2025 U.S. Equity Outlook

Second Quarter

Key Takeaways

Growth Stocks: Significant innovation and access to artificial intelligence (AI) could continue to spur earnings growth, but high valuations and the market's narrowness has left many large companies susceptible to volatility.

Value Stocks: In a concentrated market, value stocks in high-yield sectors like consumer staples, real estate and utilities have offered what we think are solid returns and potentially attractive dividends.

Growth Stocks

Balancing Optimism and Market Volatility

We expect large-cap growth stocks to continue benefiting from innovation and AI advancements in 2025. However, as we’ve experienced in recent months, high valuations and market concentration pose risks, making the landscape potentially volatile.

We think active management and careful stock selection could be key strategies for navigating these challenges.

Key Innovations Driving Growth Beyond AI

While AI remains a significant growth driver, other areas of innovation are also crucial. Investments in business continuity, supply chain resilience, digital transformation and cybersecurity are expected to bolster economic growth. Trump administration policies supporting technology, infrastructure and onshore manufacturing, along with a healthier financial sector, could further enhance growth prospects.

The AI-driven rally, initiated by the launch of ChatGPT in 2022, has focused on infrastructure such as chipmakers and data centers. As AI efficiencies spread, more companies are expected to benefit. For instance, Nvidia reported that a significant portion of its data center revenue now comes from AI operational uses rather than merely training AI models, indicating a shift toward practical applications of AI technology.

DeepSeek’s Impact on AI Infrastructure Spending

The introduction of DeepSeek's R-1 model, which the Chinese start-up company developed quickly and at a lower cost than other well-known AI models, may reduce the need for the latest chips and extensive training. This development raises questions about the need for massive investment to build more data centers.

Consider the Trump administration's recently announced $500-billion data center project and significant AI spending by companies like Microsoft and Meta Platforms. It would be hard to justify these investments in AI infrastructure if leading-edge models can easily and quickly be replicated at a fraction of the cost.

What Are the Risks?

High valuations make the market susceptible to volatility. Any news that threatens the outlook for AI investments or alters expectations for growth, inflation and interest rates could cause stocks to stumble. Policy uncertainty with the new Trump administration and geopolitical risks, such as tensions with China and the war between Russia and Ukraine, add to the potential for market instability.

Despite a decline in inflation since 2022, higher prices remain a concern. Investors worry that the new administration's labor, trade and fiscal policies could be inflationary, leading to higher financing costs and weighing on economic growth.

The Importance of Stock Selection in 2025

In this environment, we believe high-quality businesses with agile management teams will likely fare better. Active stock selection could be advantageous, as not all companies will navigate the challenges equally well.

In our view, investing in well-managed, competitively advantaged companies that can sustain growth and profitability may offer the best strategy for dealing with market uncertainties.

Value Stocks

Searching for Returns in a Concentrated Market

Large-cap growth stocks, particularly the group known as the Magnificent Seven, have spent the last two years on stilts, standing taller than others and dazzling investors with their performance from great heights.

But their footing is unsteady, making them vulnerable to risks that could trip them and cause their value to fall.

For example, earlier this year, the Chinese startup DeepSeek caused a $1 trillion rout among high-flying technology stocks by merely announcing the development of a cheaper AI model.1 Meanwhile, Nvidia beat earnings estimates but disappointed investors because its results didn’t surpass expectations by a large enough margin.

Closer to the ground is a collection of dividend-paying and low-beta stocks that receive less attention. These stocks are less sensitive to market fluctuations, and as value managers, we believe they may likely offer solid returns in today’s highly concentrated market.

The Impact of a Prolonged AI-Fueled Rally

As AI-related stocks shot up these last two years, other stocks have been out of favor and left behind. This has resulted in high-yielding and low-beta stocks trading at historically cheap prices. This frothy market seems to have undervalued these stocks and had unreasonably low expectations for their performance.

