Strategy Inception

2002

Strategy AUM (USD)

$3.84 B

As of 03/31/2025

Overview

Enhanced Core Portfolio

The strategy invests in an investment-grade, sector-diversified portfolio that is complemented by non-investment grade and off-benchmark issues.

Research-Driven Process

Fundamental research informs security selection, while a macro overlay and quantitative tools drive sector allocations and inform risk-budgeting.

Pursuing Risk-Managed Alpha

The strategy's select investments in high-yield, emerging market and non-dollar issues—combined with its emphasis on risk—seek to generate consistent alpha.

| Inception Date | 01/01/2002 |

| Total Assets | $3.84 B USD As of 03/31/2025 |

| Benchmark | BB US Agg Bond |

| Target Excess Return | 1% - 1.5% Over a standard market cycle |

| Target Tracking Error | 2% - 3% Over a standard market cycle |

| Investment Universe | U.S. Intermediate Duration Fixed Income |

Available Vehicles

U.S. and certain other countries

Institutional Strategy

Only in the U.S.

Mutual Fund

| Maximum Below Investment Grade | 35% |

| Regional Exposure | ±20% Of index |

| Issuer Limits | 5% Per issue excluding government securities and government agency mortgages |

We strive to create a core strategy with enhanced return potential through selective investments in high-yield, emerging markets, and non-dollar issues.

Philosophy

We believe consistency in risk-adjusted results can be achieved through a diversity of active positions that seek to exploit inherent inefficiencies in the bond market. We rely on the power of fundamental research—augmented by quantitative methodologies—to seek consistent excess returns over a full market cycle.

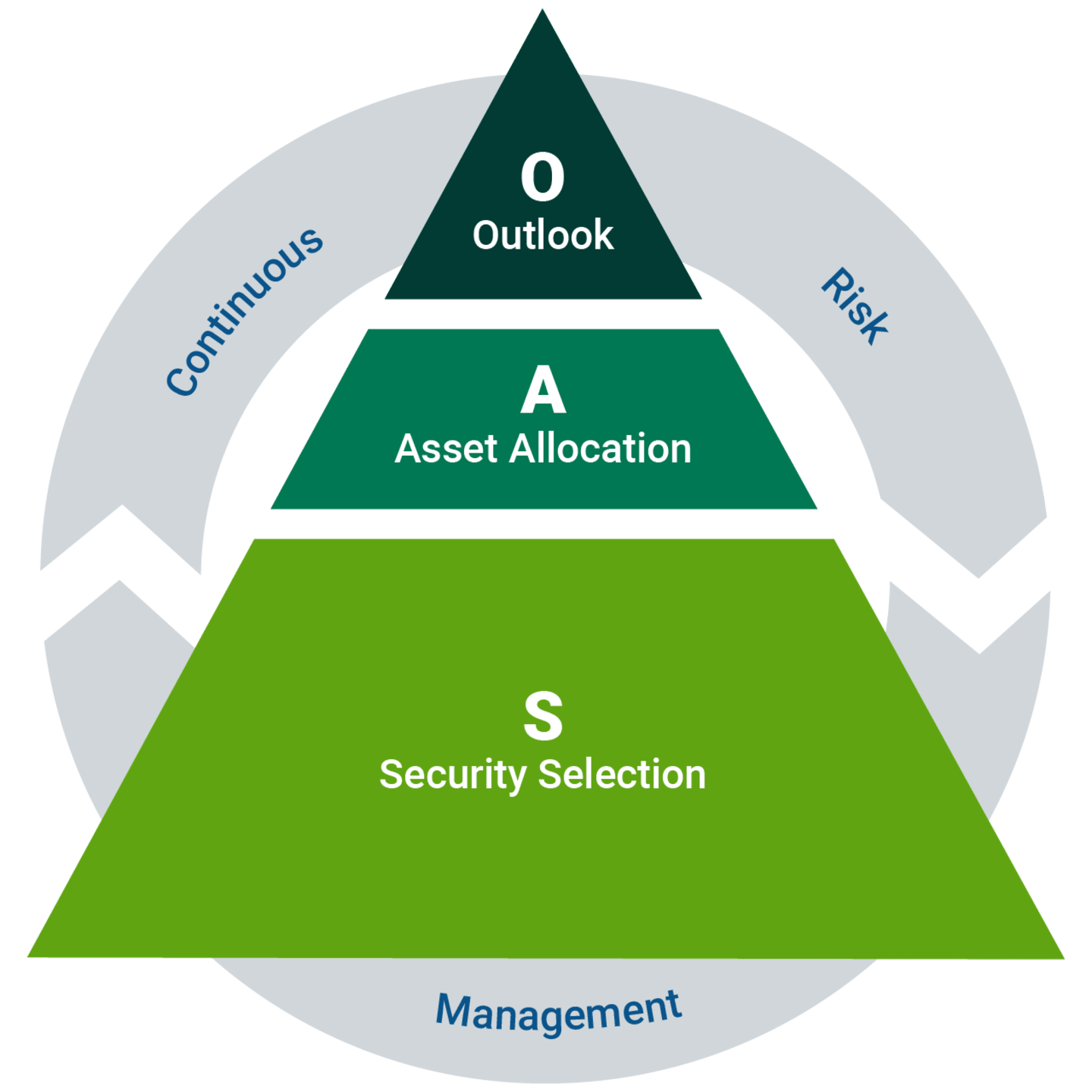

Process

We pursue opportunities by following a systematic, repeatable process that’s driven by fundamental research. This research-driven approach is complemented by proprietary quantitative models and tools designed to increase the team’s efficiency.

Outlook

Macro views on global economic growth, inflation, central bank policies, and interest rates provide context for investment decisions

Asset Allocation

Relative value of potential securities formed using a lens of economic fundamentals and rich/cheap sector analysis

Expected return information ratios are ranked by relative attractiveness

Security Selection

Attractive issues identified by analysts through deep fundamental research, reviewed with portfolio managers and traders to select securities, managing sector exposures and issuer weights

Risk Management

Independent reviews of portfolio holdings to help ensure risk-budget compliance, conducted by a dedicated Risk Management Team, informed by proprietary technology tools

Team

Managed by a veteran team who average more than 30 years’ experience

Features dedicated expertise in government, corporate and securitized markets

Includes specialists in top-down macroeconomic analysis and quantitative methodologies

Portfolio Managers

Firm Start

2018

Industry Start

1994

Firm Start

1983

Industry Start

1983

Firm Start

2023

Industry Start

1992

| Average Industry Experience | 30 Years |

| Location | New York, NY - Santa Clara, CA |

Cross-Discipline Support

Client Portfolio Managers

Dedicated Trader

Global Analytics

Takeaways

Enhanced core portfolio

Research-driven process

Pursuing risk-managed alpha

Performance

Composite Performance in USD (%)

*Annualized

Data reflects past performance. Past performance does not guarantee future results. The value of investments may fluctuate. Data assumes reinvestment of dividends and capital gains.

Insights

Sources: Bloomberg Index Services Ltd, FactSet

This is marketing material. This information is intended to be general in nature and is not personal financial product advice. Any advice contained here is general advice only and has been prepared without considering the investment objectives, financial situation or particular needs of any particular person. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your investment objectives, financial situation and needs. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. American Century nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it.

Risk-managed does not mean no risk.