Can Diabetes Devices Thrive in the Age of New Obesity Drugs?

Despite revolutionary treatments, reports of diabetes’ demise have been greatly exaggerated.

Key Takeaways

New obesity drugs can treat diabetes but can’t eliminate the disease. We believe companies making diabetes-related devices can continue to flourish.

Many investors overlook the growing global demand for diabetes management, including the continued need for insulin and glucose monitoring.

We believe medical device makers can play a crucial role in the management of this devastating disease.

GLP-1 Treatments and Diabetes Device Implications

One of the undisputed feel-good stories of 2023 was the widespread adoption of GLP-1 obesity drugs, kicking off what many have called the “age of Ozempic®.” If patients can access and afford these treatments, this would represent a remarkable social good. What is less well known is that these drugs were initially developed to fight diabetes.

The popularity of GLP-1s quickly caused the stock prices of companies that make devices for managing and treating diabetes to drop. We aim to realistically evaluate the future of these companies in a world of readily available GLP-1s. Despite the challenges, we believe that companies producing diabetes-related devices can still be compelling investments.

Revolution in Diabetes Care: From Insulin to CGM Advances

Since synthetic insulin was created in the 1920s, treatments have continually improved, becoming more effective with fewer negative side effects. This evolution has led to today’s GLP-1s, which not only reduce weight more effectively than earlier diabetes drugs but also excel at lowering blood sugar and improving other risk factors.

Just as there’s been amazing progress on diabetes drugs, there has been a remarkable revolution in diabetes-related medical devices. The technology has evolved from self-administered finger sticks to continuous glucose monitoring (CGM) with wearable, miniaturized devices like Dexcom’s G7 CGM system and Abbott Laboratories’ FreeStyle Libre CGM system.

Beyond monitoring, insulin administration has greatly advanced. We’ve moved from self-administered shots to wearable tube pumps and fully integrated tubeless pump/monitor systems. The aim has always been to create an artificial pancreas that can monitor and manage blood sugar. New technologies are making this a reality, such as Insulet’s Omnipod® 5 tubeless patch, which integrates with existing CGMs.

Diabetes Trends: Reports of Diabetes’ Demise Exaggerated

To understand why we think companies making CGMs, insulin pumps, and related devices remain viable concerns in the age of Ozempic, let’s look at some key facts about diabetes itself. According to the Centers for Disease Control and Prevention’s “2022 National Diabetes Statistics Report,” diabetes is a chronic disease affecting an incredible 11% of Americans.

The disease has two forms. Type 1 diabetes occurs when the body produces no insulin. It accounts for less than 10% of all cases. Despite progress in treatments, there is no cure. Notably, obesity is not related to Type 1 diabetes. Nor are GLP-1s indicated for use in Type 1 diabetes. These drugs don’t eliminate the need for insulin.

Type 2 diabetes is far more common, accounting for more than 90% of all cases, and typically occurs in those over age 45. Obesity is a significant risk factor for Type 2 diabetes. According to Diabetes.org, “over 85% of people with Type 2 diabetes have overweight or obesity.”1 Diabetes.co.uk says that “in the U.S., between 30% and 53% of new Type 2 diabetes cases each year are linked to obesity.”2

Another key consideration about the market for these devices is the global scope of the disease. The World Health Organization estimates that more than 500 million people have diabetes. The disease’s prevalence is expected to increase rapidly in the coming years, affecting a projected 780 million adults by 2045.

According to widely cited studies in the British medical journal, The Lancet, “most people with diabetes globally live in low- and middle-income countries (LMICs). In addition, “the rate of increase in [diabetes] prevalence is much higher [in LMICs] than in high-income countries.” The availability and use of GLP-1s in developed economies are likely to exacerbate this trend.3

Impact of GLP-1s on the Diabetes Device Market

To understand how these drugs will impact the market for diabetes-related medical devices in the coming years, we need to distinguish between users with the two types of diabetes.

We’ve seen little compelling evidence that GLP-1s benefit people with Type 1 diabetes. That’s important because some companies, such as Insulet, are predominantly focused on this condition. This suggests that obesity drugs have little impact on their businesses.