Given their lofty valuations today, we think it will be challenging for the stocks that led the market for the last two years to generate meaningful price returns in the future. On the other hand, dividends have accounted for 31% of the S&P 500® Index’s returns since 1940.2

Identifying High-Yield Opportunities in 2025

It’s among sectors where value stocks largely reside where investors can also find higher-yielding stocks.

Consumer staples stocks, for example, are among the cheapest in the market. By selling products people need rather than things they want, consumer staples companies have tended to grow earnings slower than the broader market while experiencing less volatility. Many companies in this sector pay attractive dividends, at least partially offsetting any shortcomings in stock price gains.

Conagra Foods, for example, has an annual dividend yield of 5.5% (at time of publication), compared to the S&P 500’s 1.27%.

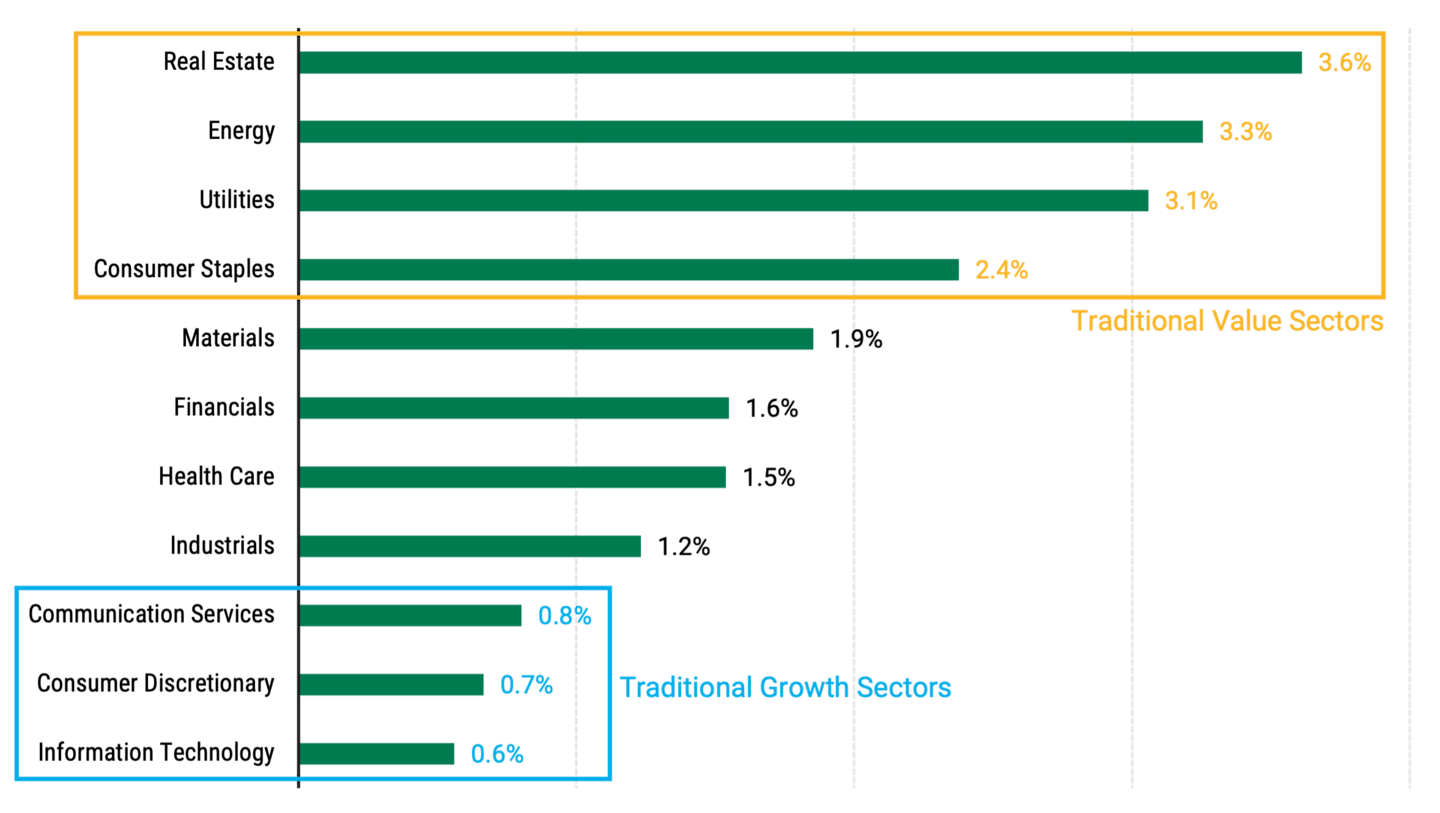

Other attractively valued sectors where we find opportunities in dividend-paying stocks include real estate, energy and utilities. As shown in Figure 1, the dividend yield in these sectors is higher than in traditional growth sectors such as information technology and consumer discretionary.

Figure 1 | Traditional Value Sectors Have Historically Offered Higher Yields

Dividend Yield

Data as of 12/31/2024. Source: FactSet.

Higher-yielding sectors, which lagged technology and other growth-oriented sectors over the last two years, have been starting to perform better as the economic outlook becomes less certain. Inflation is ramping up again, and geopolitical risks continue to widen. U.S. policy shifts, particularly the threat or implementation of tariffs, are hard for trading partners and investors to navigate.

Navigating a Shaky Market Foundation

We haven’t seen a market this concentrated since the dot-com bubble of the late 1990s and early 2000s. Large-cap growth stocks have traded at a 40% premium to their average since 2002, while large-cap value stocks have traded at a relatively modest 14% over the same span.

