Strategy Inception

1997

Strategy AUM (USD)

$2.28 B

As of 03/31/2025

Overview

Distinct All-Cap Approach

A pure-play growth strategy in emerging markets (EM) investing across the full capitalization range.

Differentiated Philosophy

Guided by a proprietary process which expands the investable universe, we look for companies with accelerating and sustainable growth characteristics.

Alpha through Stock Selection

Our active approach seeks to deliver performance above the benchmark through stock picking, not macro or sector factors.

Emerging Markets Capabilities

| Inception Date | 11/01/1997 |

| Total Assets | $2.28 B USD As of 03/31/2025 |

| Benchmark | MSCI Emerging Markets Index |

| Target Excess Return | 2% - 3% Over a standard market cycle |

| Target Tracking Error | 2% - 6% Over a standard market cycle |

| Target Number of Holdings | 70 - 90 |

Available Vehicles

UCITS, Separate Account, Sub-Advised Portfolio, Collective Investment Trust, Mutual Fund

| Maximum Position Size: | 5% Above benchmark |

| Regional Exposure: | ±10% Within benchmark |

| Sector Exposure: | ±10% Within benchmark |

Not all emerging market countries are equal. Active management can help navigate this inherently complex asset class.

Philosophy

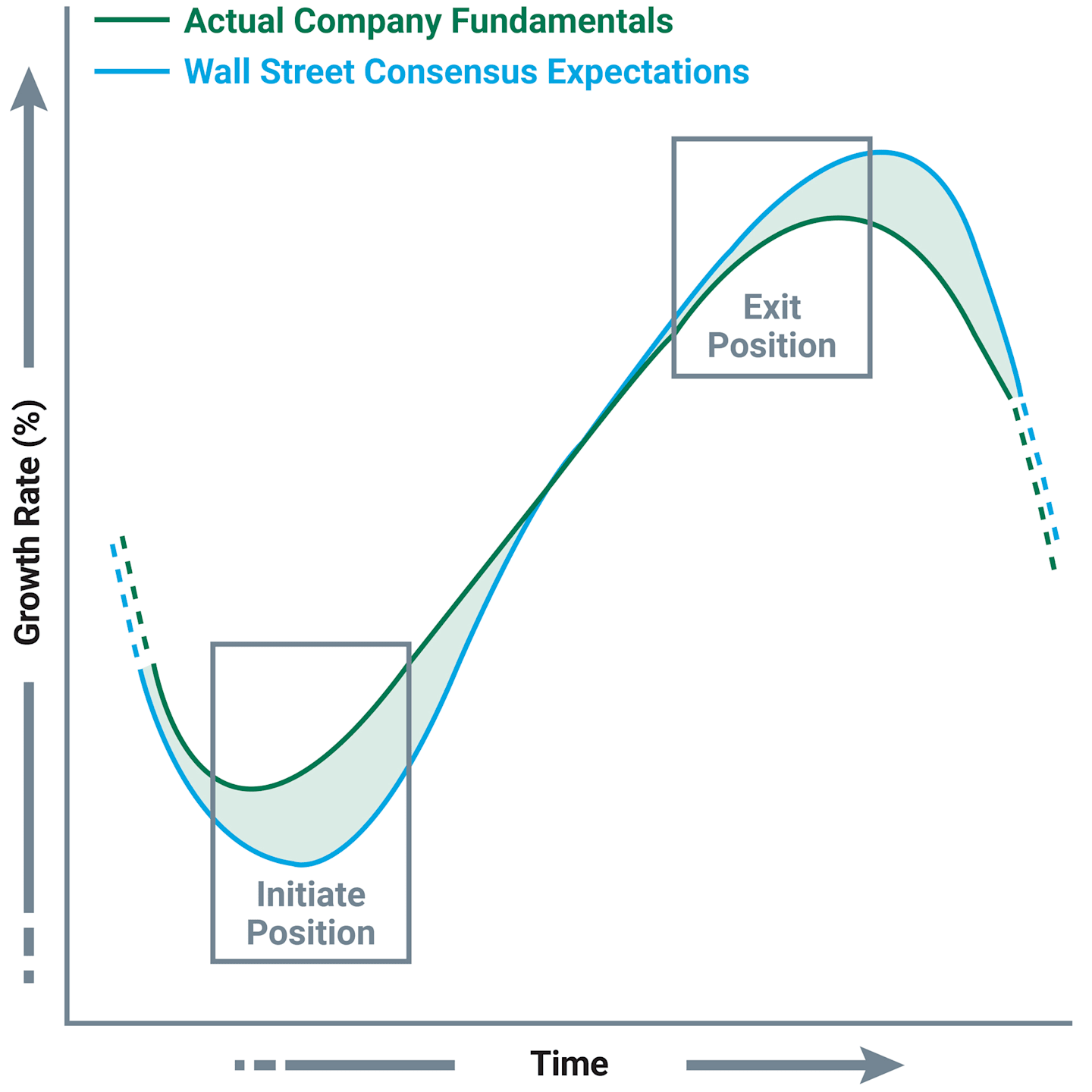

Investing with a well-defined, bottom-up growth philosophy, the team looks for stocks at inflection points where earnings growth and market expectations are rising. We believe that investing in stocks exhibiting accelerating, sustainable growth, driven by inflection in business fundamentals, can result in stock price outperformance.

