Philosophy

Focused on a Better Client Experience

We focus on providing clients with a smoother journey to their investment objectives. That’s why our strategies are built on our deep understanding of the many different risks that may interact to influence the path of portfolio returns.

Ultimately, we seek to deliver the highest return for the risk taken. With today’s increasingly complex markets, our multi-asset portfolios seek to address the risks that each client faces and balance them in a manner best suited to their needs.

Process

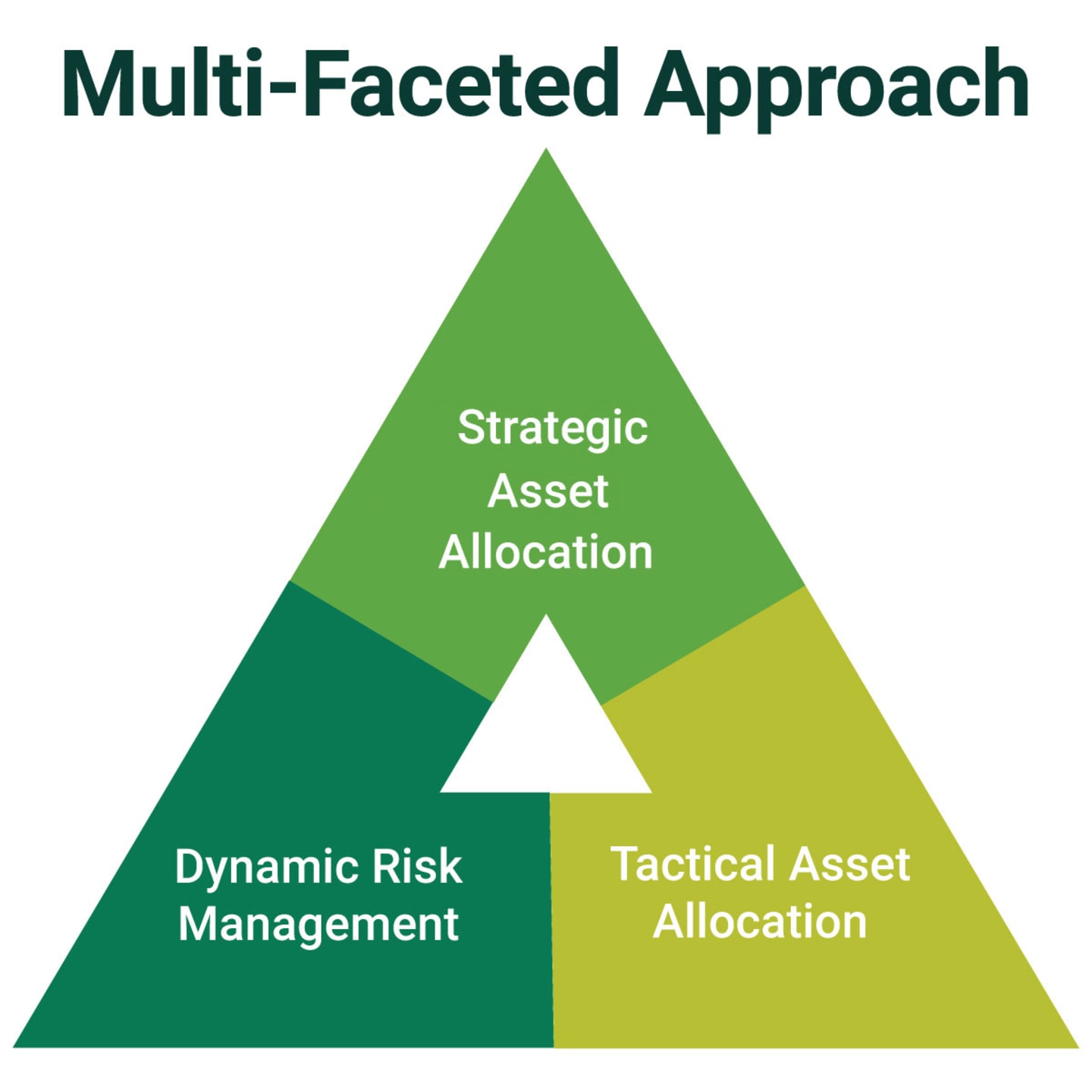

Three key elements comprise the building blocks of our risk-balanced solutions:

Strategic Asset Allocation

Our proprietary, forward-looking capital markets return and risk framework informs long-term asset allocation decision-making. It takes into account a range of factors as it seeks to meet each client’s objective while mitigating the potential for large losses.

