A Fiscal Triple Feature

Approving a new federal budget, raising the government’s debt ceiling and making decisions to extend the nation’s tax law all await the new Republican regime. There’s a lot at stake.

Key Takeaways

The honeymoon will likely end quickly for the new Congress and President-elect Donald Trump as they tackle key fiscal issues.

Approving a fiscal-year budget, raising the federal debt ceiling and negotiating tax law will be major issues in 2025.

The outcomes of these issues have critical implications for financial markets and the global economy.

Incoming Republican majorities in Congress have promised various policy changes for the federal government. But first, they must address a trio of fiscal challenges to keep the government running while figuring out how to fund it.

When Congress failed to produce a 2025 fiscal year budget, it approved a resolution to keep the government operating through late December. It must implement additional stopgaps to avoid the first government shutdown in six years.

After Congress reconvenes and Trump takes office in January, they must create a budget. However, even before that, Congress must tackle the federal debt ceiling, which was suspended in early 2023. The current ceiling expires on January 1, and how Congress responds will have significant implications for global markets and U.S. debt issuance.

The amount of debt the U.S. carries and how the Treasury funds the fiscal 2025 budget largely depend on one piece of legislation. The 2017 Tax Cut and Jobs Act (TCJA), which revamped the tax code, is set to expire in 2025. How Republicans extend or replace it could shape the trajectory of federal deficits and debt for years, especially in an era of higher interest rates.

The Path to 2025 Fiscal Challenges

Debt Ceiling

Limits on the amount of debt the federal government can incur have been in place since 1917. These caps gradually increased for almost a century. However, in 2013, mounting debt levels led Congress to suspend the debt ceiling for the first time.1

Since then, seven suspensions have followed, with the latest starting in June 2023, five months after the government reached its $31.4 trillion debt ceiling. Congress suspended the debt limit to avoid a sovereign default, a catastrophic financial event the U.S. has never experienced. In the subsequent 18 months of “limitless” spending, the federal debt skyrocketed to more than $36 trillion.

The current debt ceiling suspension expires on January 1, two days before the new Congress convenes and 19 days before Trump takes office. Failing to lift the debt ceiling theoretically could halt the Treasury’s interest payments, triggering a default. However, even if Congress fails to reach a debt ceiling deal by January 1, the Treasury can avoid a default by:

Using its cash reserves to make interest payments.

Implementing congressionally authorized “extraordinary measures” that allow Treasury officials to use cash from other sources to fund interest payments.

Federal Budget

In a not-so-unusual turn of events, Congress failed to approve a federal budget in time for the new fiscal year starting on October 1. Instead, it passed a short-term spending package six days before the fiscal year began, keeping the government running until December 20.2

Congress will likely approve another short-term package around that time to allow Trump and the incoming Republican-dominated Congress to implement their spending priorities. Failing to approve a continuing resolution would lead to a government shutdown.

Congress has narrowly averted a shutdown a half-dozen times in the past year. It didn’t approve a fiscal 2024 budget until six months after fiscal 2023 ended. The last shutdown, the longest in history, occurred from December 22, 2018, through January 25, 2019.