It’s not for us to call a market correction. However, history shows that periods of volatility that tend to follow extreme market concentration can lead to outperformance for overlooked asset classes. Value stocks fared better than growth stocks after the dot-com bubble burst. Small-cap stocks also outperformed large-cap stocks. These asset classes are home to many dividend-paying stocks.

Looking ahead, we believe the price returns for last year’s market leaders will be relatively muted. Conversely, attractively priced, higher-yielding stocks less sensitive to market movements may be well positioned.

¹ Natalia Kniazhevich, Esha Dey, and Elena Popina, “AI-Fueled Stock Rally Dealt $1 Trillion Blow by Chinese Upstart,” Bloomberg, January 26, 2025.

² Morningstar.

Inflation in Focus

Get market updates, behavioral insights and investment ideas.

View Glossary Definitions

Agency mortgages

A form of securitized debt that represents ownership in pools of mortgage loans and their payments.

Asset-backed securities (ABS)

A form of securitized debt (defined below), ABS are structured like mortgage-backed securities (MBS, defined below). But instead of mortgage loans or interest in mortgage loans, the underlying assets may include such items as auto loans, home equity loans, student loans, small business loans, and credit card debt. The value of an ABS is affected by changes in the market's perception of the assets backing the security, the creditworthiness of the servicing agent for the loan pool, the originator of the loans, or the financial institution providing any credit enhancement.

Basis points

Basis points are used in financial literature to express values that are carried out to two decimal places (hundredths of a percentage point), particularly ratios, such as yields, fees, and returns. Basis points describe values that are typically on the right side of the decimal point--one basis point equals one one-hundredth of a percentage point (0.01%). So 25 basis points equals 0.25%, and 50 basis points equals 0.50%. Only when basis points equal or exceed 100 does the value move to the left of the decimal point--100 basis points equals 1.00%, 500 basis points equals 5.00%, etc.

BB and BBB credit rating

Securities and issuers rated AAA to BBB are considered/perceived “investment-grade”; those rated below BBB are considered/perceived non-investment-grade or more speculative.

