Compare Retirement Plan Details

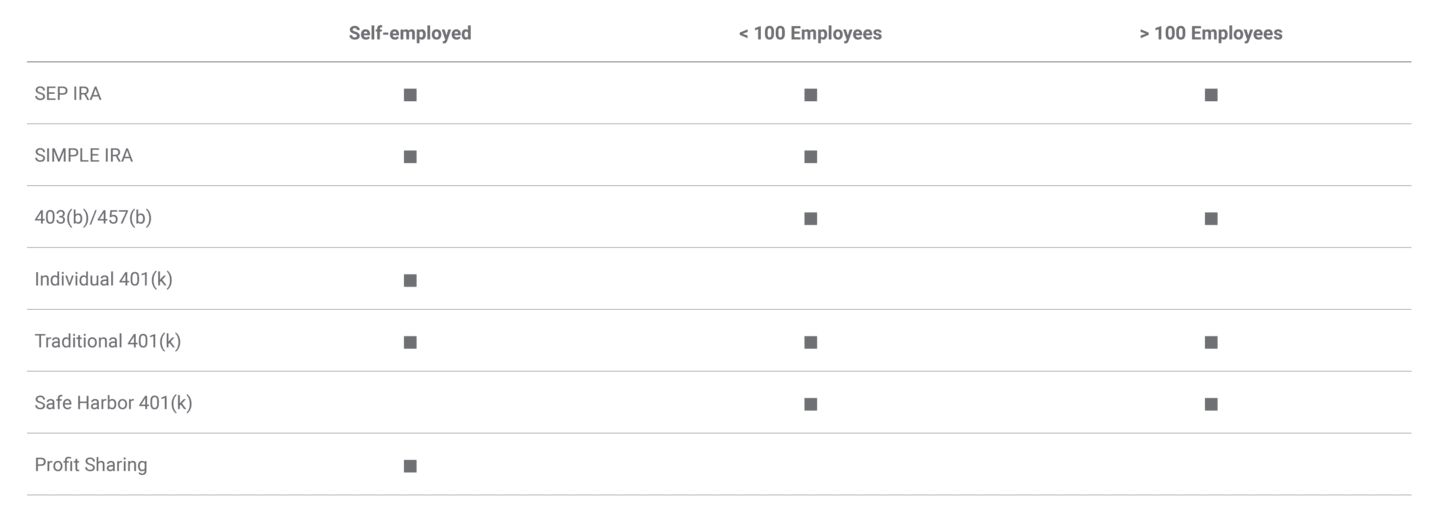

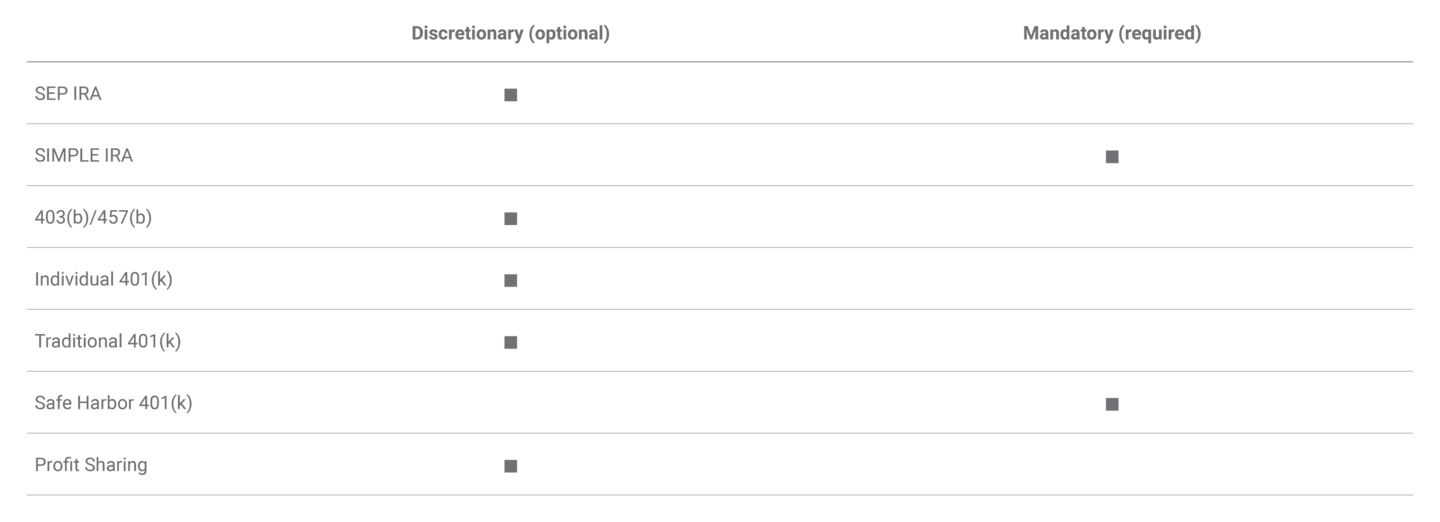

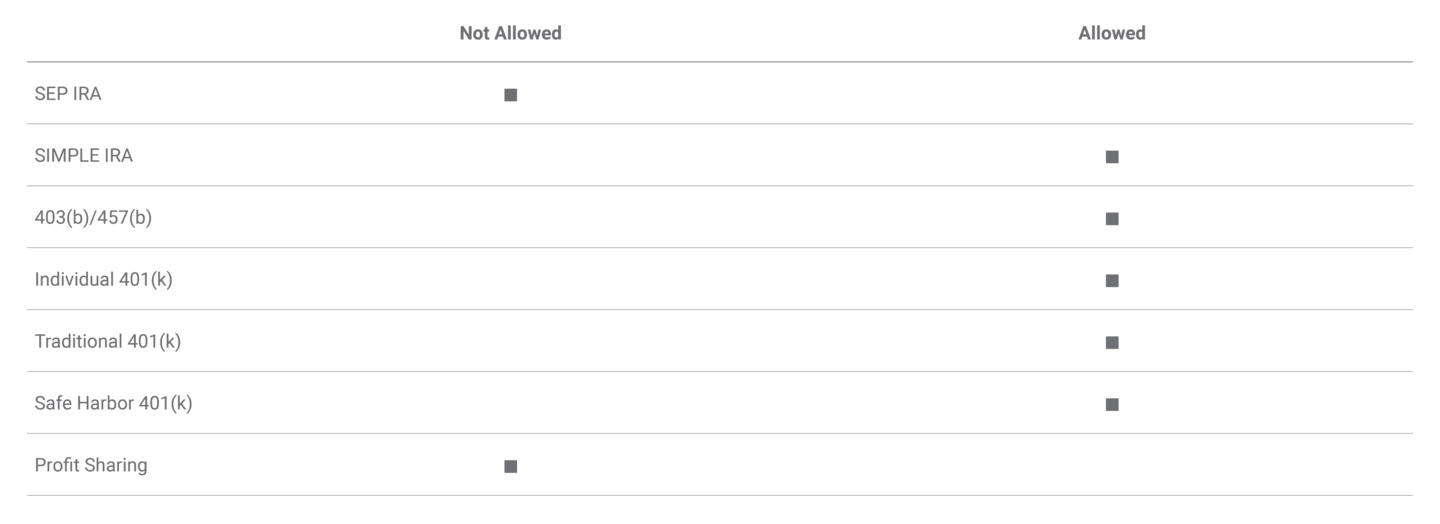

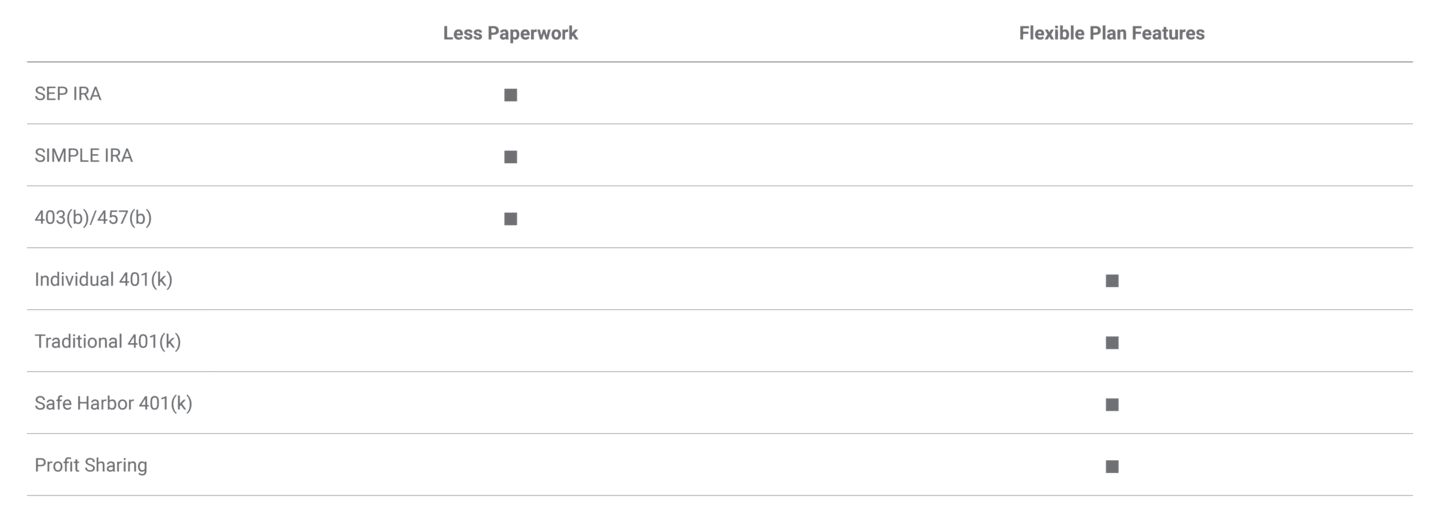

Consider features and requirements before selecting a plan for your business

Review the Plan Features at a Glance

Employer Contributions

Employer Contributions

Salary Deferrals

Notable Features

Compare Plan Details to Find a Good Fit for Your Business

Contribution Types and Limits¹˒⁷

SEP IRA

Discretionary employer contributions.

Up to 25% of compensation or $69,000, whichever is less, for 2024.

SIMPLE IRA

Employee salary deferrals up to $16,000 ($19,500 if age 50 or over) for 2024 or 100% of compensation if less.

Dollar-for-dollar employer match up to 3% of compensation, or a nonelective contribution of 2% of compensation.

403(b)/457(b)

Employee salary deferrals up to $23,000 ($30,500 if age 50 or over) for 2024.

Plan document outlines if employer contributions allowed.

Individual 401(k)

