Strategy Inception

1993

Strategy AUM (USD)

$3.06 B

As of 03/31/2025

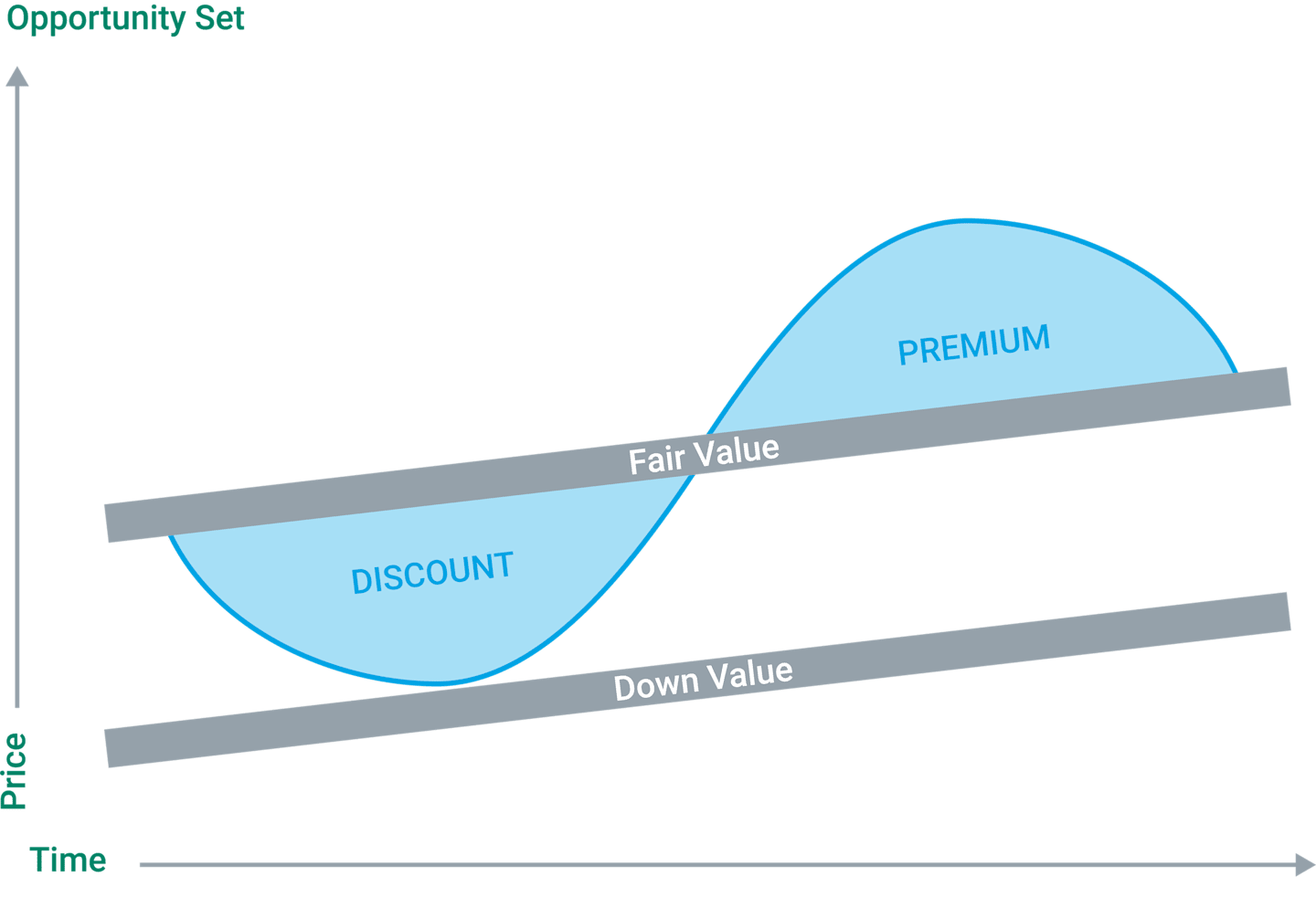

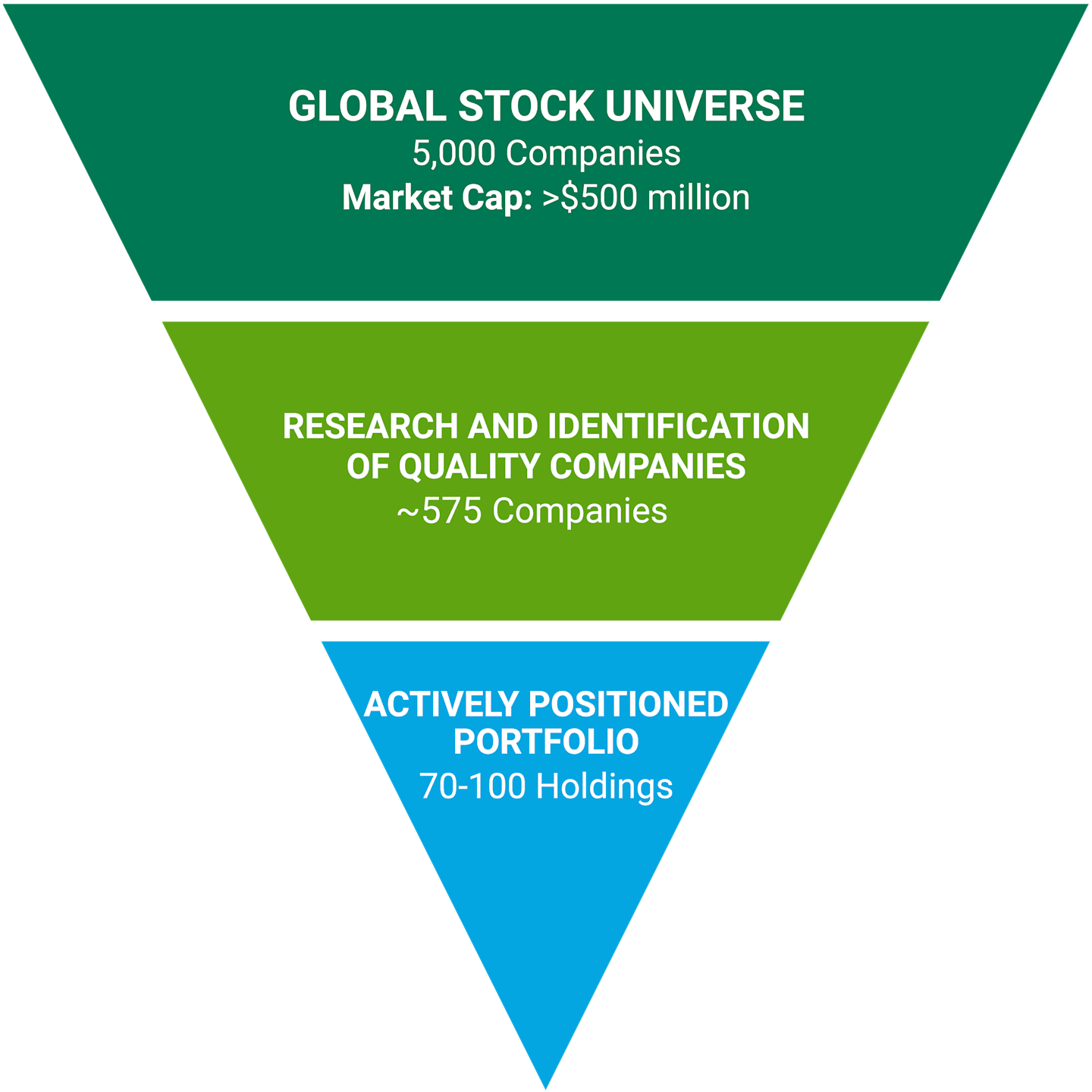

High-quality companies are typically those that exhibit high, stable and sustainable returns on capital, attractive free cash flow generation, low financial leverage, and franchise sustainability.

Many of American Century's investment strategies incorporate sustainability factors, using environmental, social, and/or governance (ESG) data, into their investment processes in addition to traditional financial analysis. However, when doing so, the portfolio managers may not consider sustainability-related factors with respect to every investment decision and, even when such factors are considered, they may conclude that other attributes of an investment outweigh sustainability factors when making decisions for the portfolio. The incorporation of sustainability factors may limit the investment opportunities available to a portfolio, and the portfolio may or may not outperform those investment strategies that do not incorporate sustainability factors. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and for certain companies such data may not be available, complete, or accurate.

Sustainable Investing Definitions:

Integrated: An investment strategy that integrates sustainability-related factors aims to make investment decisions through the analysis of sustainability factors alongside other financial variables in an effort to make more informed investment decisions. A portfolio that incorporates sustainability factors may or may not outperform those investment strategies that do not incorporate sustainability factors. Portfolio managers have ultimate discretion in how sustainability factors may impact a portfolio's holdings, and depending on their analysis, investment decisions may not be affected by sustainability factors.