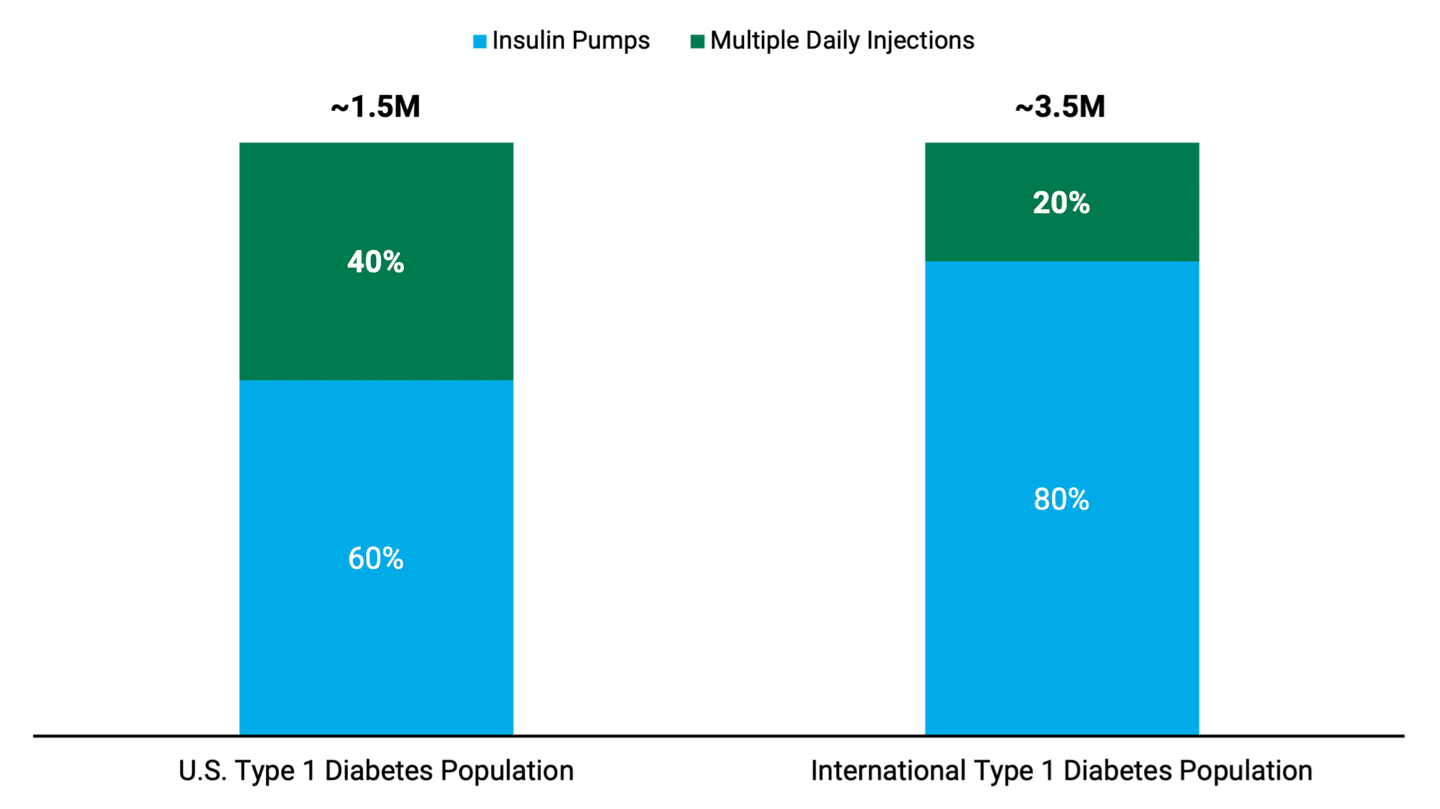

Figure 1 shows the total estimated number of Type 1 diabetics in the U.S. and abroad. It also depicts the proportion of those populations that currently benefit from using insulin pumps. This suggests that people with Type 1 diabetes, especially outside the U.S., aren’t using insulin pumps as much.

Figure 1 | Opportunity Remains for Insulin Pump Makers Among Type 1 Diabetics

Underpenetrated Type 1 Diabetes Market

Data as of November 2023. Source: Insulet. Percentages are Insulet internal estimates. The “International Type 1 Diabetes Population” is a current estimation of markets that Insulet serves.