Beta

Beta is a standard measurement of potential investment risk and return. It shows how volatile a security's or an investment portfolio's returns have been compared with their respective benchmark indices. A benchmark index's beta always equals 1. A security or portfolio with a beta greater than 1 had returns that fluctuated more, both up and down, than those of its benchmark, while a beta of less than 1 indicates less fluctuation than the benchmark.

Bloomberg U.S. Aggregate Bond Index

Represents securities that are taxable, registered with the Securities and Exchange Commission, and U.S. dollar-denominated. The index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Central bank

Entity responsible for oversight of a nation’s monetary system, including policies and interest rates.

Chicago Board of Trade (CBOE) Volatility Indexes

Volatility indexes are forward-looking measures of the market's expectations of volatility (or how much a stock index's price moves). The CBOE manages and publishes three of the most widely used volatility indexes based on three major stock indexes: The VIX Index tracks the expected 30-day future volatility of the S&P 500 Index, the VXN Index tracks the expected 30-day future volatility of the NASDAQ-100 Index and the VXD Index tracks the expected 30-day future volatility of the Dow Jones Industrial Average Index. VIX, VXN and VXD are the ticker symbols for these three volatility indexes. The VIX in particular is a widely used measure of market risk and is often referred to as the "investor fear gauge."

Collateralized loan obligations (CLOs)

A form of securitized debt, typically backed by pools of corporate loans and their payments.

Commercial Mortgage-Backed Securities (CMBS)

MBS that represent ownership in pools of commercial real estate loans used to finance the construction and improvement of income-producing properties, including office buildings, shopping centers, industrial parks, warehouses, hotels, and apartment complexes.

Commercial paper

Short-term debt issued by corporations to raise cash and to cover current expenses in anticipation of future revenues.

Commodities

Commodities are raw materials or primary agricultural products that can be bought or sold on an exchange or market. Examples include grains such as corn, foods such as coffee, and metals such as copper.

Consumer Price Index (CPI)

CPI is the most commonly used statistic to measure inflation in the U.S. economy. Sometimes referred to as headline CPI, it reflects price changes from the consumer's perspective. It's a U.S. government (Bureau of Labor Statistics) index derived from detailed consumer spending information. Changes in CPI measure price changes in a market basket of consumer goods and services such as gas, food, clothing, and cars. Core CPI excludes food and energy prices, which tend to be volatile.

Corporate securities (corporate bonds and notes)

Debt instruments issued by corporations, as distinct from those issued by governments, government agencies, or municipalities. Corporate securities typically have the following features: 1) they are taxable, 2) they tend to have more credit (default) risk than government or municipal securities, so they tend to have higher yields than comparable-maturity securities in those sectors; and 3) they are traded on major exchanges, with prices published in newspapers.

Correlation

Correlation measures the relationship between two investments--the higher the correlation, the more likely they are to move in the same direction for a given set of economic or market events. So if two securities are highly correlated, they will move in the same direction the vast majority of the time. Negatively correlated investments do the opposite--as one security rises, the other falls, and vice versa. No correlation means there is no relationship between the movement of two securities--the performance of one security has no bearing on the performance of the other. Correlation is an important concept for portfolio diversification--combining assets with low or negative correlations can improve risk-adjusted performance over time by providing a diversity of payouts under the same financial conditions.

Coupon interest rate

The coupon interest rate is the stated/set interest rate that is assigned to each interest-paying fixed-income security when it is issued. It is used to calculate the security's periodic interest payments to investors; the coupon rate is applied to the security's principal value to generate interest payments.

Credit quality

Credit quality reflects the financial strength of the issuer of a security, and the ability of that issuer to provide timely payment of interest and principal to investors in the issuer's securities. Common measurements of credit quality include the credit ratings provided by credit rating agencies such as Standard & Poor's and Moody's. Credit quality and credit quality perceptions are a key component of the daily market pricing of fixed-income securities, along with maturity, inflation expectations and interest rate levels.

