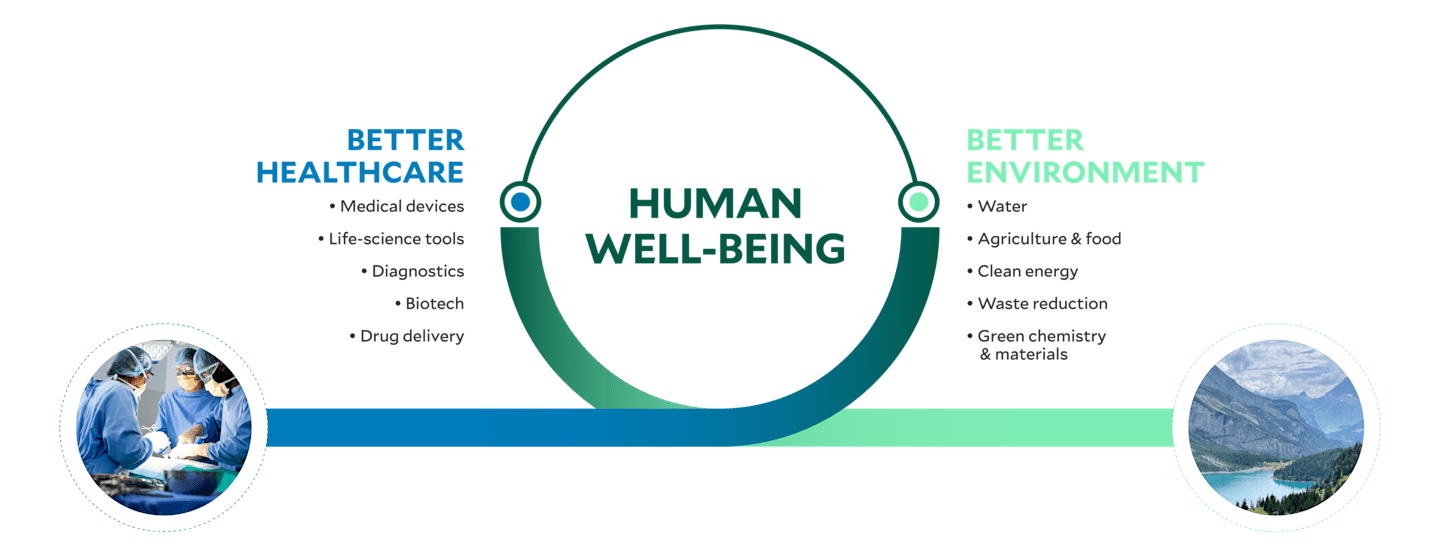

Approach

Environment + Healthcare = Well-being

When choosing companies to invest in, our team looks for breakthrough innovations in healthcare or the environment—two intertwined areas that affect human well-being. Collectively, they represent large markets and have amassed significant venture funding.

Help, cure and manage life-altering diseases & conditions through:

- Medical devices

- Diagnostics

- Biopharmaceutical

- Drug delivery

- Life Science tools

Reduce negative impact on the planet through innovation in:

- Clean energy

- Water

- Green chemistry and materials

- Agriculture and food

- Waste reduction

Portfolio Companies

Developing next-generation minimally invasive glaucoma surgery (MIGS)

Enabling better and more affordable biomarker discovery and research through a revolutionary optical, label-free technology

Developing anti-CD47 antibodies to block cancer growth more efficiently and change patient lives

Generating a new class of therapeutics based on a proven technology platform, using principles of allosteric regulation to create highly active and less toxic medicines*

Breakthrough capture, concentration, destruction, and ongoing monitoring of PFAS water pollution

Enabling zinc batteries at scale through revolutionary battery technology

Developer, owner, and operator of next-generation geothermal energy technologies

Addressing the problem of systemic toxicity with highly efficient, context-dependent, protein-based therapeutics

Creating the first effective therapy for patients suffering from the painful and costly symptoms of Chronic Venous Insufficiency (CVI) due to Deep Vein Reflux (DVR)

Treating lymphedema through a medical device that offers compression and patient mobility

Offering a minimally invasive treatment for Benign Prostatic Hyperplasia (BPH) via a medical device

*Bonum Therapeutics began as a spin-out of Good Therapeutics and was not independently sourced. Bonum Therapeutics is now a standalone company.

People

Our Private Investments team has deep experience investing in early-stage companies with breakthrough ideas. All our partners have an average of 20+ years in the industry.

Our team worked together for several years before joining American Century in 2023. We've always believed this is a people business first, so we specialize in building and nurturing industry relationships. These relationships deepen our bench considerably, and help us identify those innovative companies worthy of investment consideration.

Meet the Team

Managing Partner

Managing Partner

Managing Partner

Vice President of Sales

Director of Operations

Investment Lead

The Firm

A Shared DNA

Our dedicated Private Investments team (previously with 3x5 Partners) is backed by the size, scale, resources, and talent of American Century. The result of this combination? A unique motivation to deliver strong results for our investors and the world in which we all live.

Not only do we invest in companies we believe are positioned to solve the world’s greatest needs, but also, through American Century’s ownership structure, 40% of our profits also fund life-changing medical research. So the better we invest for you, the more we can do for everyone. View our story.

Contact Us

Call us to learn more about Private Investment opportunities.

The portfolio managers use a variety of analytical research tools and techniques to help them make decisions about buying or holding issuers that meet their investment criteria and selling issuers that do not. In addition to fundamental financial metrics, the portfolio managers may also consider environmental, social, and/or governance (ESG) data to evaluate an issuer's sustainability characteristics. However, the portfolio managers may not consider ESG data with respect to every investment decision and, even when such data is considered, they may conclude that other attributes of an investment outweigh sustainability-related considerations when making decisions. Sustainability-related characteristics may or may not impact the performance of an issuer or the strategy, and the strategy may perform differently if it did not consider ESG data. Issuers with strong sustainability-related characteristics may or may not outperform issuers with weak sustainability-related characteristics. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and may not be available, complete, or accurate. Not all American Century investment strategies incorporate ESG data into the process.

No solicitation, offer, or distribution of any investment, security, financial instruments, or financial interest of any type is being made or is intended by any of this material. This material is provided for informational and educational purposes only.

Nothing herein constitutes a recommendation of any investment, security, financial instruments, financial interest of any type, or any investment strategy.

No representation or warranty is being made regarding the suitability of any investments, securities, financial instruments or strategies for any investor. The material on this site is provided “as is.” American Century does not warrant the accuracy of the materials provided herein, either expressly or impliedly, for any particular purpose and hereby expressly disclaims any warranties or merchantability or fitness for any particular purpose.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.