Decline in Type 2 Diabetes Cases: Role of Obesity Drugs

The market for Type 2 diabetes is more complicated, however. A key question we set out to answer is: Do GLP-1s slow the progression of obese patients into diabetes, or do they stop or even reverse the progression entirely? Right up front, we should tell you that we can’t know the answer to this question with any certainty. What we present here is our best estimate given the current data.

Our analysis begins with Harvard School of Public Health data showing that more than two-thirds (69%) of U.S. adults are overweight, and more than one-third (36%) are obese.4 We expect the widespread use of GLP-1 drugs to decrease the obese population over time.

Nevertheless, we argue that the number of obese individuals in the U.S. will remain high due to underlying obesity trends, the progression of overweight people to obesity and natural population growth. In addition, there are constraints on GLP-1 uptake due to side effects and prohibitive costs. Add it all up, and we believe there could still be as many as 80 million obese people in the U.S. by 2040, despite the broad adoption of GLP-1s.

Furthermore, a notable number of people with Type 2 diabetes aren’t obese. They developed the disease due to reasons unrelated to obesity, often influenced by genetic factors. We expect that this segment of Type 2 diabetics will likely continue to grow. What’s more, the overall number of diabetes patients worldwide will likely still increase thanks to the escalating obesity rates in low- and middle-income countries.

GLP-1 Diabetes Treatment and Continuous Glucose Monitoring

Diabetes devices have long coexisted with insulin and diabetes drugs. As a result, we think it makes sense to frame the discussion as a complementary relationship.

Indeed, Abbott Laboratories recently completed an analysis that showed a significant number of its CGM device users also take GLP-1 drugs. The company’s data showed that people using both products wore their monitors more often and tended to take their GLP-1 medication more frequently compared with other users.5

According to the study, “those using both Libre and a GLP-1 exhibited a higher rate of use for both products, wearing Libre sensors more often and taking GLP1 medication more frequently compared to other users. … While we traditionally think of therapy choices as having to compete against one another, this is a good example of a complementary relationship between two products that both help optimize the treatment of diabetes."