Credit ratings

Measurements of credit quality (defined below) provided by credit rating agencies (defined below). Those provided by Standard & Poor's typically are the most widely quoted and distributed, and range from AAA (highest quality; perceived as least likely to default) down to D (in default). Securities and issuers rated AAA to BBB are considered/perceived to be "investment-grade"; those below BBB are considered/perceived to be non-investment-grade or more speculative.

Debt security

A debt instrument, including bonds, certificates of deposit or preferred stocks.

Deflation

Deflation is the opposite of inflation (see Inflation); it describes a decline in prices for goods, assets and services, and is considered a highly undesirable economic outcome by economists and policymakers.

Dividend

A payment of a company's earnings to stockholders as a distribution of profits.

Dividend yield

The return earned by a stock investor, calculated by dividing the amount of annual dividends per share by the current share price of the stock.

Downside protection

Occurs when the investor or fund manager uses techniques attempting to prevent a decrease in the value of the investment.

Duration

Duration is an important indicator of potential price volatility and interest rate risk in fixed income investments. It measures the price sensitivity of a fixed income investment to changes in interest rates. The longer the duration, the more a fixed income investment's price will change when interest rates change. Duration also reflects the effect caused by receiving fixed income cash flows sooner instead of later. Fixed income investments structured to potentially pay more to investors earlier (such as high-yield, mortgage, and callable securities) typically have shorter durations than those that return most of their capital at maturity (such as zero-coupon or low-yielding noncallable Treasury securities), assuming that they have similar maturities.

Environmental, Social, Governance (ESG) Criteria

The risk and/or opportunity to a company's market valuation resulting from environmental, social and governance (ESG) factors. Depending on the sector, environmental and social factors include, but are not limited to, 1) climate change, 2) water stress, 3) product safety and quality (supply chain and manufacturing), 4) cybersecurity and data privacy, and 5) human capital management. Regardless of the sector, governance factors include: 1) business (mis)conduct, 2) board composition, independence and entrenchment, 3) accounting practices, 4) ownership structure, and 5) executive pay-for-sustainability performance alignment.

European Central Bank

Together with the national central banks of the European Union member states whose currency is the Euro (€), the European Central Bank (ECB) defines and implements the monetary policy for the Euro area.

Eurozone

The eurozone is sometimes referred to as the euro area and represents the member states that participate in the economic and monetary union (EMU) with the European Union (EU). The eurozone currently consists of: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Federal funds rate (aka fed funds rate)

The federal funds rate is an overnight interest rate banks charge each other for loans. More specifically, it's the interest rate charged by banks with excess reserves at a Federal Reserve district bank to banks needing overnight loans to meet reserve requirements. It's an interest rate that's mentioned frequently within the context of the Federal Reserve's interest rate policies. The Federal Reserve's Open Market Committee (defined below) sets a target for the federal funds rate (which is a key benchmark for all short-term interest rates, especially in the money markets), which it then supports/strives for with its open market operations (buying or selling government securities).

Federal Reserve (Fed)

The Fed is the U.S. central bank, responsible for monetary policies affecting the U.S. financial system and the economy.

Floating rate

A floating rate is associated with payments that fluctuate with an underlying interest rate level, as opposed to paying fixed-rate income.

Fundamentals/fundamental analysis

Investment "fundamentals," in the context of investment analysis, are typically those factors used in determining value that are more economic (growth, interest rates, inflation, employment) and/or financial (income, expenses, assets, credit quality) in nature, as opposed to "technicals," which are based more on market price (into which fundamental factors are considered to have been "priced in"), trend, and volume factors (such as supply and demand), and momentum. Technical factors can often override fundamentals in near-term investor and market behavior, but, in theory, investments with strong fundamental supports should maintain their value and perform relatively well over long time periods.

Global Economic Policy Uncertainty Index

The Global Economic Policy Uncertainty Index aims to quantify the level of uncertainty surrounding future economic policies based on news coverage, tax regulations and economic forecasts. The global index is an average of national economic policy uncertainty indices for 20 countries.