Tactical Asset Allocation

Managers tilt portfolio allocations tactically toward the most attractive market segments, seeking to enhance returns by addressing opportunities and risks that can arise throughout the market cycle.

Dynamic Risk Management Techniques

Advanced techniques based on portfolio-specific objectives address more explicit volatility limits in specific client mandates. Managers often employ these techniques to adjust risk exposures based on the market environment and outlook.

People

Global Platform

We focus solely on asset management, and our only objective is to help clients achieve their best outcomes. As part of a global, multi-discipline organization, the team’s professionals leverage the firm’s Asset Allocation Committee and Global Analytics team, along with the investment expertise of nearly 200 equity, fixed income, and quantitative investing specialists worldwide.

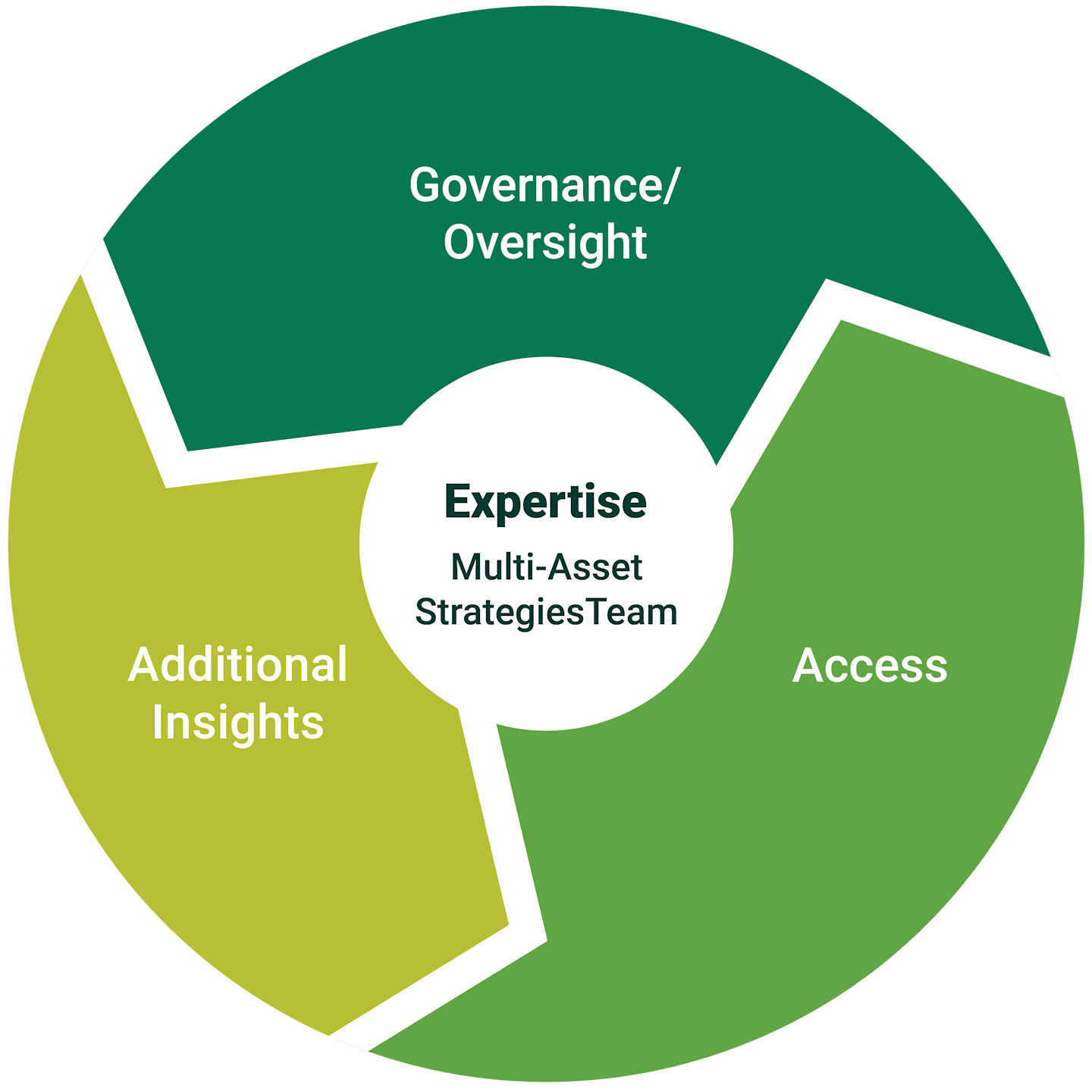

Expertise

Multi-Asset Strategies Team

Senior asset allocation professionals manage multi-asset portfolios, providing expertise in capital markets research, portfolio modeling, quantitative modeling, risk monitoring and manager selection