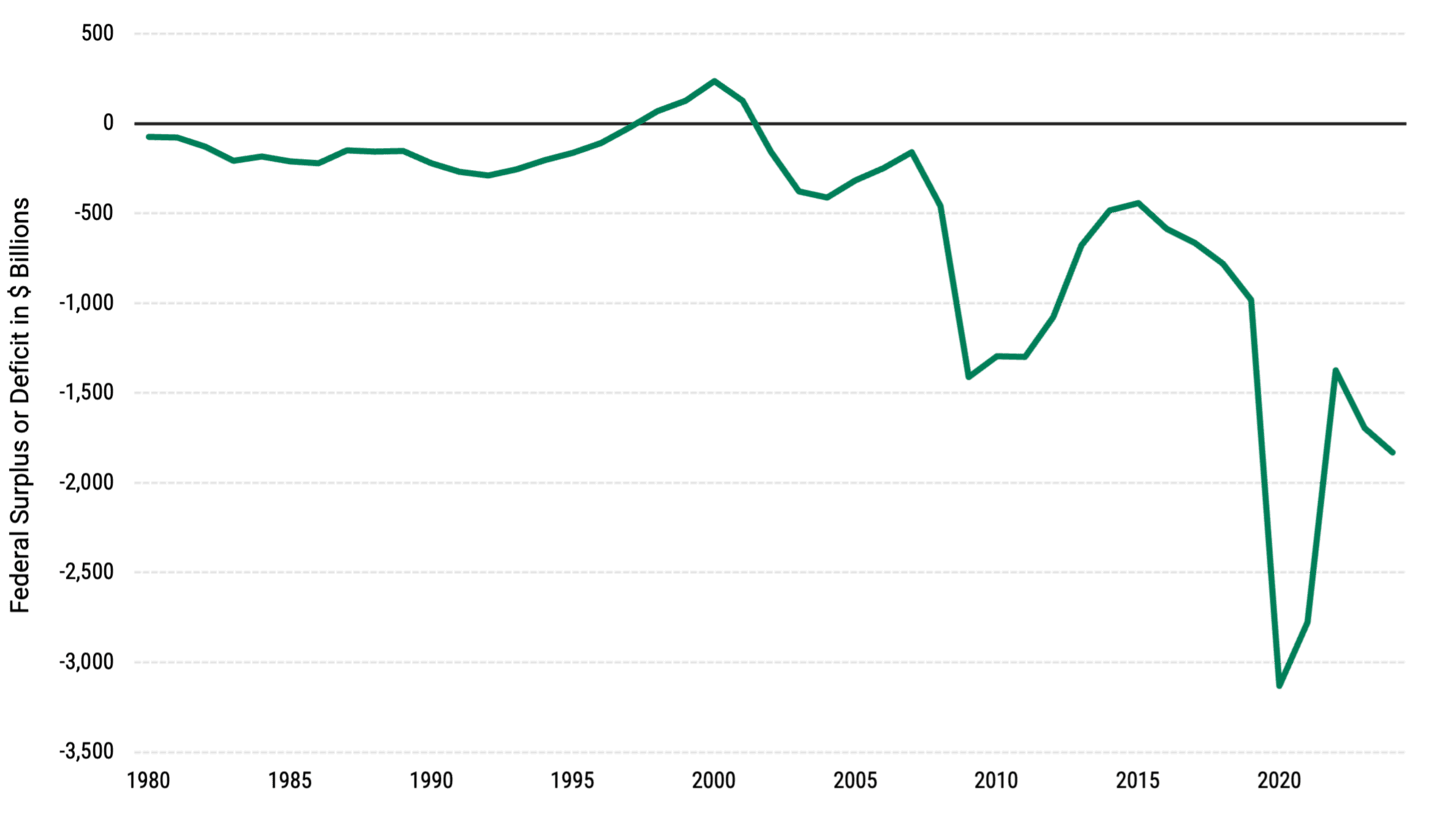

In the latest fiscal year, the federal government ran a budget deficit of $1.8 trillion, the most of any year aside from the COVID-19 pandemic. It has not had an annual budget surplus since fiscal 2001.3

2017 Tax Cut and Jobs Act

Approved in December 2017, the TCJA substantially lowered corporate tax rates, increased the standard deduction for individuals and broadened tax brackets for these filers. It expires at the end of 2025.

Since Congress enacted this law, the annual federal budget has almost tripled, excluding the fiscal 2020-21 pandemic years. That increase occurred despite a 17% increase in federal tax revenue.4

Future Fiscal Policies: What to Expect in 2025

Trump and congressional Republicans have pledged to extend many of the 2017 Tax Act’s provisions. They have also pledged to decrease corporate taxes further, eliminate taxes on overtime pay and tips and expand child tax credits.

Extending or revamping existing tax law will largely inform how Republicans shape the 2025 fiscal budget. Likewise, it’s the key factor in how much they raise the debt ceiling after the existing suspension expires.

The debt ceiling will likely increase because Republicans plan to cut taxes by a larger margin than they reduce spending. That would require the Treasury to issue more debt to cover the difference.

Sen. James Lankford, R.-Okla., Wall Street Journal, November 11, 2024

That virtual certainty has led congressional Republicans to contemplate what Washington insiders call “The Number,” the maximum budget deficit increase they are willing to accept.5

House Republicans intend to introduce a tax bill in the first 100 days of the new session. According to the Wall Street Journal, they generally prefer more spending cuts than Senate Republicans.

Meanwhile, the Senate may try to use reconciliation to approve a budget, which requires a simple majority vote. Democrats used reconciliation for budget bills in 2021 and 2022.

What’s at Stake: Potential Economic and Market Consequences

Trump and Republicans plan to increase the budget deficit — already at $1.8 trillion — and the federal debt, even as many investors desire the opposite.6

Figure 1 | The U.S. Federal Deficit Currently Stands at $1.8 Trillion

Data from 9/30/1980 - 9/30/2024. Source: Federal Reserve of St. Louis.