Gross domestic product

Gross domestic product (or GDP) is a measure of the total economic output in goods and services for an economy.

High-yield bonds

High-yield bonds are fixed income securities with lower credit quality and lower credit ratings. High-yield securities are those rated below BBB- by Standard & Poor's.

Inflation

Inflation, sometimes referred to as headline inflation, reflects rising prices for consumer goods and services, or equivalently, a declining value of money. Core inflation excludes food and energy prices, which tend to be volatile. It is the opposite of deflation (see Deflation).

Inflation-protected securities

Debt securities that offer returns adjusted for inflation; a feature designed to eliminate the inflation risk.

Investment-grade corporate bond or credit

A debt security with a relatively low risk of default issued and sold by a corporation to investors.

Liquidity

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

Magnificent Seven

This phrase refers to seven stocks that have been high-performing in the technology sector — Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

Mortgage-backed securities (MBS)

A form of securitized debt (defined below) that represents ownership in pools of mortgage loans and their payments. Most MBS are structured as "pass-throughs"--the monthly payments of principal and interest on the mortgages in the pool are collected by the financial entity that is servicing the mortgages and are "passed through" monthly to investors. The monthly and principal payments are key differences between MBS and other bonds such as Treasuries, which pay interest every six months and return the whole principal at maturity. Most MBS are issued or guaranteed by the U.S. government, a government-sponsored enterprise (GSE), or by a private lending institution.

MSCI ACWI IMI

The MSCI ACWI Investable Market Index (IMI) captures large, mid and small cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 9,139 constituents, the index is comprehensive, covering approximately 99% of the global equity investment opportunity set.

MSCI World Index

A free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

Municipal bonds

These are long-term municipal securities (defined below) with maturities of 10 years or longer.

Municipal securities (munis)

Debt securities typically issued by or on behalf of U.S. state and local governments, their agencies or authorities to raise money for a variety of public purposes, including financing for state and local governments as well as financing for specific projects and public facilities. In addition to their specific set of issuers, the defining characteristic of munis is their tax status. The interest income earned on most munis is exempt from federal income taxes. Interest payments are also generally exempt from state taxes if the bond owner resides within the state that issued the security. The same rule applies to local taxes. Another interesting characteristic of munis: Individuals, rather than institutions, make up the largest investor base. In part because of these characteristics, munis tend to have certain performance attributes, including higher after-tax returns than other fixed income securities of comparable maturity and credit quality and low volatility relative to other fixed-income sectors. The two main types of munis are general obligation bonds (GOs) and revenue bonds. GOs are munis secured by the full faith and credit of the issuer and usually supported by the issuer's taxing power. Revenue bonds are secured by the charges tied to the use of the facilities financed by the bonds.

Nominal yield

For most bonds and other fixed-income securities, nominal yield is simply the yield you see listed online or in newspapers. Most nominal fixed-income yields include some extra yield, an "inflation premium," that is typically priced/added into the yields to help offset the effects of inflation (see Inflation). Real yields (see Real yield), such as those for TIPS (see TIPS), don't have the inflation premium. As a result, nominal yields are typically higher than TIPS yields and other real yields.

Non-agency commercial mortgage-backed securities (CMBS)

MBS that represent ownership in pools of commercial real estate loans used to finance the construction and improvement of income-producing properties. Non-agency CMBS are not guaranteed by the U.S. government or a government-sponsored enterprise.

PCE

The personal consumption expenditures ("PCE") price deflator—which comes from the Bureau of Economic Analysis' quarterly report on U.S. gross domestic product—is based on a survey of businesses and is intended to capture the price changes in all final goods, no matter the purchaser. Because of its broader scope and certain differences in the methodology used to calculate the PCE price index, the Federal Reserve ("the Fed") holds the PCE deflator as its preferred, consistent measure of inflation over time.