Governance/Oversight

Asset Allocation Committee

Senior Investment Professionals provide: strategic & tactical review, qualitative insight and distinct perspective

Additional Insights

Global Analytics Team

Independent quantitative research group that serves as an extension of the MAS team to provide insights on macro trends, risk indicators and trading strategies

Access

Global Investment Platform

$213B in assets managed by 196 investment professionals, providing diverse sources of alpha across asset classes and investment styles

Diversity of Thought

Our investment professionals come from a wide variety of academic and professional backgrounds and bring their unique perspectives to designing optimal solutions for our clients. We believe their varied experiences, perspectives, and areas of expertise reduce the potential for blind spots in analyzing and interpreting complex markets.

Through this diversity of thought, passion for asset management, and highly collaborative culture, we pursue better outcomes for our clients.

Meet the Team

Team Leadership

Senior Portfolio Manager and Head of Multi-Asset Portfolio Management

Senior Portfolio Manager and Head of Multi-Asset Research

Our Risk-Balanced Solutions

Our team’s asset allocation experts develop solutions to address the investment challenges of retirement plans, pension funds, endowments, foundations, and other institutions. Our line-up features well-researched options designed to meet a wide range of client needs.

Retirement

Customizable portfolios designed for long-term growth and income for retirement

· Target Date

· Target Risk

· Retirement Income

Wealth

Portfolios designed to meet a wide variety of investor needs

· Strategic Allocation Portfolios

· Model Portfolios, including Tax-Efficient Solutions

Insurance

A broad range of sophisticated investment strategies powering insurance solutions

· Volatility-Controlled Strategies

· Growth-Oriented Strategies

Tailored Solutions

Custom portfolios designed to address individual client objectives:

· Outcome-Oriented

· Target Return

· Volatility Management

Target-Date/Lifecycle Solutions

Our singular goal is to help grow the ranks of successful retirees by seeking the greatest likelihood of a fully funded retirement for the broadest number of participants.

We offer a range of options to meet a wide variety of needs:

Proprietary mutual funds and trusts

Co-manufactured target-date series developed with industry leaders

Custom target-date solutions designed to meet the needs of individual clients/plans

For more information about our target-date solutions, connect with your Regional Retirement Specialist

Call 1-800-345-6488

The Firm

American Century Investments is a global multi-discipline organization focused exclusively on asset management.

Learn about our diverse array of independent investment teams and capabilities.

With an ownership structure that directs more than 40% of our profits to support medical research, American Century Investments seeks to deliver investment success while making a meaningful impact on the world. View our story.

Many of our portfolio teams incorporate environmental, social and governance considerations into their investment analysis. Learn more about our approach to sustainable investing.

Contact Us

For more information about our multi-asset capabilities

The target date refers to the approximate year when investors plan to retire or start withdrawing their money. The principal value of the investment is not guaranteed at any time, including at the target date.

Each target-date portfolio seeks the highest total return consistent with its asset mix. Over time, the asset mix and weightings are adjusted to be more conservative. In general, as the target year approaches, the portfolio's allocation becomes more conservative by decreasing the allocation to stocks and increasing the allocation to bonds and cash equivalents.

The portfolio managers use a variety of analytical research tools and techniques to help them make decisions about buying or holding issuers that meet their investment criteria and selling issuers that do not. In addition to fundamental financial metrics, the portfolio managers may also consider environmental, social, and/or governance (ESG) data to evaluate an issuer's sustainability characteristics. However, the portfolio managers may not consider ESG data with respect to every investment decision and, even when such data is considered, they may conclude that other attributes of an investment outweigh sustainability-related considerations when making decisions. Sustainability-related characteristics may or may not impact the performance of an issuer or the strategy, and the strategy may perform differently if it did not consider ESG data. Issuers with strong sustainability-related characteristics may or may not outperform issuers with weak sustainability-related characteristics. ESG data used by the portfolio managers often lacks standardization, consistency, and transparency, and may not be available, complete, or accurate. Not all American Century investment strategies incorporate ESG data into the process.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Diversification does not assure a profit nor does it protect against loss of principal.