provides a growing portion of the world’s electricity. See Figure 1.

Figure 1 | Solar and Wind Drive Growth in Renewable Energy Capacity

Data from 2010 - 2023. Source: International Renewable Energy Agency (IRENA).

Canada-based TransAlta is one of North America's largest renewable energy producers and one of Canada's largest wind power producers. The company’s transition from coal to natural gas has led to a greater than 66% reduction in emissions since 2015. It has set a target of reaching net zero emissions by 2045 and plans to generate about 70% of its operating earnings from renewables by 2028.2 We believe the company is well-positioned to benefit from growing electricity demand tied to manufacturing, data center growth, and overall electrification.

Infrastructure improvements in the electric power industry, such as more efficient turbines to generate electricity, can reduce costs and enable further investment in making electricity generation and distribution more environmentally sustainable. Small-cap companies are helping to drive innovation and facilitate growth in this area.

Energy Solutions for Data Centers

Data centers consume enormous amounts of electricity. This demand for power has potentially disruptive implications for the environment.

A recent McKinsey report discusses this dilemma, noting that by 2030, data center power consumption in the U.S. alone will likely triple, necessitating a substantial increase in power generation.3

Credo Technology Group Holding improves energy efficiency in data centers by providing high-speed connectivity solutions that deliver improved power and cost efficiency. Credo’s products, including integrated circuits and active electrical cables (AECs), are designed to boost power and cost efficiency as data rates and bandwidth requirements rise.

Credo’s solutions help address data center needs for power and cooling. Its solutions help ease system bandwidth bottlenecks while providing secure and reliable power. The value of the company’s products has translated to a strong market position and healthy revenue growth tied to data center demand.

How Small-Caps Are Shaping the EV Industry

Innovative small companies support the electric vehicle (EV) supply chain globally. These firms design and manufacture many of the sensors, components, cameras and lenses in EVs, as well as much of the essential EV charging infrastructure. The push for secure assisted and autonomous driving programs is also spurring innovation in the components of EV navigation, control and security systems.

Modine Manufacturing designs, manufactures and tests environmentally friendly heat transfer solutions for data centers and the commercial EV market. Its offerings help ensure optimal operation and longevity for EV components, including E-Fan modules with global radiators that significantly enhance performance and durability. Modine’s strong position in commercial EVs has helped to mitigate the challenges of the crowded consumer EV market.

The company’s Airedale cooling technologies help data centers consume less energy while maintaining a stable environment. Airedale was a pioneer in incorporating free cooling technology by using cold outdoor air to chill water in its system. In many regions, its data center solutions are designed to operate in free cooling mode for roughly 98% of the year, delivering hefty energy savings to its customers.

Energy-Efficient Construction Solutions

According to the Organization for Economic Cooperation and Development, approximately one-third of global energy use is attributable to buildings. Finding more energy-efficient approaches to commercial and residential construction is an opportunity for investors, as energy efficiency means cost savings and a reduced environmental footprint. Small-cap companies are leaders in energy-efficient design, sustainable materials and energy-saving equipment and devices.

Better design includes more efficient ventilation, insulation and drainage. Poor air circulation and drafts often contribute to a building’s energy usage. Small-cap companies have taken the lead in reducing energy needs through better approaches to construction, developing much of the technology behind energy-efficient equipment. This includes control, testing and regulation systems for heating, ventilation and air conditioning (HVAC) systems, low-energy water heaters and water pumps that can recycle water, and solar cells for electricity, heating/cooling buildings and heating water.

France-based SPIE is an example of a small-cap firm that helps builders achieve energy savings and comply with increasing governmental regulations related to building codes and HVAC efficiency standards. Its SPIE Facilities and Building Solutions divisions work with customers to improve the energy efficiency of their buildings, providing more environmentally friendly facilities that tenants want.

Small-Caps and Broader Sustainability Innovations

Small-cap firms may have an advantage over larger companies when implementing environmentally sound business processes because they can ease transitions to cleaner energy practices and support compliance with new energy regulations. One way is through circular economy techniques, such as recycling used tires into new athletic shoes or converting wastewater for irrigation and fertilization. Another involves creating systems that reduce environmental impacts by lowering water intensity and reducing packaging materials and waste.

Graphic Packaging, a global leader in consumer packaging, is helping the transition to a more circular, resource-efficient economy. Its packaging products, including PaperSeal™, Boardio™ and KeelClip™, are designed to be recyclable and reduce dependency on fossil fuel-based packaging materials.

These solutions align with consumer expectations for sustainable packaging and help the company’s clients achieve their sustainability goals. Graphic Packaging's commitment to using responsibly sourced renewable tree fibers and achieving high recyclability rates further enhances the sustainability of its products.

Identifying Greenwashing in Small-Cap Companies

Given investor interest in businesses that can profitably improve environmental sustainability, it seems inevitable that some would seek to exploit this. Greenwashing refers to a company’s efforts to tout environmentally friendly products or operations without substantiating these claims or highlighting a green aspect of its business while continuing to engage in other environmentally damaging activities.

A detailed fundamental analysis is key to counteracting greenwashing. American Century believes a bottom-up financial analysis is essential to verify a company’s sustainability claims and potential. This is especially important for small-cap companies with limited analyst coverage.

Analyzing the entire enterprise lessens the chance of greenwashing in one aspect of its business. It is important to note that smaller companies tend to have smaller staffs devoted to investor relations and making ESG-related disclosures. While this challenges investors, having a relatively small staff may lower the risk of greenwashing.

Factors Reducing Greenwashing in Small-Caps

Governments and regulators are cracking down on greenwashing as consumers, investors and other stakeholders are more interested in understanding sustainability risks and opportunities. Investors are also calling for evidence of financial materiality concerning ESG-related disclosures. The more stakeholders call for reliable disclosures, the more likely such disclosures will be refined and regulated.

Requiring these disclosures makes it harder for companies to make unsubstantiated claims about sustainability practices, and calls to coordinate sustainability reporting globally have emerged.

Global Impact of Small-Caps on Sustainability

Globally, small-caps are helping to drive sustainability-related trends that represent opportunities for investors. Because of their size, small-caps may be able to quickly adapt their operations as they identify and pursue opportunities with environmental benefits.

We believe active management and bottom-up financial analyses help identify investment opportunities among small-cap companies that show improving and sustainable business fundamentals. Engaging with management allows us to better understand a company’s approach to managing sustainability-related risks and opportunities and encourages transparency regarding these issues.

Authors

Erin O’Donnell, “Climate Change’s Crippling Costs,” Harvard Magazine, September-October 2024.

TransAlta, “Our Strategy,” Accessed March 6, 2025.

Alastair Green, Humayun Tai, Jesse Noffsinger, and Pankaj Sachdeva, “How Data Centers and the Energy Sector Can Sate AI’s Hunger for Power,” McKinsey & Co., September 17, 2024.

Sustainability focuses on meeting the needs of the present without compromising the ability of future generations to meet their needs. There are many different approaches to Sustainability, with motives varying from positive societal impact, to wanting to achieve competitive financial results, or both. Methods of sustainable investing include active share ownership, integration of ESG factors, thematic investing, impact investing and exclusion among others.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.