Sustainability Focused: A sustainability-focused investment strategy seeks to invest, under normal market conditions, in securities that meet certain sustainability-related criteria or standards in an effort to promote sustainable characteristics, in addition to seeking superior, long-term, risk-adjusted returns. Alternatively, or in addition to traditional financial analysis, the investment strategy may filter its investment universe by excluding certain securities, industry, or sectors based on sustainability factors and/or business activities that do not meet specific values or norms. A sustainability focus may limit the investment opportunities available to a portfolio. Therefore, the portfolio may underperform or perform differently than other portfolios that do not have a sustainability investment focus. Sustainability-focused investment strategies include but are not limited to exclusionary, positive screening, best-in-class, improvers, thematic, and impact approaches.

This is marketing material. This information is intended to be general in nature and is not personal financial product advice. Any advice contained here is general advice only and has been prepared without considering the investment objectives, financial situation or particular needs of any particular person. Before acting on any information, you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your investment objectives, financial situation and needs. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. American Century nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it.

Sources: MSCI Inc., FactSet

©2025 Standard & Poor's Financial Services LLC. All rights reserved. For intended recipient only. No further distribution and/or reproduction permitted. Standard & Poor's Financial Services LLC ("S&P") does not guarantee the accuracy, adequacy, completeness or availability of any data or information contained herein and is not responsible for any errors or omissions or for the results obtained from the use of such data or information. S&P GIVES NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE IN CONNECTION TO THE DATA OR INFORMATION INCLUDED HEREIN. In no event shall S&P be liable for any direct, indirect, special or consequential damages in connection with recipient's use of such data or information.

Source: MSCI. Morgan Stanley Capital International (MSCI) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.