Seeking Accelerating, Sustainable Growth

We believe the direction of revenues and earnings growth is a more powerful predictor of stock price performance than the absolute level of growth as depicted in the image to the right.

Capitalizing on Market Inefficiencies

We believe the market is slow to recognize positive inflection points and is inefficient in extrapolating current operating trends into future earnings around these inflection points.

Process

We Focus on Four Factors of Stock Selection

Our deep, diverse and dedicated investment team applies a disciplined framework we call ISGV. It seeks to identify investment opportunities through a rigorous, portfolio construction process to help manage risk and aim to achieve consistent returns over time.

Inflection

Is there a change in fundamentals?

What is driving the change?

Is it early in company's growth cycle?

Sustainability

Is the inflection in fundamentals sustainable?

What are the key risks to the durability of growth?

Earnings Gap

Does consensus fully reflect acceleration in fundamentals?

Are out-year consensus estimates beatable?

Valuation/Risk-Reward

Is valuation reasonable given the growth opportunity?

What is downside risk?

We Seek to Achieve Repeatability within Our Process

Through a continuous, multi-step process, we monitor investment universe opportunities and risks and put equal emphasis on buy and sell decisions.

Idea Generation

Identify companies exhibiting accelerating growth and improving fundamentals: fundamental information flow, quantitative screens.

Fundamental Analysis

Confirm acceleration is genuine and sustainable.

Portfolio Construction

Focus portfolio on best ideas.

Monitor risk controls and guidelines.Portfolio

70 - 90 stocks

This product also incorporates sustainability considerations. Discover our proprietary sustainability research platform.

Team

Portfolio Managers

Firm Start

2006

Industry Start

1984

Firm Start

2011

Industry Start

1995

| Assets Under Management | $2.28 B USD As of 03/31/2025 |

| Location | New York, NY |

Cross-Discipline Support

Client Portfolio Managers

Investment Analysts

Global Equity Trading

Sustainable Research Team

Global Analytics

Takeaways

A pure-play growth strategy in emerging markets which tend to be less efficient and transparent.

Employing a proprietary process that values accelerating and sustainable growth factors.

Alpha generation and risk management driven primarily by stock selection, not EM macro factors.

Performance

Composite Performance in USD (%)

*Annualized

Data reflects past performance. Past performance does not guarantee future results. The value of investments may fluctuate. Data assumes reinvestment of dividends and capital gains.

Insights

Many of American Century's investment strategies incorporate sustainability factors, using environmental, social, and/or governance (ESG) data, into their investment processes in addition to traditional financial analysis. However, when doing so, the portfolio managers may not consider sustainability-related factors with respect to every investment decision and, even when such factors are considered, they may conclude that other attributes of an investment outweigh sustainability factors when making decisions for the portfolio. The incorporation of sustainability factors may limit the investment opportunities available to a portfolio, and the portfolio may or may not outperform those investment strategies that do not incorporate sustainability factors. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and for certain companies such data may not be available, complete, or accurate.

Sustainable Investing Definitions:

Integrated: An investment strategy that integrates sustainability-related factors aims to make investment decisions through the analysis of sustainability factors alongside other financial variables in an effort to make more informed investment decisions. A portfolio that incorporates sustainability factors may or may not outperform those investment strategies that do not incorporate sustainability factors. Portfolio managers have ultimate discretion in how sustainability factors may impact a portfolio's holdings, and depending on their analysis, investment decisions may not be affected by sustainability factors.

Sustainability Focused: A sustainability-focused investment strategy seeks to invest, under normal market conditions, in securities that meet certain sustainability-related criteria or standards in an effort to promote sustainable characteristics, in addition to seeking superior, long-term, risk-adjusted returns. Alternatively, or in addition to traditional financial analysis, the investment strategy may filter its investment universe by excluding certain securities, industry, or sectors based on sustainability factors and/or business activities that do not meet specific values or norms. A sustainability focus may limit the investment opportunities available to a portfolio. Therefore, the portfolio may underperform or perform differently than other portfolios that do not have a sustainability investment focus. Sustainability-focused investment strategies include but are not limited to exclusionary, positive screening, best-in-class, improvers, thematic, and impact approaches.

This is marketing material. This information is intended to be general in nature and is not personal financial product advice. Any advice contained here is general advice only and has been prepared without considering the investment objectives, financial situation or particular needs of any particular person. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your investment objectives, financial situation and needs. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. American Century nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it.

Sources: MSCI Inc., FactSet

Source: MSCI. Morgan Stanley Capital International (MSCI) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.