2025 U.S. Equity Outlook

Second Quarter

Key Takeaways

Growth Stocks: Significant innovation and access to artificial intelligence (AI) could continue to spur earnings growth, but high valuations and the market's narrowness has left many large companies susceptible to volatility.

Value Stocks: In a concentrated market, value stocks in high-yield sectors like consumer staples, real estate and utilities have offered what we think are solid returns and potentially attractive dividends.

Growth Stocks

Balancing Optimism and Market Volatility

We expect large-cap growth stocks to continue benefiting from innovation and AI advancements in 2025. However, as we’ve experienced in recent months, high valuations and market concentration pose risks, making the landscape potentially volatile.

We think active management and careful stock selection could be key strategies for navigating these challenges.

Key Innovations Driving Growth Beyond AI

While AI remains a significant growth driver, other areas of innovation are also crucial. Investments in business continuity, supply chain resilience, digital transformation and cybersecurity are expected to bolster economic growth. Trump administration policies supporting technology, infrastructure and onshore manufacturing, along with a healthier financial sector, could further enhance growth prospects.

The AI-driven rally, initiated by the launch of ChatGPT in 2022, has focused on infrastructure such as chipmakers and data centers. As AI efficiencies spread, more companies are expected to benefit. For instance, Nvidia reported that a significant portion of its data center revenue now comes from AI operational uses rather than merely training AI models, indicating a shift toward practical applications of AI technology.

DeepSeek’s Impact on AI Infrastructure Spending

The introduction of DeepSeek's R-1 model, which the Chinese start-up company developed quickly and at a lower cost than other well-known AI models, may reduce the need for the latest chips and extensive training. This development raises questions about the need for massive investment to build more data centers.

Consider the Trump administration's recently announced $500-billion data center project and significant AI spending by companies like Microsoft and Meta Platforms. It would be hard to justify these investments in AI infrastructure if leading-edge models can easily and quickly be replicated at a fraction of the cost.

What Are the Risks?

High valuations make the market susceptible to volatility. Any news that threatens the outlook for AI investments or alters expectations for growth, inflation and interest rates could cause stocks to stumble. Policy uncertainty with the new Trump administration and geopolitical risks, such as tensions with China and the war between Russia and Ukraine, add to the potential for market instability.

Despite a decline in inflation since 2022, higher prices remain a concern. Investors worry that the new administration's labor, trade and fiscal policies could be inflationary, leading to higher financing costs and weighing on economic growth.

The Importance of Stock Selection in 2025

In this environment, we believe high-quality businesses with agile management teams will likely fare better. Active stock selection could be advantageous, as not all companies will navigate the challenges equally well.

In our view, investing in well-managed, competitively advantaged companies that can sustain growth and profitability may offer the best strategy for dealing with market uncertainties.

Value Stocks

Searching for Returns in a Concentrated Market

Large-cap growth stocks, particularly the group known as the Magnificent Seven, have spent the last two years on stilts, standing taller than others and dazzling investors with their performance from great heights.

But their footing is unsteady, making them vulnerable to risks that could trip them and cause their value to fall.

For example, earlier this year, the Chinese startup DeepSeek caused a $1 trillion rout among high-flying technology stocks by merely announcing the development of a cheaper AI model.1 Meanwhile, Nvidia beat earnings estimates but disappointed investors because its results didn’t surpass expectations by a large enough margin.

Closer to the ground is a collection of dividend-paying and low-beta stocks that receive less attention. These stocks are less sensitive to market fluctuations, and as value managers, we believe they may likely offer solid returns in today’s highly concentrated market.

The Impact of a Prolonged AI-Fueled Rally

As AI-related stocks shot up these last two years, other stocks have been out of favor and left behind. This has resulted in high-yielding and low-beta stocks trading at historically cheap prices. This frothy market seems to have undervalued these stocks and had unreasonably low expectations for their performance.

Given their lofty valuations today, we think it will be challenging for the stocks that led the market for the last two years to generate meaningful price returns in the future. On the other hand, dividends have accounted for 31% of the S&P 500® Index’s returns since 1940.2

Identifying High-Yield Opportunities in 2025

It’s among sectors where value stocks largely reside where investors can also find higher-yielding stocks.

Consumer staples stocks, for example, are among the cheapest in the market. By selling products people need rather than things they want, consumer staples companies have tended to grow earnings slower than the broader market while experiencing less volatility. Many companies in this sector pay attractive dividends, at least partially offsetting any shortcomings in stock price gains.

Conagra Foods, for example, has an annual dividend yield of 5.5% (at time of publication), compared to the S&P 500’s 1.27%.

