2025 Global Fixed Income Outlook

Second Quarter

Key Takeaways

U.S. economic growth will likely slow as interest rates, inflation, tariffs and government efficiency initiatives create headwinds.

We believe the fixed income market offers compelling income and total return opportunities, restoring the role bonds have traditionally played in diversified portfolios.

Patience Remains Key as Markets Digest Effects of Trump Agenda

Amid market uncertainty, a turbocharged news cycle and a barrage of Trump administration policy initiatives, we turn to a time-tested adage: Patience is a virtue.

Some market observers believe the financial markets remain blindly optimistic and oblivious to mounting risks, particularly from tariffs. Others carefully digest all the commotion, believing the eventual outcome will likely be benign. We are gradually moving toward the more measured latter view.

Economic Outlook: Potential Slowdown Before Reacceleration

We still believe the interest rate and inflation backdrops will cause U.S. economic growth to slow through at least the first half of the year. Additionally, we believe the Department of Government Efficiency’s (DOGE’s) work could curb near-term growth. However, we continue to believe the U.S. economy will fare better than other developed countries struggling with weak growth and persistent inflation.

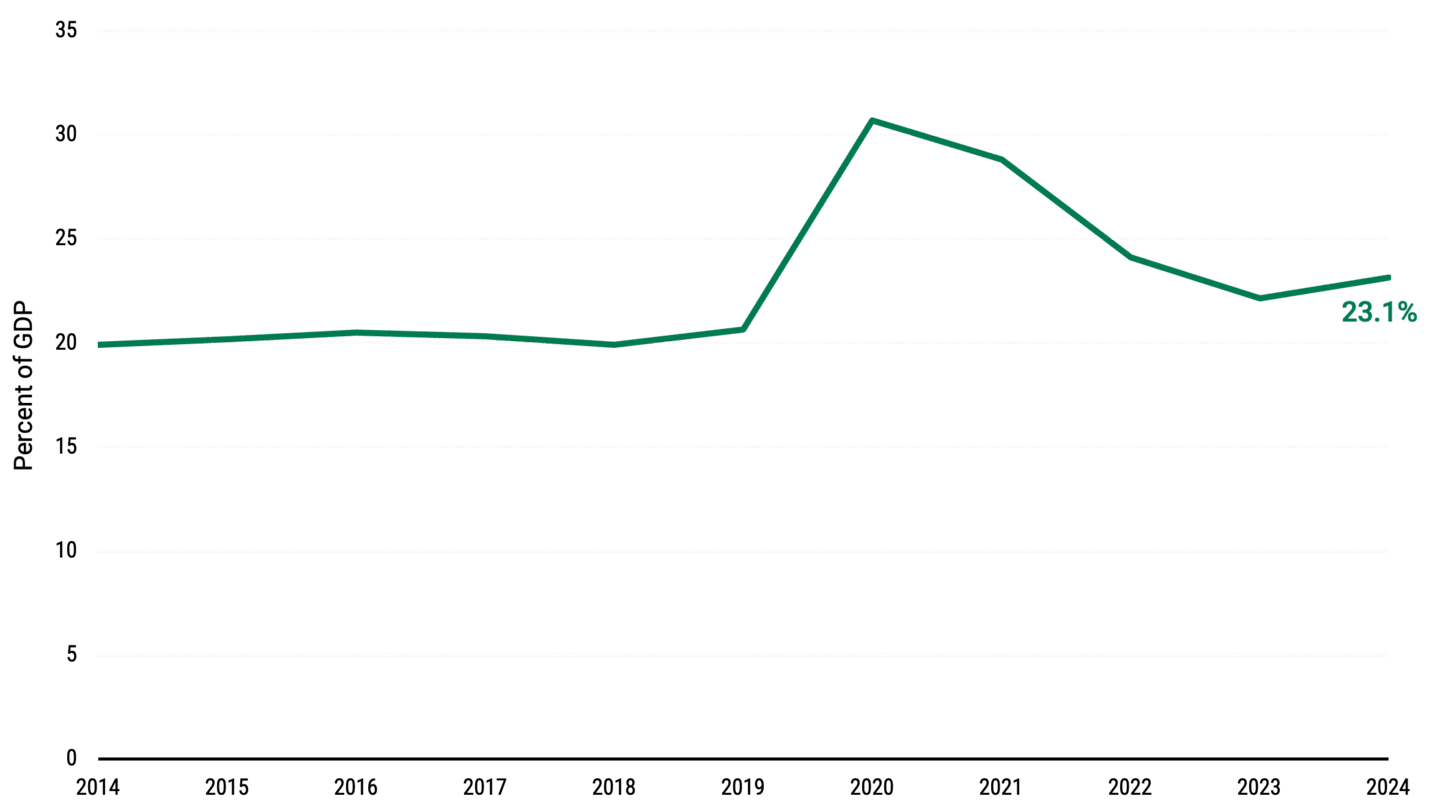

We believe those “blindly optimistic” market participants may be overlooking a potential growth obstacle. Federal government spending has been a significant component of U.S. gross domestic product (GDP) in recent years, as Figure 1 illustrates. Accordingly, DOGE-related spending cuts could pressure the nation’s GDP, at least in the short term.

Figure 1 | Federal Spending Has Consistently Accounted for More Than 20% of GDP

Federal Net Outlays as Percent of GDP

Data from 1/1/2014 – 12/31/2024. Source: Federal Reserve Bank of St. Louis, U.S. Office of Management and Budget via FRED®.

U.S. tariff policy also poses a near-term threat to inflation, the domestic economy and global growth. Tariffs likely will affect corporate revenues outlooks and economic growth rates, particularly in the short term.