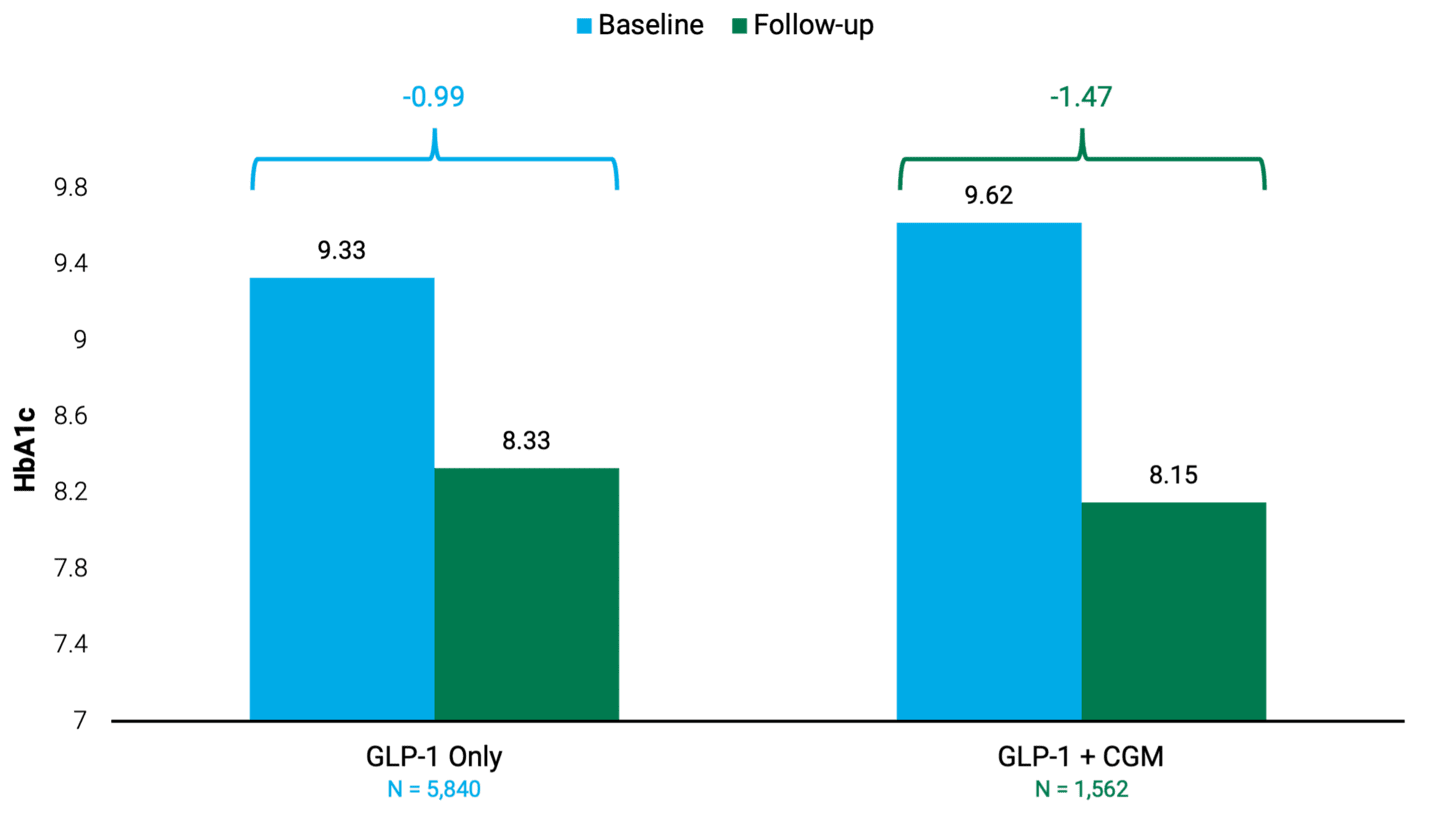

Similarly, in Figure 2, we show the results of Dexcom’s own analysis of simultaneous CGM and GLP-1 usage. This study clearly shows that CGM utilization is rising as patients and physicians use CGMs in conjunction with GLP-1s. In addition, clinical outcomes were superior for those using the two in combination rather than GLP-1s alone.

Figure 2 | CGMs Use Increases With GLP-1 Prescription

People with Uncontrolled Type 2 Diabetes on Semaglutide or Tirzepatide

Data as of November 2023. Source: Dexcom. Data from U.S. payer claims. Baseline and follow-up periods are both six-month windows. Uncontrolled includes people with HbA1c greater than or equal to 8%. GLP-1 + CGM graph cohort includes all CGM brands.

Health and Wellness Opportunities for Continuous Glucose Monitors

Lastly, investors in these companies should be aware of potential new markets for CGMs. The first is as a monitor for people with Type 2 diabetes who aren’t using insulin. Dexcom has developed a Food and Drug Administration-approved over-the-counter monitor to help users understand how lifestyle and diet impact their blood sugar levels. Additionally, we believe this product may appeal to individuals without diabetes who are interested in health and wellness.

Future of Diabetes Care Devices Amid GLP-1 Drug Advancements

The total number of obese individuals with Type 2 in the U.S. is likely to fall, given the broad adoption and use of GLP-1s. However, for companies making CGMs and insulin pumps, it’s important to note that while obesity contributes to the prevalence of diabetes, it’s not the sole factor.

This means that for people with Type 1 and non-obesity-related Type 2 diabetes, the impact of new obesity drugs on the futures of these device companies is less significant.

Moreover, individuals with Type 2 diabetes and severe pancreatic damage will require insulin for the rest of their lives. What’s more, data suggests that glucose monitors complement the use of GLP-1 drugs.

Furthermore, the prevalence of diabetes is increasing rapidly outside the U.S., particularly in low- and middle-income countries. As a result, we believe that companies making diabetes-related devices can still thrive in the age of Ozempic.

Author

American Diabetes Association, “ Obesity Care and Beyond,” accessed May 24, 2024.

Diabetes.co.uk, “Diabetes and Obesity,” October 29, 2023.

M. Jamal Hossain, M. Al-Mamun, and M. Rabiul Islam, “Diabetes Mellitus, the Fastest Growing Global Public Health Concern: Early Detection Should Be Focused,” Health Science Reports 7, no. 3 (2024): e2004.

Harvard School of Public Health, “A Global Look at Rising Obesity Rates,” accessed May 24, 2024.

Abbott, “FreeStyle Libre / GLP-1 Analysis,” September 28, 2023.

Optum’s de-identified Clinformatics® Data Mart Database includes commercial and Medicare Advantage members.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.