Pretax and Roth employee elective salary deferrals up to $23,000 ($30,500 if age 50 and over) for 2024.

Discretionary profit sharing contributions up to 25% of compensation.

The total of salary deferral and discretionary contributions cannot exceed the lesser of $69,000 ($76,500 including catch-up contributions) or 100% of compensation for 2024.

Traditional 401(k)

Pretax and Roth employee elective salary deferrals up to $23,000 ($30,500 if age 50 and over) for 2024.

Discretionary profit sharing and/or matching employer contributions up to 25% of compensation.²

The total of salary deferral, discretionary and matching contributions cannot exceed the lesser of $69,000 ($76,500 including catch-up contributions) or 100% of compensation for 2024.

Safe Harbor 401(k)

Pretax and Roth employee elective salary deferrals up to $23,000 ($30,500 if age 50 and over) for 2024.

Discretionary profit sharing and/or safe harbor employer contributions up to 25% of compensation.²

Dollar-for-dollar employer match up to 3% of compensation plus $0.50 for each dollar above 3% and up to 5%, an enhanced matching formula, or at least 3% nonelective contribution to all eligible employees.

The total of salary deferral, discretionary and matching contributions cannot exceed the lesser of $69,000 ($76,500 including catch-up contributions) or 100% of compensation for 2024.

Profit Sharing

Discretionary employer contributions.

Up to 25% of compensation² or $69,000, whichever is less, for 2024.

Eligibility Requirements³ (plan may be less restrictive)

SEP IRA

Employment in one, two or three of the preceding five years.

Employee age restriction may be up to age 21.

SIMPLE IRA

Employees must have received up to $5,000 in compensation in up to two preceding years and are expected to receive up to $5,000 during the current year.

403(b)/457(b)

403(b)s follow universal availability rule, meaning if one employee is offered the plan,

all must be.

Individual 401(k)

Not applicable.

Traditional 401(k)

One year of service for a set number of hours.

Employee age restriction may be up to age 21.

Safe Harbor 401(k)

One year of service for a set number of hours.