In a recent Barron’s survey, 50% of investors said debt reduction should be the highest priority for policymakers in the next presidential administration.7 Reforming Social Security and Medicare and their troubling financial trajectory ranked second at 14%.8 Trump, however, has pledged large tax cuts without Social Security or Medicare reform.9

The federal debt has already surpassed U.S. economic output, equaling 120% of the nation’s total economic output. That’s up from 65% just before the Global Financial Crisis. Over the past three years, federal debt has increased by 29% to $36 trillion — $4.6 trillion more than the last debt ceiling.10

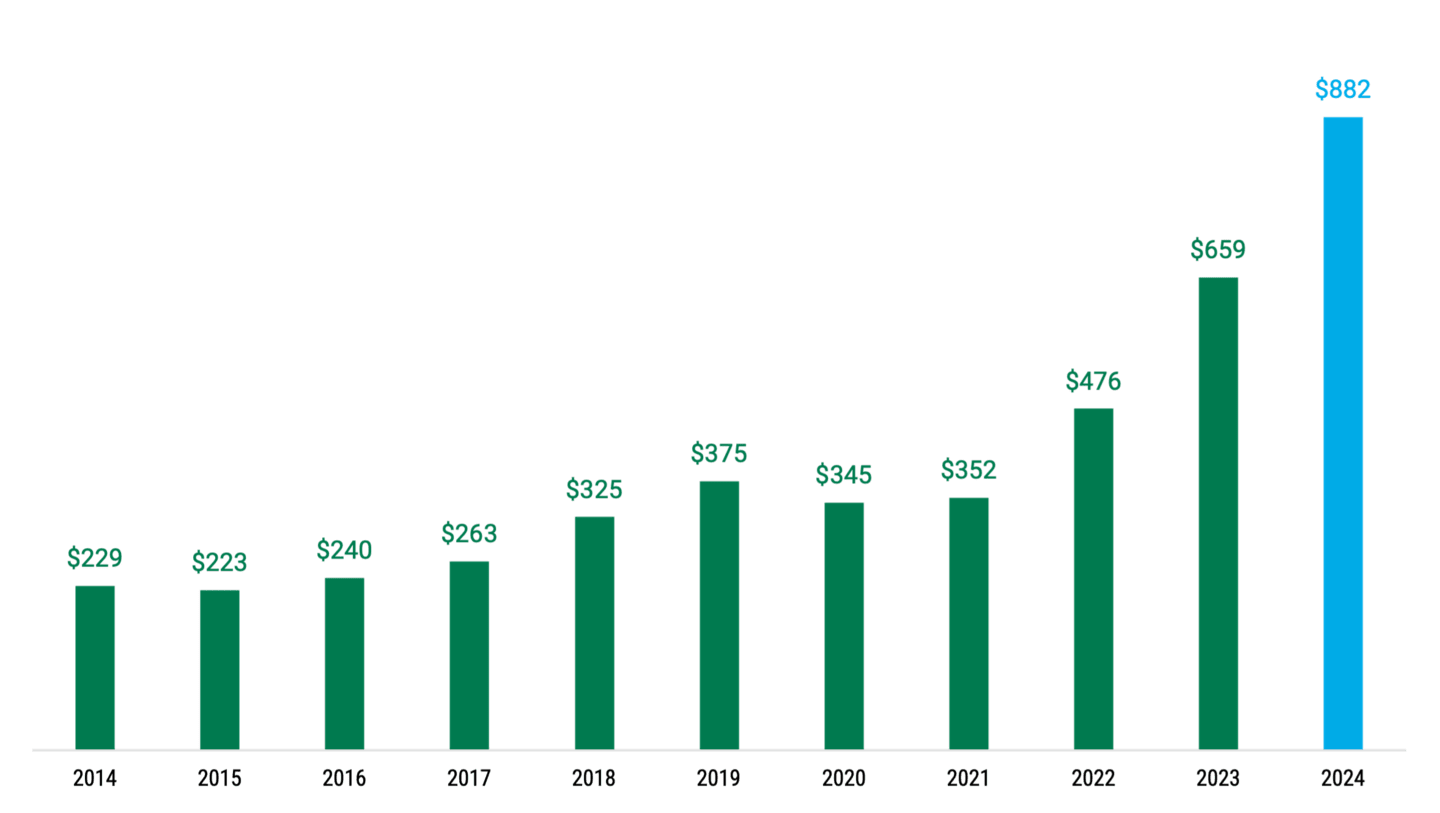

Interest payments on this debt rose even faster, almost tripling between fiscal 2020 and fiscal 2024, partly due to rising interest rates.11 Federal interest payments now exceed spending for Medicare and national defense.