Price to earnings ratio (P/E)

The price of a stock divided by its annual earnings per share. These earnings can be historical (the most recent 12 months) or forward-looking (an estimate of the next 12 months). A P/E ratio allows analysts to compare stocks on the basis of how much an investor is paying (in terms of price) for a dollar of recent or expected earnings. Higher P/E ratios imply that a stock's earnings are valued more highly, usually on the basis of higher expected earnings growth in the future or higher quality of earnings.

Producer Price Index (PPI)

Measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

Quality

Nationally recognized statistical rating organizations assign quality ratings to reflect forward-looking opinions on the creditworthiness of loan issuers.

Quantitative easing (QE)

A form of monetary policy used by central banks to stimulate economic growth. In QE, a central bank (such as the U.S. Federal Reserve) buys domestic government securities to increase the domestic money supply, lower interest rates, and encourage investors to make investments in riskier assets such as stocks and high-yield securities.

Real estate investment trusts (REITs)

Real estate investment trusts (REITs) are securities that trade like stocks and invest in real estate through properties or mortgages.

Real yield

For most bonds and other fixed-income securities, real yield is simply the yield you see listed online or in newspapers (see Yield) minus the premium (extra yield) added to help counteract the effects of inflation (see Inflation). Most "nominal" fixed-income yields (see Nominal yield) include an "inflation premium" that is typically priced into the yields to help offset the effects of inflation. Real yields, such as those for TIPS, don't have the inflation premium. As a result, TIPS yields and other real yields are typically lower than most nominal yields.

Russell 1000® Growth Index

Measures the performance of those Russell 1000 Index companies (the 1,000 largest publicly traded U.S. companies, based on total market capitalization) with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index

Measures the performance of those Russell 1000 Index companies (the 1,000 largest publicly traded U.S. companies, based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values.

S&P 500® Growth Index

A style-concentrated index designed to track the performance of stocks that exhibit the strongest growth characteristics by using a style-attractiveness weighting scheme.

S&P 500® Index

The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

S&P 500® Value Index

The S&P 500 Value Index is a style-concentrated index that measures stocks in the S&P 500 using three factors: the ratios of book value, earnings, and sales to price. It is not an investment product available for purchase.

S&P MidCap 400® Index

Provides investors with a benchmark for mid-sized companies. The index covers over 7% of the U.S. equity market, and seeks to remain an accurate measure of mid-sized companies, reflecting the risk and return characteristics of the broader mid-cap universe on an on-going basis.

S&P SmallCap 600® Index

A capitalization-weighted index consisting of 600 domestic stocks, measures the small company segment of the U.S. market.

Securitized debt

Debt resulting from the process of aggregating debt instruments into a pool of similar debts, then issuing new securities backed by the pool (securitizing the debt). Asset-backed and mortgage-backed securities (ABS and MBS, defined further above) and collateralized mortgage obligations (CMOs, defined above) are common forms of securitized debt. The credit quality (defined above) of securitized debt can vary significantly, depending on the underwriting standards of the original debt issuers, the credit quality of the issuers, economic or financial conditions that might affect payments, the existence of credit backing or guarantees, etc.

Senior-secured securities

A security that has a higher priority compared to another in the event of liquidation.

Sovereign debt

A country's own government-issued debt, priced in its native currency, that can be sold to investors in other countries to raise needed funds. For example, U.S. Treasury debt is U.S. sovereign debt, and would be referred to as sovereign debt when bought by foreign investors. Conversely, debt issued by foreign governments and priced in their currencies would be sovereign debt to U.S. investors.

Spreads (aka "interest-rate spreads", "maturity spreads," "yield spreads" or "credit spreads")

In fixed income parlance, spreads are simply measured differences or gaps that exists between two interest rates or yields that are being compared with each other. Spreads typically exist and are measured between fixed income securities of the same credit quality (defined above), but different maturities, or of the same maturity, but different credit quality. Changes in spreads typically reflect changes in relative value, with "spread widening" usually indicating relative price depreciation of the securities whose yields are increasing most, and "spread tightening" indicating relative price appreciation of the securities whose yields are declining most (or remaining relatively fixed while other yields are rising to meet them). Value-oriented investors typically seek to buy when spreads are relatively wide and sell after spreads tighten.

