Investing Risk Levels

What Kind of Risk Taker Are You?

After taking a risk assessment, you will receive a risk level corresponding to your general comfort with risk relating to investing. And help with investment decisions, such as what kinds of investments to choose—from lower risk to higher risk assets.

Know Your Investment Risk Level

Very Conservative

Investors who have a very conservative risk tolerance may have a high aversion to the risk of losing money and prioritize preserving their capital. Very conservative investors are likely more comfortable with fixed income and short-term investments, such as bonds, government securities and cash equivalents. A small allocation to equities is possible, but they are likely more willing to accept lower returns in exchange for lower risk.

Conservative

Conservative investors may want to consider balancing risk and return with a higher allocation to stocks but combine it with a significant amount of bonds, government securities and cash equivalents. Steady returns may be a conservative investor's goal, but they also want to maintain a lower level of risk.

Moderate

With a moderate risk tolerance, balancing risk and return is likely most important. An emphasis on stocks, combined with a significant allocation to bonds, government securities and cash equivalents may help achieve the balance between taking risks and growing a portfolio.

Aggressive

With this level of risk, an aggressive investor may be more willing to take on higher risks for potentially higher returns. Their primary focus may want to be on stocks, including non-U.S. companies, to potentially achieve growth with a smaller allocation to bonds and government securities.

Very Aggressive

Those with a very high-risk tolerance may seek maximum growth potential from their portfolios. Very aggressive investors may consider a strong emphasis on stocks, including non-U.S. companies, while maintaining a much smaller portion of bonds and government securities.

What Does Risk Level Mean for a Portfolio?

Your risk level can give you an idea what kinds of investments to choose. You should also consider how much time you have to invest and your goal. Here are samples of very conservative, conservative, moderate, aggressive and very aggressive portfolios to compare. These are for illustrative purposes only and are not personalized for your situation. Ultimately, the investments you choose should be based on your situation.

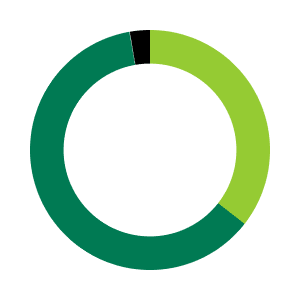

Very Conservative

Stocks = 25%

Bonds = 73%

Short Term = 2%

Conservative

Stocks = 45%

Bonds= 53%

Short-Term = 2%

Moderate

Stocks= 64%

Bonds = 34%

Short-Term= 2%

Aggressive

Stocks=82%

Bonds =16%

Short-Term = 2%

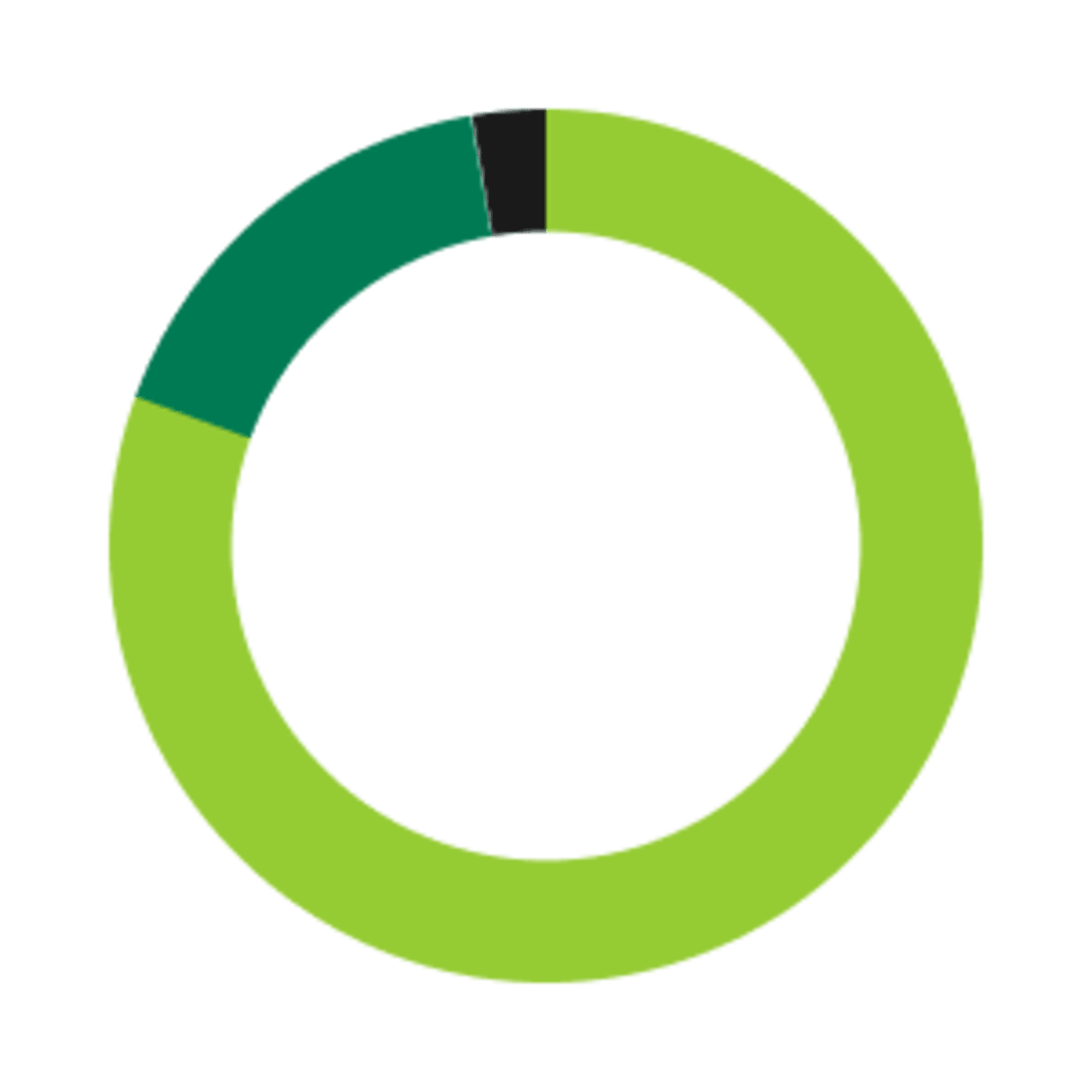

Very Aggressive

Stocks= 98%

Bonds = 0%

Short-Term = 2%

How Do You Get Started?

You can create your own investment portfolio with individual mutual funds or by choosing an automatically diversified solution. And we’re here to help you along the way, including offering advice options to help you make sense of your investing world.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.