We expect the Trump administration to use tariffs as negotiating tools to secure favorable trade deals, security provisions and other agreements for the U.S. Implementing tariffs will also provide a means for the administration to raise revenues to help pay for tax cuts. Furthermore, the impact on inflation may not be as dire as some market participants fear, given that some tariffs may restrict demand and slow spending.

Fed on Hold, Potential Easing Ahead

Recent comments from Federal Reserve (Fed) members suggest that policymakers are comfortable taking a backseat to the Trump agenda rollout. Also, with the economy still expanding, the labor market healthy and inflation above target, aggressive rate cuts remain less likely unless the economy suddenly declines. Fed officials appear committed to a cautious, wait-and-see approach that affords the central bank maximum flexibility.

Of course, that flexibility eventually may lead to more interest rate cuts than we currently expect. The pace of the economy’s slowdown and the magnitude of DOGE spending cuts will likely influence the Fed’s strategy. We expect the Fed to cut interest rates by half a point this year, but we believe this forecast could easily double by year-end.

While short-term uncertainties persist, it’s important not to lose sight of the nation’s long-term strength and opportunities. We remain optimistic that innovation, business incentives and government deregulation will power attractive long-term U.S. economic growth prospects.

Bonds Recapture Their Historical Role

After enduring early-year volatility, we believe the current fixed-income market offers compelling income and total return opportunities. These features have restored the role bonds have historically played in well-diversified portfolios.

Yields remain near multiyear highs, boosting the appeal of investing for income potential. Meanwhile, interest rates may decline as the economy slows, boosting bonds’ price-appreciation possibilities.

We continue to find opportunities across fixed-income sectors. In our view, select securitized, corporate and emerging markets securities are particularly appealing from income and valuation perspectives. Given near-term uncertainties, we believe maintaining a shorter duration and higher-quality strategy remains prudent, but extending duration may make sense when rate cuts appear imminent.

U.S. Government Bonds

Given policy volatility and an uncertain near-term growth path, we see Treasuries in a lower range than in the first quarter. We expect the Fed to remain patient in the near term amid tariff-related inflation uncertainty before easing again later in the quarter. The Fed remaining on hold should keep the curve from renormalizing and steepening meaningfully. Ultimately, we believe the curve will normalize, and we expect to add exposure in short and intermediate maturities when a renewed rate-cutting cycle resumes. Treasury inflation-protected securities (TIPS) have benefited from increased inflation expectations related to trade policy and appear somewhat rich in fundamentals. We would only look to add exposure if valuations improve.

U.S. Securitized Assets

We still favor the agency mortgage-backed securities (MBS) sector, particularly as the yield curve continues to steepen. Additionally, we believe this sector offers relative value compared to others due to its attractive income, high quality and relative protection from broader market volatility. Among credit-sensitive subsectors, we believe select commercial mortgage-backed securities (CMBS) offer value. Additionally, growth prospects for digital infrastructure may bode well for asset-backed securities (ABS) in this space. Overall, we favor subsectors with strong technical backdrops, solid fundamentals and structural protections.

Municipal Bonds

We believe the relatively high quality and longer duration of municipal (muni) bonds should aid the asset class as the economy slows. We expect muni supply to drive the asset class’s growth, which has lagged other fixed-income sectors. Municipal credit fundamentals should remain stable, largely due to reserve fund balances and conservative budgeting. With Trump’s tax proposals taking center stage, we will assess and monitor potential outcomes and the implications for municipal bond demand. In the meantime, we still favor higher-quality issuers and sectors and believe security selection remains crucial to performance.

U.S. & Non-U.S. Corporate Bonds

Across the U.S. and non-U.S. corporate sectors, we continue to focus on high-conviction bonds with attractive valuations. We expect event risk, particularly M&A activity, to continue in 2025, which may lead to improving valuations and opportunities. Accordingly, we favor borrowers with positive event risk and catalysts for spread tightening. Solid fundamentals and limited negative event risk in the banking sector support our overweight positions in the U.S. and Europe. Bottom-up security selection continues to drive our exposure among high-yield corporates in the U.S. and Europe, where our focus remains on BB- and B-rated securities. We’re also finding opportunities among issuers refinancing their debt.

Money Markets

Given ongoing volatility in Fed rate-cut expectations and tightening credit spreads, we favor reinvesting into ultra-short-term tenors (securities with one- to four-month remaining maturities). We also prefer floating-rate coupons, which we believe offer advantages to fixed-rate coupons of the same tenor. Ahead of this spring’s debt-ceiling debate, we will look for excess spreads from Treasury bills.

Emerging Markets

We remain cautious amid stretched valuations and global trade policy uncertainty. However, we are still finding pockets of value and positive idiosyncratic stories where credit fundamentals have improved and valuations have lagged. We broadly favor countries and corporates with BBB and BB credit ratings, attractive valuations and solid credit fundamentals. We also continue to rotate among low-grade sovereigns where spread levels remain attractive. On the local rates side, we’re cautiously adding exposure. Local fundamentals remain supportive, but the threat of higher fiscal spending in the U.S. and fewer Fed rate cuts warrants caution. We have increased exposure to EM currencies due to recent improvements in technical and fundamental factors. However, we remain cautious over the medium term due to tariff risks, deregulation, and domestically centered tax and fiscal programs that could strengthen the U.S. dollar versus EM currencies.

The letter ratings indicate the credit worthiness of the underlying bonds in the portfolio and generally range from AAA (highest) to D (lowest).

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, bond prices fall. The opposite is true when interest rates decline.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

©2025 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.