Reviving IPOs: Potential Opportunities for Small-Cap Companies

We believe the uptick in IPO activity could reignite interest in small-cap stocks.

Key Takeaways

The IPO market has been relatively dormant over the last two years.

We see improvement in the IPO market, with higher-quality deals in Q1 2024 compared to last year.

We believe an uptick in IPOs could expand the investable small-cap universe and potentially renew interest in the asset class.

Evolution of the IPO Market: Impact on Small-Caps

When we started 2024, we wondered why investors were skeptical about increasing their allocations to small-cap stocks.

One pushback was the declining number of publicly traded small-cap companies due to the recent slowdown in initial public offerings (IPOs).

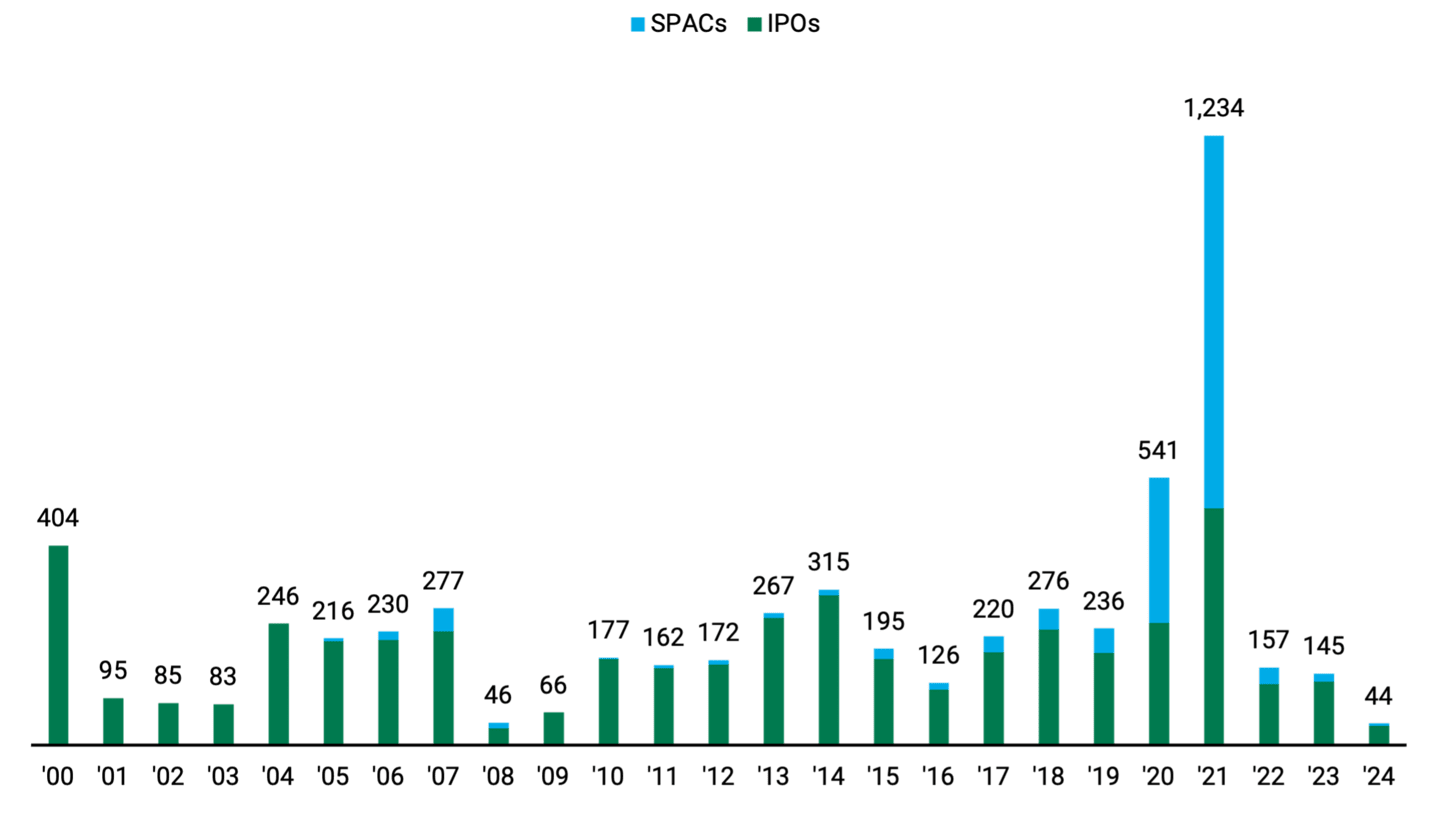

IPOs have slowed materially over the last two years after a record 1,234 were issued in 2021. Figure 1 shows that special purpose acquisition companies (SPACs) largely contributed to this surge.