Figure 2 | Net Interest Costs Over the Past Decade

Net Interest in Billions

Data from 1/1/2014 – 9/30/2024. Source: Department of the Treasury, Committee for a Responsible Federal Budget.

The twin debt and deficit woes could get worse. According to the Committee for a Responsible Federal Budget, Trump's policy plans could boost federal debt by an additional $7.9 trillion in the next decade.12 This would widen deficits even more.

By 2035, the government would raise an estimated 61 cents in revenue for every dollar it spends, compared with 73 cents for every dollar it spent in the latest fiscal year. And that would require the Treasury to issue about $2 trillion in new debt each year.13

Analyzing Market Implications of 2025 Fiscal Changes

The increased debt issuance threatens to boost interest rates over time. That’s because Treasury yields would likely have to rise to entice investors to keep buying U.S. government Treasury bills, notes and bonds. Various studies have found that intermediate-term yields would likely have to rise 80 to 100 basis points (bps) for investors to buy the additional issuance.14

In addition, many economists and analysts worry that Trump’s plan to implement import tariffs would reignite inflation, placing further upward pressure on interest rates. Stock and bond investors tend to dislike higher rates, which, in turn, tend to limit economic growth.

In the near term, a congressional battle over the debt ceiling could lead to lower Treasury yields. As counterintuitive as this scenario seems, we’ve seen it in the past.15 A debt ceiling showdown in 2011 sparked default fears, a stock market correction and a flight to quality into Treasuries.

Treasury yields were already heading lower ahead of 2011’s budget/debt ceiling crisis. And they continued to decline even after Standard & Poor’s issued its first downgrade of U.S. sovereign debt on August 5, 2011.

Given these uncertainties, Treasury yields have been volatile in recent months. Investors pushed yields markedly higher before the election only to drive them lower in subsequent weeks. Since then, questions about inflation, tariffs and Fed and fiscal policy have fueled wide swings in Treasury yields.

Navigating 2025 Fiscal Policies

In our view, making long-term portfolio decisions based on short-term policy variables is risky. Such variables can change quickly at the whims of legislative participants.

However, given the current political climate, it’s important to recognize the potential implications for interest rates and market volatility. Negotiations concerning the budget, tax bill extension and debt ceiling should help determine the scope of those implications.

Nevertheless, we believe maintaining a long-term viewpoint, regardless of political machinations, remains the most prudent investment approach.

Authors

Committee for a Responsible Budget, “Q&A: Everything You Should Know About the Debt Ceiling,” May 5, 2023; Congressional Research Service Insight, “Debt Limit Suspensions,” November 14, 2023.

Kaia Hubbard, “Congress Passes 3-Month Funding Extension to Avoid Government Shutdown,” CBS News, September 25, 2024.

U.S. Treasury Fiscal Data, “What Is the National Deficit?” updated November 29, 2024.

U.S. Treasury Fiscal Data, “How Much Revenue Has the U.S. Government Collected This Year?” updated November 29, 2024.

Richard Rubin, “Republicans First Tax-Cut Challenge: How Much Red Ink Can They Live With?” Wall Street Journal, November 11, 2024.

Ramu Thiagarajan, Hanbin Im, and Prashant Parab, et al., “Who Will Buy the Oncoming Surge of Treasuries: And at What Price?” State Street, August 2024.

Ramu Thiagarajan, Hanbin Im, and Prashant Parab, et al., August 2024.

Paul R. La Monica, “Where the Stock Market Is Headed Next, According to Our Exclusive Investor Survey,” Barron’s, October 25, 2024.

Richard Rubin, Wall Street Journal, November 11, 2024.

Richard Rubin, Wall Street Journal, November 11, 2024.

Committee for a Responsible Federal Budget, “Interest Costs Have Nearly Tripled Since 2020,” November 20, 2024.

Committee for a Responsible Federal Budget, “The Fiscal Impact of the Harris and Trump Campaign Plans,” October 28, 2024.

Congressional Research Service, Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act” (TCJA, P.L. 115-97), updated November 13, 2024.

Ramu Thiagarajan, Hanbin Im, and Prashant Parab, et al., August 2024.

CME Group, “Debt Ceiling: Lessons from the 2011 Budget Debate,” April 24, 2023.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.