Employee age restriction may be up to age 21.

Profit Sharing

One year of service for a set number of hours.

Employee age restriction may be up to age 21.

Plan Establishment & Contribution Deadline

SEP IRA

Establishment of and contributions to the plan may be made until the employer’s tax-filing deadline.⁴

SIMPLE IRA

Plan must be established by October 1 of the tax year the plan is to be effective.

Employer contributions may be made until employer’s tax-filing deadline.

Employee salary deferrals must be deposited promptly.

403(b)/457(b)

Salary deferrals must be deposited promptly.⁵

Individual 401(k)

Plan may be established up to the employer’s tax-filing deadline.⁴

Salary deferrals cannot begin until the plan is established.

Salary deferrals must be deposited promptly.⁶

Discretionary and matching employer contributions may be made until the employer’s tax-filing deadline.

Traditional 401(k)

Plan may be established up to the employer’s tax-filing deadline.⁴

Salary deferrals cannot begin until the plan is established.

Salary deferrals must be deposited promptly.⁶

Discretionary and matching employer contributions may be made until the employer’s tax-filing deadline.

Safe Harbor 401(k)

Plan must be effective at least three months during the first plan year.

Employee salary deferrals must be deposited promptly.⁶

Discretionary and safe harbor employer contributions may be made until the employer’s tax-filing deadline.

Profit Sharing

Plan may be established and contributions can be made until the employer’s tax-filing deadline.⁴

Required Annual Paperwork⁹

SEP IRA

No annual paperwork

SIMPLE IRA

Model Notification to Eligible Employees

Summary Description

403(b)/457(b)

Some 403(b)s may require IRS Form 5500

Individual 401(k)⁸

IRS Form 5500

IRS Form 1099-R

Traditional 401(k)

IRS Form 5500

IRS Form 1099-R

Safe Harbor 401(k)

IRS Form 5500

IRS Form 1099-R

401(k) Safe Harbor Plan Notice to Employees

Profit Sharing

IRS Form 5500

IRS Form 1099-R

Vested Schedule

SEP IRA

Participants are 100% vested at all times.

SIMPLE IRA

Participants are 100% vested at all times.

403(b)/457(b)

Employee contributions are 100% vested automatically.

Employer contributions (if allowed) may have a vesting schedule.

Individual 401(k)

Generally, vesting is immediate, but some plans could have a vesting schedule.

Traditional 401(k)

Employers may select up to a three-year cliff or a six-year graded vesting schedule on discretionary and matching employer contributions.

Safe Harbor 401(k)

100% vesting required on safe harbor contributions and salary deferrals.

Employers may select up to a three-year cliff or a six-year graded vesting schedule on discretionary contributions.

Profit Sharing

Employer may select up to a three-year cliff or a six-year graded vesting schedule.

100% immediate vesting is required if the employer selects two years of service for eligibility.

Participant Fees

SEP IRA

Annual $25 custodial fee per plan; waived if eligible investments total $25,000 or more.

SIMPLE IRA

Annual $25 custodial fee per plan; waived if eligible investments total $25,000 or more.

403(b)/457(b)

Annual $25 custodial fee per plan; waived if eligible investments total $25,000 or more.

Individual 401(k)

Annual $25 service fee deducted from each participant’s account.

Traditional 401(k)

Annual $25 service fee deducted from each participant’s account.

Safe Harbor 401(k)

Annual $25 service fee deducted from each participant’s account.

Profit Sharing

Annual $25 service fee deducted from each participant’s account.

Limits listed are for 2024. The IRS sets limits annually.

Contributions may be based only on the first $345,000 of compensation for 2024.

Service and age requirements may be less restrictive at employer’s discretion.

Tax-filing deadline plus any extensions.

Employee salary deferrals must be deposited as soon as administratively feasible and no later than 30 days following the month in which the deferrals were made.

Employee salary deferrals must be deposited as soon as administratively feasible and no later than 15 days following the month in which the deferrals were made.

If you are self-employed and do not report your compensation on IRS Form W-2, then your compensation is your earned income. Check with your tax advisor for information about how to determine your maximum contribution based on your earned income.

IRS Form 5500 is generally not required for single participant plans with $250,000 or less in assets.

Additional forms and notices may be required based on optional plan features.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.