Figure 1 | The Number of IPOs Has Dwindled Since 2021

IPOs Issued per Year

Data from 1/1/2020 – 4/30/2024. Source: FactSet, Jefferies.

SPACs, or blank check companies, are investment vehicles formed to acquire a private company and make it public. The boom in SPACs ultimately led to only a handful of new publicly traded small-cap companies, and approximately 40% were liquidated by the end of 2023.

At the same time, even traditional IPOs fell off. This caused some investors to wonder if IPOs are dying, leading to a shallower pool of small-cap companies. We don’t think so.

Why the IPO Pause Doesn’t Affect Small-Cap Opportunities

While the boom in private investing has undoubtedly led companies to stay private for longer, we believe the more critical factor in the dearth of IPOs is market-related.

Uncertainty around central bank policy, recession fears and the concentration of market returns in the largest companies caused many investors to decrease their allocations to small-caps. As a result, small-caps currently represent less than 4% of the broader market, the lowest level since the 1930s, according to Jeffries.

Our answer to the “lack of publicly traded companies” pushback is twofold:

Despite fewer IPOs, the small-cap pond remains deep, with more than 1,500 publicly traded companies between $1 billion and $8 billion in market cap.

IPOs aren’t dead. We believe the snoozy IPO market could awaken with a jolt if we get clarity around central bank policy and a more stable economic outlook. These conditions could stimulate investor interest in small-caps and re-open the IPO window.

Strong Start to 2024 for Small-Cap IPOs

Approaching mid-2024, the IPO market has shown signs of life, as evidenced by several higher-quality companies pricing successful IPOs. The proceeds raised are also up significantly.

Ernst & Young reported that the U.S. IPO market raised $8.7 billion in the first quarter of 2024, compared to $2.6 billion in the same quarter the year before, despite roughly similar deal volume.