Spread sectors (aka "spread products," "spread securities")

In fixed income parlance, these are typically non-Treasury securities that usually trade in the fixed income markets at higher yields than same-maturity U.S. Treasury securities. The yield difference between Treasuries and non-Treasuries is called the "spread" (defined further above), hence the name "spread sectors" for non-Treasuries. These sectors--such as corporate-issued securities and mortgage-backed securities (MBS, defined above)--typically trade at higher yields (spreads) than Treasuries because they usually have relatively lower credit quality (defined above) and more credit/default risk (defined above), and/or they have more prepayment risk (defined above).

Spread widening, tightening

Changes in spreads that reflect changes in relative value, with "spread widening" usually indicating relative price depreciation and "spread tightening" indicating relative price appreciation.

Stagflation

Stagflation describes slowing economic growth combined with high inflation.

Subordinated security

An unsecured loan or bond that ranks below more senior loans in terms of claims on assets or earnings.

Total return

For bonds and other fixed-income securities, total return is a standard performance measurement that incorporates both income (primarily from interest payments) and changes in the prices of the securities (see Price changes from market changes). It is viewed as a more complete measurement of fixed-income performance than yield alone.

Treasury Inflation-Protected Securities (TIPS)

TIPS are a special type of U.S. Treasury security designed to address a fundamental, long-standing fixed-income market issue: that the fixed interest payments and principal values at maturity of most fixed-income securities don't adjust for inflation. TIPS interest payments and principal values do. The adjustments include upward or downward changes to both principal and coupon interest based on inflation. TIPS are inflation-indexed; that is, tied to the U.S. government's Consumer Price Index (CPI). At maturity, TIPS are guaranteed by the U.S. government to return at least their initial $1,000 principal value, or that principal value adjusted for inflation, whichever amount is greater. In addition, as their principal values are adjusted for inflation, their interest payments also adjust.

Treasury note

A treasury note is a debt security issued by the U.S. government with a fixed interest rate and maturity ranging from one to 10 years.

Treasury yield

The yield (defined below) of a Treasury security (most often refers to U.S. Treasury securities issued by the U.S. government).

U.S. Treasury securities

Debt securities issued by the U.S. Treasury and backed by the direct "full faith and credit" pledge of the U.S. government. Treasury securities include bills (maturing in one year or less), notes (maturing in two to 10 years) and bonds (maturing in more than 10 years). They are generally considered among the highest quality and most liquid securities in the world.

Valuation

A quantitative estimate of a company or asset’s value.

VIX Index

See Chicago Board of Trade (CBOE) Volatility Indexes.

Yield

For bonds and other fixed-income securities, yield is a rate of return on those securities. There are several types of yields and yield calculations. "Yield to maturity" is a common calculation for fixed-income securities, which takes into account total annual interest payments, the purchase price, the redemption value, and the amount of time remaining until maturity.

Yield curve

A line graph showing the yields of fixed income securities from a single sector (such as Treasuries or municipals), but from a range of different maturities (typically three months to 30 years), at a single point in time (often at month-, quarter- or year-end). Maturities are plotted on the x-axis of the graph, and yields are plotted on the y-axis. The resulting line is a key bond market benchmark and a leading economic indicator.

Yield spread

A "spread," in fixed income parlance, is simply a difference. Yield spreads measure yield differences, typically between debt securities with high credit ratings (which typically have lower yields) and those with lower ratings (which typically have higher yields). Yield spreads can also be measured between debt securities with different maturities (shorter-maturity securities typically have lower yields and longer-maturity securities typically have higher yields).

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, bond prices fall. The opposite is true when interest rates decline.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.