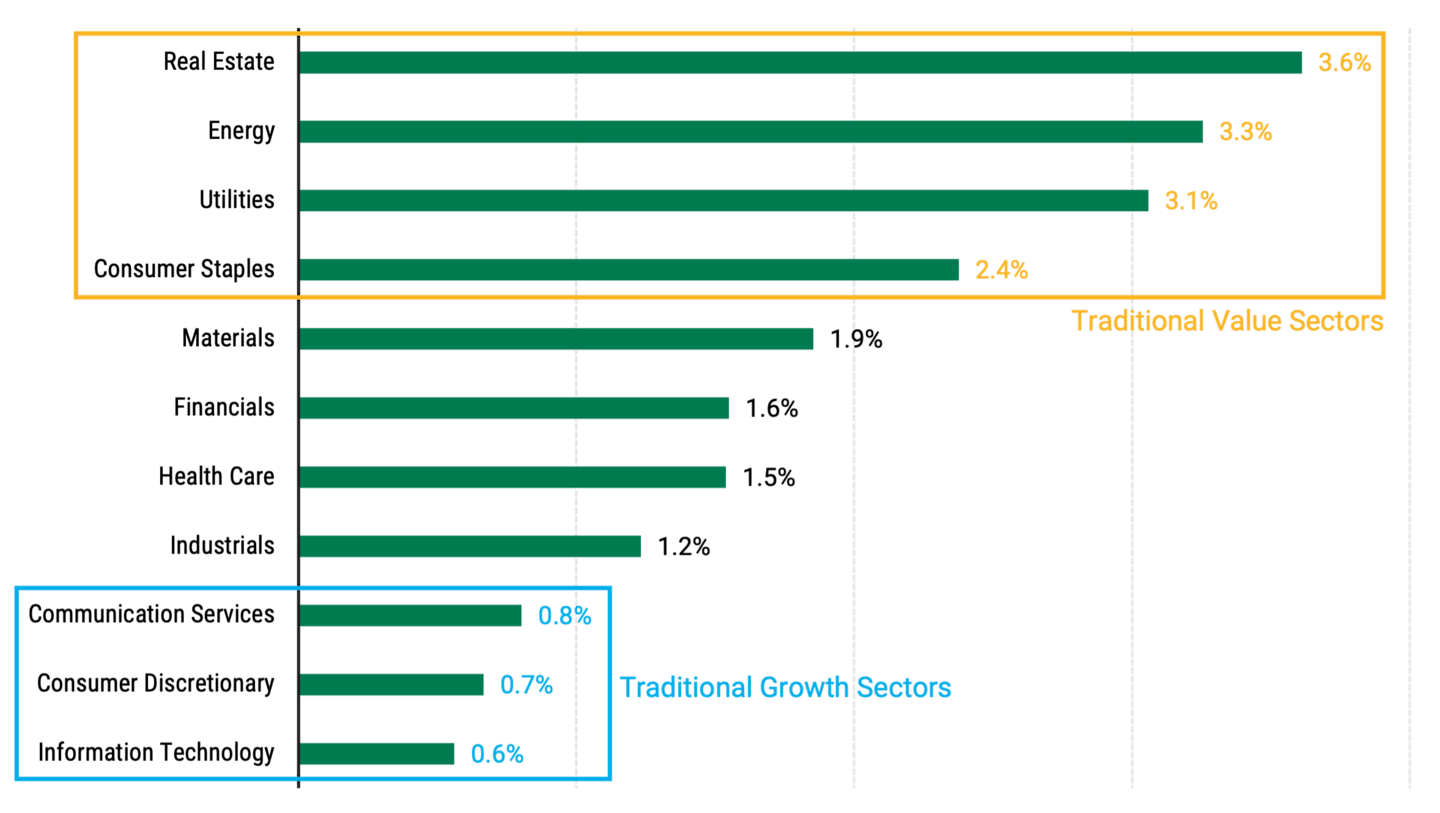

Other attractively valued sectors where we find opportunities in dividend-paying stocks include real estate, energy and utilities. As shown in Figure 1, the dividend yield in these sectors is higher than in traditional growth sectors such as information technology and consumer discretionary.

Figure 1 | Traditional Value Sectors Have Historically Offered Higher Yields

Dividend Yield

Data as of 12/31/2024. Source: FactSet.

Higher-yielding sectors, which lagged technology and other growth-oriented sectors over the last two years, have been starting to perform better as the economic outlook becomes less certain. Inflation is ramping up again, and geopolitical risks continue to widen. U.S. policy shifts, particularly the threat or implementation of tariffs, are hard for trading partners and investors to navigate.

Navigating a Shaky Market Foundation

We haven’t seen a market this concentrated since the dot-com bubble of the late 1990s and early 2000s. Large-cap growth stocks have traded at a 40% premium to their average since 2002, while large-cap value stocks have traded at a relatively modest 14% over the same span.

It’s not for us to call a market correction. However, history shows that periods of volatility that tend to follow extreme market concentration can lead to outperformance for overlooked asset classes. Value stocks fared better than growth stocks after the dot-com bubble burst. Small-cap stocks also outperformed large-cap stocks. These asset classes are home to many dividend-paying stocks.

Looking ahead, we believe the price returns for last year’s market leaders will be relatively muted. Conversely, attractively priced, higher-yielding stocks less sensitive to market movements may be well positioned.

¹ Natalia Kniazhevich, Esha Dey, and Elena Popina, “AI-Fueled Stock Rally Dealt $1 Trillion Blow by Chinese Upstart,” Bloomberg, January 26, 2025.

² Morningstar.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, bond prices fall. The opposite is true when interest rates decline.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.