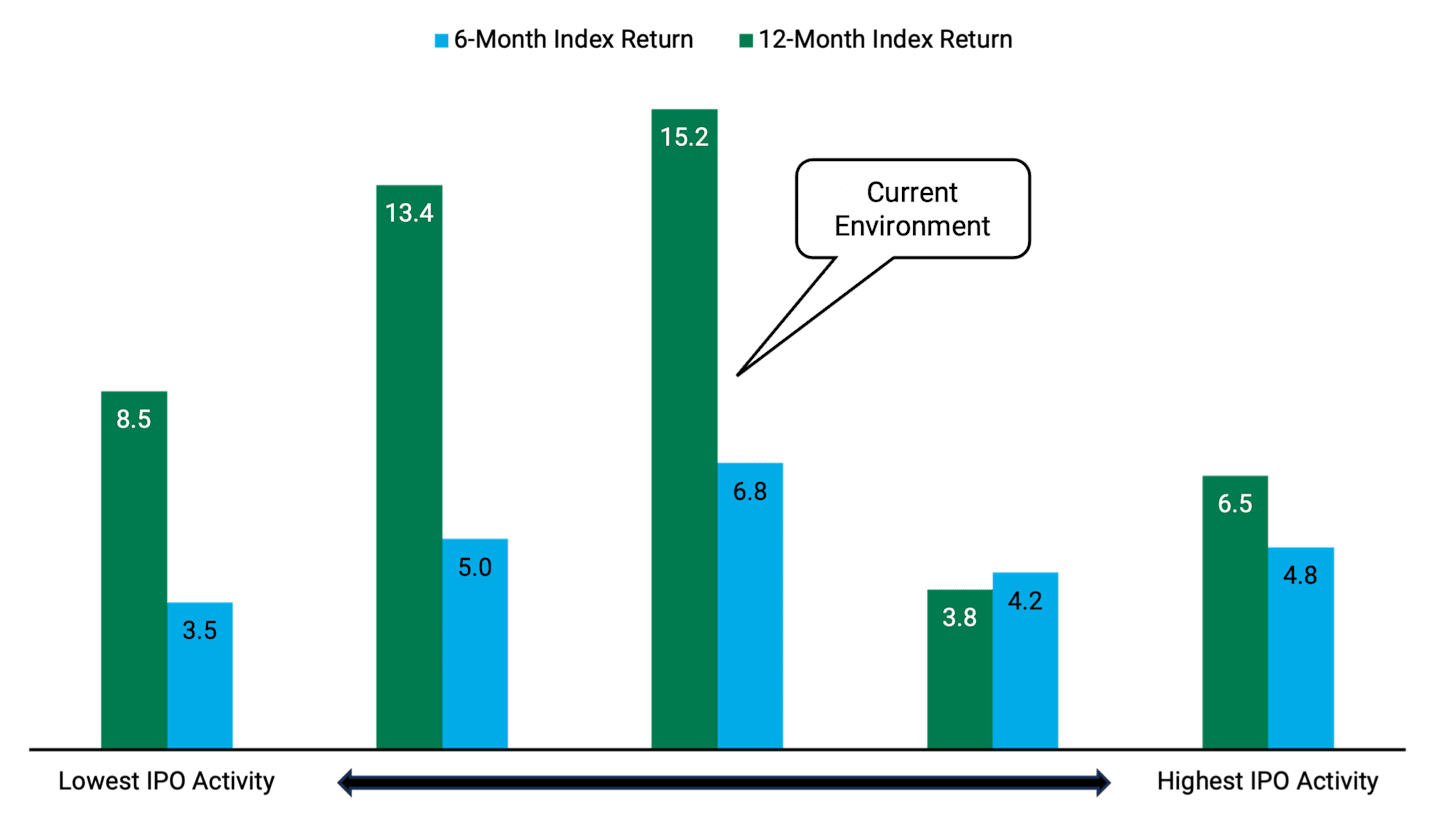

In Figure 2, we show the performance of the Russell 2000® Index from periods of the slowest growth in IPO issuance to the highest. The data shows that as year-over-year IPO activity accelerates off a low base, small-cap performance has improved. We believe an increase in IPO activity and improving small-cap performance indicates a market where investors are more willing to take on risk.

We also note that IPO issuance can accelerate to a point where small-cap performance has historically cooled. We hypothesize that this reflects lower-quality IPOs coming to the market quickly to take advantage of the hot issuance activity.

Over the last two years, IPO activity has been relatively idle. But as Figure 2 shows, the IPO market has advanced into an environment where, historically, small-cap performance has improved.

Figure 2 | As IPO Market Heats Up, Small-Cap Performance Typically Follows

Russell 2000 Index Return (%)

Data from 1/31/1997 - 3/31/2024. IPO activity is based on quintiles of monthly observations of the year-over-year change in IPO issuance. Source: FactSet, Bloomberg, FTSE Russell, Jefferies.

Our 2024 Outlook for Small-Cap Stocks and the IPO Market

We believe that the tight conditions that hampered IPO activity over the last two years — such as steep interest rate hikes and the threat of recession — have eased. This could pave the way to accelerating IPOs, potentially led by high-quality companies going public.

We think this activity shows that IPOs are, in fact, not dead and could help small-caps in two ways:

Institutional investors have money locked up in private equity or venture capital investments that could result in liquidity events for investors when these investments go public.

More IPOs increase interest in small-caps because there are more publicly traded companies. Active managers who participate in IPOs and choose wisely may have the opportunity to participate in the initial outperformance.

A pair of examples in March stand out to us.

Astera Labs (ALAB), an artificial intelligence and cloud infrastructure firm, priced its shares at $36 when trading started on March 20. Its shares shot up 72% on the first day of trading.

The next day, the social media platform Reddit (RDDT) went public, with shares priced at $34, before closing up 50% on the trading day.

The momentum generated by these two higher-profile small-cap companies carried the IPO market into April. Loar Holdings (LOAR), an industrial aerospace and defense company, went public with a 70% increase on the first day.

On May 1, luxury cruise line company Viking Holdings (VIK) was up more than 10% on its trading debut.

Large investment banks have cited robust IPO pipelines for the second half of 2024 and into 2025. We don’t expect a return to the record number of IPOs driven by SPAC mania in 2021. Still, we believe the accelerating number of higher-quality deals in 2024 could benefit the small-cap asset class.

Authors

Senior Investment Director

Explore Our Small-Cap Capabilities

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.